The Shopping Mall Implosion

22 March 2017 By PDSNETOne of the most intriguing things about living in the modern world is the massive impact that technology is having on our lives. A few short years ago, smart phones did not exist, now almost everyone has one. As a private investor, you need to think about how this, and other technology innovations, could impact the shares which you invest in.

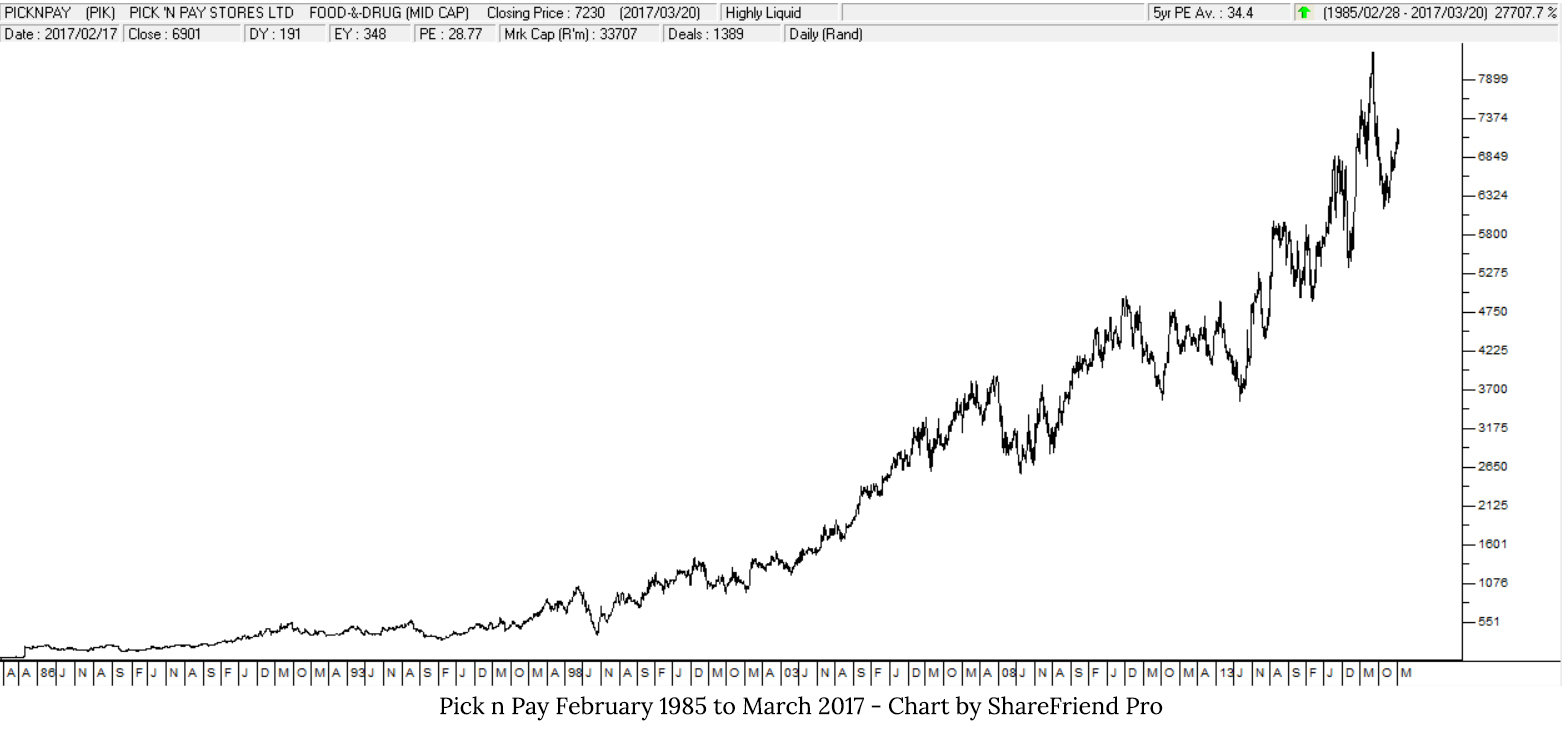

In South Africa, on-line retailing has been a minor issue which most of the retailers have addressed, but which none take very seriously. The question is, "Are they ignoring an imminent avalanche?" We all know that the internet is getting faster and faster. 3G is being replaced with 4G and 5G is on the horizon. Is it really feasible that there will come a time when most people only do their shopping online? It's a very important question, especially when you look at the billions of rand that is being invested into new shopping malls and shopping mall expansions in South Africa. What of the decision to expand Fourways Mall to 170 000 square meters, almost doubling the amount of retail space? And others like the new Mall of Africa? These massive complexes are erected at huge expense and can really only be used for what they were designed for, shopping. It is interesting to consider the case of America where the average income is much higher than in South Africa and internet access is better and far more ubiquitous. Right now America, which is recovering fast from the recent recession with nearly 300 000 jobs created last month, is expecting nearly 4000 retail stores to close in the next few months. Some retailers are closing down their entire retail operation to focus on online shopping. Others, like the country-wide chains are shutting between 10% and 15% of their stores to reduce costs. Massive department stores like Macy's and JC Penny are reducing their retail floor space rapidly, because visits to shopping malls are declining steadily. In South Africa, we generally follow trends which emerge in America, sooner or later. So this seems to indicate that the enormous amounts that are being spent on expanding our retail offering may well be misplaced. Give it some thought and maybe, if you are about to invest in a Real Estate Investment Trust (REIT), make sure it is one that does not have too much exposure to shopping malls. And how will this new trend impact on the likes of Woolies, Pick 'n Pay and Shoprite? Traditionally, these have been blue chip stalwarts of the JSE, holding up well through recessions. In the future, their survival may well be determined by how rapidly they can embrace the new technology and shift over to online shopping.

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: