The Rand Tanks

13 August 2018 By PDSNET

The yield on the R186 long bond spiked up from 8,68% to 8,85% as foreign investors pulled their cash out of South Africa and put it into safe investments like the US 10-year treasury bill.

As sometimes happens, investors suddenly reached a tipping point and then acted swiftly. The problem is that our currency is very vulnerable to this type of shift in international sentiment – because of our political vacillations, our over-indebtedness, and the government’s intention to advocate expropriation of land without compensation. These are negatives for any overseas investor – obviously. Nobody wants to invest in a country where there is even a remote possibility that his investment might be arbitrarily taken from him/her without any compensation.

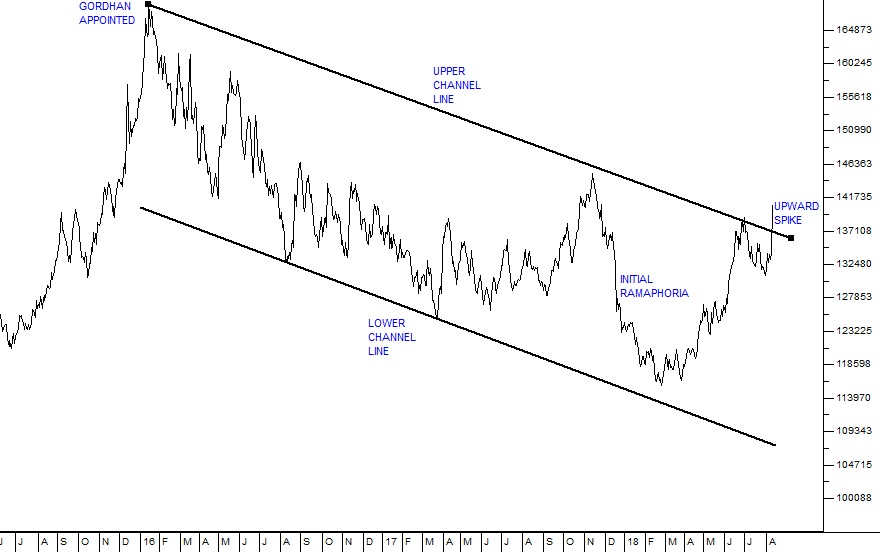

Technically, this spike in the rand/US$ chart is a problem because it takes the rand clearly through its long-term upper channel line: