Gold shares up 225%

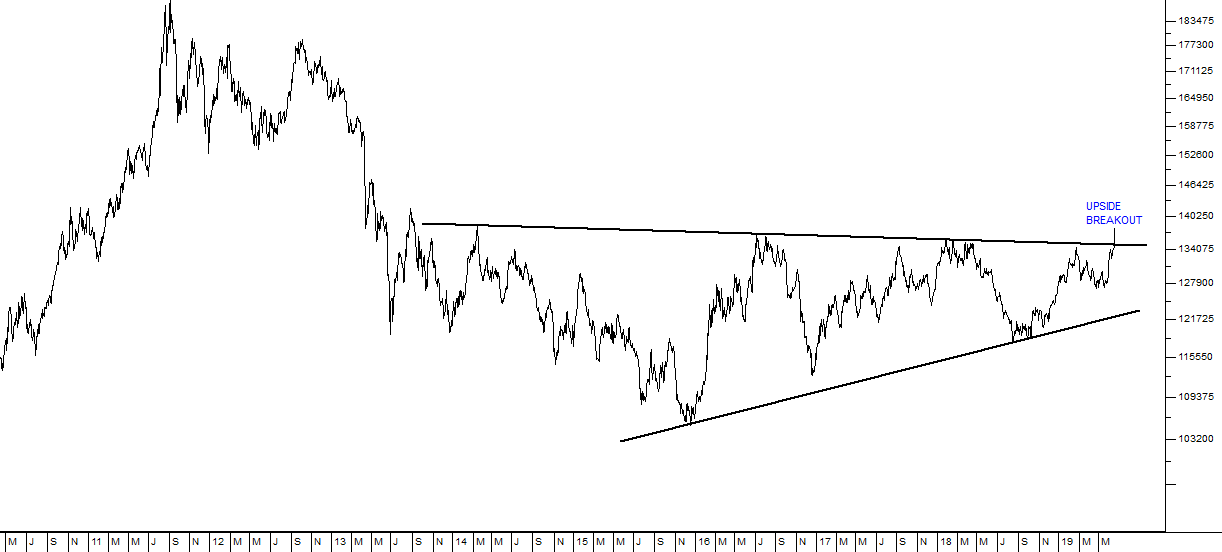

7 August 2020 By PDSNETOn 24th June 2019 we published an article under the heading “New Gold Bull” in which we drew your attention to the fact that the US dollar price of gold had broken up convincingly above resistance at around $1340. Below is the chart which we included with that article.

You can see here the clear upside breakout above the upper resistance line in the “wedge formation” in gold. That gave a clear signal that the period of sideways movement which had lasted for six years was over and a new upward trend was about to commence.

Over the year which has followed the price has surged to $2061 – a gain of 54%.

For South African investors, that gain has been amplified and extended by the 21% fall in the rand/dollar exchange rate over the same period. Together these two effects have resulted in a massive surge in the price of gold shares. Consider the chart of the JSE gold index over the same time period:

At the time that our article was published (24-6-19) the JSE gold index was at 1998. It closed last night at 6507 – a gain of 225,7% in just over 1 year.

What is the cause of this massive surge in gold shares? The underlying cause is the expected fall in the purchasing power of paper currencies following their continuous debasement (in the form of record low interest rates and quantitative easing) in the ten years after the sub-prime crisis of 2008. This has now been further extended by the extraordinary monetary stimulation in response to the corona pandemic which has seen a widespread resumption of quantitative easing and a return of effective interest rates to zero in most first world countries.

Smart investors are aware that you cannot expand the money supply so radically without debasing it. Added to that, there is little incentive to hold US treasuries because they are offering negative real returns. This makes gold the obvious choice for the protection of wealth.

The massive monetary stimulation of the world economy over the past decade will, in our opinion, result in an economic boom of monumental proportions over the next few years. That will certainly be accompanied by rising inflation which will be very difficult for central banks to contain.

This means that shares on world markets (including the JSE) are going to continue rising, including gold shares. In our article we suggested that the upside break in the dollar price of gold “could represent an opportunity for private investors”. Today, after a 225% gain, we are saying that the opportunity is not over – it has just expanded to include almost all high-quality equities.