US Economy

8 August 2022 By PDSNETThere has been a debate among international investors about whether the US economy will move into recession as a result of rising interest rates being applied by the Federal Reserve Bank (“the Fed”) to control inflation. The last time that the inflation in America reached these levels was in 1981 and then the Chairman of the Fed, Paul Volcker, had to raise interest rates to above 20% in order to bring it under control.

The problem is that real interest rates (i.e. after deducting the inflation rate) are negative so there is little incentive for consumers and businesses to save. In fact, with negative real interest rates people are motivated to spend because the purchasing power of their money is falling. The Monetary Policy Committee has raised rates by 75 basis points twice in a row, but even with that the Federal Funds rate is only between 2,25% and 2,5% and the prime overdraft rate is around 5,5% - which means that investors are still effectively getting a rate which is 3% or more below the inflation rate.

The latest US employment figures show that the businesses are still completely unconcerned about rising interest rates. The economy created a further 528 000 new jobs just in July month alone – more than double the average prediction of economists. The unemployment rate dropped to 3,5% which is at or close to the economy’s full employment level - where wages start to rise sharply because of labour shortages creating further inflationary pressure. At the moment there are twice as many vacancies as there are people looking for work.

In our view, the federal funds rate is going to have to rise by at least a further 3% before it has any noticeable impact on inflation.

What is obscuring the picture is the recent drop in the price of oil (North Sea Brent) to around $94 which is reducing some of the immediate evidence on inflation like the rising petrol price – at least in the short term. Our view is that the underlying inflationary pressure is still there and derives from years of quantitative easing (Q/E) which has seen the US create and inject at least $20 trillion into the US economy since the start of the sub-prime crisis in 2008.

Much of that cash is still sloshing around in the system pushing prices higher. The Fed is now belatedly engaging in a program of quantitative tightening (Q/T) in terms of which it is taking $47,5bn a month out of the economy – a figure which will rise to $95bn in September 2022. However, at these levels, the rate of Q/T is really not sufficient to have a major impact on the Fed’s balance sheet or inflation in the short term. We believe that the Fed will have to accelerate Q/T substantially if it is to reduce the inflation rate.

The combination of rising interest rates and aggressive Q/T will inevitably result in the economy going into recession sooner or later – especially if the oil price remains flat or begins rising again. Our view is that recession will probably happen in the second half of next year. So the drop in the oil price is a temporary respite and does not deal effectively with the underlying causes of inflation. Falling world economic growth will obviously have the effect of reducing demand for oil in time and we believe that President Biden has probably struck some sort of deal with Saudi Arabia to keep the oil price below $100 for the moment – perhaps just until the November mid-term elections are over. Biden’s ratings are at an all-time low and if he loses control of the Senate, he faces the prospect of becoming a “lame duck” president for the remaining two years of his term.

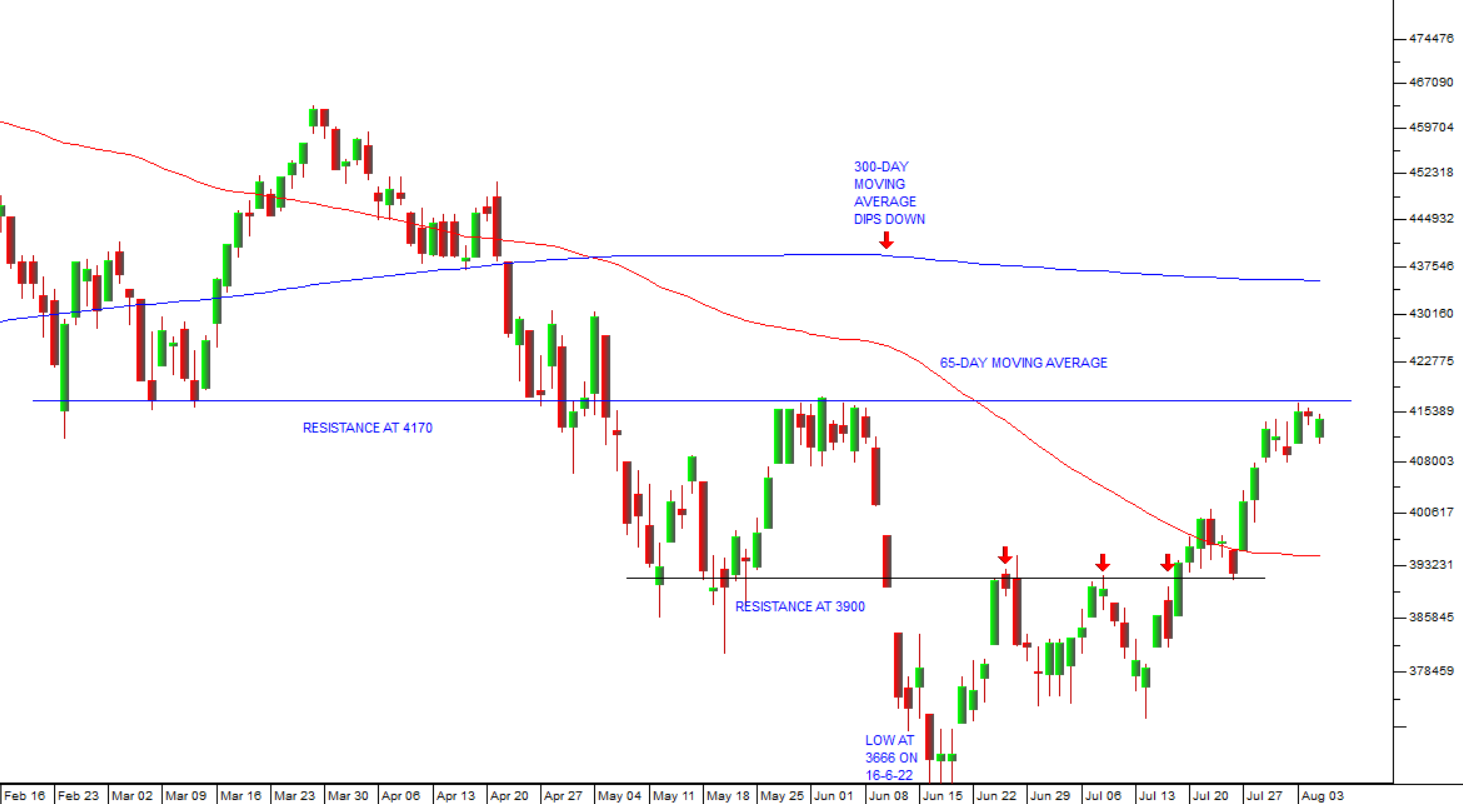

So how does all this impact on the markets? Well, it means that the current rise in the S&P500 may well be misplaced. Investors are being misled by the temporary benefits of the drop in the oil price. They are not considering the underlying inflationary pressures which brought the US economy to where it is now. We are expecting the rally to runout of steam and the bear trend to resume. Which basically means that we are expecting the S&P to drop below its previous cycle low at 3666. Consider the chart:

You can see here that the rally has successfully broken above the resistance at 3900 after three attempts (the red arrows) and is now encountering well established resistance at 4170. This will probably be a much more difficult hurdle for it to jump. Our opinion, for what it is worth, is that the index will probably fall back from this level to test the 3900 level – which has now become a support level.

An old piece of stock market wisdom is that “The trend is your friend.” In other words, don’t invest against the direction of the underlying trend. And, right now, the trend is downwards. The probability of it breaking up from where it is now is simply somewhat lower than the probability of it breaking down. This does not mean that it cannot happen. It just means that it is relatively unlikely. If you do decide to be a contrarian, then our advice as always is to make sure you have a strict stop-loss in place.

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: