Wall Street and the JSE

23 March 2018 By PDSNETth January 2018, is not yet over. President Trump imposed about $50bn worth of tariffs against China, reigniting the prospect of a trade war between the two largest economies in the world. The point to notice is that this is a new issue in the correction which was not there on 26th January. At that time the correction began because of better than expected employment figures and the fear of a more rapid rise in interest rates.

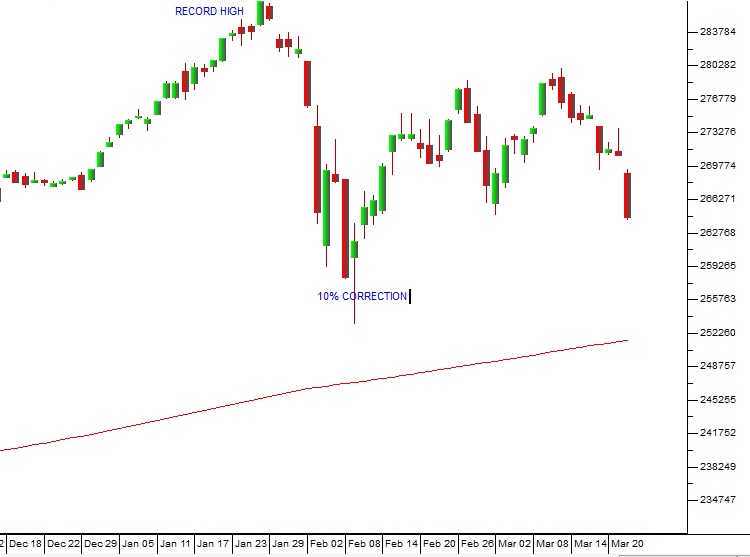

From a technical perspective, the S&P has corrected 10% - but it took only 9 days to do that and since then it has been hovering in a sideways to upwards pattern – before last night’s drop:

S&P500 Index December 2017 to March 2018 - Chart by ShareFriend Pro

We still believe that this correction will be both shorter and sharper than the 14% correction which occurred between August 2015 and February 2016. We also do not see this radical move by Trump as sufficient to negate the rising evidence that the US economy is booming. In other words, we expect some further “backing and filling” as the market absorbs this new development – and then a strong upward move to a new all-time record high. Our market has felt the direct effects of these moves on the S&P – as you can see from the following chart: