US Economy and the Rand

16 July 2018

By PDSNET

With it comes a 0,25% hike in interest rates. This steady increase in interest rates “tightens” the money supply, and is also intended to reverse and “normalise” the effects of quantitative easing and the ultra-low interest rates over the past decade. There could possibly be a further two 0,25% rate hikes this year still.

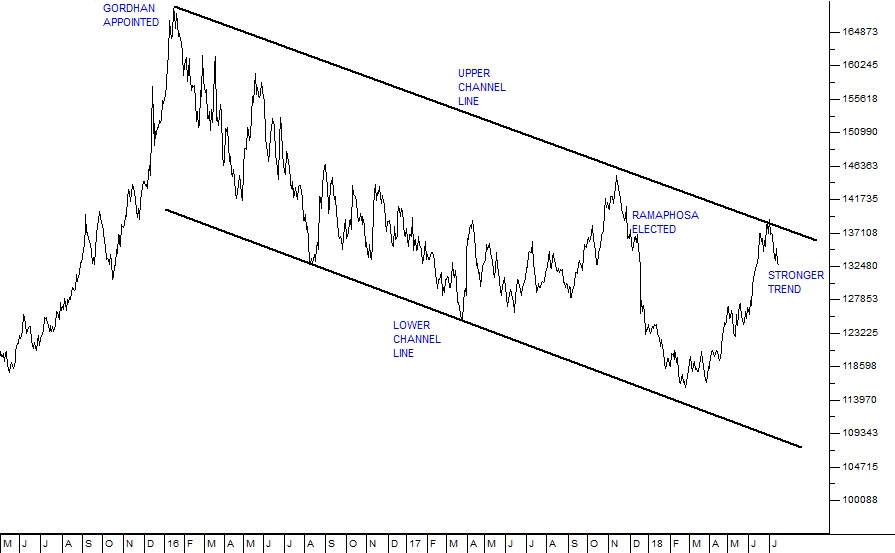

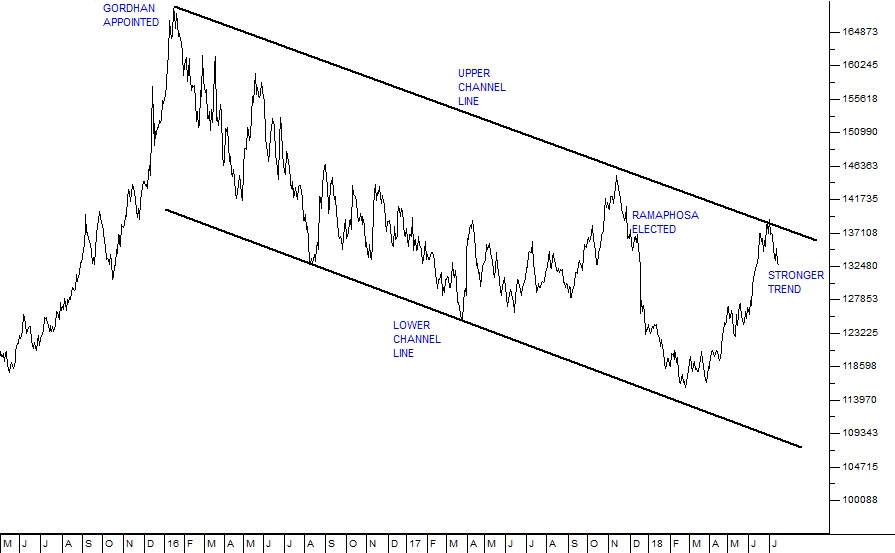

Together with the current “risk-off” attitude of international investors, interest rate hikes and open market bond-buying have pushed the rand back to its upper channel line at around R13.75 to the dollar. Consider the chart:

Rand Dollar Exchange Rate May 2015 to July 2018 - Chart by ShareFriend Pro

Here you can see the long-term strengthening channel defined by upper and lower channel lines. As we have suggested in previous articles, the recent weakness took the rand back to its upper channel line – and now it appears to have entered into a new stronger trend.

Trendlines, like the channel lines drawn on the chart above, are not precise instruments, but they offer a very good indication of approximately how far a trend is likely to go. What is notable technically is that the upper and lower channel lines on the rand chart are parallel.

Right now, all emerging market currencies are weakening against hard currencies and particularly the US dollar. The rand is down under 7% since the start of the year compared with the Turkish lira which is off 20% and the Brazilian real which is off 13%. Some analysts says that our comparatively better performance is due to the Ramaphosa factor and suggest that if Ramaphosa had not been elected, the rand would be at R17 to the US dollar by now.

Another factor is the level of our current account of the balance of payments. The trade balance, which is the major part of the current account, has swung from a R75bn surplus in the 4

th quarter of 2017 to a R25bn deficit in the first quarter of 2018. That’s a R100bn turnaround and it will certainly have impacted on the rand’s level against the US dollar. But trade account figures are notoriously volatile.

What is clear is that the current “risk-off” attitude of international investors has been partly a function of the tighter US monetary policy and partly a result of the tough talk coming out of Washington and China which threatens a trade war between these two economic giants. In our opinion, such a trade war is unlikely to materialise to any great extent. We believe that the rhetoric will calm and things will return to normal leading to renewed rand strength in due course – but the real question is, will it remain with the strengthening channel that it currently occupies?

Our view, for what it is worth, is that further rand strength can be expected – mainly because the factors which caused the dollar to strengthen and Wall Street to weaken appear to be coming to an end. This opens the door for our stock market and currency to go up again.