The Foschini Group

27 May 2019 By PDSNETThe Foschini Group (TFG) has done things that other clothing retailers have apparently been unable to do. The retail trade in South Africa has been beset by low consumer spending and fierce competition from overseas brands like Cotton On. Large iconic brands like Edgars are teetering on the edge of bankruptcy and yet TFG seems to be able to continue growing its sales and profitability.

The retail clothing business is extremely difficult to manage because of constantly shifting fashions and the need to keep stock levels under control. Rapid, accurate responses are needed to the ever-changing fashion world so that stores can display those styles of clothes which their clients are reading about online.

TFG said that it experienced difficult trading conditions in all three countries where it operates – South Africa, the UK and Australia and yet its results were outstanding.  In South Africa, turnover in the year ended 31st March 2018 was up by 8,9%, in the UK up by 31,3% and 58,3% in Australia.

Working capital management is critical in this business. This means minimising the amount of capital tied up in stock and debtors. On the debtors side, 72% of TFG’s business is done in cash so the company is not dominated by its debtors’ book.

Managing stock is far more difficult. Buyers have to patrol the European and American fashion worlds looking for the latest trends and then communicating these rapidly back to the factories to ensure that stores can display the most appealing range of clothing. The scope of this problem is daunting. TFG has 4085 stores in 32 countries. All of them need to display the latest fashions and they need to hold just the right amount of stock to meet demand. Too little and their customers will look elsewhere switching to their competitors and too much will result in obsolete stock and excessive cash tied up in working capital.

TFG is masterful in its management of its stock. Much of this is due to the improvements made to their communications systems. The changes in individual store stock levels are communicated immediately to their factories resulting in rapid adjustments to production, ensuring a minimum of waste and obsolescence.

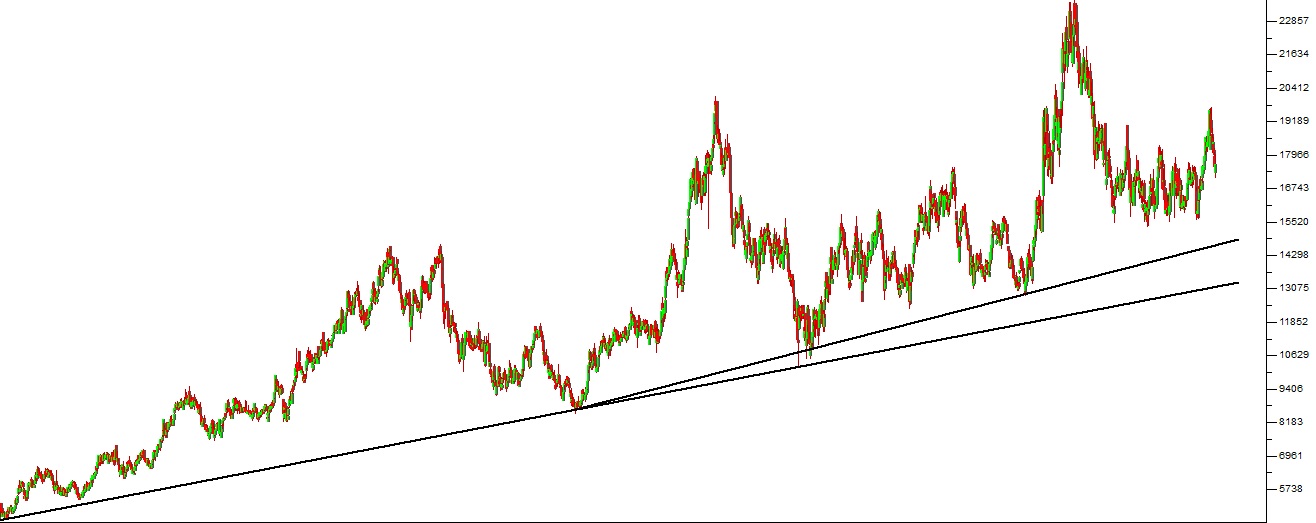

Technically, the share is what we call a “diagonal†because its chart goes from the bottom left-hand corner of your screen to the top right-hand corner over the past ten years. Consider the chart:

The Foschini Group (TFG) May 2009 to May 2019 - Chart by ShareFriend Pro

Obviously, the chart is more volatile than that of other shares, because of the difficult nature of the industry in which it operates, but the steady upward trend - which has accelerated in the last five years – shows an exceptional business philosophy and outstanding management. TFG has managed to do what very few South African retailers have been able to do – it has successfully diversified overseas and its foreign businesses are all thriving. It has also been able to enter the online market effectively. This can be seen from the 57% jump in online sales over the last year. We believe that this is a solid blue chip share which is worthy of a place in any portfolio. With the probability of improved economic conditions in the main geographies where it operates, we believe that the share is due for an upward move.DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: