The Confidential Report - October 2017

Political

Political polls are hardly solid evidence, but the May 2017 Ipsos poll is at least interesting. It showed that ANC [glossary_exclude]support[/glossary_exclude] had fallen to 47% from the 54% that it won in the 2016 local government elections. Clearly, much now depends on who the party selects as its next leader at its December leadership conference. Ramaphosa is probably the ANC’s best option if they wish to retain their majority in the 2019 elections and the majority of ANC members [glossary_exclude]support[/glossary_exclude] him. However, the Zuma camp might still have sufficient influence to get Dlamini-Zuma elected, but that will almost certainly [glossary_exclude]lead[/glossary_exclude] to the ANC losing their majority in 2019. It appears quite likely that South Africa may have a hung parliament after that election. Obviously, private investors on the JSE will be very interested in the election result, but it seems unlikely that it will have a major impact on the direction of the share market – at least in the short term. The explosion of the KPGM scandal this month indicates that anything to do with the Gupta’s is now tainted. Every responsible/honourable company and individual will distance themselves from such things. Many large companies in SA are reviewing their relationship with KPMG and deciding on whether to continue employing them as auditors/advisors. What is particularly damning is the “rogue unit” report – which KPMG has now ignominiously withdrawn. This report was used for the “capture” of SARS and to discredit and put pressure on Pravin Gordhan to resign. The effects of this on the SA economy run deep. It is probable that KPMG International will survive, but the damage done to their name and their local division is catastrophic – as it should be. The earlier demise of Bell Pottinger shows that the international community is not on the side of the Guptas. Zuma and the Guptas have reached a point of pariah status with everyone – down to the humblest unemployed man living in one of Gauteng’s many informal settlements. The ANC’s only hope for the 2019 election is to appoint someone credible (i.e. not Dlamini-Zuma) and then try desperately to put the Zuma/Gupta era behind them before the election. Failing that, they will surely lose their majority.Economy

The surprising GDP growth figure for the second quarter of 2,5% took South Africa out of its technical recession (two quarters of negative growth) and was based primarily on a sharp recovery in agriculture. The third quarter of 2017 is expected to be softer, but still positive. Clearly, the South African economy is benefiting from a very strong performance in the US and a much better performance in Europe. This is stimulating demand for our exports and compensating for a collapse in consumer spending locally. We expect the improvement in the world economy to continue and to steadily drag the SA economy upwards, despite the internal bad economic management and political risk. One of the best ways for the private[glossary_exclude] investor[/glossary_exclude] to assess the economy is to be observant. Look at what is going on around you. Of particular importance are store closures. For example, the Pick ‘n Pay family store at Douglasdale near Fourways in Johannesburg has recently closed. This is a very well-populated A/B [glossary_exclude]income[/glossary_exclude] [glossary_exclude]grou[/glossary_exclude]p area and the centre (“The Buzz”) has a number of other stores and a large gymnasium. If you add to that the sudden closure of the Mug and Bean on the square in Montecasino followed quickly by the closure of the John Dory’s right next door, it becomes a little disturbing. Obviously, consumers are really feeling the pinch and are cutting back on eating out. This is reflected in the surprise announcement from Spur that they are cutting their dividend because the second six months of their financial year saw a sharp drop-off in turnover. All in all, the South African consumer appears to be conserving cash and paying off debt. Our belief is that this phase will not last too long because of the impact of the strong US economy and the improving European economy on our exports. Already there seems to be much building going on – the horizon has many cranes visible. Companies don’t build new buildings if they are expecting the economy to be bad. Tax collection in the first quarter of 2017 was about R13bn below budget leading to speculation that the fiscus could be as much as R50bn down for the whole year. Finance Minister Gigaba will deliver his mini-budget at the end of this month – and he is going to have to balance the books with less than was expected. In our view, his most probable solution will be to increase VAT from 14% to 16% or even 17%. Notably, the collection of personal [glossary_exclude]income[/glossary_exclude] tax dropped by 5% despite the new marginal tax on those earning R1,5m a year or more. This shows that increasing taxes often results in less tax being collected as more people are then incentivised to take the time to avoid or evade tax – this results in what is known as the backward bending curve where collections increase up to a certain point as taxes increase, but then begin to decline. The inflation rate is coming down steadily and this is making room for the Monetary Policy Committee (MPC) to reduce rates. The process will be slow, but we are fairly certain they will cut another 0,25% in November. Obviously, given the political uncertainty and the vulnerability of the rand, the MPC will proceed cautiously, reducing rates by 0,25 basis points periodically. The effect of this approach is cumulative. As consumers and businesses pay less interest, they are motivated to spend more and to borrow more to enable spending. Over time and with successive interest rate declines this can push sentiment towards positive and help the economy get back on to a growth footing. However, any kind of collapse in the rand will mean an indefinite delay of such rate declines.The Rand

The progress of the rand is of critical importance to private investors. Certain shares on the JSE (rand-hedges) benefit from a weakening rand, while others suffer. With the appointment of Pravin Gordhan in early 2016, the rand broke its long-term weakening trend and began to appreciate against first world currencies. This strengthening trend has been arrested by his firing and the subsequent downgrades of the country’s debt. Now the rand appears to be at the start of what may turn out to be a new weakening trend. We believe that a clear and sustained break below R13.60 to the US dollar could signal a new adverse trend. If this occurs then you would obviously be better off looking for rand-[glossary_exclude]hedge[/glossary_exclude] shares, or shares with a strong rand-[glossary_exclude]hedge[/glossary_exclude] component – which means companies that export overseas, especially to America and Europe. If the weakening scenario plays out, then the strongest point for the rand was R12.48 to the US dollar made on 24th March this year (the red circle). For the strengthening trend to resume, that level needs to be exceeded.

Rand Dollar Exchange October 2012 to October 2017 - Chart by ShareFriend Pro

Wall Street

As we predicted, the S&P500 index of the 500 largest companies trading on Wall Street has broken up to another new record high (2529.12). We expect this pattern to continue for the foreseeable future. Obviously, the surging bull market will be broken by periods of sideways and downward movement (nothing in the markets moves in a straight line), but the underlying trend will be up as the US economy gains momentum and the rest of the world follows. What is happening is that consumers and businesses are beginning to spend the massive cash piles which they have been hoarding since the 2008 sub-prime crisis. As they do this, demand will grow and so will corporate profits. We believe that they will not only spend their hoarded cash, but they will go on to borrow five times as much and spend that too. The S&P is being led mainly by technology shares and especially Apple which has now passed a market capitalisation of $1 trillion and become the first company ever to do so. The US economy and stock market are being driven by easy money, [glossary_exclude]low[/glossary_exclude] oil prices and a surge of efficiencies arising from new technologies.

S&P500 Index October 2015 to October 2017 - Chart by ShareFriend Pro

American companies are required to produce financials every quarter (unlike in South Africa where they only need to report every six months). The listed companies in the S&P500 provide guidance in advance of how they expect their results to look. The reporting season for the third quarter in the US only begins in about a week, but 54 companies have issued positive guidance which was above expectations. This is roughly double the average (25) at this time and higher that the record of 45 in the 1st quarter. Of the 54 companies, 30 are in the IT sector – which shows that IT is leading the US economy with turnover and profits arising from technology advances. We expect this pattern to continue into future quarters – and clearly, so do most investors on Wall Street. One of the most interesting characteristics of a great bull market, like the one taking place on Wall Street right now, is the regular appearance of apparently well-informed bears (people who expect the market to fall). As the market goes up, breaking record after record, there is always another “expert” who publicly announces the “top of the market” and warns of the “impending bear trend”. Of course, a month or two later when the market has made yet another new record high, that expert is discredited – but there always seems to be another ready to take his place. The latest bear on Wall Street is the highly respected fund manager, Victor Dergunov, founder of the Albright [glossary_exclude]Investment[/glossary_exclude] [glossary_exclude]Group[/glossary_exclude]. His latest article headed “The Drop is Coming Soon” is very negative about the future of Wall Street. Only time will tell if he is right, but we expect him to join the growing list of “experts” who have wrongly predicted the top of the market and then been discarded and discredited.Commodities

South African platinum production has fallen from 5,3 million ounces to just 4 million ounces and might go lower. 40% of the demand for platinum comes from the automotive sector which uses the metal for exhaust systems, especially in large diesel engines. Many of the engines are being replaced by petrol engines and then there is the announcement by Tesla that they are now designing a battery-powered heavy-duty truck. Auto-catalyst demand is obviously directly linked to the internal combustion engine and if the world shifts to a new technology, one of South Africa’s most lucrative resource markets could well be in danger. The address by Roger Baxter, CEO of the Chamber of Mines, at the Africa Down Under mining conference held in Australia highlights the plight of the mining industry in the country. He began by pointing out that the current Minister of Mineral Resources, Zwane, is directly linked to a number of corruption scandals involving the Guptas. He went on to say that investment into mining in South Africa had virtually come to a standstill, especially since Zwane unilaterally published the third mining charter – which is now suspended pending the outcome of a court case regarding its legality. Baxter said that mining companies in South Africa had made a collective loss of over R50bn in 2015 and that 65% of platinum producers were unprofitable. Mining is, and always has been, a vital part of the South African economy. Thousands of people, especially in rural areas are employed directly and indirectly in mining. The [glossary_exclude]low[/glossary_exclude] commodity prices, together with the negative impact of Zwane's influence, are destroying this entire industry with disastrous consequences. The forecast for South African mines from Moody’s is despondent. The ratings agency says that regulatory uncertainty and a hostile government attitude combined with [glossary_exclude]low[/glossary_exclude] commodity prices is preventing mining companies from investing. This means that mines will be run just to produce short-term cash without any investment into future expansion. Unprofitable mines will be closed. This can be seen from recent decisions by Sibanye and AngloGold Ashanti to [glossary_exclude]close[/glossary_exclude] unprofitable operations and retrench as many as 16000 staff. The ramifications of such widespread retrenchments will impact directly on the country’s GDP. Iron ore appears to be finally facing the glut which has been predicted for many months. With supply from both Australia and Brazil increasing while Chinese demand for the metal declines, ore prices have dropped below $70 per ton and are expected to fall further to the [glossary_exclude]low[/glossary_exclude] fifties. China is the world’s biggest manufacturer of steel, but its economy has slowed a little as supplies increase, leading to a drop in prices. Other commodities appear to be holding up and demand is likely to increase as the US economy continues to grow rapidly and Europe begins to perform.Companies

JSE MARKET CAP.

The Business Day (18-9-17) reported that the market capitalisation of the JSE has grown by 250% in the past ten years. This is an interesting statistic because, at least for most of the past three years (until its recent upside breakout), the JSE overall index has been more or less flat. However, it supports the assertion that equities are almost always your best long-term investment – better than property, fixed interest and most other types of investment. Another interesting statistic is that blue chip shares have doubled their value every four-an-a-half years for the past thirty years. And, obviously, some shares have done far better. We return to our long -held belief that the easiest way for the man-in-the-street to make money in the share market is to find and buy high-quality, blue chip shares when for some reason they are out of favour with the big institutions – and hence trading on a dividend yield of around 5% or more.LISTINGS BOOM?

The listings boom, if it is really there, is still in a very early stage, but there appears to be some definite momentum. This can be seen from the type of companies that are listing or trying to list. A while back we had Dischem – which is an extremely well-known South African brand and was always going to be a success, if only because Clicks has been a great success and it is in the identical market. After that we had Long4Life – which relied on its founder’s name, Brian Joffe, to make it a success. More recently we have had Kaap Agri – a well-established business in the agricultural sector which is likely to benefit from the resurgence in the agricultural sector. Then there was Star which combined Shoprite with Pep in a Christo Wiese motivated operation. After that came African Rainbow [glossary_exclude]Capital[/glossary_exclude] – Patrick Motsepe’s effort at capitalising on the demand for a strong BEE rating. And now finally we have 4Sight. This is an ultra-high-tech operation aiming to raise R300m on listing, but valuing itself at R1bn in total. Its CEO Dr Antonie van Rensburg suggests that there is much money to be made by “digitising the physical world”. He has a doctorate in engineering and plans to acquire companies which have already developed “smart” technologies. This last seems like a bit of a stretch. But you never know. Once again, the enduring advice is wait and see how the market does with this R2 share early October listing before you make up your mind. We are firm believers in allowing the stagging in a new listing to work itself out before buying. This listing seems to have far less tangible substance than any of the other listings mentioned above. But one thing is certain. More and more companies are coming to the JSE. There have been 14 so far this year. This does not tie up with all the doom and gloom which we read in the newspapers about the economy. Listing a company is a very [glossary_exclude]expensive[/glossary_exclude] and complex process. And a listings [glossary_exclude]boom[/glossary_exclude] is one of the strongest signs that a great bull trend is in progress – or that a major new [glossary_exclude]group[/glossary_exclude] of potentially disruptive technologies is unfolding – or both. We think it’s both.BIRD FLU

Since the outbreak of bird flu in South Africa, it has spread to every province and resulted in the culling of more than 3 million chickens. All four major producers (RCL, Quantum, Sovereign and Astral) have reported cases. The chicken business is recovering from the severe drought which pushed feed prices up to record levels. The current maize crop has seen prices tumble and most chicken producers are expecting to make good profits, but if the outbreak of bird flu continues it will have a negative impact. CBH has abandoned its quest to buy Sovereign partly because of the threat of the bird flu outbreak. All in all, the chicken business remains the most difficult business to manage.PSG (PSG)

This investment house has a reputation for making excellent investments. Capitec Bank and Curro Holdings are arguably over-priced at current levels, but enough institutional fund managers consider them to be good investments to keep them at current levels. What is interesting is that PSG is in the process of launching two more businesses, both of which could turn out to be the next Curro or Capitec. They are Evergreen, a retirement home property business, and Stadia which is listing now and has the potential to be very similar to Curro. The share price of PSG is below its “sum-of-the-parts” valuation and could well be at a very attractive point. Sometimes in the share market, a share which looks expensive now can get a lot more expensive. PSG looks like one of those and if it ever unbundles, significant value will be released. It is also true that PSG is trading very [glossary_exclude]close[/glossary_exclude] to its long-term underlying support line. Consider the chart:

PSG Group December 2013 to October 2017 - Chart by ShareFriend Pro

CAPITEC (CPI)

As we have previously suggested, Capitec Bank is worthy of the high rating which it enjoys. The recent results were nothing short of amazing. In six months it generated headline earnings of R2bn, up 17% on the previous comparable period. Bear in mind that none of the other banks has managed a double-digit increase in profits this year. At the same time Capitec now has 9,2 million customers – a number that is rising by approximately 106 000 a month. The share price has come off recently (like its parent company PSG), but we regard this as a potential buying opportunity. Consider the chart:

Capitec Bank January 2016 to October 2017 - Chart by ShareFriend Pro

You can see here that the Capitec share price has fallen back towards its underlying support trendline and come up a bit since then. We certainly do not believe that it will break down through that line and so it probably represents the best value that it is going to right now.DATATEC (DTC)

Datatec, the JSE-listed international IT company run by Jens Montana, has taken the unusual step of selling off half of its business to Westcon-Comstor, which produces almost 80% of its profits. The sale was done for US$830m of which $630m will be received in cash. Of this, about $130m will be retained and the balance, $500m, is available for distribution as a special dividend or by way of a share buy-back. This means that shareholders can expect to get a return of about R30 per share – on a share which is currently trading in the market for R58. Indeed, the sale means the total value of the Westcon-Comstor is more than the entire market capitalisation of Datatec. And Jens Montana is talking about other possible sales. Whichever way it plays out, this share at a price of around R58 looks like good value.SIRIUS (SRE)

Sirius is a real estate company which concentrates on investing in Germany – so it is a rand-[glossary_exclude]hedge[/glossary_exclude]. It’s approach is to buy up buildings which are less than half empty and then bring them up to being more than 90% let - and then sell them as viable going concerns. For example, it recently sold a building in Kiel which was bought when it was only 19% let and then managed to let 92% of it before selling. Now it has bought two more properties for a total of 25,8m euros which are 38,3% let and 41,3% let. Obviously, it can achieve a significant capital gain by increasing the amount of space let to somewhere above 90% and then selling them. Its share price has been rising rapidly and we expect it to continue climbing.STEINHOFF AFRICAN RETAIL (STAR)

The latest new listing to come to the market is Star, a spin-off of Steinhoff, which includes food, clothing and furniture. With the repurchase of Whitey Basson’s 8,7m shares, Star became a 50,6% shareholder in Shoprite. That means that Shoprite is about 43% of Star and the balance is mainly Pep stores. Star was listed on 20th September 2017 and our advice remains for new listings - Wait until the share has been trading for about a month to allow time for the stags to sell out and the market to establish a value for the assets. Star came to the market at about R21 and has edged up to R22 – giving the company an initial market cap of about R70bn. This means it will be one of the larger blue chip shares on the JSE. We believe that this share will perform well.ZEDER (ZDE)

Zeder made an all-time high of 925c on 18th May 2015 and since then it has been trending downwards. It’s main asset is its share in Premier Foods which makes up about 60% of its total value. It also has a sizeable stake in newly-listed Kaap Agri and a number of other investments. Zeder is part of the PSG group – which means that it is very competently managed and can access substantial resources when needed (look at Curro, for example). Premier has been through a tough time and will have a new CEO (Phil Roux has resigned) but we think that it will perform well in 2018. We regard Zeder as cheap at current levels.NUWORLD (NWL)

Nuworld is a company that imports and markets a [glossary_exclude]range[/glossary_exclude] of electronic goods in South Africa and elsewhere. It is a well-managed company in a difficult environment and yet has managed to be effective, steadily growing earnings over the past four years. It has a net asset value which is just above the current share price and it is trading on a P:E of 7,18. It has a well-developed overseas operation with branches in Dubai, Australia, Brazil and Hong Kong. Its market rating should improve when it publishes results for this year. The only negative is that the share is fairly thinly traded. We believe that this share is good value at the current price.AFRICAN RAINBOW CAPITAL (AIL)

This share came to the market at 850c pre-listing and has fallen quite far to around 790c. Obviously this is because of stagging. In other words, some of the investors who had the shares pre-listing did not want to keep them and sold depressing the price. It also shows the wisdom of watching to see how a new listing performs before jumping in. In time, no doubt, AIL will find a level at which shareholders, on average, are happy – and then it will probably represent really good value. The concept appears to be sound – a BEE company which can [glossary_exclude]offer[/glossary_exclude] any prospective acquisition blue chip BEE status – but the pre-listing price was probably a little too high, especially for a relatively new idea.ANGLOVAAL INDUSTRIES (AVI)

Anglovaal Industries is a well-established industrial company with diverse interests in the South African economy. They produce products in food, cosmetics, footwear and beverages. Among their assets is I&J, a well-known fish brand sold locally and exported. The company says it might be interested in selling off I&J. The share has performed very well in a difficult economic environment as can be seen from the chart:

Anglovaal Industries January 2016 to October 2017 - Chart by ShareFriend Pro

We believe that this is a good defensive blue chip share in the current recessionary conditions.COMAIR (COM)

Comair is arguably one of the best-run companies listed on the JSE. It competes directly with the loss-making SAA and yet manages to be consistently profitable. This is achieved by a relentless focus on efficiency and costs. It runs half the number of air craft with one sixth of the number of staff – and yet it generated an after-tax profit up 54% on last year at R297m. More than anything else this graphic example shows how pointless it is for South Africa to continue supporting a loss-making national airline. The Comair share price has been showing a pleasing upward trend:

Comair December 2015 to October 2017 - Chart by ShareFriend Pro

ADCOCK (AIP)

As expected, Adcock has seen a significant turn-around since Brian Joffe and Bidvest gained control of the company. In its latest results for the year to June, turnover was up 7% while after-tax profit jumped 213%. The company has recently bought the Genop group which gives it [glossary_exclude]entry[/glossary_exclude] into the ophthalmic/optometrist/ aesthetic and plastic surgery markets. It looks like a good share with great prospects:

Adcock Ingram Holdings October 2015 to October 2017 - Chart by ShareFriend Pro

Clearly, Joffe and his team cut a significant amount of dead wood out of the operation.GRAND PARADE INVESTMENTS (GPL)

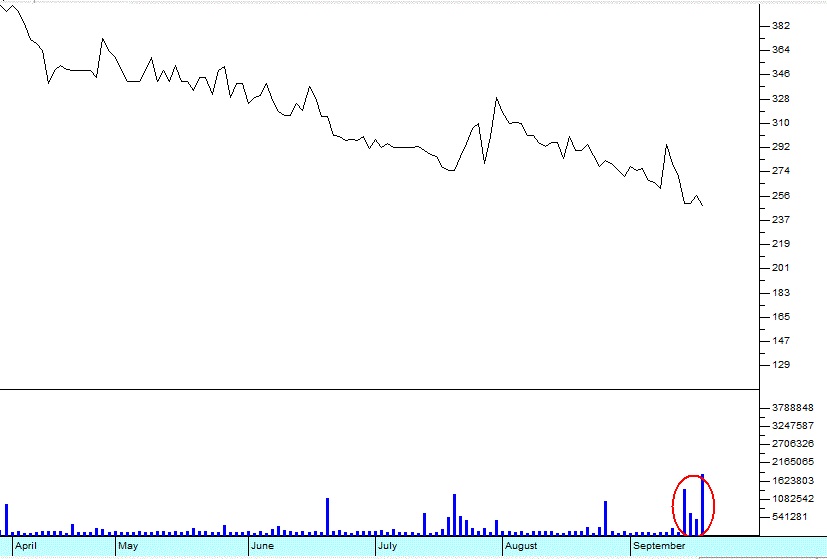

It is always interesting to look at shares which are trading well below their net asset value (NAV). Grand Parade is just such a share with a NAV of almost R5 and a share price which is less than half of that. The company owns the lucrative Grand West casino in the western Cape as well as Grandslots, a gaming business, and it has a stake in Spur corporation. Its share price has come down in the last two years, but may be reaching some sort of support at around 250c judging by the increase in volumes (see the red elipse). This could prove to be a low point. Consider the chart:

Grand Parade Investments April 2017 to September 2017 - Chart by ShareFriend Pro

YORKOR (YRK)

This is a relatively thinly-traded timber company operating mostly in South Africa. Obviously, its profits depend to a large extent on the local construction industry – which has been in the doldrums for some time. Yorkor’s most interesting asset is its plantations which are extensive. The constant upward revaluations of these assets as the land value appreciates and the trees planted on them grow and mature means that Yorkor is always trading at a significant discount to its net asset value (NAV). Right now, you can buy Yorkor shares for 283c, but its current NAV is 943c. In its most recent results, its plantations were revalued upwards by 21% to R2,8bn. Without this revaluation, the company’s profits declined. The company has been buying its own shares back and in the period bought back 4,6% of its issued share capital. This effectively increases the NAV for the remaining shareholders. There is also a merger with an international timber company, Green Resources, which should result in a significant re-rating. The real question is where else can you buy 943c worth of assets (real assets) for just 283c? The Confidential Report Webinars are hosted on the first Wednesday evening of the month and include a single comprehensive report covering the month and providing an overview of factors impacting the JSE including political developments, international markets, the local economy, commodities, currencies, individual JSE-listed stocks, and much more. The next Confidential Report webinar will be on the 1st of November at 18:30. To register, click here.← Back to Articles