Picking Winners - Orion Minerals

6 November 2017 By PDSNET

Often, when a share falls, it does so for a reason which is not immediately known to the investing public – the same applies to shares which suddenly begin to rise sharply. This is particularly true for new listings which the investing public is generally unfamiliar with. When a share makes a new high, it is often because insiders know something which they are seeking to capitalise on before it becomes generally known to the investment community.

This is true for all shares, but it is especially true for so-called “penny stocks” (which are shares trading for less than 100c). These are usually much smaller companies trading on the Alt-X and not attracting the attention of institutional fund managers (because they are just too small). Their small size makes them much more risky and potentially much more profitable.

A share which closes the highest price that it has been at for the last six months is being bought up by somebody – and usually, that person has the inside track on a development which will materially improve that company’s profitability and share price – otherwise, why are they buying? They want to buy up the shares before the price gets too high or the information becomes generally known.

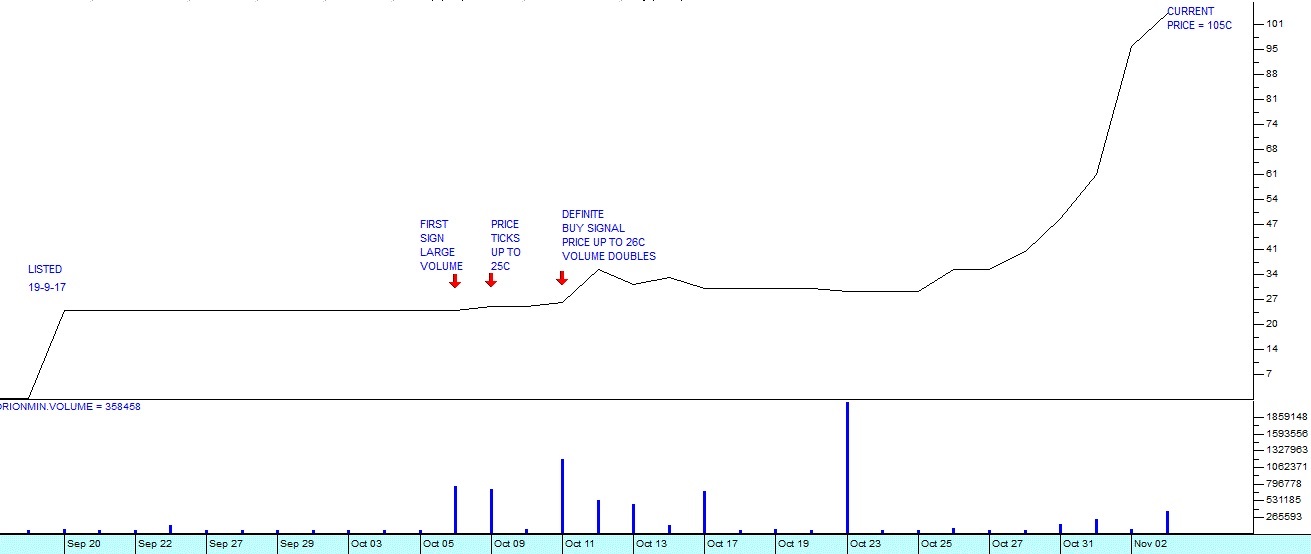

The best way to illustrate this is with an example. Recently, a share called Orion Minerals (ORN) listed on the JSE. For the first ten days it changed hands at 24c a share with an average daily volume of just over 20 000 shares traded each day. Then suddenly on the 12th day after it listed (on 6th October 2017), a massive 766 000 shares changed hands. This was followed the next day by a 1c rise in the price to 25c and a further 722 000 changing hands. This, of course, triggered an immediate, sharp buy signal on the On Balance Volume (OBV) indicator in your software.

The slight increase in price accompanied by the massively increased volumes was a clear indication that the “smart money” was mopping up all the loosely held shares available in the market. A few days later on 11th October 2017, 1,2 million shares changed hands at 26c. This should have been enough for any speculator to want to jump in. Had you done so, you would have been able to make an unbelievable 300% profit in less than a month since it closed on Friday last week at 105c.

I say “speculator” because this share was clearly highly risky on a number of fronts. Firstly, it is a new listing – which means that it is difficult to assess. Investors have not had much chance to assess its merits and decide what it is worth. Secondly, it mines zinc and copper near Prieska. Thirdly, it was very thinly traded to begin with – which obviously means that it might have been difficult to get out of if it triggered your stop.

Against all that is the massive profit which it offered to those who took the risk.

Consider the chart: