The Confidential Report - August 2021

4 August 2021 By PDSNETAmerica

Current estimates are that the US economy will grow at the rate of 6,6% overall this year and as much as 8,3% in the third quarter. S&P500 companies continue to produce record-breaking profits. The growth in GDP is truly enormous for such a large economy and will clearly cause the boom in commodity prices to continue. On Friday (30-7-21) Amazon shares fell 7,6% because they reported a quarter below analysts’ predictions - but still up by 27% which remains an impressive performance.

The personal consumption expenditures (PCE) price index is a good measure of inflation and one which is watched closely by the US Federal Reserve Bank (the Fed). It climbed by 3,5% in June month – above May’s 3,4% and the highest level since 1991. The Fed still believes and says that the rising inflation in the US is transitory and results from last year’s low base, but we are not so sure. Compensation costs (i.e., wages) rose by 0,7% in the June quarter – which equates to an annual rate of 8,4% while food and energy prices are up 4% on the year. Clearly, if the inflation does not begin to subside as the Fed expects, then it will have to adopt a more hawkish stance – which could easily lead to a sell-off in equities.

Current information is that the third wave of virus is mainly impacting those states in the South which have low vaccination rates and considerable vaccination resistance. Almost half of the US population is now vaccinated, and consumers are flush with cash. Some companies in America, like Disney, are making vaccinations mandatory for on-site workers. It is apparent that it will become very difficult to obtain employment without a vaccination in the future. What is clear is that by the end of last week fears of the third wave becoming a factor in the economy were receding.

88% of S&P500 companies are beating earnings forecasts in the 2nd quarter – with just over 25% of companies having reported. The profit margin for S&P companies is expected to be 12,4% - which is the second highest margin on record. These high profits have resulted in the S&P500 index recording its sixth straight monthly gain in a row.

The US senate has just passed a bipartisan $1,2 trillion infrastructure investment bill. If the bill can pass through congress, it will be a major further stimulant for the US economy.

Technically, the S&P500 is hovering around its new record highs at 4400 and remains well above its rising trendline. Consider the chart:

.png)

You can see here that the S&P has made a further new record high at 4422.3 and remains in its strong bullish trend. Technically it remains vulnerable to a major correction of between 10% and 20% - but we continue to believe that when that correction comes it will present a buying opportunity and not the start of a new bear trend.

Our reading of the US economy is that it continues to grow strongly and while the average earnings multiples of the S&P500 companies are high in historical terms they will go still higher. Other world markets like the London Stock Exchange, Tokyo, Shanghai will be dragged up. The JSE is in “catch-up” mode and is generally seen as cheap by international investors.

Political

Despite the civil unrest and the widespread looting which followed it, the significance of Zuma’s arrest cannot be over-stated. It is a victory for the rule of law and constitutional democracy in South Africa. It sends a message to all who were involved in state capture that they cannot expect any leniency or avoid incarceration. It is also a strong message to potential overseas investors that the South African courts are effective, and the rule of law is paramount. The country has chosen to follow law and order rather than the anarchy which exists in other countries in Africa. The impact on our share market and bond market will be substantial over time.

The riots and destruction which followed the arrest of Zuma are a major concern, but in our opinion are not a long-term threat to the economy or the stock market. In our experience, civil unrest in South Africa is invariably fairly short-lived and while the scale of this unrest is significant in the end it was not persistent, and it lasted just 9 days. It is also obvious that Zuma’s arrest triggered a feeding frenzy of looting some of which must be seen as a result of persistently high levels of unemployment and poverty. The looting indicates a general disregard for the law in South Africa which has been building up for decades. It is most obvious in the blatant disregard which more and more drivers have for the rules of the road. It has been well said that in South Africa we do not have rules of the road – just guidelines. We do not believe that there will be any lasting impact on JSE-listed shares from this civil unrest - although some have been temporarily affected. Perhaps the most significant result has been the impact on overseas perceptions of the country’s stability which has had a knock-on effect on the level of foreign direct investment (FDI) and the strength of the rand. The unrest is estimated to have cost the country about R50bn and it is now estimated that South Africa’s debt will peak at 88,9% of gross domestic product (GDP). The IMF has warned that this level of debt remains critical and that every effort should be made to ensure that relief measures do not result in an increase in that level.

The government has alleged that the unrest has been deliberately orchestrated and encouraged by a group of 12 suspects of whom six have been arrested. Four have appeared in court. The acting Minister in the Presidency, Khumbudzo Ntshavheni, said that it was clear that the people doing the looting were not all destitute, since many arrived in expensive vehicles to carry away stolen items. If the unrest has been orchestrated, then the public will clearly expect convictions in short order. The Minister of Defence, Nosiviwe Mapisa-Nqakula, has said that she does not believe that the unrest was an orchestrated uprising, but rather that it was part of a "counter revolution”. She was appointed by Zuma when he was president and is probably towing the Zuma line. It is also clear, however, that the government and President Ramaphosa would prefer to see the unrest as part of a planned insurrection rather than as a result of a persistent lack of service delivery and high unemployment. One of the consequences of the unrest has been a massive temporary disruption of the supply chain for food and fuel, especially in Natal. This could lead to food and fuel shortages in the coming months as damaged infrastructure is gradually replaced.

It is now widely anticipated that President Ramaphosa will conduct a cabinet re-shuffle in the near future. His objective will be to remove some of those Zuma-orientated elements which have been indirectly or directly opposing his reforms. Ministers which come to mind are Gwede Mantashe (Energy and Mining) and Nosiviwe Mapisa-Nqakula (Defence). Mantashe has been dragging his feet on creating a business-friendly environment for the mining sector and has been a direct impediment to the freeing up of the energy sector until Ramaphosa stepped in to set a new limit of 100MW for distributed generation without a licence. The Defence Minister openly contradicted Ramaphosa’s assessment that the recent unrest was an orchestrated attempt at insurrection – and she was appointed by Zuma long ago. The suspended Minister of Health, Zweli Mkhize, has been the subject of a damning report from the Special Investigating Unit and will almost certainly be replaced. The position held by the late Jackson Mthembu as Minister in the Presidency, has still got to be filled with a permanent appointment. Jackson Mthembu was a close ally of Ramaphosa. There is also the possibility that Ministers in the “security cluster” (police and defense) may be replaced after their tardy response to the civil unrest. Clearly, it is in the best interest of the economy and the stock market if Ramaphosa’s reforms are not opposed by his own ministers.

Economy

The extension of the level four lockdown for a further two weeks was a blow to the liquor and restaurant industries, but evidently the measures did have a positive impact on the progress of the third wave as case numbers are declining, particularly in Gauteng. Most companies and individuals have adapted to the “new normal” with thousands working from home. The easing of restrictions announced by the President on Sunday 25th July 2021 will go a long way towards helping the economy, especially the liquor and restaurant industries – although many small businesses will not survive.

The vaccination roll-out is steadily gaining momentum and, despite the unrest and looting, the goal of reaching 250 000 vaccinations per day has been achieved – which means that the government’s target of vaccinating 40% of the South African population by March next year is also probably achievable. In our view, by the end of this year the worst of COVID-19 will be substantially behind us, and the economy will be well-positioned for recovery. The government’s decision to pay for the vaccination of people who are not members of a medical aid has speeded up the roll-out of vaccinations in South Africa. Only about 12% of the population belongs to a medical aid so this move, enables private organisations like Discovery, Clicks and Dischem to vaccinate the vast majority without medical aids. The many private vaccination sites, which have staff and stock of the vaccine, are now likely to be fully utilized.

According to Business for SA Steering Committee chairperson Martin Kingston, it is now estimated that as much as 80% of the South African population could have received their first dose of the vaccine by October this year. We see that as optimistic, but there can be no doubt that the vaccination program is making good progress. From 1st September 2021 the vaccine will be open to everyone over the age of 18 and the country could be vaccinating as many as 420 000 people each day. Obviously, as the country reaches “herd immunity” the threat from all variants of the virus will be significantly reduced and life can become more normal. Of course, the virus will have left an indelible scar on the economy with many businesses not surviving and others springing up to take advantage of new opportunities, especially in the IT sector.

President Ramaphosa has announced that the government has now agreed a Social Relief of Distress (SRD) grant of R350 per month lasting until March 2022 and costing R26,7bn to be given to all unemployed/destitute people. This and the recently agreed R18bn boost to civil service wages might easily be seen as electioneering given that the elections are now expected to be postponed to early 2022. They will also absorb most of the extra tax collected so far as a result of the commodity boom. The fiscus announced that it had collected R33,8bn more in tax than was budgeted in February which enables them to supply a total R38,5bn relief package without increasing the national debt. This leaves the ratio of debt to GDP at 79% rising to as much as 89% by 2025. Hopefully, the commodity boom will continue, and the government will not have too many additional unexpected expenses so that the national debt can come back under control. A major problem is the fact that several state-owned enterprises (SOE), most notably Eskom, will have to transfer their debt to the Treasury fairly soon. It is estimated that Eskom alone will have to transfer between R200bn and R250bn to the Treasury. This will obviously make the debt to GDP figures look far worse.

Of course, the underlying causes of the civil unrest must be the high unemployment level and the persistent extreme poverty in South Africa. Unemployment remains very high for structural reasons which are seldom acknowledged by the ruling party:

- Businesses are unwilling to employ more people due mostly to the cost and difficulty in firing them should they prove unsatisfactory.

- The government has adopted many measures which are not business friendly – such as the third mining charter – and has all-but destroyed some industries like the construction industry and damaged others like the mining industry.

It seems that the ANC still has to learn that government cannot overcome the unemployment problem with further grants and handouts. The only way to significantly impact the unemployment rate, is to create an economic and legal environment which is business friendly. The government also cannot reduce unemployment by itself employing more people. All that does is create more inefficient and potentially corrupt bureaucracy at a direct cost to the fiscus.

The ratings agency, Standard & Poors (S&P), recently pointed out that a major problem for the South African economy was the “inflexible labour market with heavy unionization in the private and public sectors”. While S&P has not changed its rating for South Africa, that rating remains 3 notches below investment grade.

Finance Minister, Tito Mboweni, has said the settlement with the civil service unions (which will cost the government and additional R18n) will not impact the budget. This money will have therefore come from reductions in the budget allocations of other departments. The settlement means that the lowest paid civil servants will get an effective 11,7% increase. The deal is still way below what the unions were demanding which was the consumer price index (CPI) plus 4%, but has been accepted by the majority of unions and so is binding on all. It is, however, only valid for one year which means that negotiations will soon have to commence again in September this year. The union movement is perceived to have been substantially weakened. In our opinion, acceding to this offer signals a further significant reduction in its power.

One of the inevitable consequences of the civil unrest of the past weeks is that the monetary policy committee (MPC) is motivated to keep interest rates low for longer to allow the economy to recover. Many small businesses in Natal and to a lesser extent Gauteng were completely destroyed during the rioting with an inevitable cost to the broader economy. Keeping interest rates lower for longer is always good for the share market. The ratings agencies will also consider the impact of the violence and looting on their ratings and may decide to downgrade South Africa further. The civil unrest may also cause prices of foodstuffs to spike during the next few months, but that effect is likely to be temporary and should not impact on interest rates. The reality is that Zimbabwe is probably more likely to suffer more from food and other shortages arising from the civil unrest than South Africa.

The thinly veiled threat by Toyota SA’s parent company to the eThekwini (Durban) municipality should be taken seriously. The threat to withdraw the production of its vehicles from South Africa is real. The unrest and looting have not really impacted their business directly, except that their plant was closed for a week and they were temporarily prevented from exporting vehicles through the Durban harbour and transporting vehicles to Gauteng along the N3. Despite this, they were seeking assurances that there would be no further instances of this type of unrest and asking what steps were being taken to ensure the safety of their operations. This shows that the most serious and lasting impact of the unrest will be to South Africa’s international reputation and will be felt in foreign direct investment (FDI).

One of the bright spots in the South African economy at the moment is agriculture. This sector only experienced mild disruption to exports during the recent unrest and looting, while we have also had excellent rainy season. The agriculture sector accounts for about 3% of gross domestic product (GDP) and employs just under a million people. The unrest occurred during the peak export season for citrus. South Africa is the world’s second largest producer of citrus for export (after Spain) and has been capitalizing on an increased international demand for the fruit as a result of the pandemic.

The inflation figure for June 2021 came in at just 0,2% - which meant that the consumer price index (CPI) was 4,9% - down from May’s 5,2%. This benign inflation outlook is an enormous achievement given the stresses which the economy has been under as a result of COVID-19 and the recent unrest. The admirable control of the money supply has enabled the economy to maintain very low interest rates and attract investment from overseas. Hopefully it will continue to do so going forward. The monetary policy committee (MPC) is unlikely to increase rates this year and probably well into next year – which will give the economy a much-needed boost.

General

Following the momentous decision by the President to allow projects to produce 100MW or more of electricity, South African private companies are planning the building of about 10GW of renewable power plants at a cost of over R500bn – which will not require government funding. This will obviously reduce the load on Eskom and have a major impact on load-shedding. Eskom normally runs at a shortfall of between 6GW and 8GW. The building of the projects will also eventually enable many of the coal-fired power stations to be shut down, reducing the country’s carbon footprint while creating about 100 000 jobs.

That the government has definitely not got hold of Adam Smith’s principle of “The least government is the best government” can be seen in the fact that parliament is busy processing the National Health Insurance (NHI) bill which aims to establish an NHI fund that will buy services from “accredited” private sector and public sector providers with the objective of providing everyone health care services that are free at the point of delivery. The simple fact of the matter is that South Africa simply cannot afford to provide universal health care, free of charge, no matter how laudable such an idealism might be. The NHI fund, if it is ever implemented, will almost certainly turn out to be another massive government bureaucracy that will add significant costs and be subject to the corruption and incompetence which plagues other such operations.

The Treasury’s suggestion that employees be allowed to withdraw as much as one third of their pension while the other two thirds is kept pending their retirement is an attempt to provide some relief following the impact of COVID-19 and the unrest. South Africans are generally very bad at saving, which results in only about 6% of citizens retiring with sufficient savings. The generally poor performance of pension funds as investment vehicles has motivated us to advise individuals to withdraw as much as possible from their pension funds as soon as they can and then invest those funds into a selection of high-quality blue chip shares. In other words, we believe that individuals should take responsibility for their own retirement savings and educate themselves in the art of equity investment.

South African ports are among the least efficient in the world. Four of our ports, including Durban and Cape Town are ranked among the worst 5% of ports. This obviously results in a substantial loss of trade for this country with knock-on effects on the mining and agricultural sectors particularly. The recent cyber-attack on Transnet’s port system has made the situation far worse with Cape Town losing an estimated one week of off-loading and some ships choosing to bypass the port completely. Fruit and meat exports have been particularly hard hit with a severe shortage of cold storage facilities.

The Rand

At the time of last month’s Confidential Report (7th July 2021) the rand was recovering from a shift to “risk-on” in the international investment community. This risk-on sentiment was driven by the fear of a renewed surge in COVID-19 cases due to the Delta variant in both the US and the UK.

This was followed by the arrest of Jacob Zuma which triggered widespread unrest and looting here in South Africa. Overseas investors naturally reacted negatively to the news which strongly suggested a complete break-down in law and order. The rand collapsed to levels around R15 to the US dollar where it found some support.

Since then, as it has become more obvious that the 9 days of civil disturbance have subsided and seem unlikely to be repeated, confidence is slowly returning. Overseas investors are once again turning their attention to the high real rates of return offered by our government bonds when compared to the yield on long-dated treasuries in first world countries. Consider the chart:

.png)

You can see here the low which the rand made at R13.43 against the US dollar at the end of May 2021, followed by the shift to risk-off as fears of a third wave of the pandemic briefly impacted markets. The period of “returning stability” was then interrupted by the unexpected advent of 9 days of civil unrest and looting in Natal and Gauteng. This took the rand up to support levels around R15 to the US dollar. In our view, the response of the rand was surprisingly muted given the scale of the unrest.

Since then, as the unrest subsided confidence has been returning slowly and the rand has tracked back towards R14.50 to the dollar.

Consider the long-term pattern in the rand/dollar:

This shows that the impact of the recent civil unrest on the long-term strengthening pattern of the rand. We expect the strengthening trend to now resume and for it to take the rand all the way back to levels below R13.50 to the dollar and beyond. This will obviously be bad for rand-hedge shares in the short term, but it will benefit the economy through the lower cost of fuel and reduced inflation.

Commodities

The prices of commodities on world markets are strictly a function of supply and demand. They are responding positively to increased demand, especially, from China as their economy ramps up to supply booming consumer spending in the US and elsewhere. Base metals and precious metals prices are rising steadily as the demand for every kind of product increases across the world. The massive monetary policy stimulation following the sub-prime crisis and more recently to compensate for the impact of COVID-19 have thrust first world economies into a powerful economic boom.

South Africa is a direct beneficiary of this through its mining industry. Precious and base metal prices have risen sharply. Even coal companies like Tharisa and Exxaro have seen rising prices. Overall, the impact on South Africa has been dramatic with an additional R34bn in taxes collected above projections in the February budget so far this year and more is expected. Commodity taxes should make a significant dent in the national debt by the end of the tax year in February 2022.

The gold price in US dollars appears to have resumed the upward trend which has been in place since the start of 2016. Consider the chart:

.png)

Our expectation is that, as the world economy gains momentum, inflationary pressures will begin to rise resulting in an increased demand for gold.

Companies

PROPERTY

The unrest and looting has caused the JSE property index to fall about 5% as about 200 properties were attacked and 600 stores damaged to a greater or lesser extent. The property index was busy recovering from the impact of COVID-19 when the unrest began. What is clear from the chart is that the effect of the riots has been far less than the pandemic:

Some property consolidation deals have been shelved or put on hold as investors wait to see what will happen next. In addition, the valuations of some properties, especially in Natal will have to be reviewed and probably reduced. In our opinion, the property sector remains underpriced at current levels and should continue to perform in the future.

LEWIS

On 31st January 2019 when Lewis was trading the market for 3750c we wrote an article https://pdsnet.co.za/index.php/lewis in which we said, “At current levels, the share is trading on a P:E of 10 and a dividend yield (DY) of 5%. We believe that this share represents a bargain at current levels.” Obviously, this was well before the unpredictable “black swan” event of COVID-19 which took the share down to a low under 1500c in March 2020. Since then, however, the share has recovered all the way back to the same price – only now it is trading on a P:E of 6,24 and a dividend yield of 6,82. The company’s balance sheet remains ungeared which means the risk in buying this share is very low. Given that the average P:E on the JSE is 16,75 and the average dividend yield is 2,4%, Lewis looks like a total bargain to us. In its results for the year to 31st March 2021 the company reported operating profit up by 174,2% and headline earnings per share (HEPS) up by 136,9%. The company is strongly cash generative with R447m in cash and no debt on its balance sheet. Consider the chart:

In our view this is one of the best bargains on the JSE right now. The company has shown its ability to survive and grow through the pandemic and the recent civil unrest. We believe that it is poised to grow rapidly and pay good dividends as it does so.

ANGLO

Anglo’s results for the six months to 30th June 2021 are nothing short of spectacular. Attributable profit was $5,2bn of which $4,1bn was returned to shareholders. This performance was due to effective management combined with rising commodity prices. Commodity shares are usually quite volatile because they depend on the international price of commodities, but Anglo overcomes this problem to some extent by being diversified across a variety of precious metals, base metals and minerals. From its low of R210 in March 2020 the share has risen to R653 – a gain of over 200% in 15 months. Consider the chart:

We expect Anglo to continue to perform well as commodity prices continue to rise.

BRITISH AMERICAN TOBACCO

British American Tobacco (BTI) describes itself as a "leading consumer goods company" - which is a euphemistic way of saying that they produce and sell an enormous number of cigarettes and related products world-wide. It is also the second largest company on the JSE after Naspers. In recent decades, cigarette companies have become increasingly oppressed. Their ability to advertise their products and even package them has been severely curtailed in many countries. They are seen to be exploiting an addiction which is clearly anti-social, very bad for the individual's health and which regularly involves them in lawsuits for damages.

What is interesting is that the share trades on a price: earnings (P:E) ratio of 9,49 and a dividend yield (DY) of 6,26% - which is very unusual for an international blue-chip rand-hedge. The poor rating reflects the perception that smoking generally has become a socially unacceptable activity and the company faces increasing regulatory restrictions across the world. Despite this, roughly 20% of the world's population still smoke - making a truly massive market.

This is one of the shares that has performed well and perhaps even benefited from COVID-19. The CEO says that he aims to double non-combustible sales by the 2023/24 year. In its results for the six months to 30th June 2021 the company reported revenue down 0,8% while "new category" sales rose by 40,4%. CEO, Jack Bowles, said, "This has been an exciting period of growth in New Categories, with New Category constant currency revenue up by 50% in the first half. We added 2.6m consumers, our highest ever increase, to our non-combustible product consumer base, to reach 16.1m". Consider the chart:

This shows that BAT has been stuck in a sideways pattern since late last year. In our view it offers a rand-hedge on very high yields in a stable world-wide market. This should be attractive to private investors.

CAPCO

This is a UK-based real estate investment trust (REIT) which has as its primary asset (94% of its portfolio) Covent Gardens in London. Covent Gardens is one of the most visited shopping areas in London and as the third wave of the pandemic recedes should benefit directly from much higher footfalls. With a loan-to-value (LTV) of just 18% and a vacancy rate of 3,4%, we believe that this share is significantly under-valued. Consider the chart:

This shows that prior to Brexit, Capco was a favourite property share in the UK. Brexit and then COVID-19 have brought the share down to much lower levels where it is trading for less than its net asset value (NAV). It has recently broken convincingly up out of that downward trend and should perform better now.

VIVO

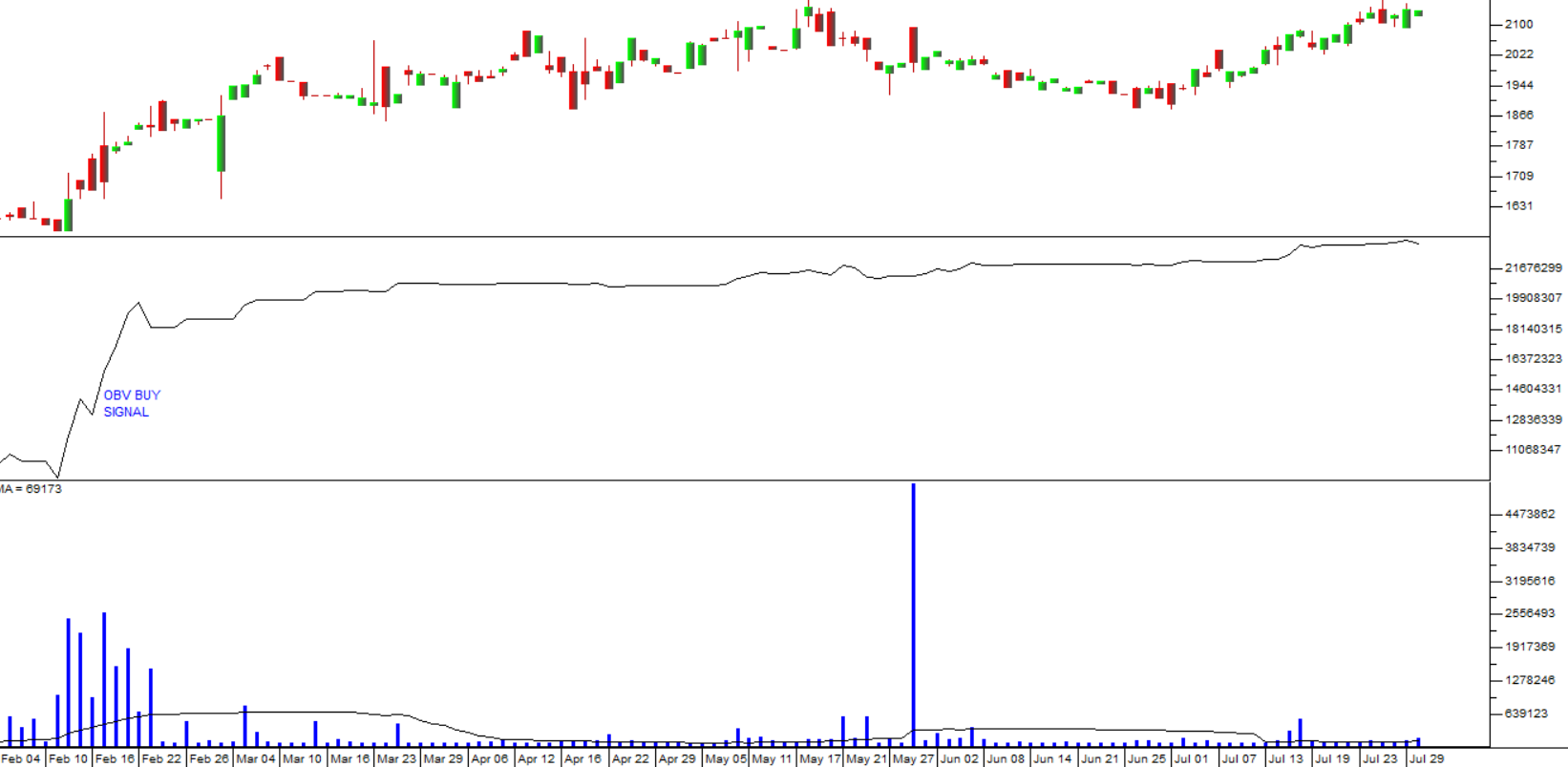

This is an energy company which has Shell petrol stations, mainly in South Africa, but also in other African countries. It recently bought 230 stations from Engen which took it into 8 new African countries. In the 6 months to 30th June 2021 the company reported headline earnings per share (HEPS) of 6c (US) compared with 1c in the previous period. Petrol stations offer a very steady source of income since the supply of petrol is an essential service for both consumers and businesses. This company has been growing both organically and by acquisition with the potential to expand further into Africa. On 15th February 2021 the share gave a strong on-balance-volume (OBV) buy signal at a price of 1675c. Since then, it has risen to 2141c – a gain of 27,8% in under six months.

The OBV shows a surge in volumes traded accompanied by rising prices – which indicates strong buying of the share by the “smart money” or insiders. Consider the chart:

The chart shows the OBV in the centre with a clear buy signal shown as the upward spike in February 2021. Since then, there has been steady accumulation. The volumes traded are sufficient for private investors.

LIBERTY 2 DEGREES

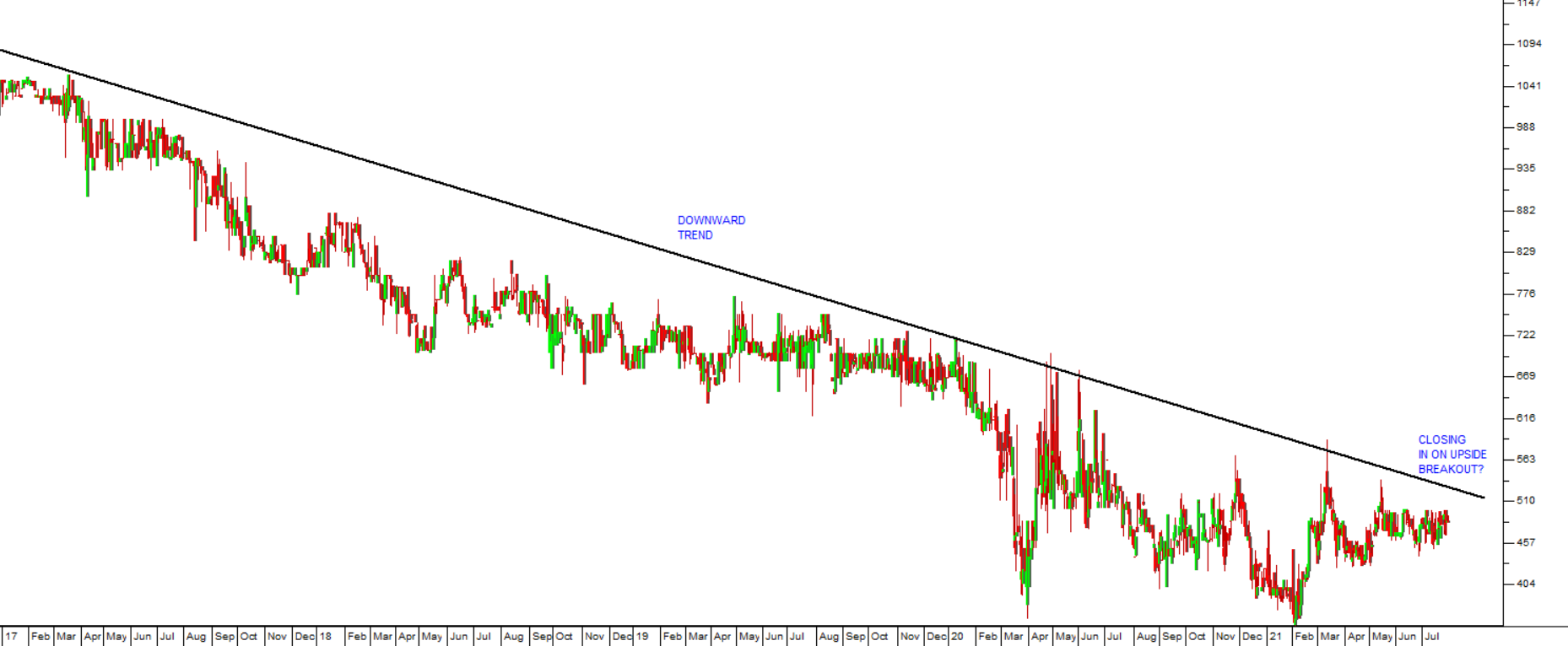

This is a real estate investment trust (REIT) which owns a 25% stake in Sandton City as well as Nelson Mandela Square and Eastgate Shopping Mall. The share has been hammered down by both COVID-19 and the general sell-off in property shares. It has been falling since it listed in December 2016 and is now trading for less than half its listing price. With a loan-to-value of just 23% and an occupancy of 96,7% the share looks seriously under-valued. It is trading for about 63% of its net asset value. In our view, this is one of the better options in the heavily over-sold property sector. Consider the chart:

Technically, the share has been in an extended downward trend since it listed. We now think it is heavily under-valued and due to break up through its downward trendline.

PROSUS

This share has been hammered down by its recent complicated transaction to acquire up to $1,37bn worth of its own shares and up to $3,63bn worth of its parent company, Naspers' shares. This idea was a further effort to close the gap between its net asset value (NAV) and its share price but has not been well received by institutional fund managers. Some have decided to get out of Prosus resulting in the recent downward trend in the share price from its peak of R1937,76 (19-2-21) to current levels around R1300. Obviously, Prosus’ main asset remains its 29% holding in the Chinese social media and gaming giant, Tencent and recent moves by the Chinese authorities to clamp down on social media have temporarily pushed the share even further down. In our view, however, this offers an opportunity for private investors to get into the share at lower levels.

In its most recent results for the year to 31st March 2021 the company reported group turnover up 53,6% and trading profit up 49%. These are truly amazing figures for such a large company. Consider the chart:

.png)

At its height in February this year the share was the darling of the big institutions and trading on a P:E of 69,62. Now that it has temporarily gone out of favour, it is trading on a P:E of 23,67 – which looks cheap to us. Conservative private investors might want to wait for a clear upside break through the downward trend line, but in our view the share is now under-priced.

MR. PRICE

This is a favourite share of the institutional fund managers. Obviously, as a retailer it has borne the brunt of COVID-19 and the recent civil unrest. Despite this, in the year to 3rd April 2021, the company reported that sales were up by 8,5% in the group with online sales jumping 64,1%. The company is strongly cash generative and ended the year with R4,9bn in available cash. Steady buying of the share by the institutions keeps it at an earnings multiple of between 10 (March 2020 after COVID-19) and 30 (after Ramaphoria in March 2018). Right now, it is on a P:E of 20,4 – which looks cheap to us. Consider the chart:

.png)

This chart shows a standard candlestick in the top half and the share’s price: earnings (P:E) ratio in the bottom half. You can see the impact of “Ramaphoria” in the early part of 2018 and the effect of COVID-19 in March 2020. In our view, as the South African economy normalises and institutional fund managers look for value, the P:E will move back towards 30. This implies that the price could move up by as much as 50%.