The Confidential Report - November 2017

31 October 2017 By PDSNETEconomy Mr. Gigaba’s mini-budget was worse than most people expected. It revealed a massive R51bn shortfall in tax collections – due partly to the lower-than-expected growth rate of the economy, but made far worse by the need to inject funds into state owned enterprises (SOE) and the fact that tax collections have been less effective. The worst of the SOEs by a long shot is Eskom where the government has guaranteed just over R200bn. Eskom has been racked with accusations of corruption and state capture which has made the lenders of these funds nervous. They have now insisted that the government appoint a new credible board of directors for Eskom by this month – or they will not be willing to roll over their loans. The same is being said of other SOEs like Denel, SAA, the Post Office and the Trans Caledon Tunnel Authority (which has nearly R26bn of loans guaranteed). Clearly, after a protracted period of fleecing, these SOEs are being forced to adopt a much more business-like approach. To finance the shortfall, Gigaba cannot just print the money (Mugabe-style) because he does not control the Reserve Bank. He is being forced to privatise – beginning with the sale of the government’s stake in Telkom. This is ironical because privatisation has been a very unpopular word in the ANC since it took power. But the reality of the situation is forcing them to do what should probably have been done years ago. And we can still look forward to an increase in taxes in February 2018 – probably a jump in VAT to 16% or 17%. Fitch has expressed in no uncertain terms that SA will be downgraded on 24th November – and the rand has responded accordingly. This probably puts paid to any pre-Christmas cut in interest rates. It might surprise you to know that South Africa has a government-funded institute whose function it is to stimulate productivity and employment in the economy. It’s difficult to believe. Productivity is so important in the South African context that it ought to be entrenched into the constitution. Of course, Productivity SA has a beautiful website, complete with a “vision”, a “mission” and “values”. What it is short of apparently is funding. Its latest move is an attempt to get the [glossary_exclude]Labour Relations[/glossary_exclude] Act changed to force companies to report any intention that they might have to retrench staff. No doubt if this is implemented, it will be yet another headache for embattled private companies in South Africa to contend with. Perhaps one of the greatest impediments to productivity and employment in South Africa is the fact that the [glossary_exclude]Labour Relations[/glossary_exclude] Act makes it so difficult to fire someone that employers avoid hiring where ever possible. Once you employ someone, it is almost impossible and certainly very [glossary_exclude]expensive[/glossary_exclude] to get rid of them. We should be following the American idea that the easier it is to fire an employee; the more people businesses will hire. The JSE Overall index, having broken up out of its three-year sideways market, is now following Wall Street up to a series of new all-time record highs. As we have indicated previously, all the markets of the world follow Wall Street – sooner or later. We believe that the JSE has some catching up to do, having been held back by various internal problems such as the firing of Pravin Gordhan and the ratings downgrades. Obviously, now that the rand appears to be weakening again, this rise is due in good part to the presence of so many large rand-hedge companies on the JSE – such as Naspers and Anheuser-Bausch. In our view, more and more South African companies will follow this trend upwards in the coming months. The new records on the JSE Overall and Top40 indexes contrast sharply with all the negative press on the SA economy. Clearly investors, both local and overseas, believe that our economy is about to improve. The productivity of a country and hence its competitiveness in the world economy is directly linked to the effectiveness of its tertiary education – especially that which is aimed at producing skilled artisans. Before the new South Africa, skilled artisans took on apprentices who worked closely with them while studying the theory and passing exams. After about five years this resulted in the production of a highly skilled person who was eminently employable both in South Africa and overseas. With the advent of the new South Africa, that system was swept aside in favour of the Technical and Vocational Training Colleges (TVET). There are 50 of these which are still being funded by a payroll levy being paid by all companies today. They included the so-called Sector Education and Training Authorities (SETA’s) – one for each sector. Theses SETA’s have been very badly run, rife with corruption, nepotism and incompetence to the point where half of them have received qualified, disclaimed or adverse audit reports. At the same time, there is a growing shortage of skilled artisans in South Africa and some companies are going back to training their own – despite still having to pay the levy from which they get nothing. South Africa is steadily slipping down in the competitiveness rankings of the countries of the world – and that is impacting on our ability to produce and sell our exports. Economic indicators, from motor car sales to the consumer price index (CPI) are an important part of obtaining an accurate [glossary_exclude]perception[/glossary_exclude] of the state and direction of the South African economy. As a private investor, knowing where the local economy is headed can have great significance for a number of sectors and listed shares. This month a new economic indicator is being launched which we think will give a very good indication of the state of the South African consumer in these difficult times. It is the Consumer Default [glossary_exclude]Index[/glossary_exclude] (CDI) being produced by Experian. It will show the average level of first-time consumer defaults on mortgage bonds, vehicle finance, personal loans and credit cards. In time, as a history develops, this should provide a very accurate monthly indicator of the extent to which consumers are taking strain – which, in turn, should give an indication of the level of consumer spending and the performance of retailers like Shoprite, Pick ‘n Pay, Woolworths and Spar. The collapse of Eskom is gaining momentum with the sudden suspension of Suzanne Daniels, their head of legal, after she sent a letter of demand to McKinsey and Trillian to return the R1,6bn that they had been paid illegally by Eskom. The board and senior management of Eskom have been decimated by the constant suspending of key individuals with the tacit [glossary_exclude]support[/glossary_exclude] of Lynne Brown, the Minister of Public Enterprises. All these dubious developments are being closely followed by Eskom’s creditors who are owed about R360bn, of which more than R200bn is guaranteed by the government. Needless to say, a collapse of Eskom’s credit rating and the recall of these loans would place South Africa into a devastating financial position. It would lead to multiple credit rating downgrades and a massive increase in the cost of borrowing and the government’s interest bill – not to mention a collapse of the rand.

Wall Street

Wall Street continues to make new record highs (as predicted in earlier reports) driven by rising earnings among the [glossary_exclude]S&P500[/glossary_exclude] companies, most notably the technology and health sectors (for example, see the section below concerning block-chain technology under the heading Technology). Some of the rise in share prices is being driven by Donald Trump’s much-touted tax reforms which are estimated to cut the corporate tax rate to between 25 and 35%. Using the lower of these two options means roughly a $10 per share increase in the after-tax profits of the [glossary_exclude]S&P500[/glossary_exclude] companies (according to JP Morgan) and that should translate into 2700 on the S&P500 index. The financial shares next to report quarterly earnings include Merrill Lynch, Bank of America, Citigroup, JP Morgan and Blackrock. These will all have benefited from the excellent conditions for [glossary_exclude]financials[/glossary_exclude] in America. This leads the way for the S&P to move much closer to the point-and-figure target which we set last year of 3027. And the progress of the JSE Overall [glossary_exclude]index[/glossary_exclude] shows that this bull market is starting to impact powerfully on the JSE. Traditionally, October month has not been a good month for stock markets. It is burdened by the history of the 1929 and 1987 crashes and several lesser falls. Thursday, October 19th 2017 was exactly thirty years since 1987’s “Black Monday”. However, this October has been one of the best ever in the history of Wall Street with the S&P500 [glossary_exclude]index[/glossary_exclude] rising to a series of new record highs. In fact, this year or early next year could see the [glossary_exclude]bull[/glossary_exclude] market on the S&P achieve “GOAT” (Greatest Of All Time) status. Since the second World War, when the S&P [glossary_exclude]index[/glossary_exclude] commenced, there has only been one other [glossary_exclude]bull[/glossary_exclude] market which exceeds the current one in terms of its percentage gain. That happened between 1990 and 1998 and saw the S&P rise by 302% also driven by technology shares. The current [glossary_exclude]bull[/glossary_exclude] market, which began in 2009 is now up 275% - less than 7% from being the “GOAT”. To achieve this record, the S&P needs to rise to 2717 (according to Leuthold [glossary_exclude]Group[/glossary_exclude] which did this research). We believe that it will reach that point – probably before the middle of next year – and, of course, the JSE (together with other world markets) will follow it up. While the [glossary_exclude]bull[/glossary_exclude] market roars ahead, some well-known investors are biting their finger nails. For no one is this more true than George Soros. Early in 2017, Mr. Soros said that 2017 was a repeat of 2008 which ended with the S&P down heavily. Accordingly, he has built up massive short positions in ETF’s which invest only in the S&P [glossary_exclude]index[/glossary_exclude]. In regulatory filings for the August quarter, Soros revealed that he has short positions in Powershares (QQQ) and SPDR S&P500 (SPY). As each trading brings a fresh all-time record high, Mr. Soros must be feeling more and more like the Christian Scientist with appendicitis. He must either abandon his opinion and take his loss or grimace and hold on to his position in the hope that he is right someday soon. His 13F filing in November will show which of these options he chose. Surely an investor of his experience and status is familiar with the basics of stop-loss…?Technology

We live in a world of “disruptive technologies” where new ideas and inventions constantly make new businesses possible and relegate old businesses to the scrap heap. One such technology is the concept of a block-chain database. This concept overcomes the inherent problem with digital records – that they are easily copied and manipulated. Obviously, there are some things that we definitely do not want to be copied or manipulated – most particularly the title to financial assets. Imagine if your property title deeds could be copied and sold or changed without your consent or knowledge. But this cannot happen because your title deeds are registered in a registry which is a government-run operation that records all ownership of property. Even Strate which keeps a digital record of all JSE-traded share certificates does so by maintaining a real-time register of the owners of shares – which changes thousands of times throughout the trading day. Block chain registries ensure that records cannot be duplicated or lost or sold twice (known as “double spend”). They give the buyer and seller in a transaction complete assurance when the asset is transferred and the money received – because the record of the registry is carried on multiple different servers – all of which have to maintain exactly the same record. The applications of a totally reliable digital record which requires no central registry, government guarantee or backing authority are immense. They go well beyond the various cryptocurrencies (such as “bitcoin”) now available. Where ever assets, represented by a piece of paper can be traded, there is an application for a block-chain database – which will inevitably be far cheaper and easier to maintain than the existing cumbersome and mostly paper-based registries. The main driver of the boom on Wall Street is technology – led by the motor car firm Tesla as it rolls out its new model 3. The company is endeavouring to ramp up production of this vehicle to 500 000 a year. At the same time, it will supply you with the solar panels and batteries to ensure that your model 3 (and your home) is powered by solar power which is stored on a Tesla battery. These new technologies have caught the imagination of the American public. To buy a model 3 you must have a reservation on their digital waiting list – and put down a $1000 deposit. Currently the waiting list is 18 months long and places [glossary_exclude]close[/glossary_exclude] to the front are being sold for as much a $4000 – indicating the extreme buying pressure for this car. At the same time, Elon Musk, born in Pretoria, CEO of Tesla, is planning to have a manned space station on Mars in 2022 and is well on his way to achieving that goal.The Rand

The trend in the rand has changed from strengthening to weakening. This is a very important development for private investors on the JSE because it means that you must now look closely at the rand hedge component of the shares which interest you. Do they import much of what they sell or are they primarily exporters? As the rand falls, rand-hedge companies receive more and more for their products.

Rand Dollar Exchange April 2013 to October 2017 - Chart by ShareFriend Pro

In our view, the rand is now clearly on a weakening trend. The brief influence of Gordhan is over and further downgrades by the ratings agencies are imminent. A key factor will be the outcome of the ANC’s December elective conference, but we are not very hopeful about that. The next hope is the 2019 elections which we believe the ANC will lose in a similar manner to their loss of the big metros in South Africa. But that depends on the Electoral Commission, a chapter 9 institution tasked with ensuring free and fair elections. The CEO of the Electoral Commission is one Sy Mamabolo – who has been working there for 20 years and was involved in organising the 2014 and 2016 elections. Any attempt to interfere with the 2019 election would clearly be a disaster.Commodities

The mining industry is in a terminal state of collapse because international investors and investors generally are no longer willing to put money into such a high-risk environment. With the third mining charter held in suspension pending a court hearing, nobody knows what the future legislative environment will look like. On the risk-reward scale for countries in sub-Saharan Africa, South Africa ranks 8th – behind countries like Mali and Zambia. Typically, the investment in a mining operation takes up to 10 years to generate a return for investors – and South Africa is by no means the only possible investment avenue despite its rich commodity resources. The result of this is that even local mining CEO’s, like Neal Froneman of Sibanye, are now unwilling to invest any more money here. Instead he is pursuing mining ventures in America. If and when the regulatory uncertainties in the mining industry are resolved, it will take at least a decade for any sort of recovery to occur. An interesting event occurred recently – the price of palladium exceeded the price of platinum. This is only the third time that this has happened since records began in the 1930’s. The platinum price has been under pressure from aggressive re-cycling of the material used in auto-catalysts. South Africa has between 75% and 80% of the world’s platinum and is the second largest palladium producer. Both metals are under considerable threat from the advent of fully electrical motor vehicles. This is now imminent with some manufacturers saying that they will no longer produce cars powered by an internal combustion engine after 2021. Elon Musk is driving the innovation in this area and is aiming to produce 500 000 model 3 Tesla’s next year. Whether he achieves that goal or not, the writing is on the wall. Petrol and diesel engines are [glossary_exclude]close[/glossary_exclude] to the end of their life.Companies

The new A2X stock exchange is gaining ground rapidly. It now has companies with over R40bn in market capitalisation listed and has signed up Coronation, Peregrine and African Rainbow. With dealing costs that are up to 40% cheaper than the JSE, we do not expect it to take long before A2X forces the JSE to review its cost structure to remain competitive. The other newly launched stock exchanges are minute by comparison. The largest of them is ZAR X, which has companies with a combined R3,3bn market cap. listed. This, of course, is all good news for private investors. The JSE’s monopoly is finally being broken. The JSE Overall [glossary_exclude]index[/glossary_exclude] is following Wall Street up – as we predicted. Consider the chart:

JSE Overall Index - Chart by ShareFriend Pro

But what is important is to understand the anatomy of that rise. It is far from universal. The main driver of the index has been very big companies (like AB Inbev, BAT, Richemont and Naspers) which dominate the index and whose businesses are substantially located overseas. They are obviously rand-hedges, but it is not only their rand hedge component that is pushing them higher – it is the general bull trend in overseas shares, led by Wall Street. The mid-cap index is not doing so well:

JSE Mid Cap Index - Chart by ShareFriend Pro

Here you can see that the mid-cap index (which is the next 60 largest companies after those in the JSE Alsi 40) has fallen so far this year. But you can also see that recently (from the beginning of October) the mid-cap has also started to move up sharply. We believe that the medium sized companies and small companies on the JSE will now begin to enter the [glossary_exclude]bull[/glossary_exclude] market strongly.CARTRACK (CTK)

This company specialises in managing tracking devices in motor vehicles. It does fleet management and vehicle recovery and insurance. Its main business is in South Africa, but it also has profitable businesses in South East Asia, Europe and the US. The company increased turnover by 14% and headline earnings per share (HEPS) by 20% in the six months to end-August 2017. The company has a strong growth path and its shares have been performing very well. They are a little tightly-held, but the growth should compensate for that. This is one of the few industries that is flourishing in South Africa in these troubled times.

Cartrack Holdings (CTK) - Chart by ShareFriend Pro

ROLFES (RLF)

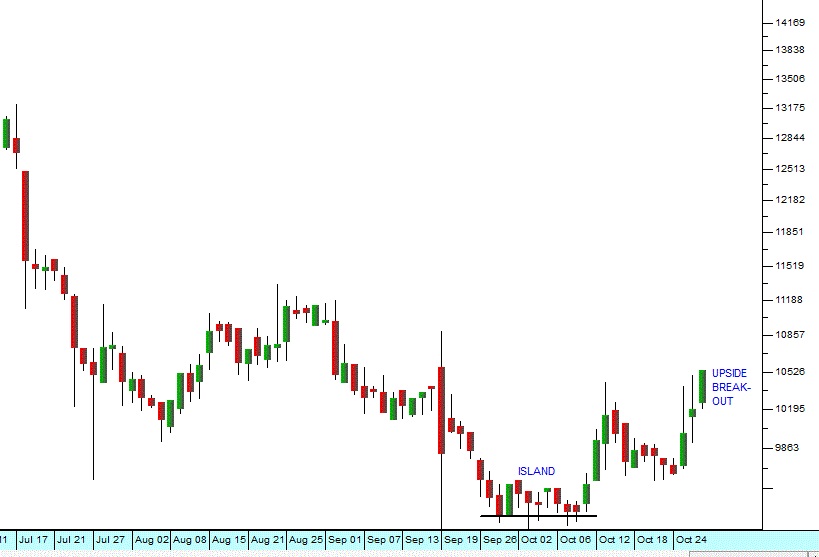

Rolfes is a manufacturer and supplier of coating and specialised chemicals to a variety of industries in South Africa. It has just come out of a bad time during which it had to re-state its financials after the sudden resignation of its financial director. With a new FD and auditors, the company is now in the process of re-building. In the year to June 2017, turnover rose by almost 10% while headline earnings per shares (HEPS) were up 8,1%. Clearly, this is a company which will benefit directly from any improvement in the South African economy. Its products are used by almost every industry from agriculture to cosmetics. If you think that the SA economy is likely to improve, this is a share which you could consider. From a technical perspective, it has fallen from around 580c to just over 300c – which is roughly its current net asset value(NAV). Now it appears to be forming an “[glossary_exclude]island[/glossary_exclude]” with clear support below 300c. Consider the chart:

Rolfes Holdings (RLF) - Chart by ShareFriend Pro

After a substantial fall plus an island formation, it is normal for a share to recovery rapidly – but, of course, this cannot be guaranteed.WEARNE (WEA)

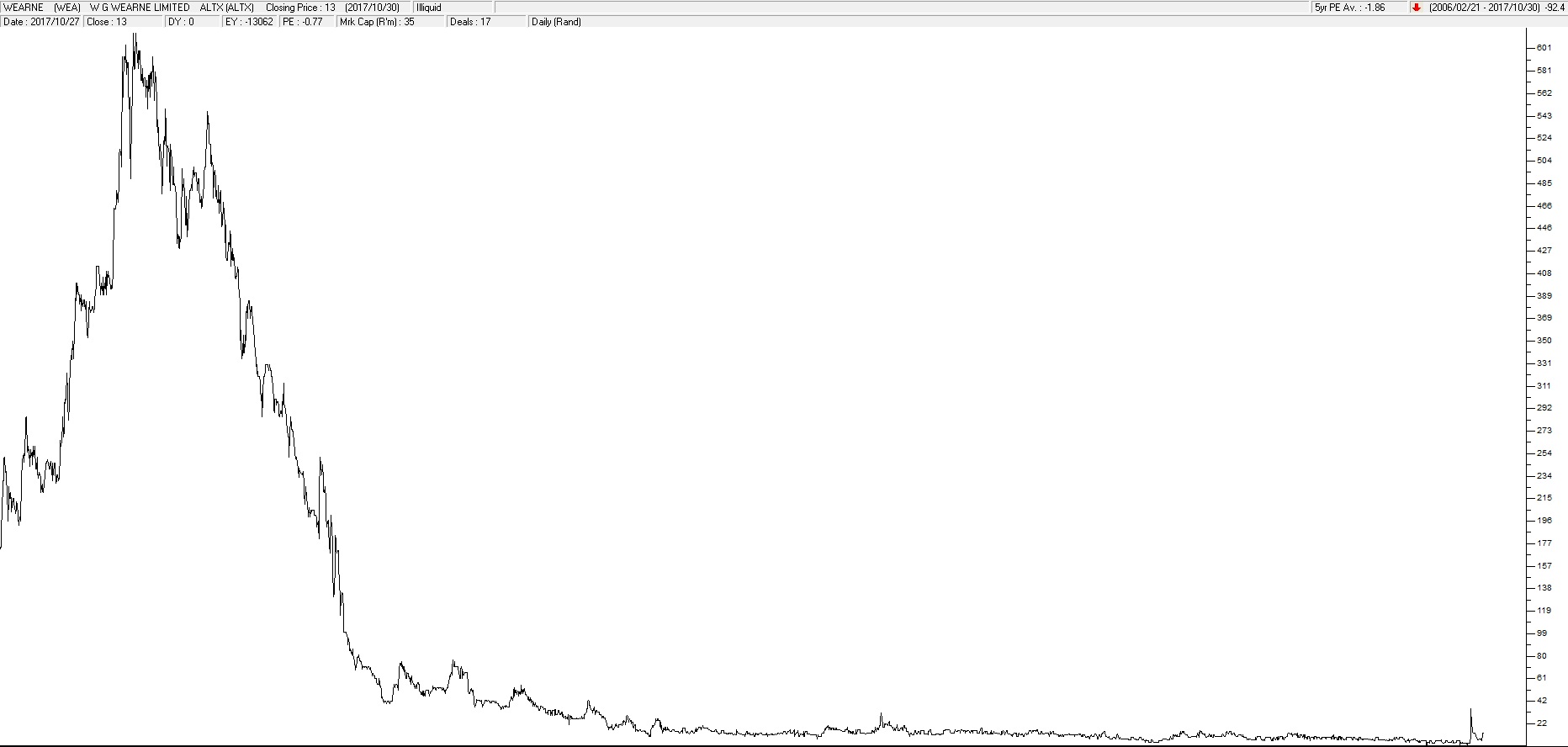

The story of W.G. Wearne must be one of the saddest on the JSE. The company was established in 1910 as a small family business and eventually listed on the JSE on 21st February, 2006. Its business was the production (mining) and supply of aggregates to the construction industry. Its listing on the Alt-X was greeted with enthusiasm and the share moved up quickly from 150c to a high of 615c by March 2007. Then came the sub-prime crisis, which was followed by the general collapse of the construction industry in South Africa. The share fell to just 40c over the next two years. Since then it has been limping along, gradually losing ground until eventually it reached 5c earlier this year.

W G Wearne Limited (WEA) - Chart by ShareFriend Pro

As a private investor, looking at this share should help to entrench the principle of stop-loss into your mind. Your first loss is almost always your best loss. Being successful in the share market is not so much a matter of making money as it is of not losing it. And yet this rule is the hardest to follow because we always hope that things will get better. If we have seen a share trading for 615c, we just cannot stomach the idea of selling it for less – and certainly not for 40c. And yet, in this case, selling for 40c would have proved to be a wise decision. Remember that old stock market saying, “A long-term investment is just a short-term investment that went wrong!” Do you have any long-term investments that you wish you had sold a long time ago?EMIRA (EMI)

This property fund has recently decided to spend R200m converting an office block in Rosebank to 280 residential units. This is an interesting development because the level of vacancies of office properties now stands at 11,8% in South Africa – the highest it has been for the past twelve years. The Emira share price has been in a steady downward trend since its peak of R19 made in late January 2015. Perhaps this new approach will improve their prospects. Certainly, the rise in vacancies in office accommodation is a clear indication of the toll on small and medium businesses of the current economic climate.PRETORIA PORTLAND CEMENT (PPC)

Three years ago, PPC was trading on the JSE for R33 a share. Today it is available for around just 700c. This is a great company and a bulwark of the South African construction industry – and it has fallen on hard times. Construction generally is in great difficulties. But PPC has reduced its debt substantially through a rights issue and has almost completed its massive expansion project with new plants in Zimbabwe, the DRC, Ethiopia and Rwanda. Once these plants come on stream it will be generating good profits. We don’t believe that the Afrisam/Fairfax deal will go through – mainly because it under-values the company. However, we note that the PIC has increased its stake in PPC to 21% recently – and it already controls Afrisam so maybe it is planning to push the merger through by controlling enough PPC shares. Whatever happens, we think this share is worth at least R10 and has good upside potential even from there.SASOL (SOL)

The Sasol share price was hammered by the collapse of oil in the second half of 2014 after a double [glossary_exclude]top formation[/glossary_exclude]. It eventually found support at around R360 per share – with resistance at around R490. Consider the chart:

Sasol (SOL) October 2012 to October 2017 - Chart by ShareFriend Pro

Now Sasol has encountered a new problem that may well see its share price fall through that support at R360 – its black economic empowerment scheme (BEE). Years ago, when oil was above $100 per barrel and rising Sasol set up the Sasol Inzalo scheme which gave thousands of black investors the opportunity to invest in Sasol at a discount. The scheme was based on money that the company loaned against what looked like the certain appreciation of the share’s price and steadily increasing dividend flows. That scheme will mature in about a year from now with a substantial deficit. Management has proposed issuing a further 43 million Sasol shares to pay for the deficit and establish a new scheme (Khanyisa). But major shareholders have objected to a 6% dilution of their holdings for no discernible return. Of course, the recent collapse of the rand since the mini-budget will help to keep Sasol above its support. The problem with BEE is one which many large listed companies in South Africa face. They are required by various charters to ensure that they always have a significant black investor holding – but often these investors sell the shares as soon as they get them – which means that the company falls back below its BEE shareholding requirement. To overcome this problem, companies have taken to issuing a new class of shares which rank in all respects the same as the ordinary shares, but can only be sold to another person of colour. This restriction severely reduces the market for these BEE shares – which then inevitably trade at a significant discount. What is being learned here is that any interference in a free market like the JSE is going to result in a cost – one which is usually borne by the shareholders.MONDI (MND)

Mondi is a great South African share with a long history of solid growth and rising profits. It is a blue-chip share which has diversified very effectively overseas and so now has a significant rand-hedge component. In the September quarter it generated a 245m euro profit – which was 8% more than the comparative period. The company receives a significant part of its income from Europe where economies are growing much more rapidly than the SA economy. The CEO (Peter Oswald) says that sales and profits in Europe are on a definite upward trend. The share is in a strong [glossary_exclude]bull[/glossary_exclude] trend which does not look like it will end anytime soon. The recent sell-off in the share’s price should be seen as a buying opportunity. We don't believe it will go much below support at R330. Consider the chart:

Mondi Limited (MND) October 2009 to October 2017 - Chart by ShareFriend Pro

RICHEMONT (CFR)

Richemont is one element of the Anton Rupert empire which incorporates luxury brands in Europe, America and the far east. The share has been benefiting from the general [glossary_exclude]bull[/glossary_exclude] trend in shares overseas, led by Wall Street. It is also a rand hedge and so benefits from any weakness in the rand – which is something we expect to happen. Richemont AB Inbev and Naspers account for most of the positive move in the JSE [glossary_exclude]Top[/glossary_exclude] 40 index because of their size and the fact that they do not have significant interests in South Africa. We believe that the [glossary_exclude]bull[/glossary_exclude] market on Wall Street will continue and that the rand will probably weaken from current levels – which means that Richemont will benefit both ways.GAIA (GAI)

This is a strange little company that invests in wind farms and pays very good dividends. It owns minority stakes in two wind farms and paid out a total dividend of 88,5c per share in the most recent financial year. This is a great return on its current share price of around 849c (dividend yield = 8,32%) – and more exciting investments are planned. The only problem with this company is that it is thinly traded with only 3700 shares traded per day over the past 30 trading days. This means it is attracting no institutional investors, but that volume is probably sufficient for a private investor, especially one who is prepared to wait for a while before realising his/her investment. All the time getting solid interim and final dividends. We think this is a bit of a steal at 850c when the net asset value (NAV) is 1063c – but be prepared to wait a while.PREMIER FISHING (PFB)

Premier Fishing was listed on the JSE in March this year at 520c per share. It has since fallen to around 385c – probably because it has attracted little institutional interest and the fishing business is seen to be influenced by the weather and other extraneous factors. This is a small fishing company with a market capitalisation of around R1bn. It recently made a very good acquisition – it bought 53,5% of the Talhado squid company that operates out of Port Elisabeth for about R106m. This is an impressive deal because Talhado made a profit after tax of R51m in the year to August 2017 – which means that the deal was done on a historical P:E of just over 4. Once Talhado is added to Premfish’s figures those earnings (or at least 53,5% of them) will be added to Premfish’s earnings and re-rated to a P:E of 15. This basically means that their investment will then be worth roughly R409m (53,5% of R51m X 15). So, if the deal is concluded in November, Premfish will effectively have paid R106m for something that will then be worth nearly four times that much. We note that the Premfish share is relatively thinly traded – managing only R100 000 worth of shares changing hands per trading day on average over the past 3 weeks. Nonetheless, this would make it sufficiently liquid for anyone wanting to buy say R30 000 worth of the share (our rule is that there must be roughly 3 times what you want to buy changing hands on average every trading day). Technically, the share price appears to have stabilised and found support at current levels so we believe that it will prove to be a good investment.AEEI (AEE)

African Empowerment [glossary_exclude]Equity[/glossary_exclude] Investments, the company out of which Premfish was listed, is planning another listing in the next six months – its technology arm, AYO. This listing will be more than twice as large as Premfish at over R2bn. AYO is a technology company which owns a 30% stake in British Telecoms SA and other interests in system integration, security management, local area networking and network services. As the listing boom, which we spoke of last month, gains momentum, technology shares like this will probably be the most popular. The world’s stock markets are being driven by technology companies like Apple, Amazon and others. We expect the listing of this company to be a success. And it is worth considering the parent company AEEI. Clearly, they have an experience of and appetite for new listings. They intend to retain a controlling interest in AYO – but the listing will increase the value of their holding significantly.EOH (EOH)

This share has been under the whip for some time – really since it’s highly esteemed CEO, Asher Bohbot, retired. After its sustained rise from just 70c in September 2001 to a peak of R178 in August 2015, the share made a massive double top at around R170 per share and then fell back. The most recent problem was a story carried by the news outlet amaBhungane that it was somehow linked to the Gupta’s and state capture. The company, through its new CEO Zunaid Mayet, vigorously objected and has finally been cleared of this allegation.

EOH (EOH) - Chart by ShareFriend Pro

The share reached a bottom at about R93 where it produced an “island” [glossary_exclude]formation[/glossary_exclude] before beginning to move up again. We believe that this may well be an opportune moment to buy back into this excellent share. You would be getting it for about 60% of its peak value.ALTRON (AEL)

For the two years between 2014 and 2016, Altron did badly, but since then the share has executed a long slow “saucer bottom” and now appears to be mounting something of a comeback. The newly appointed CEO, Mteto Nyati, is at the front of this new optimism. Consider the chart:

Altron (AEL) - Chart by ShareFriend Pro

Here you can see the hammer formation. This is a trading day (in this case, the 26th October 2017) where the bears make a supreme effort to drive the share price down, but cannot sustain the effort and are met with bullish sentiment. The result is a candle with a “tail” which is twice as long as the body of the candle. In general, a hammer formation is considered to be a bullish signal. You will also note that the hammer has been accompanied by increased volume traded.CLICKS (CLS) AND DISCHEM (DCP)

The latest results for the Clicks [glossary_exclude]group[/glossary_exclude] are very encouraging, as are its plans to grow its store base to 900 stores from 622. Operating profit for the year was up by 14,7%. The massive jump in its store footprint could conceivably add 50% to its headline earnings – but what is more interesting is the implications for its main competitor, the recently-listed Dischem. Dischem only has 108 stores and, theoretically, there can be a Dischem wherever there is a Clicks – so the upside potential for Dischem just grew enormously. The Dischem share price benefited from the Clicks results more than the Clicks share price. For our money, Dischem remains the preferred play.