The Confidential Report - November 2022

2 November 2022 By PDSNETAmerica

The overriding truth about the share market; the truth that we cannot lose sight of right now is that:

WE ARE IN A BEAR TREND

For the past two weeks the S&P500 index has been trending up, culminating in Friday’s 2,46% climb to close at 3901.06. The bulls have somehow managed to convince themselves that the US Federal Reserve Bank (the Fed) is at or close to some sort of “pivot point” where it is going to change the direction of its policy decisions.

We have heard nothing from the Fed to indicate that this might be true. On the contrary, Jerome Powell has been adamant that America’s high inflation has to be squeezed out of the economy by rapidly raising interest rates, combined with the steady reduction in the size of the Fed’s balance sheet through quantitative tightening (Q/T).

As we have pointed out previously, this bear trend, in our opinion, was brought on about 18 months too early by the war in Ukraine and the impact of that event, particularly on oil prices. In our view, the bear trend should have started in mid-2024 rather than in March 2022. This premature start means that the bear trend is taking place in an environment where the US economy is still strong with many S&P500 companies still reporting profits above expectations.

The result of this has been an unusual amount of bullish sentiment within the bear trend, which is visible in the enthusiasm which accompanies any rally and the relative strength and persistence of those rallies. Of course, most of the investors in the market today have never seen or been aware of a bear trend before because they only became involved in the markets after 2009. They were drawn into the market relatively recently by its record-breaking 13-year upward trend which ended at the beginning of this year. They do not comprehend what is happening now because they have no previous experience of it.

At the same time, we are concerned that this bear trend may well be worse than previous bear trends, because the bull trend which came before it was artificially and continuously sustained by the massively accommodative monetary policy stances of the various central banks since 2009. Interest rates were kept close to zero for years while excessive quantitative easing (Q/E) was used to inject excessive amounts of cash into the world economy. The COVID-19 pandemic extended this generous accommodation further to the point where central banks, and especially the US Fed, are now being forced to stamp on the brakes hard in an effort to bring inflation under control. In the past, adjustments to the Fed funds rate have always been made in 25 basis point intervals to give the economy time to adjust. In this cycle the Fed funds rate is being hiked by 75 basis points at a time – three times more quickly than the norm.

Consider the following chart of the S&P500 index:

The chart shows the clear downward slope of the bear trend, beginning with the record high at 4796 on 3rd January 2022 and progressing in the normal fashion of bear trends through a series of lower highs and lower lows. The support/resistance levels at 3900, 3666 and 3585 which we have discussed in previous Confidential Reports are shown as are the various moving averages (MA) that we have used to delineate the trend. You will note that the current rally has taken the S&P back to the 3900 resistance level, at which point you can expect it to encounter some significant resistance and quite probably to run out of steam. We expect the S&P to fall back from current levels and ultimately to break below the bear trend low of 3577 made on 12th October 2022.

The reverse “golden cross” sell signal is shown where the 50-day exponential moving average broke down through the 200-day simple moving average on 3rd March 2022. Despite the rally of the last two weeks, you will note that the 50-day exponential moving average is nowhere close to breaking up through the 200-day simple MA to give a golden cross buy signal - and the 300-day simple moving average is still falling steadily.

We believe that, far from being almost over, this bear trend, which is now 10 months old, has only just begun. We predict that the Fed will raise rates again at its November monetary policy committee meeting by at least a further 75 basis points. Indeed, they will be encouraged to do so by this extraordinary rally in the stock market and by the continuing profitability of major companies.

At this stage, there is almost nothing in the news coming out of the economy that indicates that consumers and businesses are yet feeling the pain of rising interest rates.

It is true that the housing market has cooled off a little and there has been a sell-off of high-flying tech stocks. Existing home sales were down by 1,5% in US in September. Tesla shares fell on disappointing 3rd quarter earnings and sales.

But real interest rates still remain substantially negative, with the inflation rate above 8% against an effective yield on the US 10-year bond of around 4%. While real interest rates remain negative, there is no incentive for consumers and businesses to curtail spending. The strength of the economy is echoed in the unemployment figures which show the US at an unemployment rate of 3,5% in September 2022 – which is a 5-decade low. The economy created 263 000 new jobs in September month alone. Private consumption expenditure (PCE) rose by 5,1% in September 2022 – above August’s 4,9% but slightly better than expectations of 5,2%. The PCE is the Federal Reserve Bank’s preferred measure of inflation, and it is still rising. For the Fed to “pivot” towards a more accommodative monetary policy stance, they will need to see clear evidence that the economy is cooling off rather than growing.

Historically, the stock market tends to anticipate the economy by between 9 and 18 months. With this in mind, the bear trend which we are seeing now indicates that the smart money expects the US economy to move into a recession later next year and in 2024. This viewpoint is supported by many economists who have predicted a recession beginning in the second half of 2023. But some of the latest figures are making that difficult for novice investors to understand, especially the unemployment rate.

87% of S&P500 companies have reported their second quarter profits and 75% of them came in above the average of analysts’ expectations. Profits are up 6,7% on average. Third quarter earnings are now coming in with 129 S&P500 companies reporting. These results have been mixed – Microsoft and Alphabet disappointed while General Motors produced solid results. The year-on-year predictions for the average performance of the S&P500 are that earnings will increase by 3,3% - considerably down on the 4,5% increase predicted at the beginning of October 2022, but still positive.

Chevron reported $11,5bn quarterly profit and Exxon reported $112bn – both well ahead of estimates. At the same time, Amazon and Apple have given weak guidance. Meta, which owns Facebook, fell 24% on Thursday last week. GDP grew by 2,6% in the 3rd quarter to 30th September 2022 showing that the economy is not yet in recession.

Some investors hope that the monetary policy committee (MPC) might only hike rates by 50 basis points in November instead of the more widely predicted 75 basis points. In our view, this hope is misplaced, and we expect the Fed to raise rates in November by 75 basis points for the 4th time. They might even raise them by 100 basis points.

Investors could be forgiven for thinking that this does not look like an economy that is moving into recession – and no doubt that accounts for some of the periodic optimism which we have seen. But it is very important to understand that the effect of rising interest rates on consumers and companies is cumulative. Each successive hike is added to the accumulated effect of the hikes that came before it so that the interest burden on consumers and businesses alike adds up month by month. Inevitably, it must begin to reduce spending and corporate profits. That is what the smart money in the market is expecting and why they remain bearish.

China

The Chinese economy is a significant player in the world with GDP approaching $18 trillion, just over three quarters of the size of the US. China has been struggling with a sustained outbreak of the Omicron variant of COVID-19 and has taken strain as a result of the Ukraine war and rising fuel costs. The property market in China is apparently contracting. There is evidence that many consumers have over-extended themselves and may not be able to keep making their mortgage bond repayments. Gross domestic product (GDP) growth is expected to slow sharply to 2,8% this year compared with last year’s 8,1% and the average growth of 9% per annum since 1978. Obviously, with America and Europe expected to go into recession next year, the prospects for China appear dismal. The Chinese economy has a direct impact on the demand for commodities and that affects emerging economies like South Africa. Private investors on the JSE cannot afford to ignore the impact of China on the world economy and South Africa.

Ukraine

From our perspective it appears that the war in Ukraine has moved decisively in favour of the Ukrainians. Russia’s desperate efforts to conscript more soldiers and their repeated defeats on the battlefield are beginning to impact on Putin directly. There has been increasingly public criticism of Putin’s handling of the war effort within Russia and even from his inner circle. The winter in Ukraine is and will further slowdown the progress of the war, but it is now clear that Russia has lost significant territory and will probably lose more – including Kerson – which will threaten its control over Crimea. With NATO-supplied weaponry and support the Ukrainians are steadily pushing the Russians back across the Dnipro River. In our view, the situation is rapidly becoming untenable for Russia and for Putin in particular. We expect some sort of resolution of the situation within the next few months which may well involve the removal of Putin from office.

Political

It now seems probable that Cosatu will withdraw its support from the ANC following its national elective conference. This will have a substantial negative impact on the ANC’s support in the 2024 elections and add to their general slide from popularity. Our view is that the ANC will get less than the 50% that they need to control parliament and will have to compromise with one or more of the other parties after 2024. In our view, the most likely candidate is the official opposition, the DA. Their policies are similar enough to those of the Ramaphosa administration in many areas, and they have the support to give the combined entity a significant majority in parliament. Obviously, the ANC will then have to compromise on many issues to accommodate the DA, but we do not see that as a bad thing.

The South African Democratic Teachers Union (SADTU) has split with the other members of COSATU to accept the Finance Minister’s offer of a 3% wage increase. This split in COSATU shows how fragile the union movement has become in South Africa. It is also very good news for Godongwana as he struggles to continue the government’s debt consolidation program. It probably may mean that a civil service strike can be avoided – and if it goes ahead, it will only be partial.

The fact that the Office of the Presidency has achieved an unqualified audit in its financials for the year ended 31st March 2022 is an achievement. It is the first unqualified audit in 7 years and important because the presidency needs to set an example for other government and quasi-government departments and enterprises. The ANC government has been plagued by qualified audits at every level and this marks a major step in President Ramaphosa’s effort to clean up the government’s image.

In his response to the Zondo Commissions report, President Ramaphosa has put forward a plan to counteract and prevent state capture. Part of that is the decision that the Investigating Directorate of the National Prosecuting Authority (NPA) set up to prosecute state capture offenders will become permanent. To date, no one has been convicted of state capture, although there have been some high-profile arrests and asset forfeitures. In our view, Ramaphosa has acted to stop state capture, but the process has taken far longer than expected and there are still remnants of state capture visible, especially in some state-owned enterprises (SOE).

Economy

The Finance Minister delivered a solid mid-term budget on Wednesday last week, aided by a R106bn revenue overrun largely due to higher commodity prices. He was able to use two thirds of that overrun to reduce government debt to 4,9% of GDP – a vast improvement on the February 2022 budget’s estimate of 6%. He also allocated R33bn in bailouts to Transnet, Denel and Sanral, but said that bailouts to SOE's were declining. He said that the government would take on between one third and two thirds of Eskom’s massive R400bn debt but gave no further details. The R350 a month social relief of distress grant is to continue for another year and the civil servants are “pencilled in” to get 3% increase this year and nothing in the next fiscal year. He estimated that the economy would grow by 1,9% this year and an average of 1,6% for the next three years. A major feature of the budget was the infrastructure spend which will increase from R66,7bn to R112bn. This is obviously good news for the construction sector. All in all, it was a very good budget which will make both investors and the ratings agencies happy.

The latest six-month monetary policy review published by the Reserve Bank indicates that the South Africa economy is doing well because it is focusing on reducing the government debt, controlling, and reducing inflation and maintaining a surplus on the balance of payments. In effect, despite our domestic challenges, the country is running at a profit and using that profit to reduce its debt and strengthen its currency. South African’s have become obsessed with the current bout of loadshedding – and that is undoubtedly a serious problem which severely restricts economic growth. But that problem is also a function of the country’s transition from coal to renewables – a process that was inevitable and always going to be fraught with problems. In our view the energy situation will ultimately resolve itself, if only because companies and individuals, frustrated by Eskom’s rising costs and unreliability, are steadily installing, and commissioning their own power generation based on renewables. The government’s main budget deficit came in at R42,7bn in August 2022 down from July’s R129,5bn. For the year to date the deficit is down 17,7%. Tax revenue was up by more than 10% year-on-year in August 2022 over the previous year.

Manufacturing output rose 1,4% in August 2022 but is expected to drop in September as a result of 25 days of loadshedding. August had just 5 days of loadshedding compared with July’s 22 days. Mining output dropped again in August – this time by 5,9% following July’s 8,2% contraction. This was due to strike action, loadshedding and falling commodity prices. This means that the third quarter gross domestic product (GDP) will probably decline, and the economy may well fall into a recession, especially with the impact of the strike at Transnet. The composite leading business cycle indicator (CLBCI) fell 2,3% in August month-on-month and 3% year-on-year. This indicates that GDP may contract in 2023.

Responding to the jump in loadshedding the Bureau for Economic Research’s purchasing managers index (PMI) fell into negative territory in September, coming in at 48,2 – down sharply from August’s 52,1. This was confirmed by the S&P Global PMI which fell to 49,2 in September 2022 from August’s 51,7. Manufacturing makes up about 14% of the country’s gross domestic product (GDP). The power cuts have prevented companies from manufacturing and restricted all other aspects of business activity. It is possible that South Africa could record a second consecutive quarter of negative growth in the three months ended on 30th September 2022 – resulting in a technical recession due almost entirely to loadshedding.

The strike at Transnet, which began on the 6th of October 2022, has had a further negative impact on the country’s rail logistics and Transnet has already declared a “force majeure” at its ports. The United National Transport Union (UNTU) whose members make up about 54% of the Transnet workforce went on strike after it rejected a 1,5% offer and indicated that the revised offer of 4% plus a R5 000 once-off payment was also unacceptable. They finally settled for a 6% across-the-board increase plus other benefits after being on strike for one week. They were joined in the strike by the SA Transport and Allied Workers Union (SATAWU) after a court ruling rejecting Transnet’s application to prevent them from striking in sympathy. SATAWU has a further 22 000 Transnet employees as members and is still considering the Transnet offer. UNTU and SATAWU were asking for up to 13,5% wage increases. It is clear that the rising level of inflation was being used by unions to justify larger wage demands at a time when government institutions are trying to bring their wage bills down. It is not clear exactly what effect the strike has had on Transnet, but it seems likely that it has made already low levels of efficiency even worse. Roger Baxter, the CEO of the Minerals Council of South Africa, says that Transnet Rail and Transnet’s Port Authority are already responsible for revenue losses amounting to about R50bn in the mining industry so far this year. He indicated that this logistics problem was as serious as the loadshedding being applied by Eskom. He suggested that the mining industry could generate about R150bn more in revenue, pay R27bn more in tax and create 50 000 more jobs if this problem was resolved. On 10th October 2022, Kumba announced that, because of the force majeure at Transnet, it would lose about 50 000 tons of production per day, rising to 90 000 tons after 7 days as a direct result of the Transnet force majeure. Furthermore, they said they would lose about 120 000 tons of exports which will cost them about $8,5m a day in production and $11,7m in lost export revenue. All in all, the strike was costing the mining sector about R1bn a day. On 11th October 2022 big business, out of desperation offered an additional R148 per container to fund pay increases for workers to stop the strike.

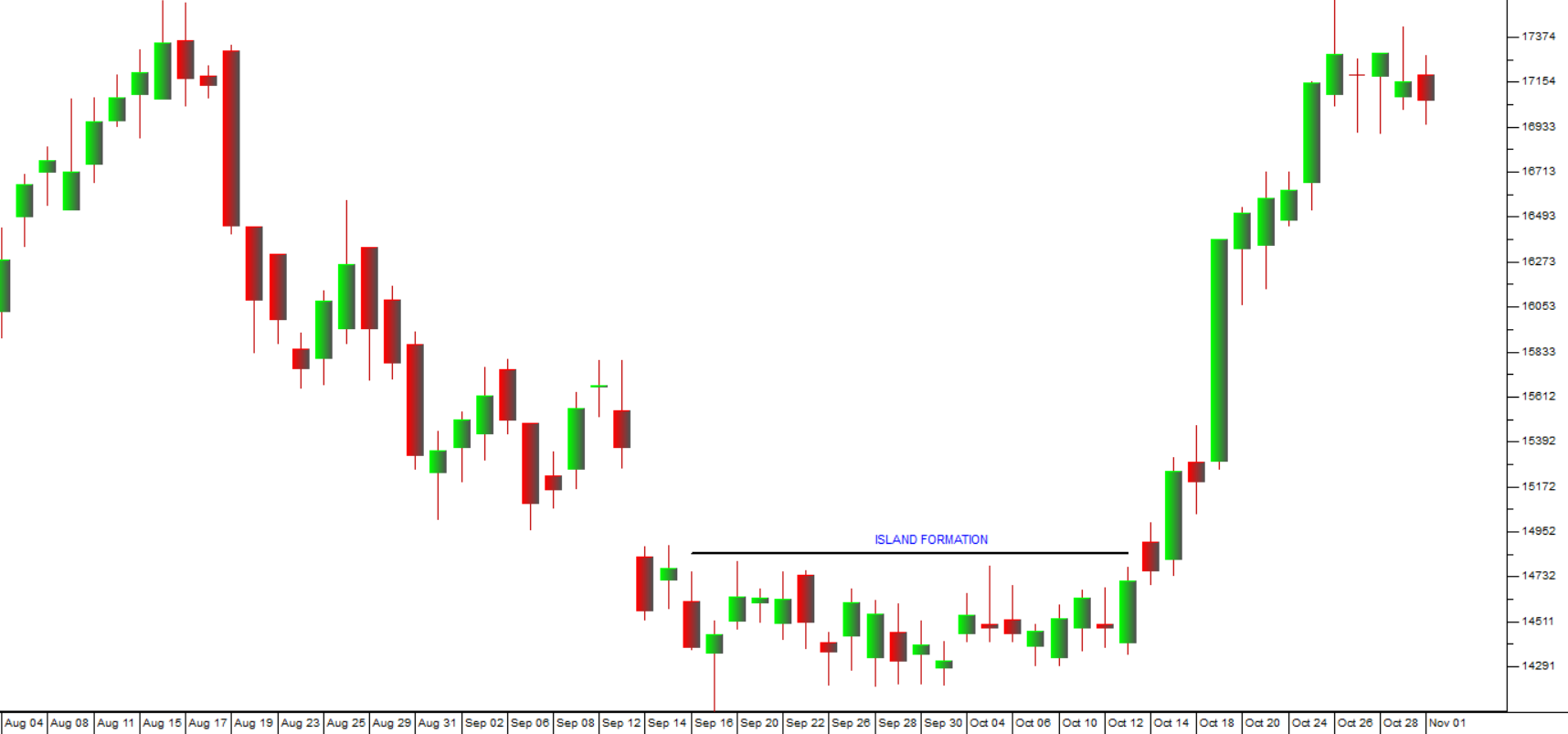

The BankServ economic transactions indicator (BETI) shows the level of transactions passing through the BankServ clearing house and includes both ATM transactions and EFT transactions. In September 2022, the index fell for the 4th month in a row mainly because of the weak state of the economy and increasing loadshedding. To this must be added significantly higher inflation – especially the cost of food and fuel. In our view, the South African economy will almost certainly go into a recession now (defined as two successive quarters of negative growth). When added to the recessionary conditions becoming apparent in the world economy and the decline in commodity prices, this means that the current bear trend in shares on the JSE is likely to persist for some time. Consider the chart:

You can see here that the JSE Overall index entered its bear trend 3 months later than the S&P500 – on the 2nd of March 2022, but that it has been in a downward channel since then.

Retail sales in August 2022 were 1,8% down for the 4th month in a row showing that consumers are struggling with rising interest rates, loadshedding and the increased cost of fuel. At the same time, the consumer price index (CPI) fell to 7,6% year-on-year in August from July’s 7,8%. This shows that inflation is stabilising – albeit at well above the Reserve Bank’s target range of between 3% and 6%. The primary factor causing the drop in the CPI was the fall in fuel prices, but food prices continued to rise. Core inflation, excluding food and fuel, rose to 4,7% which may open the door for a 100 basis point rise in interest rates at the next monetary policy committee (MPC) meeting, but we think that is unlikely.

The Public Servants Association (PSA) has delivered a 7-day strike notice to the government after rejecting the government’s offer of a 3% wage hike. The union was demanding 6,5% after reducing its demand from 10%, but it has now reverted to demanding 10% again. The three teachers’ unions have accepted the government’s offer, but the remaining larger civil servant unions in Cosatu have rejected it. The government has now decided to “pencil in” the 3% wage hike into the mid-term budget policy statement (MTBPS) despite the PSA’s disagreement. So, it now seems inevitable that the strike will go ahead. In our previous experience civil service strikes of this nature have not been particularly impactful on the economy or the stock market – at least not in the short term. Obviously, Finance Minister Godongwana needed the matter of the civil service wages to be resolved so that he could include it in the MTBPS. The alternative would have been to exclude the expenditure from the budget and deny the members of those unions which have accepted the increase.

The producer price index came down slightly for the second month in a row in September 2022 showing that underlying inflationary pressures are easing. The decrease was largely due to the fuel price which may not be sustained in future months. The oil price and the strength of the rand against the US dollar are the primary components of fuel prices in South Africa. North Sea Brent oil has been trending up since the middle of September but talk of a global recession should keep a lid on how far it can go. The rand is a function of international investor sentiment which is firmly “risk-off” at the moment as American interest rates rise.

Eskom

It is notable that Eskom electricity production in June 2022 was down 4% year-on-year, 7,7% in July and 2% in August. September’s loadshedding will surely result in a further drop in production. It seems clear to us that Eskom is basically dying and that in time it will cease to exist – certainly as a generator of electricity. It might survive as a distribution network, but even that is in question. More and more businesses and consumers are choosing to incur the expense of installing their own electricity generation. This pattern is likely to continue and even accelerate given Eskom’s unaffordable request for a 32% increase in their fees.

The decision by Anglo America to launch a renewable energy company, Envusa Energy, is interesting. It shows that the monopoly which Eskom has had on power generation in South Africa for decades has unwound to the point where entering the market to provide energy is viable for a large, listed company. Anglo’s stated initial objective is to provide up to 5 gigawatts of power – not only for the use of its own subsidiaries, which need about one gigawatt, but also for other companies and users. Undoubtedly there is a strong demand for power sources which enable consumers and businesses to avoid Eskom’s increasingly expensive and unreliable service. South Africa has an abundance of wind and solar power potential, and Anglo is intent on making a profit out of the gap left by Eskom’s incompetence, corruption, and indolence. Envusa expects the first energy to be delivered by 2025. So, it appears that South Africa’s energy crisis will not last indefinitely. The need will be supplied by private enterprise who will step into a gap created by government incompetence and corruption - as has happened in other areas like education, health care and security.

Andre de Ruyter’s comments at the mining conference in Johannesburg come as something of a surprise. His first assertion was that Eskom is not over-staffed. It has about 42700 staff with the intention of reducing that to about 40300 by 2026. De Ruyter said some of the staff were working “extraordinary hours” to keep the lights on and that he was desperate to hire new skills. He also argued that electricity in South Africa was not over-priced compared to other countries – even with the 32% increase. Germans pay more than four times what South African’s pay per kilowatt hour. He said that South Africans use electricity wastefully and need to become more efficient to reduce demand. In our view, we find it strange to hear the CEO of a company trying to get consumers to use less of his company’s product.

Finance Minister, Enoch Godongwana has said that he will set out the government’s decision about taking some of the Eskom debt onto its balance sheet in the February 2023 budget. The government may take as much as R250bn of Eskom’s R400bn debt over in the deal that would also see the debt restructured. It is thought that this could be done now because of the tax surplus arising from the commodities boom without resulting in a massive increase in the government deficit. Effectively the debt is being passed from Eskom to the South African taxpayer.

The first 6000 hectares of land adjacent to Eskom power stations has been leased to independent power producers who will use it to generate as much as 2 gigawatts of power which can then be added to the national grid. The leases are for 30 years and the IPP's are expected to invest about R40bn into the projects at no cost to the taxpayer or Eskom. Altogether, Eskom has about 36000 hectares of land to lease out in this way and further agreements will be signed every quarter according to Eskom CEO, Andre de Ruyter. This program has the potential to move South Africa away from coal-fired power stations towards renewables at no cost to Eskom or the government.

The Rand

The rand has continued to reflect the shift towards “risk-on” which has been dominating international markets since Wall Street entered a bear trend at the beginning of this year. In fact, there is a clear relationship visible between the strength of the rand against the dollar and the S&P500 index. Whenever the S&P is rising, the rand also tends to be stronger against the dollar – because there is a shift towards risk-on - and vice versa. Consider the following table:

|

RAND |

|

S&P500 Index |

||||||

|

|

From |

|

To |

Percent |

From |

To |

Percent |

|

|

Weakness |

12-Apr |

1448 |

16-May |

1619 |

-11.81 |

4397 |

4008 |

-8.85 |

|

Strength |

16-May |

1619 |

08-Jun |

1526 |

5.74 |

4008 |

4115 |

2.67 |

|

Weakness |

08-Jun |

1526 |

14-Jul |

1711 |

-12.12 |

4115 |

3790 |

-7.90 |

|

Strength |

14-Jul |

1711 |

10-Aug |

1617 |

5.49 |

3790 |

4210 |

11.08 |

|

Weakness |

10-Aug |

1617 |

26-Sep |

1809 |

-11.87 |

4210 |

3655 |

-13.18 |

|

Strength |

26-Sep |

1809 |

04-Oct |

1760 |

2.71 |

3655 |

3790 |

3.69 |

|

Weakness |

04-Oct |

1760 |

12-Oct |

1831 |

-4.03 |

3790 |

3577 |

-5.62 |

|

Strength |

12-Oct |

1831 |

27-Oct |

1792 |

2.13 |

3577 |

3807 |

6.43 |

The table shows the periods of strength and weakness in both the rand and the S&P500 index since mid-April 2022. Thus, for example, in the period between the 12th of April and the 16th of May the rand weakened from 1448c to the US dollar to 1619c or 11,81%. During the same period, the S&P500 index fell from 4397 to 4008 or 8,85%.

The correlation is not 100%, but there is a definite direct relationship between the rand/dollar exchange rate and the S&P500.

The chart shows that, putting aside its volatility, the rand has generally been weakening against the dollar as interest rates rise in US which coincides with S&P continuing with its bear trend. Consider the chart:

In our view, the rand is holding its own particularly well in this radically changed international financial environment. All currencies have been falling against the US dollar because the rising interest rates in America have simultaneously made US Treasury Bills more attractive while they have made equities worldwide less attractive. As indicated above, we expect this trend to continue with the S&P500 losing ground and the rand falling against the US dollar but holding its own against other currencies like the euro and the British pound.

General

The ANC’s much-vaunted National Health Insurance (NHI) is basically a joke. The idea is that a central fund will buy health services from existing medical facilities, both private and government. Those facilities must first be approved by the Office of Health Standards Compliance (OHSC) and for this it has received completely inadequate funding from the Treasury. There are approximately 5000 health facilities in South Africa and the OHSC is supposed to inspect all of them every 4 years. This implies that they will inspect about 1200 each year – but the reality is that they inspected 387 in their first year to 31st March 2021 and 544 in the year to March 2022. All of the facilities inspected were government-run where standards were actually found to be deteriorating. No private health facilities were inspected. Of the provinces, only the Western Cape had improved standards – in every other province standards had declined. It seems clear to us that the NHI is a white elephant which should never be implemented. It is typical of the grandiose populist ideas which the government proposes combined with their consummate inability to produce results. Bringing down the unemployment rate or managing the electricity crisis are other examples. Luckily, the NHI has yet to metastasize into a major expense.

Denel has become the latest state-owned enterprise to come to the Treasury with the begging bowl. They have been given a R3,4bn bailout to save them from liquidation. They have been unable to pay salaries and meet current expenses and they are losing qualified and experienced staff. Their story is similar to that of SAA, SABC or the Post Office. In our view, these are all government-run entities that South Africa does not need. They have been a constant drain of the Treasury for years and they add almost no value to the economy. In our view they should be privatised, sold, or just closed.

Companies

BANKING INDEX

Since interest rates began to rise, and especially since April 2022, we have been suggesting that banking shares were getting cheap. As a general rule of thumb, the banking sector benefits from rising interest rates because much of the money which they have borrowed is at lower fixed rates while they are able to extend new loans at higher rates. They can, of course, be impacted by a rising level of bad debts, but the large banks have usually made provision for this and have adjusted their lending policies to eliminate those borrowers who are unlikely to be able to repay.

As a rule of thumb, blue chip shares and especially banks, are considered cheap when their dividend yield (DY) rises above 5%. The big institutions (such as pension funds, insurance companies and unit trusts) have a constant stream of funds which they need to invest. They are always looking for high-quality shares which are trading at relatively low prices, so, when the banks are at a DY above 5%, they tend to place their funds there. Right now the JSE banking index is on a DY of 5,38 and looks cheap to us. Their profitability can be seen by the recently declared 42% increase in Standard Bank’s headline earnings for the nine months to 30th September 2022. We consider Standard Bank to still be relatively cheap at R170 and on a DY of around 5%. Consider the chart:

CONSTRUCTION

The mid-term budget policy statement (MTBPS) has seen the government spending on construction projects almost double to R112bn. This could be a major boost for established local construction companies, provided the tenders are put out. The roll-out of projects has been slow so far but is now expected to pick up as the government tries to stimulate employment through the construction sector. Look at the chart:

You can see here that the construction sector was recovering after COVID-19 in 2020 but began to decline again from the beginning of this year. There are only six companies left in the sector – Raubex, WHBO, PPC, Afrimat, M&R and Aveng. Afrimat is really more of a base metals mining company these days.

CONSOLIDATED MOTOR HOLDINGS (CMH)

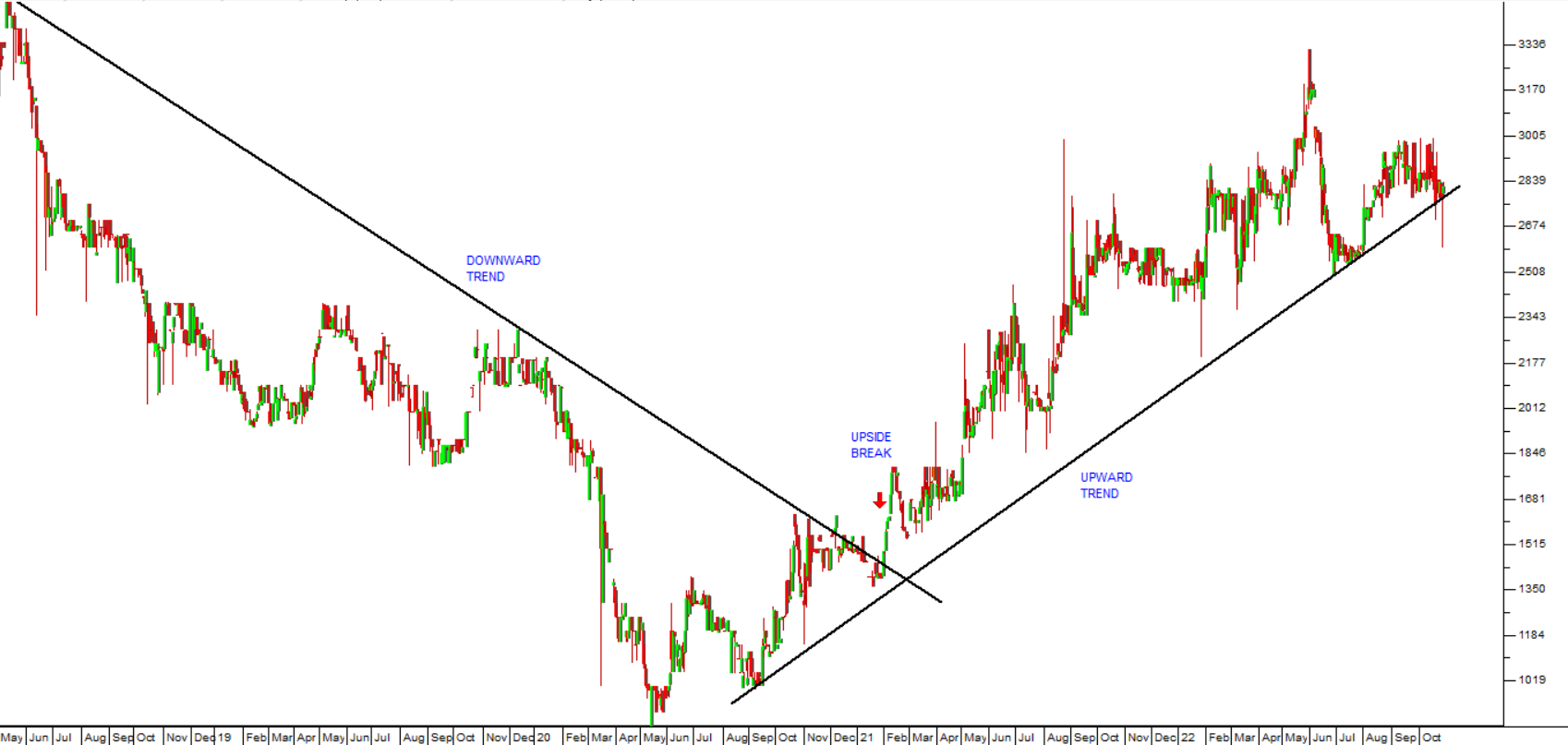

Consolidated Motor Holdings is a motor vehicle distributorship network with dealerships in Nissan, Volvo, Toyota, Opel, Subaru, Lexus, Mazda, Isuzu, and Ford. They sell both new and used vehicles. In their results for the six months to 31st August 2022 the company reported revenue up 11,7% and headline earnings per share up 51%. These excellent results were achieved despite the impact of the chip shortage, loadshedding, six interest rate hikes and a much higher price of petrol. Consider the chart:

As you can see the share was in a downward trend until May 2020. After that it began to recover. We recommended applying a long-term downward trendline and waiting for an upside break. That break came on 29th January 2021 at a share price of 1400c. Since then, the share has been climbing steadily and is now trading for over R28. So, it has doubled in 20 months. We still believe that the share has further upside potential.

SANTOVA (SNV)

Santova is an international logistics company with 21 offices in 11 countries. The company designs, implements, coordinates, controls, and monitors international supply chain activities. Obviously, its business has been impacted by the worldwide supply chain problems. It has benefited from higher prices for its services but has also managed costs very effectively. In its results for the year to 28th February 2022 the company reported revenue up 40% and after-tax earnings up 144%. Then in a trading statement for the six months to 31st August 2022 the company estimated that headline earnings per share (HEPS) would jump by between 56,2% and 66,2%.

This is a share which gave a clear on balance volume (OBV) buy signal on 27th October 2021 at 425c per share. It is now trading for 738c – a gain of 73% in a year.

DISCHEM (DCP)

Dischem is a chain of pharmacy stores that competes directly with Clicks offering a range of cosmetics, over-the-counter remedies, and prescriptions. It has 253 pharmacies and 33 baby stores with 50 Medicare stores acquired from 1st October 2021. The company is growing rapidly both organically and by acquisition. Theoretically there can be a Dischem store wherever there is a Clicks store which gives Dischem substantial “blue sky” potential. The share is also very defensive which means that it is not much affected by the fall-off in consumer spending or the state of the economy. In a trading statement for the six months to 31st August 2022 the company estimated that headline earnings per share (HEPS) would increase by between 43,1% and 45,4%. Consider the chart:

You can see here that between 2018 and March 2021, Dischem shares were in a downward trend. We advised applying a long-term trendline and waiting for an upside breakout. That breakout came on 25th March 2021 at a price of 2211c. After that, the share rose steeply to around R38 and then began to move sideways during 2022. We expect it to resume its upward trend on the strength of the excellent results to the 31st of August 2022.

ALTRON (AEL)

Altron is an information and communications technology company with operations in South Africa as well as the UK and Australia. In its recently published results for the six months to 31st August 2022 the company drew attention to the difficulties of doing business in South Africa with loadshedding, the residue effects of COVID-19, the floods in Natal and sharply higher inflation especially of the fuel price. Despite all these negatives, the company was able to report revenue up 15% and headline earnings per share (HEPS) up 467%. Consider the chart:

As you can see the share is now in an upward trend based on the strong recovery in its results. It is trading for about 75% of its net asset value (NAV) and on a P:E multiple of just over 10 which we think makes it relatively cheap.

RAUBEX (RBX)

This is one of the few survivors in the construction industry. It has operations in construction, materials and infrastructure and it makes money mostly by winning government and quasi-government tenders. It has suffered much since Sanral stopped putting out tenders because of the controversy over e-tolling. In the mid-term budget policy statement (MTBPS) the Finance Minister said that Sanral would be getting a R23,5bn bail-out. He also said that spending on infrastructure projects would almost double to R112bn. Raubex will probably be one of the main beneficiaries of this effort to stimulate the economy. In its financials for the year to 28th February 2022 the company reported revenue up 30,9% and headline earning per share up 263%. This was obviously a sharp recovery from the dark days of COVID-19, but in a recent trading statement for the six months to 31st August 2022, the company said that it would be maintaining the higher level of earnings with HEPS expected to be between 10% and 20% higher. Consider the chart:

The share has been falling for the past six months and has now reached a level where it is trading close to its net asset value (NAV) and on a P:E multiple of under 10. If it benefits from the new tenders issued by government agencies, this share could recover rapidly. Obviously, it is a risky option, but it has already fallen substantially so the downside risk is probably already mostly in the share.

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: