The Rand Barometer

The South African rand is one of the most heavily traded emerging market currencies in the world. On average more than R50bn worth of our currency changes hands every trading day. This makes our currency a favourite for international currency speculators because they know that they can take up or sell out of a large position in the rand very quickly. It also means that our currency responds very sensitively and immediately to any event among the emerging market economies – even if that event has little or nothing to do with South Africa.

It makes the rand an excellent barometer of our complex political and economic progress. If the rand is generally strengthening then our political and economic situation is improving in the eyes of international investors – and vice versa. And these international investors often have a very well-informed and objective view of what is going on. They have to have because they stand to gain or lose billions of US dollars.

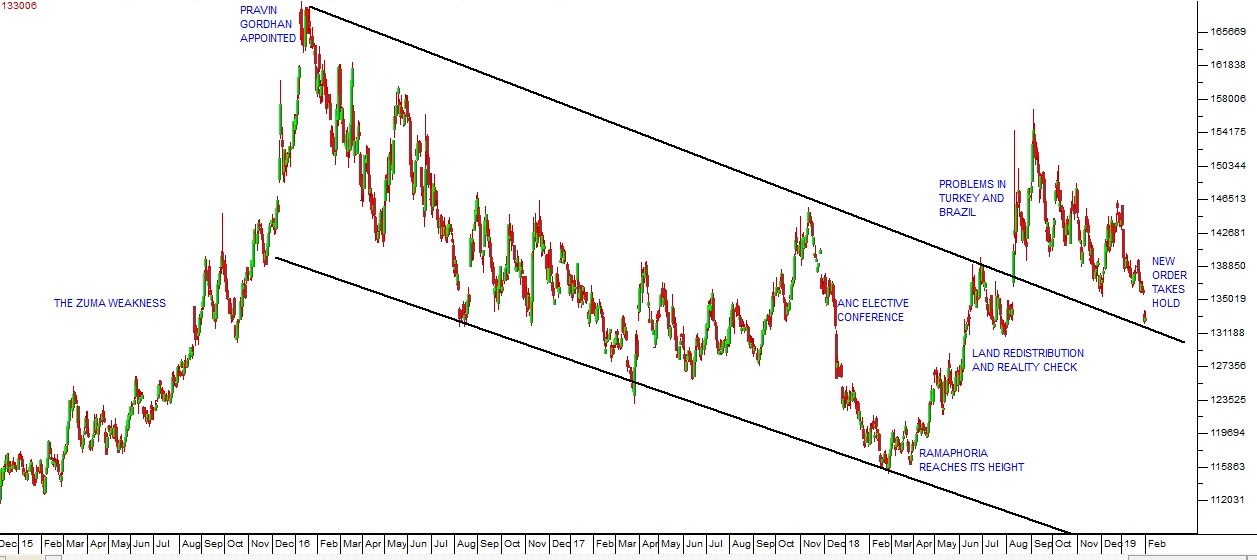

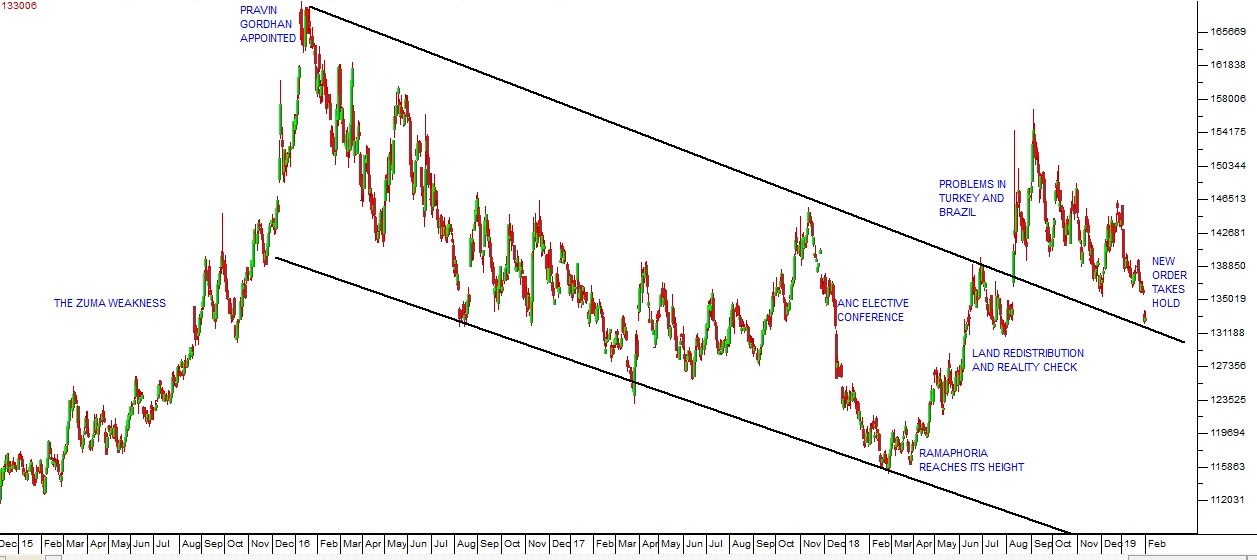

With this in mind, the progress of the rand over the past three years has been instructive. Consider the chart:

Rand Dollar Exchange December 2014 to February 2019 - Chart by ShareFriend Pro

This chart shows how the rand has performed against the US dollar over the past four-and-a-half years. At the beginning of this period we were firmly in the Zuma period which was associated with a steady weakening of the rand. This weakness came to an end with the appointment of Pravin Gordhan as Minister of Finance in January 2016. His leadership saw a definite improvement in overseas perceptions of our economy and the rand entered a long-term strengthening channel. Even after he was fired this strength persisted and gained momentum with the ANC elective conference and the surge of optimism which has become known as “Ramaphoria”. From February 2018, Ramaphoria gradually faded and gave way to concerns over land redistribution. It became apparent that the cost of corruption and incompetence during the Zuma years was far greater than we had previously imagined. Then suddenly in mid-August last year we were hit by a crisis which gripped all emerging markets and caused the international investing community to shift dramatically from “risk-on” to “risk-off”. They immediately pulled their cash out of the rand causing it to fall unexpectedly outside its long-term strengthening channel. Problems in Turkey and Brazil and, to a lesser extent, China, which really had nothing to do with South Africa, shifted perceptions of emerging economies markedly – and the rand suffered vicariously. After that there followed a grinding period as international investor confidence slowly returned and emerging markets once again became the high-risk, high-return preference of world investors. This pattern was strongly re-affirmed when international investors suddenly became aware that South Africa was energetically cleaning up its act. That caused the rand to be sharply rerated on 31st January 2019 from around R13.60 to the US$ to R13.30. It also brought the rand back inside its long-term strengthening channel. So the strength of a currency is like the strength of a share – it reflects the perceived financial health of the entity that it represents. A share represents a company and it will strengthen if that company is perceived to be doing well. A currency represents a country and directly reflects overseas perceptions of that country’s progress. Thus the rand/dollar exchange rate is an excellent, objective and accurate barometer of how South Africa is doing.← Back to Articles