The Foschini Group

27 May 2019 By PDSNETst March 2018 was up by 8,9%, in the UK up by 31,3% and 58,3% in Australia.

Working capital management is critical in this business. This means minimising the amount of capital tied up in stock and debtors. On the debtors side, 72% of TFG’s business is done in cash so the company is not dominated by its debtors’ book.

Managing stock is far more difficult. Buyers have to patrol the European and American fashion worlds looking for the latest trends and then communicating these rapidly back to the factories to ensure that stores can display the most appealing range of clothing. The scope of this problem is daunting. TFG has 4085 stores in 32 countries. All of them need to display the latest fashions and they need to hold just the right amount of stock to meet demand. Too little and their customers will look elsewhere switching to their competitors and too much will result in obsolete stock and excessive cash tied up in working capital.

TFG is masterful in its management of its stock. Much of this is due to the improvements made to their communications systems. The changes in individual store stock levels are communicated immediately to their factories resulting in rapid adjustments to production, ensuring a minimum of waste and obsolescence.

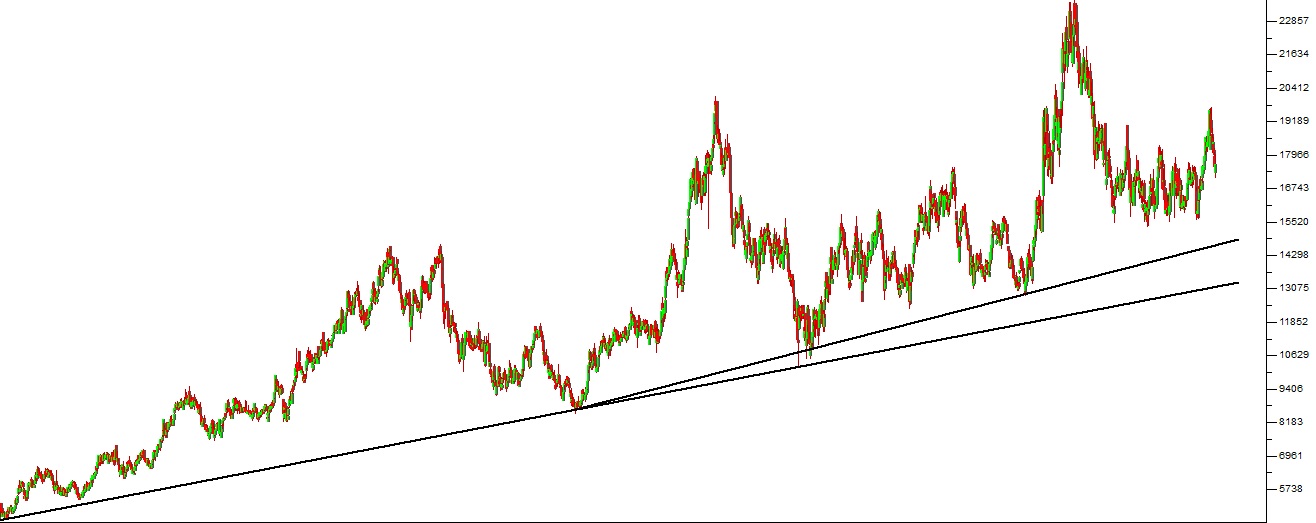

Technically, the share is what we call a “diagonal†because its chart goes from the bottom left-hand corner of your screen to the top right-hand corner over the past ten years. Consider the chart: