S&P500 Going to 3506

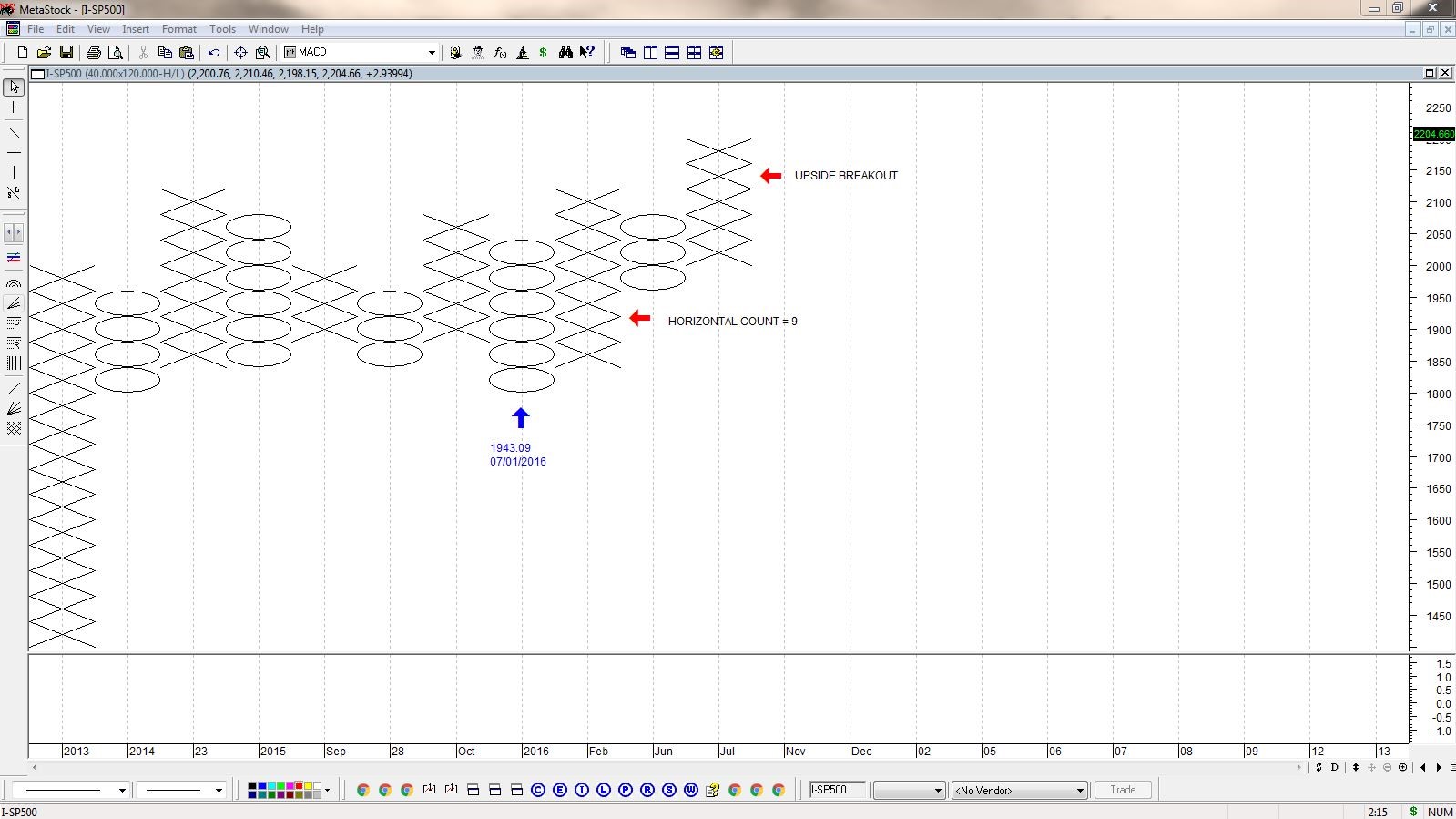

19 July 2019 By PDSNETIn December 2016 we wrote an article on the use of a Point and Figure (P&F) horizontal count to forecast the future of the S&P500 index. At the time, the S&P had been in a long sideways pattern which made a good horizontal count possible once there was an upside breakout. In our article, we published this P&F chart to explain the count:

P&F is a one-dimensional chart (it has no time dimension like normal charts) so this chart shows data from November 2014 to December 2016 which enabled a horizontal count of 9 and predicted that the S&P would rise to 3027 from its position at the time of just below 2200 (i.e. a 38% rise).

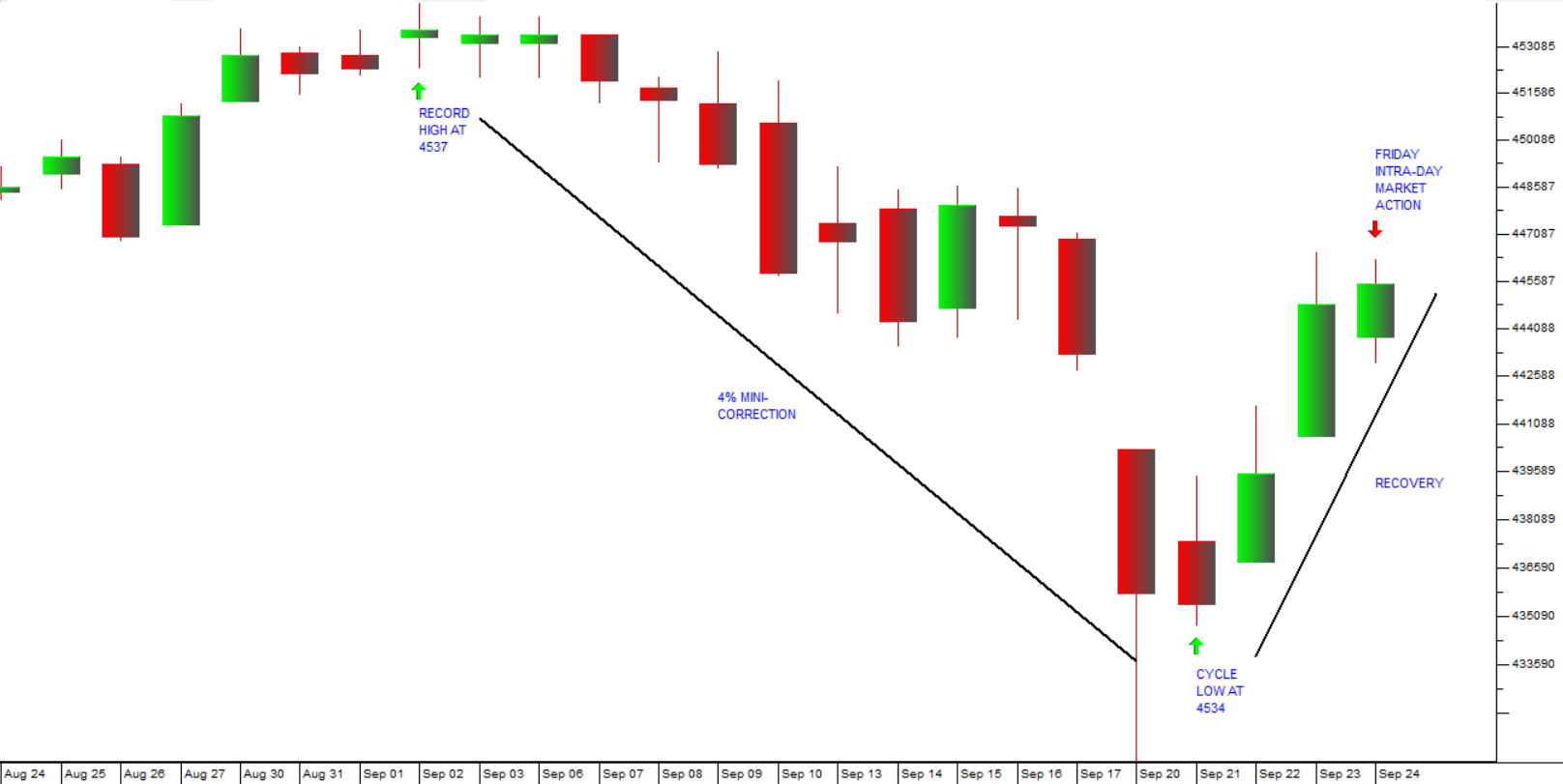

Today that prediction has almost been fulfilled with the S&P reaching a record high of 3014 on 15th July 2019.

Now we are in a position to make another prediction based on the sideways movement of the S&P over the past 18 months. This prediction is not as strong as the previous one because the sideways movement has not been as consistent – which means that we can only get an unbroken horizontal count of 5. Nonetheless, it predicts that the S&P500 will rise to at least 3506 – an increase of 17% from where it is now.

The chart below is a standard candlestick chart showing the two periods used for the horizontal counts mentioned:

The latest horizontal count (taken from MetaStock) looks like this:

In this horizontal count, we found that a box size of 77 was best. The low point for the S&P’s sideways pattern was 2351 on 24th December 2018. This gave us the following calculation for the upside target:

(3 X 77 X 5) + 2351 = 3506

Both of these forecasts were made using a 3-point reversal size.

Of course, we should also make the point that horizontal counts are inevitably conservative. In other words, they usually in our experience tend to under-estimate the upside target.

Refer to Module 28 in the PDSnet Online Investment Course for a detailed explanation of Point and Figure charting.