The Corona Correction

29 January 2020 By PDSNETOne of the enduring characteristics of markets is that they over-react. The size of their over-reaction depends on exactly where they are in the cycle and whether sentiment at the time is generally negative or positive. The S&P made a new all-time record high on the day before Martin Luther King Jr Day (20th January 2020) – after a consistent run which has lasted since the beginning of October 2019 – almost four months. Clearly, the market is now looking for a reason to correct. And since Donald Trump has been preoccupied with his Impeachment trial, he has been leaving the Chinese and the rest of the world in peace.

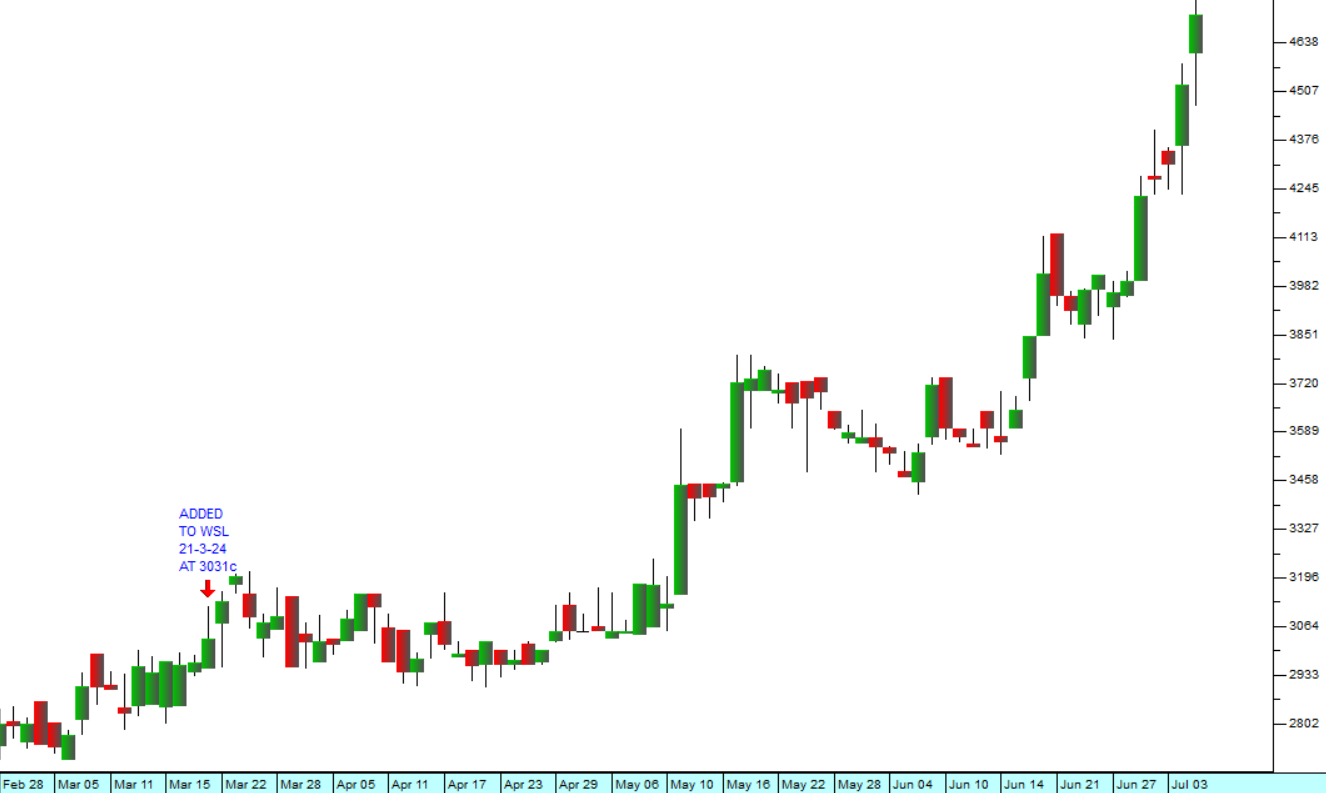

The coronavirus is becoming the very excuse that markets need to correct. With growing numbers of people infected, a rising death-toll and the spread to countries outside China, the virus has caused some panic on world markets. The S&P500 index fell 2,6% from its highest point (3329.63 reached on 17-1-20). Technically at record levels and after a 4-month run, the S&P was surely due for some sort of correction. In the absence of any negative tweets from Donald Trump, the spread of the coronavirus is providing the necessary scare. But can a disease which has so far only caused deaths in China – really damage the world economy that badly. The restrictions on movement inside China, imposed by the authorities will certainly impede the economy. China also is the world’s largest importer of commodities which could hurt South Africa – but at this stage we feel that the 2,6% fall in the S&P is probably over-done. That does not mean that it cannot fall further. Consider the chart:

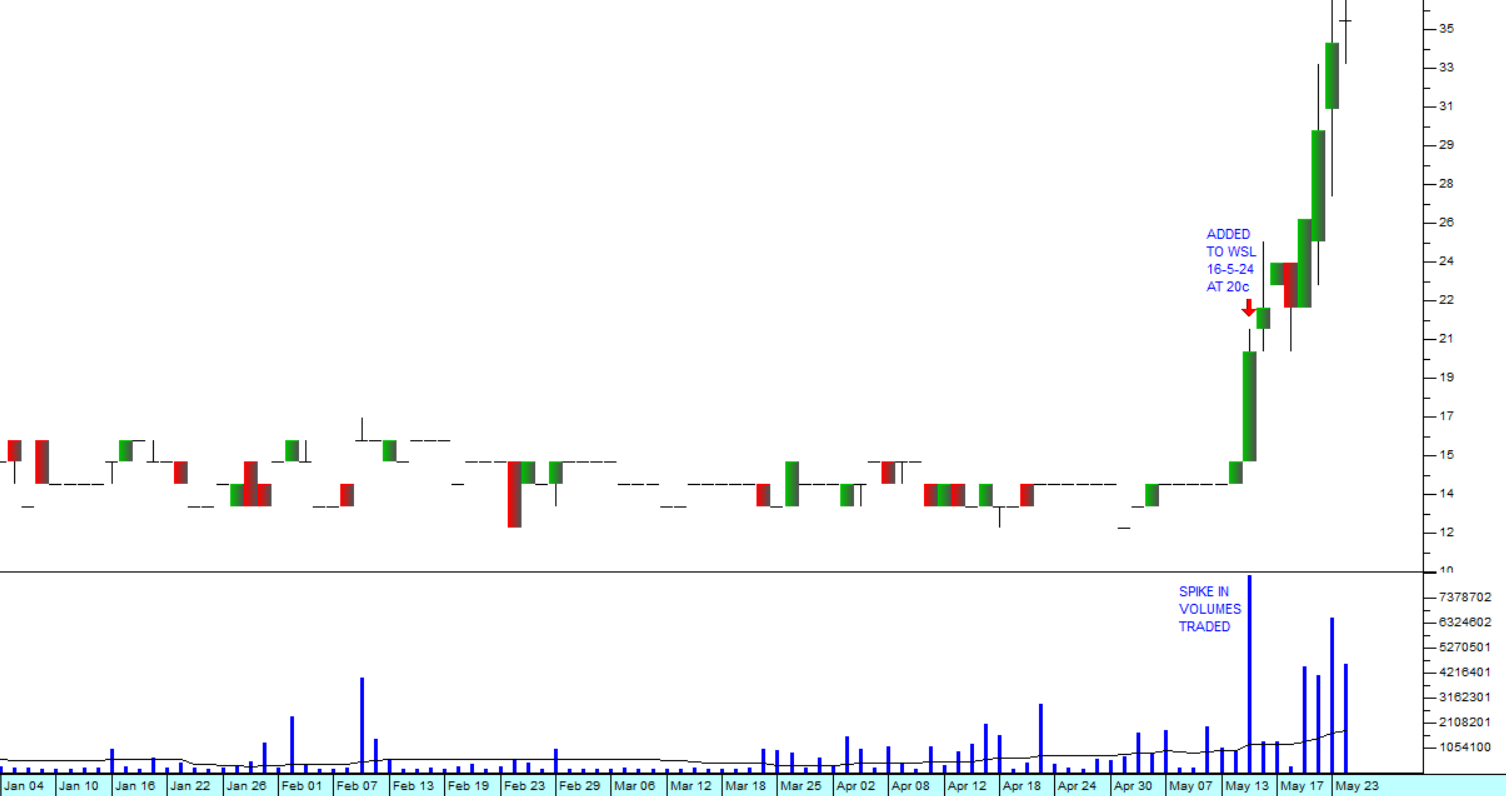

If this is the start of a correction, then you can expect either the virus or some other reason to take the S&P down at least 10%. In our view, authorities are moving quickly to contain and control the spread of the virus which has less than one third of the mortality rate (2,8%) of the SARS virus (9,6%) – but appears to spread more quickly. Scientists are urgently engaged in finding a vaccine and an effective treatment. Of course, the rate of infection could become far worse, but we believe that it will not spread significantly beyond China and that the situation will be brought under control fairly soon. In our view, this correction has the potential to become a buying opportunity – especially for shares like Prosus, which have taken a sharp fall. Look at the chart of Prosus:

Prosus (PRX) October 2019 to January 2020 - Chart by ShareFriend Pro

You can see here that Prosus made an “island” at the start of December 2019 and has been moving up from that point. The island created support at around R1020 and the share may fall further to reach that level. Technically, it seems unlikely that the R1020 level will be broken. You should watch Prosus and the S&P closely to find the best buying opportunities.

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article:

_art4mAy24.png)