The Confidential Report - May 2017

2 May 2017 By PDSNETPolitical

The president has delivered a shattering blow to the South African economy, just as the economy was beginning to show definite signs of renewed optimism at the start of 2017. South African consumers may have been frightened into “pulling their heads back into their shells”. When consumers and businesses are scared, they typically stop spending and conserve cash to cope with whatever the new uncertainties may occur. This tends to reduce the sales of white goods and big ticket items like motor vehicles. It results in major investment projects being curtailed or abandoned and it results in consumers “trading down” to cheaper products. Economists and analysts have had to modify their forecasts downwards to reflect the new somber mood.

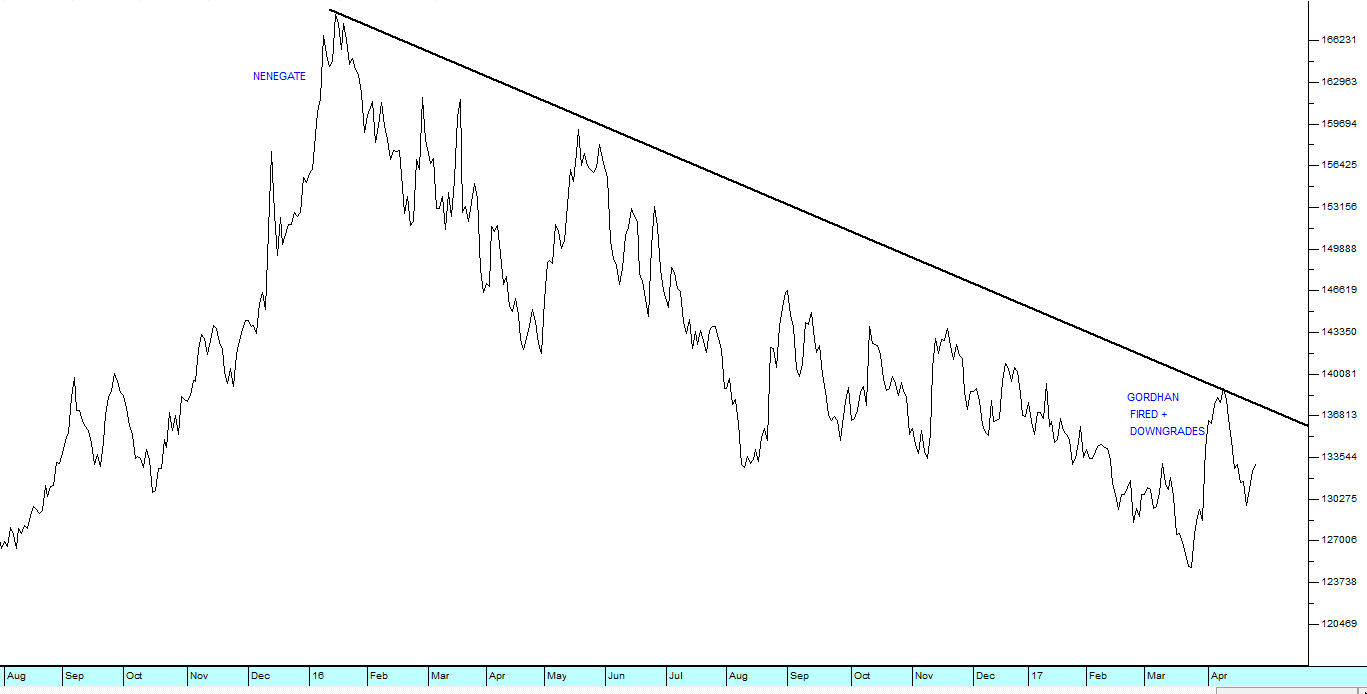

What is interesting is that while some JSE shares have fallen (notably, the banks) the general trend among equities remains upwards. Obviously, some of this is due to the fact that there are many large companies listed on the JSE which have a substantial proportion of their business overseas – like BAT or Anheuser Bush. Consider the JSE Overall index:

The JSE Overall Index - Chart by ShareFriend Pro

Here you can see that the JSE has been trading in a sideways pattern bounded by an upper resistance line and a lower support line. Since the start of 2017, however, the market has been trending up in a pattern which promises to break through the upper resistance. Perhaps, as a private investor you should remember Warren Buffet’s words “Be greedy when others are fearful…” and prepare yourself to buy in when the negativity is at its peak. The motion of no confidence which is being motivated by the DA is likely to fail, because Zuma has been preparing for it by removing those members of parliament who oppose him and bringing more who [glossary_exclude]support[/glossary_exclude] him. It is highly likely that he will win this vote and entrench himself for the next two years. This is particularly true if the Court motion to have the vote done by secret ballot is turned down. Zuma will also use his position to ensure that Dlamini-Zuma is selected by the ANC to take over from him when his term ends. This will ensure that he and his supporters are not brought to book – unless the ANC loses its majority in 2019. Recent polls suggest that, if an election were held now, the ANC would get only 48% of the votes or less. And in two years’ time, that number is likely to be much lower. The energetic efforts of the various opposition parties resulted in some very large public marches and on-going [glossary_exclude]rallies[/glossary_exclude], all calling for Mr. Zuma to step down. The president has replied by saying that he will only step down when asked to do so by the ANC – which, of course, he now controls almost completely. South Africans will have to wait for the elections in 2019 before they get a chance to reduce the ANC’s majority to less than 50%. So we have another two years of bad and probably populist economics to endure. This might not be so bad because South Africa is likely to follow the world’s larger economies into a period of relative prosperity. Since the Bank of Baroda has been closing the Gupta business accounts, the Guptas have launched an application to buy an existing licensed bank in South Africa – the International Bank of Habib. In this endeavor they were blocked by the erstwhile Minister of Finance, Pravin Gordhan – but the new Minister will almost certainly give this deal the go-ahead and that will solve the Gupta’s banking problems. This might well be why Zuma was in such a hurry to get Gordhan out and Gigaba in – he may have been under extreme pressure from the Guptas. The decision by the UK public relations company Bell Pottinger to cease dealings with the Guptas is yet another example of how this Indian family have become local and international pariahs. Nobody wants to deal with them because they are seen as subverting the South African democracy for their own profit. The Guptas say they have done nothing illegal, but public opinion does not need proof in the legal sense. A strong suspicion and a deluge of well-placed media articles are sufficient. Our new Finance Minister has been at pains to reassure [glossary_exclude]investors[/glossary_exclude] and the ratings agencies that he intends to continue with the policies and objectives established by Pravin Gordhan, but very soon he will have to decide on how to deal with demands from various parastatals for additional funding of state guarantees. The first candidate will probably be the SABC which is known to be applying for funds to bail it out and enable it to continue paying salaries. His response will be a [glossary_exclude]clear[/glossary_exclude] indicator of how he intends to deal with the demands in future and his probable stance on fiscal discipline. There seems to be little doubt now that the Gupta’s orchestrated a massive payout from Eskom for the Tegeta coal company. According to a leaked report from the Treasury, the R659m paid to Tegeta is part of Eskom’s “irregular, fruitless and wasteful” expenditure and should be treated as an interest-bearing loan. The report goes on to say that the Tegeta coal was sub-standard and below the Eskom’s guidelines. This contract was organised during Brian Molefe’s tenure as CEO and he was certainly involved with the Gupta’s in organizing it. Obviously this type of activity by a major parastatal cannot be ignored and appropriate remedies must be sought. The report recommends that the funds be recovered from Tegeta or failing that from the Eskom employees concerned. Eskom is making much of the fact that the leaked report was “just a draft” – but common sense indicates that by the time the “final” report is tabled the damning findings will have been removed or watered down. “Procurement” is the term used to indicate the government purchasing or procuring goods and services – usually from private enterprise. Usually, before any project can be considered for procurement, a detailed feasibility study must be done. The government is trying to push through the nuclear build program and is asking for some of the rules of procurement, possibly including the feasibility study, to be waived for this deal. The draft 2016 Integrated Resource Plan (IRP) indicates that nuclear power will not be needed until 2037, but the president is intent on getting it done now despite the enormous cost to the economy and the fact that it is unnecessary. In fact, the demand for power from Eskom has been declining, mainly because of the increased costs and unreliability of their service. More and more companies and private individuals are making other arrangements. Eskom actually now has surplus power generation capacity. It has been closing down some of its coal-fired power plants recently. It seems [glossary_exclude]clear[/glossary_exclude] that the Government has already secretly accepted a deal to build these nuclear power stations (from Russia) and now has to meet obligations to them. Why else would they do something so irrational? One of the key reasons for getting rid of Pravin Gordhan was probably that he stood in the way of this deal. Now the courts have rejected the deal because there was insufficient public participation. The determinations given by the previous Minister of Energy have been overturned as part of a pattern which must be becoming all too familiar to Mr. Zuma. He has gained control of the Ministry of Finance, but not of the judiciary. The decision by many unions to [glossary_exclude]ask[/glossary_exclude] President Zuma not to address their May-day celebrations comes hard on the heels of his rebuff by the Kathrada family at the funeral of this ANC icon. There appears to be a massive groundswell of negative [glossary_exclude]sentiment[/glossary_exclude] towards Zuma which the ANC would be well-advised to take cognisance of. If they do not they may well find themselves without a majority following the 2019 elections.Wall Street

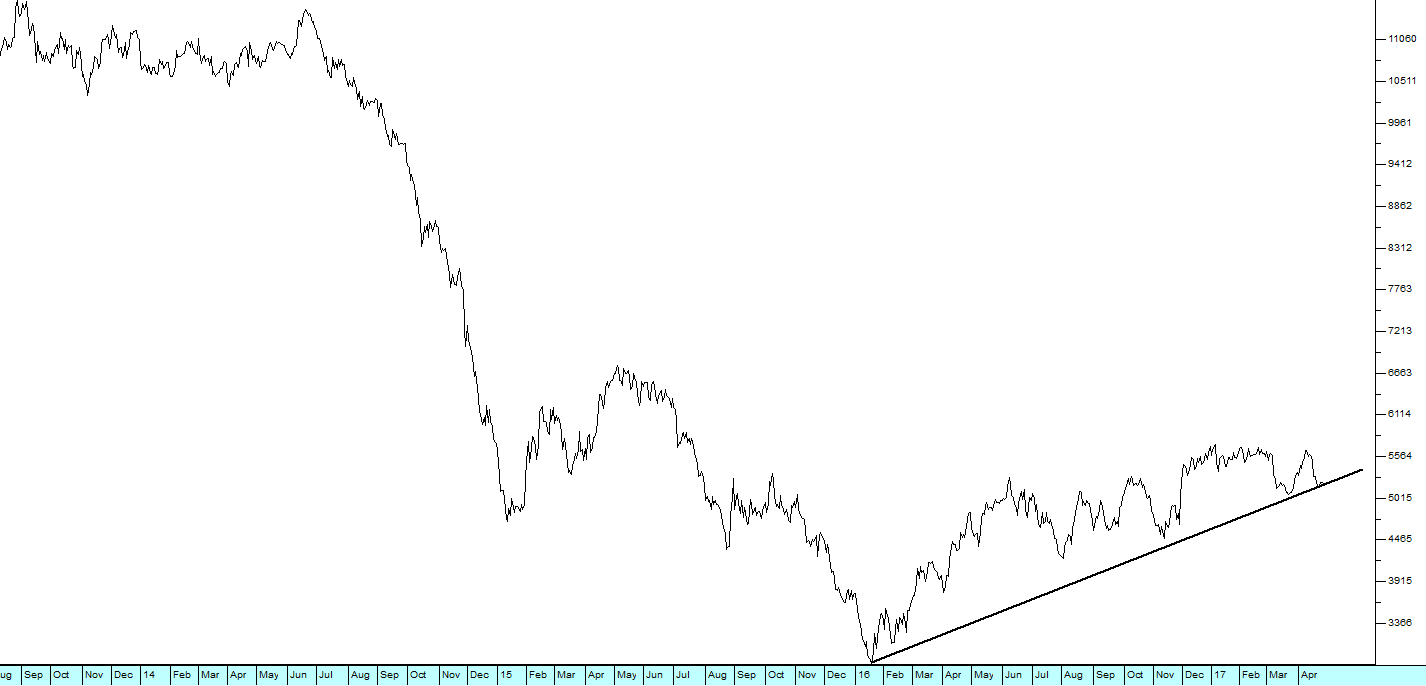

The great bull market which commenced in March 2009 is continuing. This can be seen from the following [glossary_exclude]long[/glossary_exclude]-term chart of the S&P500 index:

S&P500 Index - Chart by ShareFriend Pro

Here you can see the channel that the S&P has been in and the fact that since the second touch point in February 2016, the index appears to be accelerating upwards towards the upper channel line. We believe that this rising trend in the S&P now reflects the strong recovery in the US economy and the steady improvement of other world economies, like Europe and China. The trend echoes the rising trend on the JSE and indicates strong bullish sentiment among investors world-wide.The Rand

The sudden firing of Pravin Gordhan as Minister of Finance and the subsequent downgrades by the ratings agencies had a sharp negative impact on the rand, taking it back from R12.50 to the US dollar to around R13.90. Subsequently, the rand has surprised everyone with its strength. Clearly, overseas investors are still interested in South Africa and believes our economy is going to continue improving despite these blows. The rand is one of the most heavily-traded emerging market currencies in the world with over R50bn a day changing hands. As a market, it is far too big for the Reserve bank to influence significantly. Therefore, its recent strength indicates that international currency speculators still believe that this country’s economy will do well, despite its many challenges. Consider the chart:

The Rand/Dollar - Chart by ShareFriend Pro

The speculation raised by Stuart Theobald (Business Day) that there was an attempt to make money out the rand by taking a short position prior to the firing of Pravin Gordhan is probably without foundation. Experts and traders say that there was no unusual trading prior to the announcement. This indicates that the Guptas and their entourage may well have missed a golden opportunity to make some serious money in a very short space of time – of course, assuming they were behind the move and had prior knowledge of it. Nobody really expects Zuma to undertake such a sophisticated move – because that would indicate that he actually understands and appreciates the effect of his actions on the currency markets – which, clearly, he does not.The Economy

Our new Minister of Finance appears to be moving strongly in the direction of populism. Populism means policies to appease the masses, irrespective of their [glossary_exclude]long[/glossary_exclude]-term impact on the country’s inflation [glossary_exclude]rate[/glossary_exclude], credit rating, employment level or other important economic metrics. The classical populist strategy was that put into effect by Robert Mugabe in Zimbabwe. He didn’t bother with sticking to a bi-annual budget. Whenever the country was short of money he simply printed it – a policy which eventually resulted in run-away inflation and the collapse of the Zimbabwean currency. Alan Greenspan, the Governor of the US Federal Reserve bank, in his book “The Age of Turbulence”, had the following to say about economic populism: “Economic populism seeks reform, not revolution. Its practitioners are [glossary_exclude]clear[/glossary_exclude] about the specific grievances to be addressed, but its prescriptions are vague…It is far from cerebral. It is more a shout of pain. Populist leaders [glossary_exclude]offer[/glossary_exclude] unequivocal promises to remedy perceived injustices. Redistribution of land and the prosecution of a corrupt elite who are allegedly stealing from the impoverished are common cure-alls…In all of its various forms, of course, economic populism stands in opposition to free-market capitalism…I would argue that economic populists have a better chance of achieving their goals through more capitalism, not less.” One of the key considerations in South Africa will be the line between black economic empowerment and populism. Exactly at what point does BEE cease to be about remedying the past wrongs of apartheid and become about pandering to the masses, at the expense of the economy, in [glossary_exclude]order[/glossary_exclude] to retain or win their votes? In the new South Africa, the rand has remained remarkably stable because of the adherence to a strict monetary policy. If Zuma and Gigaba decide to [glossary_exclude]abandon[/glossary_exclude] that monetary discipline, the initial effect will be that the economy will go into a boom, because everyone will have more money – in the short term. The [glossary_exclude]long[/glossary_exclude]-term effect (which will begin to show after about a year) will be a rising inflation [glossary_exclude]rate[/glossary_exclude]. It is said that the path of inflation up to 20% per annum is quite slow, but once it passes 20% it begins to feed on itself, because people begin to take it into account when asking for wage increases and businesses build it into their pricing strategy. It’s a little like Pandora’s box – once you [glossary_exclude]open[/glossary_exclude] it, it can be extremely difficult to get whatever comes out back into the box again. One of the problems with this scenario is that allowing the money supply to increase in an uncontrolled fashion will probably result in an economic boom - at roughly the time of the 2019 elections. And it may be that the Zuma camp will point to that as a vindication of his populist policies in [glossary_exclude]order[/glossary_exclude] to garner [glossary_exclude]support[/glossary_exclude]. The CEO initiative whereby government in the form of Pravin Gordhan, labour and the CEOs of leading SA companies came together in 2016 to avert a ratings downgrade has been largely negated by the parliamentary re-shuffle and the downgrade by rating agencies. The sixteen months of hard work is probably mostly wasted. The CEO’s of all the major banks who were involved all say that the effect of the downgrade will be felt in lost jobs, especially for the lowest earners in South Africa – the poorest of the poor. And the impact of the cabinet re-shuffle and the subsequent downgrades on the local motor vehicle market is likely to be severe. So March sales were up by an encouraging 2,1% - but expect April sales to be sharply down. Our saving grace, of course, will be exports of motor vehicles, up 7,8% in March, as the world economy recovers. The Purchasing Managers’ Index (PMI) for March was again above 50 for the third month in a row – indicating that the manufacturing sector may be recovering from recession. At this point it is difficult to tell what the impact of the downgrade will be on manufacturing, but it will certainly be negative. Manufacturing is being boosted by a recovery in overseas economies, especially the US. It is also boosted by the excellent maize crop this year and recovering commodity prices. Manufacturing contributes 13% of South Africa’s GDP and as such is an important element. The February figure was disappointing, but most economists believe that manufacturing will pick up during 2017. The war between Tom Moyane and the previous Finance Minister, Pravin Gordhan is now over, with the appointment of Gigaba. The February 2016 budget for tax collections had to be revised down because of lower VAT, customs and personal tax collections – which is, at least partly, due to the weaker economy. Tax collections will probably pick up now as the economy recovers, but this is likely to be off-set by much higher costs of capital due to the rating downgrades. The international funds tracking the World Government [glossary_exclude]Bond[/glossary_exclude] Index require that a country has an investment grade rating by at least two of the three major ratings agencies. South African no longer complies – which means that an estimated $8bn (R100bn) will probably leave the country in the next month or so. On the positive side, the downgrade has been fairly fully discounted which means that the actual event, now that it has happened, will not move the needle significantly. What is more important is the effect it will have on future investment decisions. Foreign direct investment is a key component of growth in South Africa, especially in industries like the motor industry. Throughout their time in office, the ANC have consistently said that addressing South Africa’s horrendous unemployment level was a key priority of theirs. However, while they have been in office, what they have been doing is exactly the opposite of job-creation. They have severely damaged the mining sector through section 57 stoppages, policy uncertainty and downright hostility. Employment in the mining sector is a pale [glossary_exclude]shadow[/glossary_exclude] of what it once was, as is mining production, especially in precious metals. They have allowed huge quantities of steel and chicken to be dumped on the economy significantly reducing the size of our home industries. Thousands have lost their jobs as a result and a number of large companies have had to [glossary_exclude]close[/glossary_exclude] (such as Highveld Steel). They have hammered the construction industry so that the remaining construction companies have either decided to downsize or have moved off-shore in search of better markets. To counter this they have increased employment in the public sector – so that we now have a bloated and inefficient civil service to pay for. The simple truth is that the government cannot really create a meaningful number of sustainable jobs – only the private sector can. But this government is doing everything in its power to eliminate growth in the private sector. The latest evidence of this is the downgrade to junk status by all three major ratings agencies. The chicken industry has been complaining for some time about the “dumping” of bone-in chicken on the South African market by Brazil and Europe. Both countries deny that they are dumping. In this discussion, the chicken-producing companies have been very vocal about the potential for job losses, but not much has been said about the enormous benefit to consumers of lower chicken prices. Bone-in chicken is one of the most important sources of protein in South Africa, especially for the lower [glossary_exclude]income[/glossary_exclude] groups. The fact that other countries appear to be able to produce and transport such chicken to South Africa profitably certainly suggests that our chicken industry is less efficient at some level. And that in turn suggests that perhaps we should not be in the chicken business if we cannot produce it for the same price as the Europeans and Brazilians, especially bearing in mind the transport costs that they incur just to get it here. One of the most important factors in the recovery of the South African economy is the relative decline in strike action this year. Compared to 2014 when strikes crippled the platinum sector and other parts of the economy, this year most collective bargaining issues have been resolved without a prolonged strike. The effect of this on the economy can hardly be over-emphasised. The trade figures, which come out once a month, show South Africa’s performance as an exporting and importing nation. Recently we have been recording a series of monthly surpluses because commodity prices are rising on the back of the recovery in the world economy, while domestic demand for imports has fallen because of the depressed state of the local economy. Last year we had a trade deficit of over R24bn in the first quarter and this year we expect to have a small surplus of about R1,5bn. One way of looking at this is that South Africa is running at a “profit”. We are exporting more than we import. If this state of affairs continues it will have the effect of causing the rand to strengthen further and thus bring down local inflation and eventually, interest rates. The excellent rainy season has had a massive impact on the size of the expected maize crop – which now stands at about 14,5 million tons – nearly 90% higher than last year. This will result in a steady reduction in food costs, both directly, as the price of maize meal comes down, and indirectly as animal feed costs reduce. The export of our surpluses will be a welcome boost for foreign exchange reserves. The good rains have also had the effect of improving the crops of the millions of subsistence farmers in South Africa who grow small areas of maize to help feed their families. The effect of this will be to make the very poor much better off this year than they were last year. Foreign Direct Investment (FDI) is vital to any emerging economy and especially to South Africa. As an emerging economy with a particularly [glossary_exclude]low[/glossary_exclude] local saving [glossary_exclude]rate[/glossary_exclude], we depend heavily on overseas capital to get new businesses going. If overseas investors turn their backs on South Africa following the ratings downgrades that could easily cause a spiral of lower GDP growth and further ratings downgrades and so on. The fact that two important business leaders have decided not to invest further into South Africa following the parliamentary re-shuffle and the downgrades does not bode well for the future. Neil Froneman, CEO of Sibanye, has made it abundantly [glossary_exclude]clear[/glossary_exclude] that he has no intention of investing further into South Africa while the government is so overtly anti-business. He has cancelled a massive uranium and gold tailing treatment operation which would have created many new jobs and he has put any approach to buy Lonmin on hold. At the same time, a Pioneer Foods deal involving an unnamed overseas investor has been lost as a direct result of the downgrade. South Africa simply cannot afford for this to become a trend.Commodities

Gold

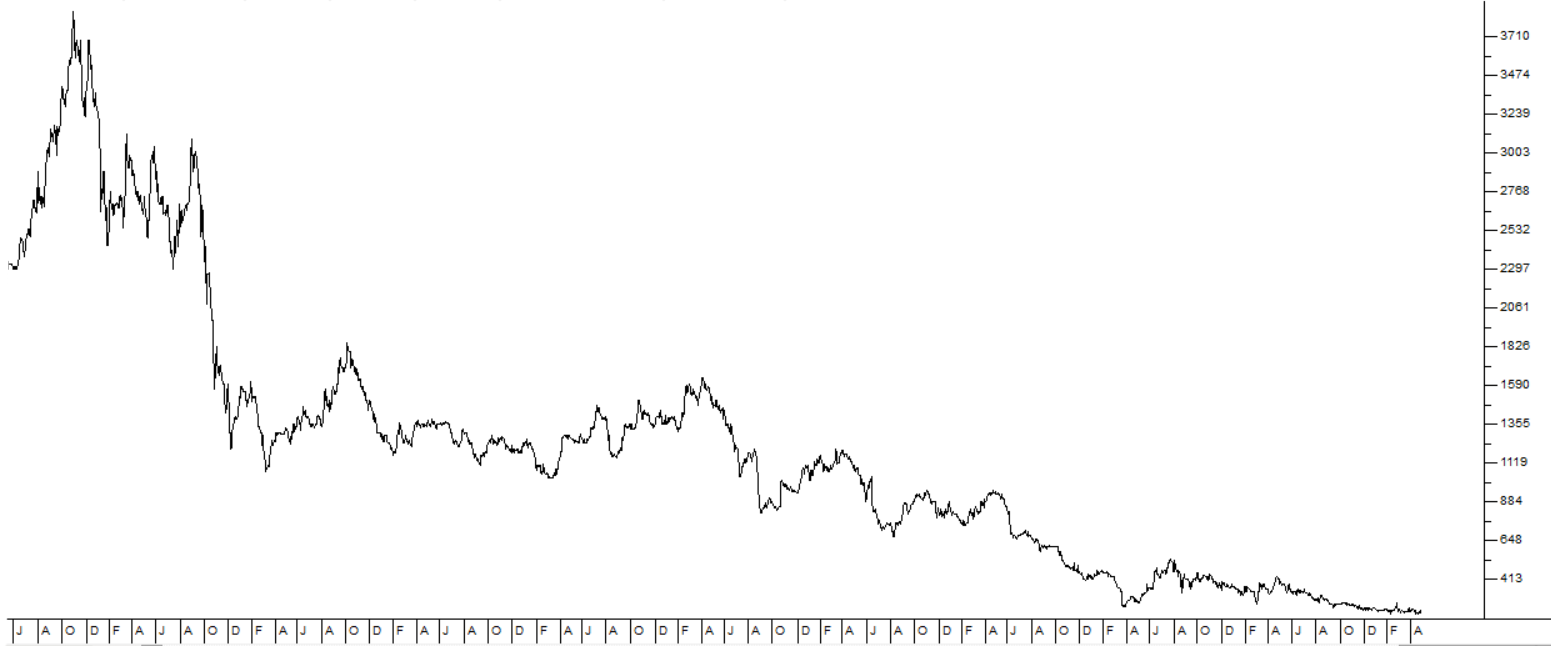

Gold has always been a major part of the South African economy and a strongly followed investment option. Although we are now only the 8th largest producer of gold in the world, almost 50% of the world’s known underground reserves of gold are still here in this country. The problem is that they are mostly very deep and uneconomical to mine with current mining technology. Most gold analysts are expecting the gold price to rise in 2017 (GFMS to $1260 and Metals Focus to $1470) because the production of gold has remained static, while demand will almost certainly pick up towards the end of this year as the world economy recovers. If you are interested in speculating on the gold price (purchasing a commodity or a commodity share can never really be considered investment, because commodities are notoriously volatile), then you basically have two [glossary_exclude]options[/glossary_exclude] – you buy a gold ETF or you buy a gold share. The ETF represents actual physical gold, so your risk there is relatively small and much the same as buying krugerrands. This is a good defense if you think that the rand might fall further, but you should [glossary_exclude]bear[/glossary_exclude] in mind that physical gold does not pay a dividend and so all you can hope for is a capital gain. Buying a gold mining share is far more risky because they have a multitude of possible problems, from union action to faulting and flooding. As one analyst said, “when you buy a gold mining share (especially in South Africa), you are buying a big hole in the ground surrounded by a [glossary_exclude]lot[/glossary_exclude] of angry workers!” However, if you think that the gold price is going to rise and especially, if you are also negative on the rand at the same time, then a gold share could easily double or treble or more. The price of gold itself is unlikely to double anytime soon, but it could easily go up by 40% in US dollars and more in rands. If you were thinking of buying a gold share then Sibanye (SGL) would probably be a good choice. Newgold (GLD) is a well-established gold ETF that will provide you with a solid hedge against the weakness of the rand and exposure to any upside in the gold price – just don’t put more than about 10% of your available investment capital into physical gold. Consider the chart of gold in rands:

Gold Close in Rands - Chart by ShareFriend Pro

As you can see from this 10-year chart, the gold price in rands generally goes up over the [glossary_exclude]long[/glossary_exclude] term. You can also see that in recent times (for about the last year) it has been falling or static. Some of that is due to the relative strength of the rand against the US dollar over that period.Oil

The approval of fracking activities in the Karoo might well have a major impact on the South African economy. Leaving aside the environmental impact, South Africa has never had its own oil resource and has been forced, through Sasol, to convert coal to oil which now accounts for about one third of our fuel usage. Now that approval has been given and the concerns of the environmentalists swept aside, the real question is exactly how large is the fracking potential of the Karoo? Recent reports indicate that it is relatively small – certainly in comparison to the deposits in the northern part of Mozambique. Perhaps it would be smarter to just import their [glossary_exclude]cheap[/glossary_exclude] oil and let them deal with the environmental problems. On a global scale, there has been some progress in the implementation of renewable energy sources, but oil still remains the primary source of energy and we don’t see that changing any time soon. In other words, the oil price will continue to be a major factor in the world economy for at least the next ten years and probably beyond. And the oil price impacts on the price of everything. Almost every product is transported at some point in its life [glossary_exclude]cycle[/glossary_exclude] by an oil-fired internal combustion engine and many products include oil derivatives like plastics among their components. So the price impacts the price of all products around the world. The fall in the oil price during the latter half of 2014 had the effect of negating and obscuring the inflationary effect of the massive “quantitative easing” undertaken to avert economic depression after the 2008 sub-prime crisis. And now most economists appear to have forgotten that well over $12 trillion has been printed and inserted into the world economy – but that extra cash is still out there and, as the world economy recovers, we should expect inflation to pick up again. That affects all commodities, including oil. So we believe that the oil price in now on the rise as the US economy, always hungry for oil, emerges from its prolonged recession. Consider the chart of North sea brent oil:

North Sea Brent Oil - Chart by ShareFriend Pro

This chart shows the collapse of oil in 2014 to its [glossary_exclude]low[/glossary_exclude] point of $28 per barrel at the beginning of 2016 – and its subsequent recovery.Iron

For some time now, analysts have been saying that the price of iron ore would fall substantially as demand, especially from China waned and massive new [glossary_exclude]cheap[/glossary_exclude] sources of iron ore came on line. The expectation is that iron will drop below $50 per ton and perhaps to as little as $40 per ton by 2018. This will have an impact on Kumba’s profits which is 70% owned by Anglo. Recent cost-cutting at the mine has seen it approach a cost of around $40 per ton, but one has to wonder why Anglo did not sell this investment when the price of iron ore was higher a few months ago. Of course, the world economy is recovering, but it seems unlikely that the recovery will be sufficient to mop up the massive surpluses expected in the iron sector in the short term.Platinum

Implats is now considering laying off as many as 4500 employees at its Marula mine. The platinum industry and the mining industry in general has been plagued by policy uncertainty from the government, section 54 stoppages and excessive union action. The upshot has been that almost all new investment in the South African mining industry has ceased and thousands of employees have lost their jobs. Implats’ move is simply the latest in a [glossary_exclude]long[/glossary_exclude] sad decimation of the South African mining industry. As indicated earlier, the mining sector, which was once the pillar of the South African economy, is now a feeble [glossary_exclude]shadow[/glossary_exclude] of what it was. But South Africa produces about 80% of the world’s platinum – which puts it in an excellent position to establish a cartel of platinum-producing countries and drive prices up (just as Saudi Arabia did with the OPEC cartel in the oil industry). It seems that our leaders do not have the wit to effectively exploit our burgeoning natural resources for the benefit of the entire country.Regulatory

The new Home Loan and Mortgage Amendment Bill creates an “Office of [glossary_exclude]Disclosure[/glossary_exclude]” and will require banks to disclose all home loans that have been applied for and either accepted or rejected. The objective is to ensure that the granting of home loans is not discriminatory on the basis of the [glossary_exclude]applicant[/glossary_exclude]’s skin colour. What appears to have been over-looked is that banks are in business to make a profit – and for that reason they will lend money at interest to anyone who they believe has capability to repay that money. They have absolutely no motivation to reject loans from eligible applicants on the basis of skin colour, because that would make them less profitable and less competitive in a very competitive market. The new law will involve considerable reporting and paper work for the banks – a cost which will ultimately have to be borne by all mortgage bond holders and which will result in less available money for home loans. One of the key elements of populism in South Africa is what is called the “equitable [glossary_exclude]distribution[/glossary_exclude] of land”. The origin of this question is the unfairness of colonial [glossary_exclude]acquisition[/glossary_exclude] of land by conquest which was extended by the National Party during the apartheid years. The new Regulation of Land Holdings bill is up for public comment. Currently, the government, in an effort to appeal to the masses, is seeking to expropriate land without compensation – but this flies in the face of the constitution - which cannot be changed without a two-thirds majority in parliament. More significantly, the new bill will prevent foreign buyers from buying land in South Africa and force those who sell to [glossary_exclude]offer[/glossary_exclude] it first to the government. The bill envisages a “land [glossary_exclude]commission[/glossary_exclude]” through which land transactions will have to be approved. The first task of this [glossary_exclude]commission[/glossary_exclude] will be to establish a register of land in South Africa, and particularly, government land of which there is a large and unquantified amount. In our view, this [glossary_exclude]commission[/glossary_exclude] would simply be another government agency which will be badly run and add another layer of bureaucracy to the land market in South Africa.Other

Pravin Gordhan worked hard for a year to enable South Africa to avoid the ratings downgrade which has now become a fact of life in the economy. Unfortunately, just before he left office he saddled investors with a new Dividend Withholding Tax (DWT) increase to 20%. This will undoubtedly make South Africa a less attractive investment destination and private companies will look to try and get their excessive profits out and into the hands of shareholders by other means such as paying salaries. It will also directly impact the returns from investing on the JSE. Dividends have dropped by 5% and that means that the potential for capital gain is down by the same amount. This will impact everyone who invests on the JSE, [glossary_exclude]rich[/glossary_exclude] and poor alike – not just the super-wealthy at whom the tax was aimed. Historical dividend yields will remain the same, but the effective future dividend yields of every company listed on the JSE at any share price will simply be lower. Tom Moyane has described the recent tax collections as an “outstanding achievement”, but in reality they reflect the difficult economic environment of lower corporate and personal tax. Countries in Africa have traditionally struggled to collect sufficient tax to meet their governments’ populist spending – resulting in a deficit. Sometimes, that deficit can be made up through borrowing, but usually, sooner or later, it is made up through inflation. The worst example is Zimbabwe whose tax collections were so bad that they forced the government to print money continuously, leading it to galloping inflation and finally the collapse of the Zimbabwean dollar. Since the infamous parliamentary “re-shuffle” and the downgrade, South Africa’s economic agenda has probably become markedly more populist – meaning, in all likelihood that the government will now try to accommodate what they perceive to be the desires of the masses without much concern about the inevitable economic fallout. If this is accompanied by poor tax collection, the next logical step is African-style “quantitative easing” – or literally printing the money to pay expenses (like the government salary bill) and meet the aspirations of the more radical elements in the economy. This makes it even more important, as a private investor, not to keep much of your wealth in cash. The investigation launched by the JSE into trades that were made to profit from the recall of Pravin Gordhan from his international road-show may reveal that insiders to that recall were taking positions in the banks or the rand to capitalise on their inevitable fall. Taking advantage of advance knowledge of a known market event is insider trading and illegal. The trail might [glossary_exclude]lead[/glossary_exclude] back to a party that is directly connected to the decision. Certainly, the rand fell about 8% and the banking sector has taken a pounding on the JSE. Anyone with a short position would have made millions of rands in just a few days. South Africa’s Independent Power Producers Program has resulted in a significant amount of power being produced from renewable energy resources. The program has been hailed internationally as an example of how to tackle the move to renewable energy. The problem is that renewable energy is a growing threat to the coal industry in South Africa, where there are substantial vested interests. There are currently 37 renewable energy contracts that should have been signed by Eskom two years ago and that are awaiting the agreed go-ahead. The recent cabinet re-shuffle is the most recent excuse for delay. Clearly, South Africa needs to move away from coal and towards renewables – which are becoming more and more cost-effective and are environmentally neutral. A lack of [glossary_exclude]clear[/glossary_exclude] leadership is putting this highly successful program in jeopardy. The impact of the downgrade on parastatals has become very [glossary_exclude]clear[/glossary_exclude]. Transnet was able to raise R300m through the bond market in March, but raised only R20m in April and Sanral, now downgraded, has decided to postpone its debt issue until later. The ripple effect of these developments and others like them will probably impact on every level of South African society sooner or later. If State-Owned Enterprises (SOE) cannot raise funds in the bond market they will become more dependent on the funds from the treasury. The treasury is itself downgraded and may also battle to raise sufficient funds – which could [glossary_exclude]lead[/glossary_exclude] to another downgrade. The impact is also being felt in bond issues by commercial enterprises with several postponing issues. South African investors are often tempted to place a portion of their funds in off-shore investments. Investment houses like Old Mutual advise their clients that they should keep about 30% of their funds off-shore as a hedge against the weakness of the rand. And of course, when thinking about this it is essential that you have a well-developed understanding of what you think the rand/dollar exchange rate is going to do in the next three years. Off-shore investment is only really worthwhile if you think that the rand is going to fall significantly. And even if that is your view, you should remember that the JSE Top 40 receives about 65% of its income from off-shore sources – which means that, just by buying [glossary_exclude]high[/glossary_exclude]-quality blue chips, you are already hedged against the rand. There are also excellent shares like Capco which are entirely invested in [glossary_exclude]top[/glossary_exclude]-[glossary_exclude]class[/glossary_exclude] London properties. In our view, the rand is currently in a strengthening pattern and so off-shore investments should be viewed with great care. And you should [glossary_exclude]bear[/glossary_exclude] in mind that all shares are to a greater or lesser extent a hedge against the weakness of the rand, simply because they are real assets and will go up in price with other real assets (like property) when the purchasing power of the rand declines. One of the persistent problems in the “new” South Africa has been the flood of immigrants, mostly illegal, that have come to settle here and take advantage of our relative prosperity. Their existence here is blamed for the [glossary_exclude]high[/glossary_exclude] unemployment [glossary_exclude]rate[/glossary_exclude], the excessive crime and the proliferation of squatter camps, especially in Gauteng. The periodic outbreaks of xenophobia indicate the difficulty with which they are being absorbed into our society. And clearly, while we may be able to build houses for our own population, we will be hard-pressed to build houses for the whole of Africa. The new Minister of Home Affairs has undertaken to address the huge backlogs of asylum seekers and to establish “Processing Centres” at border posts to assist asylum seekers and migrants. Immigrants can be a source of new skills and expertise, but they can also be a drag on economic growth and a drain on resources. The Home Affairs [glossary_exclude]portfolio[/glossary_exclude] will be a delicate balancing act for the new Minister. The three new competitors to the JSE, which will all be up and running by the end of this year, will certainly force a re-think of share and securities trading in South Africa. The ZAR X and the 4AX are planning to build up participants by appealing to medium and small companies that may not previously have been able to afford a listing. This is unlikely to worry the JSE for many years to come. The A2X is the real and immediate threat. They are going after the JSE’s blue chip listings, representing about 90% of all JSE trade, and offering substantially cheaper costs to both the listed company and stockbrokers who deal in their shares. When A2X gets going in October this year, we can expect a big shake-up of JSE rates and costs. For decades the JSE’s monopolistic attitude towards the market has been a source of irritation and expense for the investing public, stockbrokers and listed companies alike. Many are looking to move to the 2AX as soon as they can.Companies

GROCERY RETAIL

Most economists and analysts are pointing to lower consumer confidence, especially since the downgrade, to [glossary_exclude]support[/glossary_exclude] their view that retail shares like Shoprite, Pick ‘n Pay, Spar and Woolworths will be under pressure. However, these four massive retail outlets have all reported pleasing improvements in earnings. Thus Pick ‘n Pay expects Headline Earnings Per Share (HEPS) to be up by between 15% and 20% for the year to February 2016, Shoprite reported a 17% jump in HEPS in the year ended August 2016, Woolies saw HEPS up by 23% in the same year and Spar reported a 22% jump in the year to September 2016. While these figures show that while the retail industry may have become considerably more competitive, it remains nonetheless the [glossary_exclude]high[/glossary_exclude]-growth defensive investment that it always was. We see retail shares as a good investment option.CLOTHING RETAIL

The clothing sector has become fiercely competitive with an increased number of stores fighting for a reduced consumer spend. In January this year retail spend was down 2,3% from last year and then in February it was down 1,7%. The worst element was the clothing, footwear and leather category – down a massive 7,6%. The clothing sector is now heavily over-traded and some sort of consolidation seems inevitable. Added to the reduced consumer spend on clothing, there are a host of new overseas brands, like Cotton On, that have entered the South African market very aggressively with [glossary_exclude]cheap[/glossary_exclude] fashion offerings that are taking consumers away from traditional clothing outlets like Edcon, Foshini and Mr. Price.PICK ‘N PAY (PIK)

The decision to cut the payout on the Smart Shoppers card to half a percent from one percent and then to pay out monthly “customer discounts” to 30 million selected customers every week, may have a negative impact initially, but the prospect of getting one or more discounts in any week might well compensate. The P&P loyalty program has been the most successful loyalty program in South Africa and has performed well above management expectations. It also provides management with a treasure trove of information on customer buying habits. The most recent figures for the year to February show a decline in sales volumes from existing stores, but P&P opened 151 new stores during the year which has significantly increased its footprint. The share price is already discounting substantial future profits, which may or may not materialise. P&P has come off its recent highs, but still looks over-priced on a P:E of 27.

Pick n Pay (PIK) - Chart by ShareFriend Pro

Technically, Pick ‘n Pay has definitely found some support at about R61.50 and may well bounce off this level.MASSMART (MSM)

Massmart saw same-store sales fall by 1,7% in the March quarter compared to last year and the rest of Africa sales fall by 19,4%. This is a further indication that South African consumers are taking strain. The rest of Africa was hit by lower commodity prices. Massmart has plans to [glossary_exclude]open[/glossary_exclude] 11 more stores in the rest of Africa this year.NETCARE (NTC)

Netcare’s trading update released at the end of March 2017 shows turnover up 7,7%. Headline Earnings Per Shares (HEPS) were expected to be down between 9% and 13% on the previous comparable period and this has spooked the market. The share normally trades on an dividend [glossary_exclude]yield[/glossary_exclude] of between 2% and 3% because it is seen as a defensive stock, but right now it is on a yield of 3,25%. Consider the chart:

Netcare (NTC) - Chart by ShareFriend Pro

Over the past two years it has fallen from R44 to R25 – off-loading 43% of its market capitalisation. It is undoubtedly a blue chip share – which is currently out of favour for some reason. We believe that this is a share to watch, because sooner or later it must represent a great buying opportunity. Its recent double bottom at around 2440c indicates that the downtrend may be over. This is definitely one to watch.CAPITAL APPRECIATION (CTA)

This is a Special Purpose Acquisition Company or “SPAC” which has been established to make acquisitions on the JSE. What is unusual about SPACs is that they are listed on the JSE with the intention of raising capital and then buying a going concern. A SPAC has to make an investment within two years of its listing. Obviously, investors become interested in this type of [glossary_exclude]open[/glossary_exclude]-ended proposition only if the directors of the SPAC have a substantial experience and reputation to bring to the company. In the case of CTA, they have Michael Sacks as Chairman and he is also the chairman of Netcare. CTA recently made its first acquisitions getting into the payment processor business. The company has a net asset value of 80c per share and this compares to its share price of 84c following its acquisitions.TASTE (TAS)

Taste Holdings competes with the larger Famous Brands as an investment vehicle in the restaurant and fast food market. Almost two years ago in July 2015, the share reached a high of over 500c per share. Today it wallows at around 200c per share. It has always been a somewhat contradictory investment because it incorporated a jewelry division, which appears to [glossary_exclude]offer[/glossary_exclude] very little synergy with its fast food businesses. Now it has decided to sell the jewelry business and raise capital through a rights issue. The idea is to focus on growing its overseas brands, Starbucks and Dominoes Pizza. Selling the jewelry business is probably a good idea, because it will raise much needed capital and increase focus. The rights issue of a further 80 million shares at 150c will dilute earnings and dividends per share. In three years Taste will have raised R620m through rights issues, which does not look too good against its current market capitalisation of R738m. Institutional investors may well decide not to follow their rights. The fast food business has been a very good business for most of the current recession since the sub-prime crisis, but the Taste Holdings management has not been able to capitalize on it to the same extent as Famous Brands. Famous Brands has grown headline earnings per share every year since 2003 while Taste showed a headline loss of 19,2c last year. The Taste share price has turned up since its low in October last year, but we believe it is early to regard this as a new upward trend. Consider the chart:

Taste Holdings (TAS) - Chart by ShareFriend Pro

BASIL READ (BSR)

Over the past ten years the once mighty construction industry in South Africa has been reduced to a [glossary_exclude]shadow[/glossary_exclude] of its former self. This can be seen in the progress of the JSE Construction index which has off-loaded more than two-thirds of its value during that period.

Basil Read (BSR) - Chart by ShareFriend Pro

The Voluntary Rebuild Programme came after the agreement by various construction companies to pay a fine of R1,4 billion for collusion during the World Cup and other construction. The government has taken the opportunity to get agreement to a radical restructuring of the industry, aimed at Black Economic Empowerment. Basil Read has decided to become 51% black-owned rather than mentor two “emerging” contractors to the point where their turnover is a quarter of Basil Read’s. Erstwhile Finance Minister, Pravin Gordhan promised to increase government spending on infrastructure – but there is no saying what the new Finance Minister will do.GROWTHPOINT (GRT)

Growthpoint shares reached R26 in July 2012 and since then they have been moving sideways. Recent trades have been at around R25.

Growthpoint (GRT) - Chart by ShareFriend Pro

With over R100 billion in properties and a market capitalisation of R72,4 billion, Growthpoint is South Africa’s leading Real Estate Investment Trust (REIT). Its management is stable and [glossary_exclude]top[/glossary_exclude] [glossary_exclude]class[/glossary_exclude] and it owns some of the best properties in South Africa. Indeed, that is now the problem – 86% of its profits are from South Africa and it may well feel the impact of the downgrade more than other companies. Technically the share is in an extended sideways pattern – which may be a top formation. But if it breaks above resistance at around R30, there could be significant upside potential. Alternatively, if it falls through support at around R22 it could be in for a significant fall. In general REITs are a stable, but unexciting investment. They are paired with the bond market since their performance is similar.BARCLAYS AFRICA GROUP (BGA)

We have [glossary_exclude]long[/glossary_exclude] advised our clients to look for high-quality blue chip shares when they are out of favour with the big institutional fund managers. To find such shares we have suggested that you look for any blue chip which is on a dividend yield (DY) of 5% or more. BGA is just such a share. It has been the least favoured of the big four banks and now, after the downgrade, sits on a DY of 5.8%. The price earnings growth ratio reveals that BGA has been growing earnings by an average of 11,65% for the past thirteen years, but the P:E [glossary_exclude]ratio[/glossary_exclude] is only 8.31 – which gives a P:E growth [glossary_exclude]ratio[/glossary_exclude] of 0,71. This basically means that the share is one of the most under-valued blue chips on the JSE today. Of course, there is some risk. Nobody knows exactly how the downgrade will impact on the banks’ business in the coming years, but the risk is substantially mitigated by the fact that this is a massive and well-run company with a [glossary_exclude]long[/glossary_exclude] track record of producing good profits. If you don’t feel the risk, then you are probably not going to make much money. Certainly you are not paying R203 for the share – but somebody did at the beginning of 2015. Now you can get the share for less than R147.ZEDER (ZED)

Zeder is an interesting and somewhat unique share on the JSE. It is a PSG-controlled operation which is mostly an investment in Premier (about two-thirds of its “sum-of-the-parts” – SOTP valuation). What is interesting about it is its other agriculture investments. For example, it has 40% of Kaap Agri which is about to be listed on the JSE and should be well-received. It also owns more than 90% of the [glossary_exclude]seed[/glossary_exclude] company Zaad. Seeds are a vital part of agriculture which makes this a relatively stable investment which should grow both organically and by acquisition. Zeder’s controlling stake in Agrivision in Zambia is also interesting. Zambia has been called the bread-basket of Africa with high rainfall and fertile soils. Agrivision has two massive and growing irrigation projects in Zambia. Clearly, food will be an important part of any [glossary_exclude]long[/glossary_exclude]-term growth in Africa. We see that Zeder’s other investments (i.e. aside from Premier) will grow rapidly over time, and the high degree of diversification will tend to mitigate any uncertainty due to climate. Altogether a good investment.AB-INBEV (ANH)

It was a bit of a shock when Anheuser Busch got rid of the board of directors of SA Breweries as soon as the acquisition was done. That [glossary_exclude]group[/glossary_exclude] of directors had been responsible for the steady and impressive growth in SAB over many years. Now, in its financials for the December quarter AB-Inbev has disclosed that SAB’s South African beer sales have slumped by 5%. That is the largest fall on record. Clearly, AB-Inbev would have done better keeping the board as it was. Certainly South African investors are not very impressed and have sold the share down from around R200 to under R150 in four months. Its net [glossary_exclude]asset[/glossary_exclude] value is more than double that, so it’s probably worth keeping an eye on.PAN AFRICAN (PAN)

Pan African is listed in London and on the JSE. Its tailings project, Elikhulu, has a 13-year life producing about 56 000 ounces of gold a year for the first five years and then 45 000 ounces a year for the next five. The cost of production is $527 per ounce – against a current gold price of around $1284 and rising. The beauty of a tailing operation is that you are re-processing material that is already on the surface. Its grade is precisely known and there are none of the problems of a deep mine. There is also not much exposure to union action – since the process is largely mechanical. If you expect the gold price to rise, this could be a good option.SIBANYE (SGL)

Niel Froneman, CEO of Sibanye is clearly very optimistic about the future of precious metals prices going forward. He has been buying up gold and platinum resources aggressively both inside and outside South Africa. The Stillwater purchase in the US (now finalised) makes Sibanye the third largest palladium miner in the world – and so linked to motor vehicle sales world-wide. The deal could be questioned on the basis that it involves buying a mine which will increase Sibanye’s precious metals output by a fifth, but will cost the company the equivalent of its current total market capitalisation. It only really makes sense if you have the view that precious metals prices are headed into a strong [glossary_exclude]bull[/glossary_exclude] market. At the same time Froneman’s interest in buying Lonmin has been halted abruptly by the recent cabinet re-shuffle and the ratings downgrade in South Africa. In general, Froneman has been buying up precious metals production at a time when they are relatively cheap, following the collapse of commodity prices. Now it remains to be seen whether his forecast for precious metals is sound. We believe that it is.PEMBURY (PEM)

The Pembury [glossary_exclude]Group[/glossary_exclude] listed on the JSE on 31 March offering 100m shares by private placing and a preferential [glossary_exclude]offer[/glossary_exclude] of 40m shares at R1 each – in [glossary_exclude]order[/glossary_exclude] to raise R140m. The share price has fallen on stagging to around 88c, but appears to have found some support at that level. The company is in the same business as Curro and Advtech – the [glossary_exclude]provision[/glossary_exclude] of education. There appears to be a virtually unlimited demand for education and Pembury has increased the number of students which it has by 64% to over 1800. This type of business is very capital intensive, so investors will have to be patient if they are waiting for dividends. It is, however, apparent that there is no shortage of schools to be bought or pupils to attend those schools. We believe that this will be a sound and perhaps an exciting investment.PSG (PSG)

The Mouton family has grown this business from a stockbroking firm into a significant investment house. Almost half of its valuation consists of its stake in Capitec Bank which appears to be fully priced. However, the company is sitting on R1,3bn in cash and so is in a position to make acquisitions. At this stage, PSG is looking at making as many as four new listings on the JSE this year – which will significantly increase their sum-of-the-parts (SOTP) valuation. These listings also suggest that the JSE may once again be heading into a listings boom in the next few years. Certainly, there has been a noticeable increase in the number of new listings recently.COMBINED MOTOR HOLDINGS (CMH)

If you are looking for great value in a generally depressed market, perhaps you should consider CMH. This company makes its money by running new- and used-car dealerships. On the face of it, with motor car sales down about 11%, this might not seem like a good idea, but that negativity is already discounted into the share’s price – so you are getting it cheaply. What is more important is how well this company has coped with decline in motor car sales and whether you think that motor car sales will pick up in the future. The latest financials from CMH show that their turnover in the year ended February 2017 fell 7% because they had to [glossary_exclude]close[/glossary_exclude] three of their BMW dealerships. But against that backdrop management managed to increase their profits by 8% and their dividend by 26%. This is an outstanding achievement and shows that they have a really good management team. Looking at other metrics, the P:E [glossary_exclude]ratio[/glossary_exclude] is a very attractive 7,39 and the dividend yield is 6,04%. Finally the P:E Growth [glossary_exclude]ratio[/glossary_exclude] over the past six years comes in at 0,377 – which indicates that the share represents excellent value at the current price. Over the past seven years profits have consistently gone up – and so has the share price. We regard this as a very good contrarian buy at these prices.

Combined Motor Holdings (CMH) - Chart by ShareFriend Pro

DISCHEM (DCP)

The Clicks results for the six months to end-February 2017 are strong, despite the weakened economy and poor consumer spending. Headline Earnings Per Shares (HEPS) was up 13,5% showing that the business model of health and beauty products combined with a pharmacy is both successful and defensive. This bodes well for the recently-listed Dischem. Right now Dischem has about 20% of the stores that Clicks has and it is using the capital it raised on listing to rapidly expand its store footprint. Theoretically there should be a Dischem in every shopping mall where there is a Clicks. If it reaches that point, and there is no reason to expect that it won’t, then Dischem has a bright future. The recent strong turn-around in the share’s price indicates that it is very favourably regarded by the investment community. We believe that this is an excellent investment that will do well despite the poor economy.