Winning Shares List

Investment in the share market is not about certainties – it is about probabilities.

Success comes from bending the odds in your favour, so that it becomes like playing a roulette table where you have a 60% or 70% chance of winning.

That, of course, means that you must fully expect to lose 30% or 40% of the time – which is why every successful investor has an effective stop-loss strategy. It just does not make any sense to keep losing money indefinitely in a share which is falling. Being successful in the share market is not so much about winning as it is about not losing.

The Winning Shares List (WSL) is one of the most effective mechanisms available to help you to bend the odds in your favour on the JSE. It cuts the number of possible investments that you have to choose from down from the approximately 300 listed shares to just those shares which have a strong possibility of doing well.

Right now, there are 86 shares on the WSL and only 18,6% of them (or 16 shares) have fallen from the prices at which they were first added to the list. The worst of those is Grinship (GSH) which is down just 4,14%.

This means that 69 of the 86 shares (80%) on the list are going up, with the best share on the list being 4Sight (4SI) which was added 295 days ago at a price of 31c and closed on Friday the 24th of May 2024, at 84c – a gain of 170,97% so far.

The list is designed to include only those shares which we consider to have the potential for a significant capital gain. The fact that a share is included does not mean that it is necessarily of “good quality” or that it is “highly rated”. It simply means that we have assessed that it has significant upside potential.

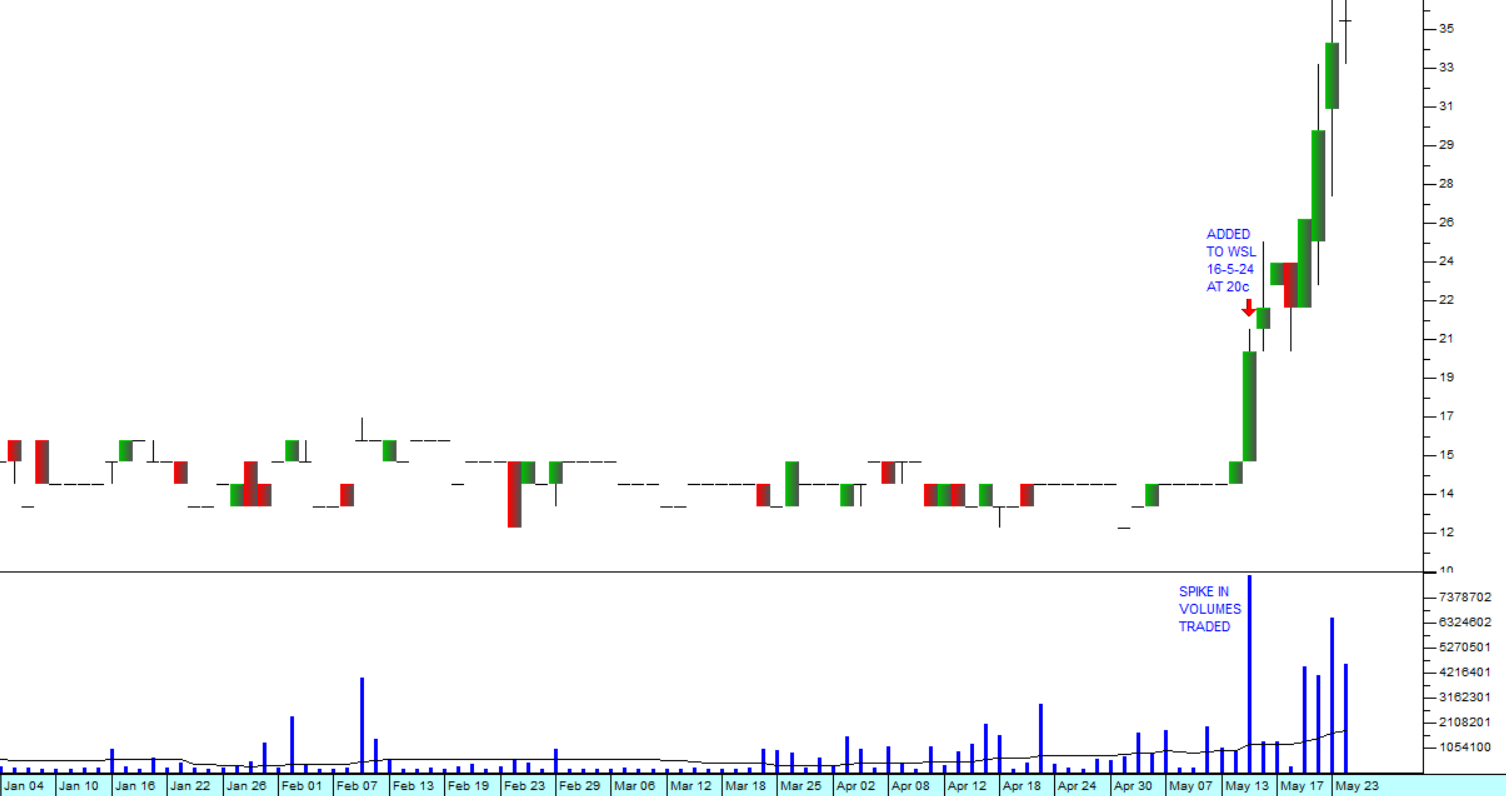

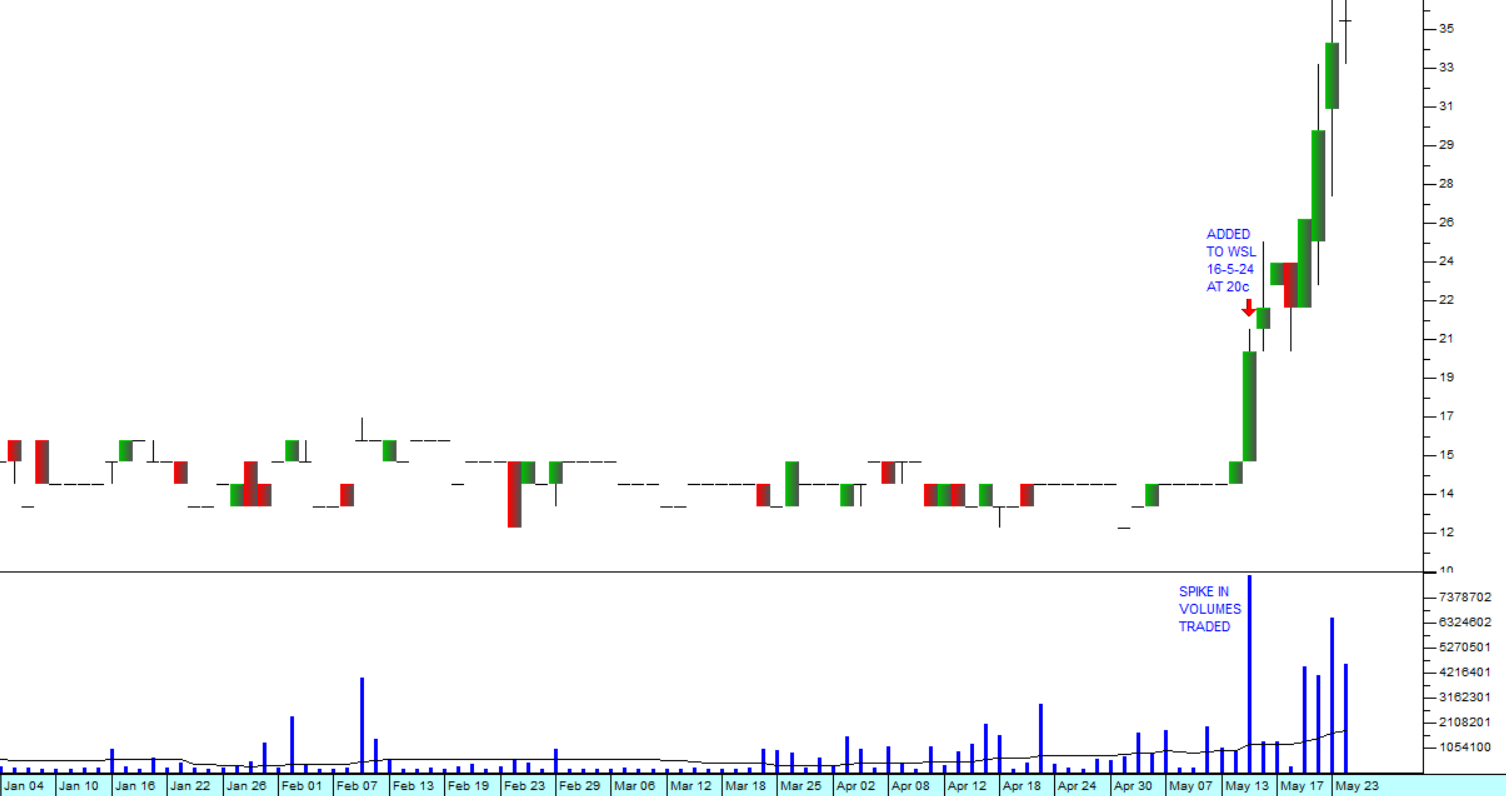

On 16th May 2024 we added Kore to the WSL at a price of 20c per share. We did this because of the massive and unusual volume traded on the previous day which was more than seven times the average daily volume traded in that share. The price was also up by 5c on the day – showing that insiders were busy buying up all the shares they could lay their hands on.

By Friday the 24th of May 2024, just 7 trading days later, the share closed at 35c and we still did not really know why the share price was rising – but it was up a massive 75%. Consider the chart:

Here you can see that since the beginning of this year, Kore was a very uninteresting penny stock hovering between 12c and 16c on relatively thin volumes. It is a potash mining exploration company with interests in the Republic of Congo. Then suddenly on 16th May 2024, the share traded a massive 13,4m shares and the price popped up to 20c. This is a classic example of the insiders buying up all the loosely-held shares that they could because they knew the share was about to explode. So we added it to the WSL.

On a previous occasion, we added Quantum to the WSL on Monday the 5th of March 2024 at 525c per share and it subsequently rose to 1830c just 23 trading days later.

These insider trading opportunities are relatively unusual, but can be extremely profitable when they occur. Many of the other shares added to the WSL are not so dramatic, but have done consistently well over a longer time frame. Some recent examples include:

Harmony (HAR) was added to the WSL on 16-11-23 at 9920c and closed on Friday last week at 17328c – a gain of 74,6% in just over 6 months.

Murray and Roberts (MUR) was added to the WSL on 21-12-23 at 106c and is now trading at 175c – a gain of 65% in just over 5 months.

Pan African (PAN) was added to the WSL on 31-1-24 at 430c and is now trading for 575c – a gain of 33,72% in just under four months.

So, we suggest that, when you are looking for shares which have the potential to perform well, you begin with the WSL and make your selections from that.

← Back to Articles