York Rights Issue

12 December 2022 By PDSNETOne of the main reasons that companies list on the JSE is so that they can raise capital by selling their shares. Normally, this is done through a rights issue where the existing shareholders are offered the opportunity to buy additional shares at a price below the current market price.

The rights issue takes the form of a “renounceable nil-paid letter of allocation” also just known as a nil-paid letter or “NPL” which is given to existing shareholders. Each NPL entitles them to buy one more share in the company at a discount to the current share price.

For example, on 5th December 2022, the listed company York Timbers (YRK) announced the decision to raise R250m by way of a rights issue to its existing shareholders holding shares at the close of trade on 15th December 2022 (the record date).

The shareholders would get NPL's for 43,12791 new shares for every one hundred shares that they already held on the record date. Each NPL would entitle them to buy one more York share for 175c – which was a 33,87% discount to the average price of the shares on the JSE immediately prior to the board’s decision to undertake the rights issue (1st December 2022).

Because the NPL's allow an investor to buy shares below the current market price of York in the market, they (the NPLs) have a value - and the JSE allows them to be traded on the market alongside the ordinary shares in the market until the date when the new shares must be taken up. This enables those investors who do not wish to take up their rights to sell their NPL's to other investors. The price of the NPL's is given by the gap between the market price of the share and the take-up price of 175c. So, in effect, an NPL is a derivative instrument whose value is leveraged to the value of the underlying share.

In the case of York, the company began with approximately 331 240 586 shares in issue worth an average of 265c each giving it a value (market capitalisation) of R877,8m. Now it will issue a further 142 857 142 new shares so in total it will have 474 097 728 shares in issue and the company will be worth R877,8m plus the R250m raised in the rights issue - or R1 127,8m.

If you divide this value by the number of shares which will then be in issue, the share should be worth about 238c each (R1 127,8m/474m shares).

In effect, the issued shares of the company would be increased by 43% with the issue of 142,86 million new shares. In return, the company would receive R250m in cash – and, theoretically, that cash injection would exactly compensate the shareholders for the dilution. Shareholders would get an NPL which theoretically should have a value of about 63c (238c – 175c).

Consider the position from the perspective of a private investor with one thousand York shares. Before the rights issue his shares were worth R2 650. After the rights issue they would only be worth R2 380 (1000 X 238c), but he would get 431 NPL's each worth about 63c each, or R271 (431 X 63c) – so in total his investment would now be worth R2 651 (R2 380 + R271). In other words, he should neither gain nor lose anything because of the rights issue – in theory.

In America rights issues are called “privileged subscriptions” because the existing shareholders supposedly get the “privilege” of buying additional shares at a discount to the current market price. But you can see, a rights issue confers no benefit on the existing shareholders because the value of the rights is equal to the cost of the dilution.

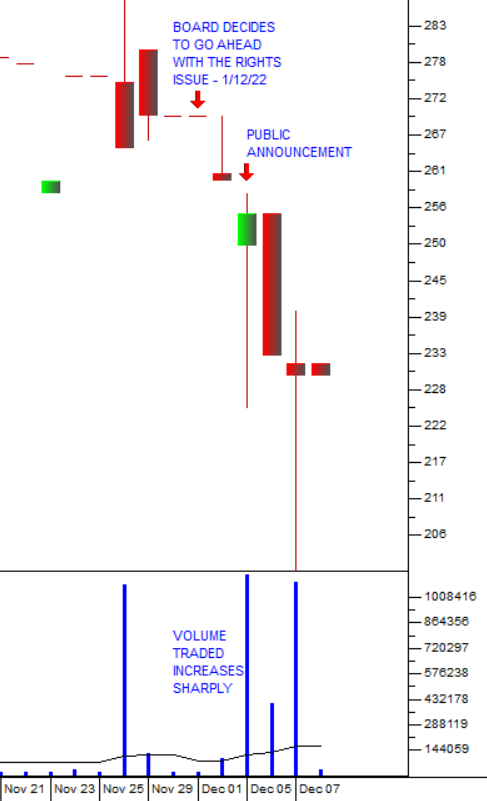

The announcement to go ahead with the rights issue had a direct impact on York shares trading in the market. Consider the chart:

Here you can see that on the date when the board made the decision (1/12/22), the share closed at 270c and then, following the announcement on Monday (5/12/22) the following week, the share fell on unusually high volumes to 230c – which is just below their theoretical value after the rights issue.

From 13th December 2022 until 3rd January 2023, the NPL's will trade alongside the ordinary shares on the JSE with the abbreviation YRKN. Remember that the value of the NPL's will be geared to the value of the ordinary shares – which are already trading for 8c less than their theoretical value of 238c. This means that the value of the NPL's has already dropped from 63c to 55c – or by 12,7% even before they begin trading. Like all derivative instruments, the NPL's will be very volatile during their 3-week lifespan. After 3rd January 2023, the NPL's will have no value.

This article is not meant to suggest that York shares or their NPLs are a good investment. Rather, it is presented to give you a topical example and explanation of rights issues and how they work because they come up from time to time on the JSE and, as a private investor, you need to understand them.