The Prosus Winner

18 May 2020 By PDSNETIt has been well said that no matter what happens in the world or in South Africa, there is always a way to make money from it in the share market - it is just a matter of seeing where the opportunity lies.

The advent of the coronavirus in late January this year, while it was a world-wide human and economic catastrophe, presented just such an opportunity. The contagion forced a sea-change in behaviour patterns world-wide requiring people to stay at home for an extended period of time. In this process, companies and individuals have been learning to work and play from their homes.

Some businesses like the airlines industry, tourism and restaurants have been virtually destroyed by COVID19, but others like online gaming have flourished.

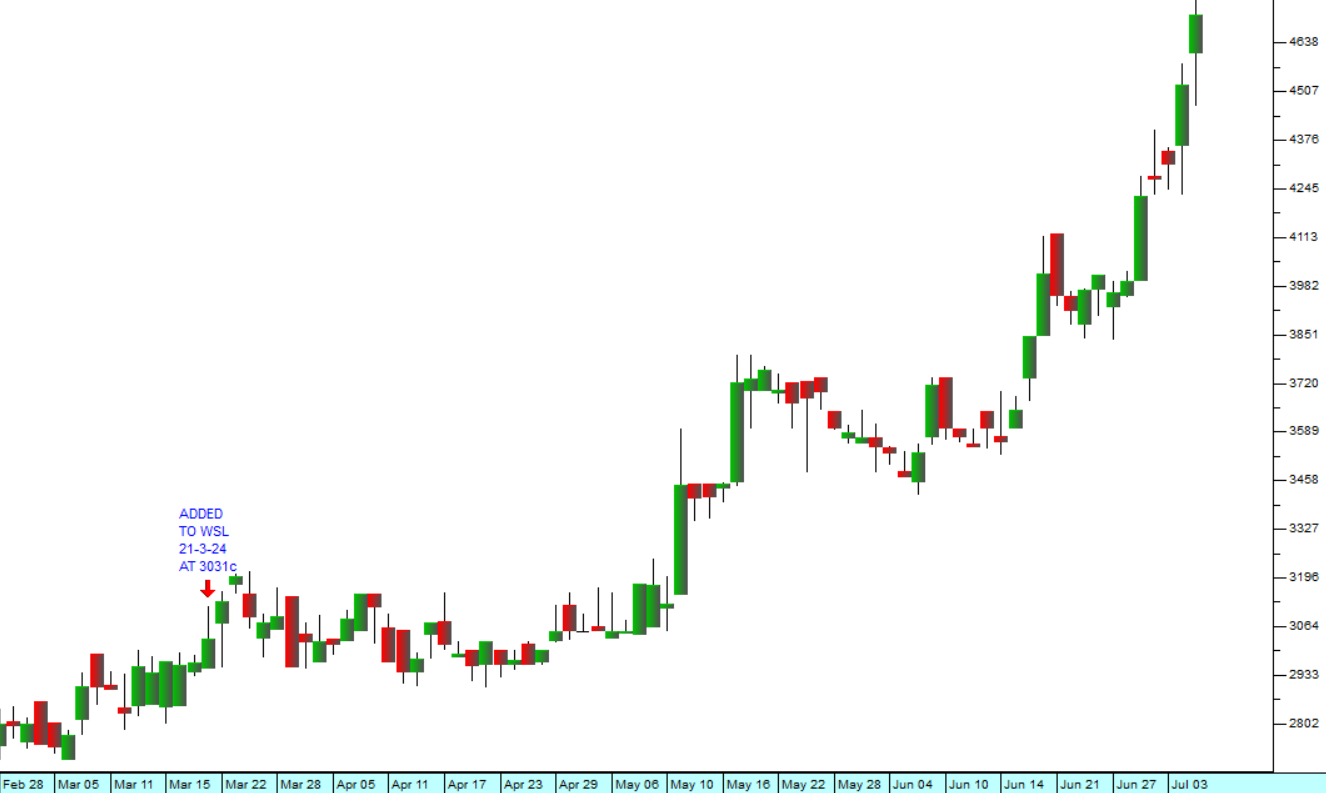

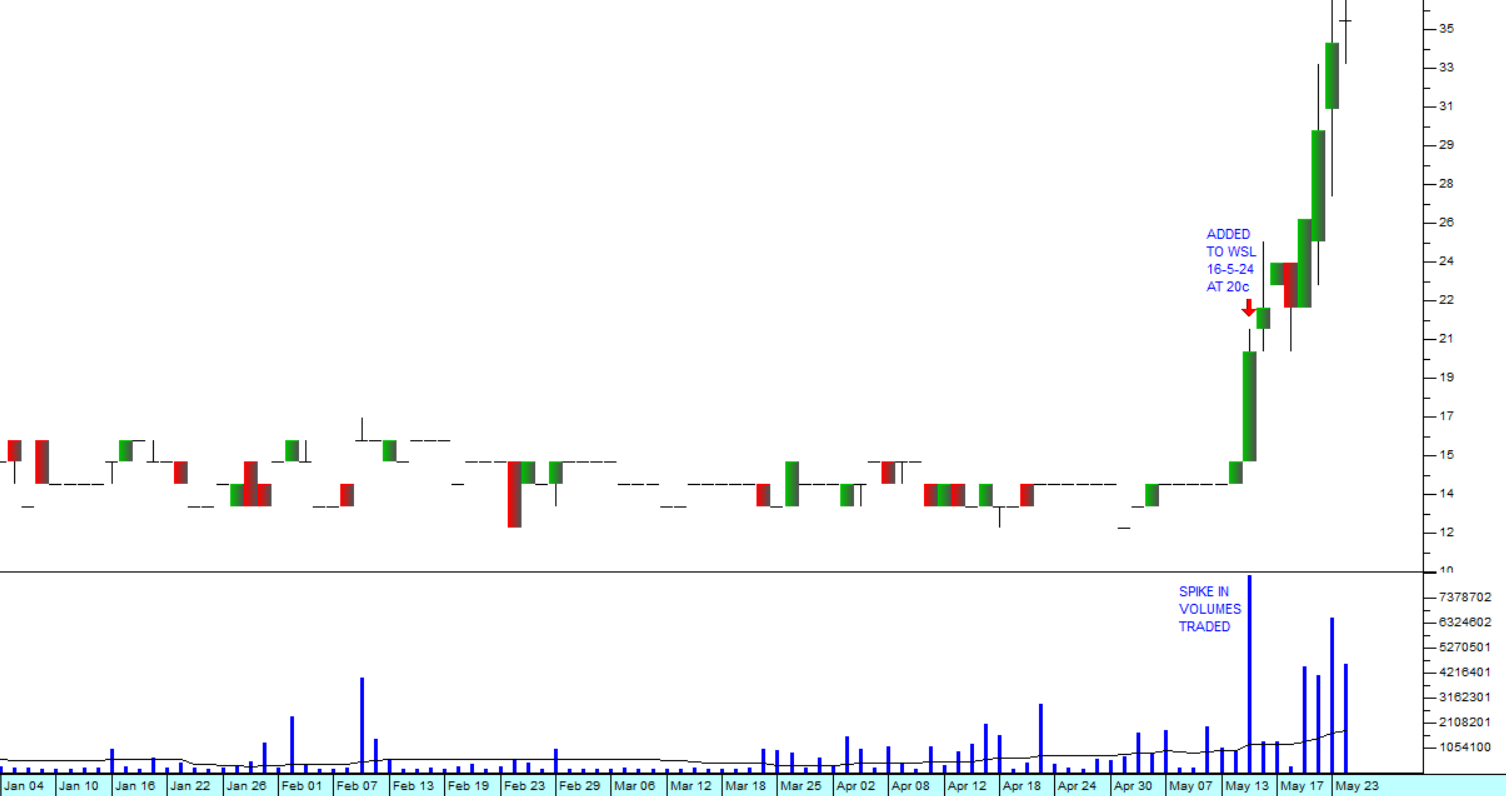

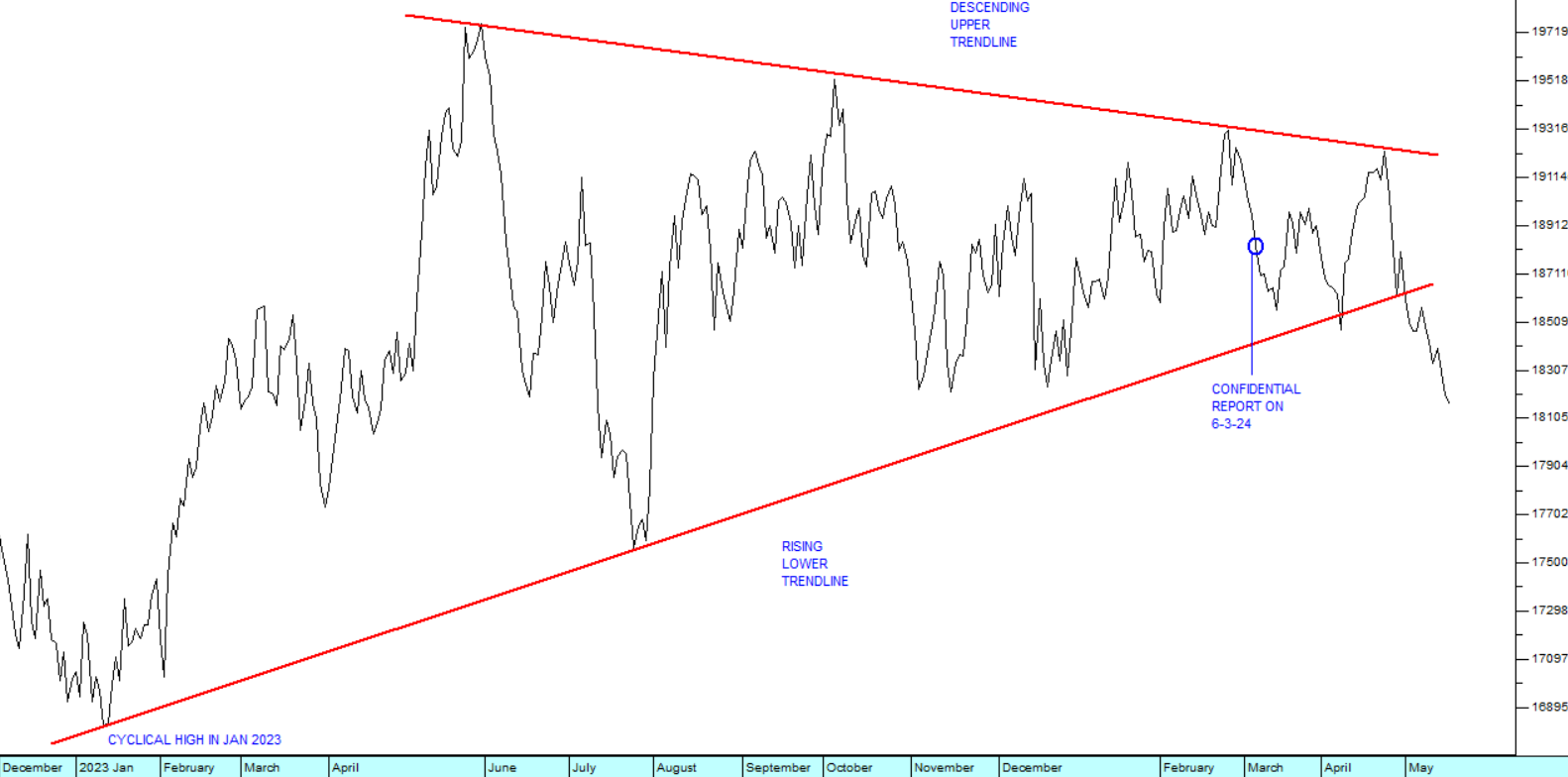

On 29th January 2020, we published an article about the impact of the coronavirus on world markets. In that article we said, "In our view, this correction has the potential to become a buying opportunity - especially for shares like Prosus have taken a sharp fall". We suggested that you should watch Prosus and the S&P500 index to find the best buying opportunity. Since then (29th January 2020) Prosus has risen by 50% in under four months. Consider the chart:

Prosus, through its ownership of 31% of the social networking and gaming giant, Tencent, has benefited from a massive increase in online gaming. National lockdowns all over the world have created a huge market for internet-based home entertainment and social media. Among its various internet-based offerings, Prosus has a share in the blockbuster game, Fortnite, which now has more than 350 million users world-wide. And that is just one of its many online products.

After the virus has run its course, we believe that consumers will remain wary of going out to restaurants and entertainment where large groups are gathered into confined spaces - like the theatre or stadium sports events. We see a semi-permanent shift towards online gaming and other online activities. This means that a share like Prosus should continue to benefit in the future.

Prosus also has the significant advantage of being a rand-hedge which for South African private investors is a major consideration.

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article:

_art4mAy24.png)