The Confidential Report – May 2018

2 May 2018 By PDSNETPolitical

One of the legacies of the Zuma era is a massive and inefficient civil service. Years of “jobs for pals” and rampant nepotism has seen the civil service grow to unmanageable proportions. The economist Dawie Roodt has estimated that, including the state owned enterprises (SOE), the civil service now employs about 3 million people. In the February budget, the government estimated that it would spend in total R1,68 trillion – out of which more than R585bn would be civil service salaries. That is just over 35%. This means that the enormous civil service is sucking up funds which could be better spent on development. The challenge is to reduce the size of the government, beginning with the number of ministers. It has been estimated that South Africa could probably manage with roughly two thirds of the number of ministries that it has. Over time, the effect of that on the economy would be enormous. Pravin Gorhan, as Minister of Public Enterprises, is moving to eliminate corruption and state capture in state owed enterprises. His most recent move is to replace the board of Denel following the resignation of the previous CEO Mantsha among allegations of state capture. This of course follows the immediate replacement of the Eskom board which was virtually President Ramaphosa’s first move. The new board of Denel is comprised almost entirely of people of colour, all of whom have a track record of good governance and integrity. We can expect the financial bleeding of SOEs to decline as new boards are appointed. Probably, the next most important SOEs are Transnet and Prasa. But these together with the embattled Airports Company (ACSA) fall under the Department of Transport. The objective is to eliminate state subsidies and reduce the need to provide government guarantees.Economy

The reality of the South African economy is that there are approximately 30 million people living below the “Upper Bound Poverty Line” (UBPL) which is set at R992 per month. This is an improvement on the situation in 2006 when 66% of South Africans lived below the UBPL – but it is still a very disturbing statistic. The people most at risk are black, female, the uneducated, rural living and children (under 17 years old). Clearly, everything possible must be done to address this situation – and that mostly comes down to increasing the growth rate of the economy. The 1,3% recorded for 2017, although better than expected, is totally inadequate. Growth rates of 4 to 5% are needed to begin to roll back the level of poverty – and those can only be achieved if the government embraces the main principles of mixed capitalism and ceases to create uncertainty in the business community. Of the various forecasts of SA’s growth in 2018, the most optimistic is that of Standard and Poors at 2%. This is followed by various commercial banks between 1,5% and 2%, while the World Bank and IMF estimate 1,4% for this year and 1,8% for 2019. Overseas investors are talking about higher rates of growth between 3% and 4% - but that seems unlikely. All of us are sure that this year will be much better than 2017 and 2019 should be even better. The government says that improved confidence alone could boost GDP growth by 0,5% and President Ramaphosa is hoping that his overseas tour will result in $100m in investment coming into the country over the next 5 years. A major factor in our growth is the steady improvement in the US and world economies. In the end, the South African economy is export-led and will only really get going in response to growth in the rest of the world. The fall in the official inflation rate to 3,8% is indicative of the strength of the rand in recent months – but that has now reversed somewhat. The inflation rate is now getting close to the [glossary_exclude]bottom[/glossary_exclude] of the Reserve Bank’s target range of between 3% and 6%. Retail spending is climbing based on lower inflation and rising confidence. In January, retail sales increased by 3,2% and in February by 4,9%. No further interest rate cuts are expected however. The Monetary Policy Committee (MPC) has said that it does not intend embarking on a rate-cutting cycle at this stage. If President Ramaphosa is successful in drawing significant overseas investment into the economy, we could well be looking at much stronger growth by the end of this year or early next year.Commodities

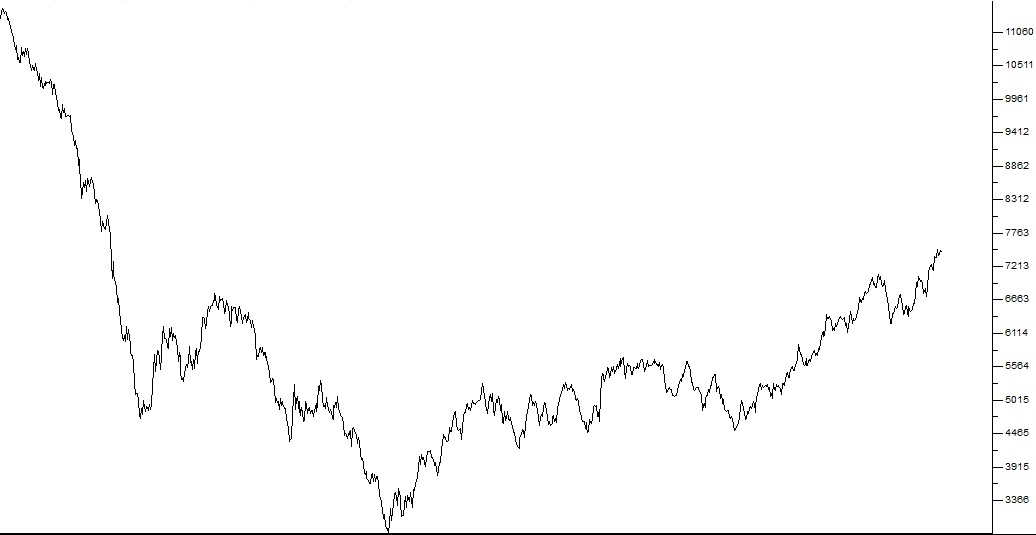

The steady upward trend in the oil price since the beginning of 2016 is a direct result of the world’s economic recovery. Whether we like it or not, most of the world’s energy is still based on fossil fuels – and that seems likely to remain so for some time to come. A stronger world economy naturally means rising use of internal combustion engines to transport products and people. It seems unlikely that the oil price will ever go back to where it was (at around $150 per barrel) but as the world moves out of recession and into a period of strong economic growth, more oil is likely to be used. Renewable energy is growing, but it has a long way to go (at least ten years) before it significantly impacts on the oil price. The decision handed down by the [glossary_exclude]High[/glossary_exclude] Court that a mining company cannot be penalised if its empowerment shareholding falls below the 26% stipulated in the charter is enormously significant, because it means that mining companies do not have to continually [glossary_exclude]top[/glossary_exclude] up their empowerment shareholdings as their empowerment partners sell their shares. The Mineral Resources Minister, Mantashe, has now said that he has no intention of appealing the [glossary_exclude]High[/glossary_exclude] Court’s decision on this issue. Clearly, this clarity is going to be very good for international investment into the SA mining industry. At the same time Mantashe said that good progress had been made with the 3rd mining charter and it would be gazetted in May 2018. This is also good news because it brings to an end years of uncertainty. It seems likely that the Chamber of Mines has acceded to the requirement for a 30% empowerment shareholding, but at the same time will probably argue for the charter to remain in place and unchanged for at least ten years to give some stability to the sector. Another very creative suggestion is that junior mining companies (i.e. up to a certain size) be exempt from compliance with the charter. It is thought that this will stimulate a new junior mining industry that will create significant employment and new exploration. Zwane’s third charter, in its original form, would definitely have killed the goose which laid the golden eggs, whereas an investment-friendly third charter must rank as second only to the turnaround taking place at Eskom in the positive achievements of Ramaphosa’s new administration. The platinum industry is in crisis mainly because of the falling rand price of platinum. The price has fallen from over R16 600 per ounce two years ago to its current level of R11 124 – and all the while mining costs have been rising. At this level, smaller producers are closing completely and larger producers are closing shafts. South Africa used to produce around 75% of the world’s platinum and now is only producing about 50%. This situation has arisen partly because of the significant increase in re-cycled platinum which now accounts for more than a quarter of world supply. The stronger rand since Ramaphosa was elected has not helped. Consider the rand price of platinum over the past two years:

Platinum Price in Rands April 2016 to April 2018 - Chart by ShareFriend Pro

Of course, legislative uncertainty and considerable strike action by the unions have made the situation worse – but essentially the platinum industry is downsizing rapidly in response to much lower prices – a trend which appears to have no immediate end.ALUMINUM

The aluminum price has been climbing steadily as the world economy, and especially the US economy, recovers. Aluminum is used in a multitude of manufacturing industries from motor car manufacturing to ship building. The recent US decision to “blacklist” Rusal, the Russian supplier of 6% of the world’s aluminum, has caused the price of aluminum to spike upwards as customers scrambled to find a new source of supply and available stocks were bought up. Consider the chart:

Aluminum Price April 2016 to April 2018 - Chart by ShareFriend Pro

The price of our aluminum producer, Hulamin, has moved up – but perhaps has not yet fully discounted the current and future trend of aluminum on world markets. As the US economy recovers and the recovery spreads to other countries, the demand for this important commodity will continue to rise.Wall Street

The primary factor weighing on Wall Street was the threatened trade war between the US and China. Trump decided to slap tariffs on $60bn worth of Chinese imports into America and stated that the Chinese had been stealing US intellectual property. The Chinese responded with some tariffs of their own on US goods. But now it appears that the two sides are actively engaged in talks to resolve the situation without resorting to tariffs. Wall Street has responded positively but uncertainly to the news of the talks. It remains in a correction but has built strong support at 2581 on the S&P500. Consider the chart:

S&P500 Index December 2017 to April 2018 - Chart by ShareFriend Pro

Further bad news could see that support at 2581 broken and a deepening of the correction, while good news on the quarterly results of S&P500 companies or a fading of the tariff issue between the US and China could stimulate an upward move. You will also notice that there is the beginnings of a downward-sloping resistance line – which could indicate a triangle. The 300-day simple moving average remains firmly upward-sloping which supports our conviction that this is just a correction in an overall bull trend and not the start of a new bear trend. Another factor emerging from the US in recent weeks has been the strengthening of the yield on their 10-year treasury bill to 3%. This has been caused by the rising oil price which has seen North Sea Brent reaching almost $75 per barrel. Consider the chart:

Brent Oil June 2014 to April 2018 - Chart by ShareFriend Pro

The growing world economy (especially in the US) is stimulating the demand for motor vehicles and hence oil. All of this is causing a return of money to the US (attracted by the higher interest rates) and a consequent weakening of emerging market currencies like the rand. So the rand has fallen back from R11.50 in February this year to around R12.50 – which is beneficial for our mining industry and bad for the local inflation rate and particularly fuel prices, which have risen sharply. The real question is how these developments will impact on equities. Will they cause the current correction to extend and deepen? Technically, as we have seen above, the S&P500 is holding on to clear support at 2581. If that support is breached then we can expect to see the correction extend from its current 10% towards 15% and maybe even further. On balance, we believe that this is unlikely.The Rand

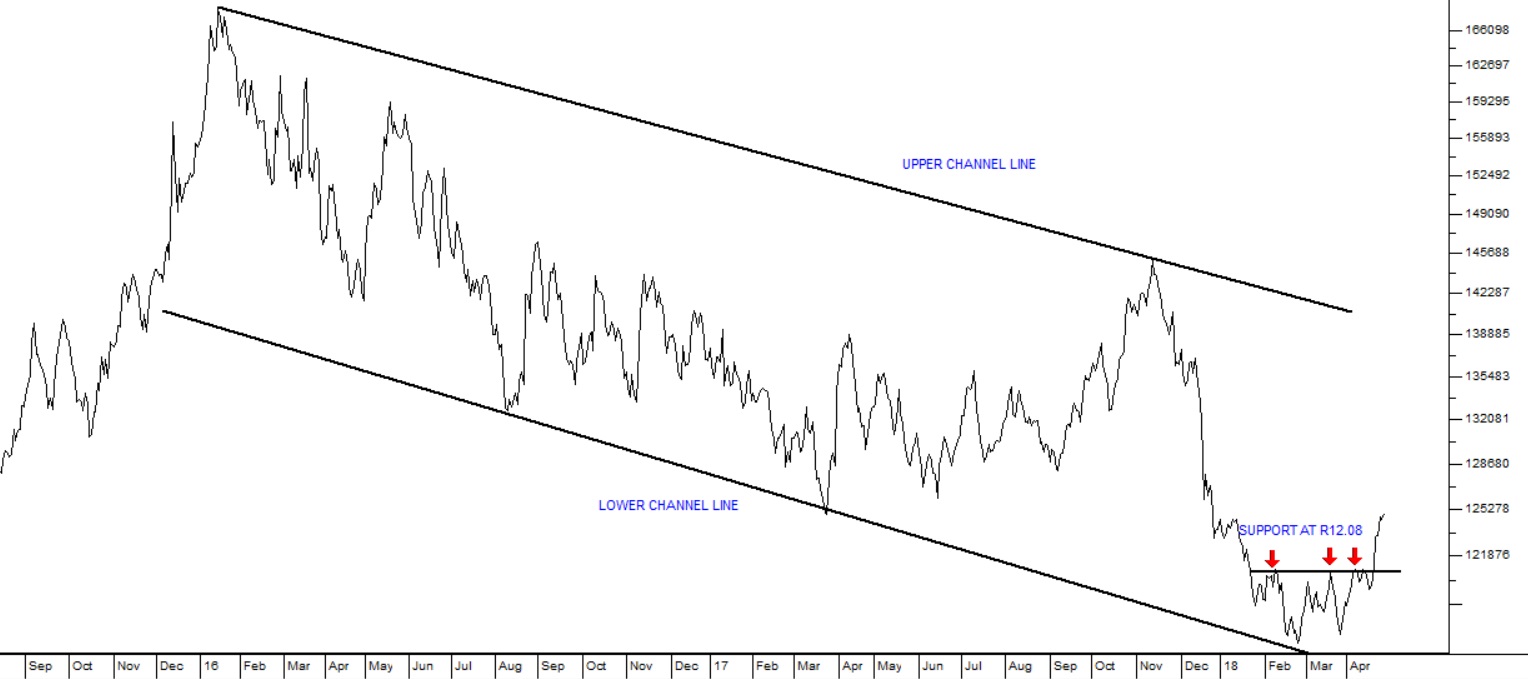

As always, the strength of the rand is a key factor which should be considered by all private investors. Looking at the chart, it would appear that key support at R12.08 has been broken convincingly:

Rand/US Dollar Exchange Rate October 2015 to April 2018 - Chart by ShareFriend Pro

The long-term strengthening channel remains in tact, but we could see further weakness towards the R13.50 level in the near term.General

The signing of contracts with another 27 independent power producers (IPP) by Energy Minister, Jeff Radebe, means that there are now 53 IPPs. The ultimate goal is to have over 100 IPPs producing more than 17 gigawatts of power. That is about what the new Medupi and Kusile power stations will produce together when they are fully operational. In the process another 80 000 jobs will be created and a considerable amount of investment capital injected into the sector. Some of this new power will be absorbed by the economic growth which is anticipated, but obviously, Eskom will have to begin closing its older coal-fired power stations at some point. The unions are worried that this will result in a loss of jobs and they are protesting. However, it seems that overall, the IPPs will be net creators of employment – just not in a state owned enterprise. The slow, but steady, demise of the Edcon group is probably not of much interest to private investors because it has not been listed on the JSE for many years. Nonetheless, its decision to close its store in central Johannesburg is something of a shock. It reflects, not so much the fall off in retail, as the way it has changed. So far Edcon has been forced to close more than 200 stores in the effort to bring down costs. Despite having sold their debtors’ book, they are still carrying far too much debt. Pep and Ackermans are aggressively attacking their lower income markets and there has been a flood of new overseas brands like Cotton On which are making inroads into the upper-end market. We believe that, eventually, Edcon will shrink to a fraction of its current size and then probably be bought out. The company has been going for about 90 years and has more than 1300 stores, but it has not changed with the times. The secondary listing of Sanlam on the new exchange, A2X, separates this new exchange completely from its other smaller rivals and makes it a serious threat to the JSE. Sanlam has a market capitalisation of R179bn – which is more than four times the size of A2X’s entire market cap up to this point. A2X estimates that it will be up to 40% cheaper to trade shares on its exchange than on the JSE – and it already has 4 large stockbroking firms registered to trade. Clearly, as investors and stockbrokers begin to appreciate the advantages of dealing through A2X rather than the JSE, there will be a migration and the volume on the JSE will decline. The JSE will be forced to reduce prices for the first time in many decades as it faces some serious competition.New Listings Cancelled

This past month has been unusual in that it has seen two substantial new listings withdrawn – and in both cases the companies had effectively reported making a loss in their most recent financials.SAGARMATHA

The failed listing of Iqbal Surve’s new company Sagarmatha (SGT), which is the Nepalese name for Mount Everest, on Friday 13th April, was a disaster for the company. The company reported that it had surpassed its minimum subscription of R3bn but the JSE decided not to allow the listing to go ahead because it had not submitted its financials to the Companies and Intellectual Property Commission (CIPC). The company expected to have 1,2 billion shares at just under R40 each – giving it a value of just short of R50bn. Critics said that the company was technically insolvent and has R2,3bn of debt. The company had a net asset value per share (NAV) of just 34c but the asking price for the shares was to be 3962c. Journalist, Gareth Van Zyl, asked “…what innovation, intellectual property or technology business does Sagarmatha actually own…?” SGT was to take ownership of its primary asset, Sekunjalo Independent Media, on the day that it listed – but that company reported an R11m loss in the six months to end-June 2017. Newspapers like the Business Report and Cape Times have shown their bias by publishing positive spins on Sagarmatha, while opposition newspapers have tried to make the listing appear to be a failure even before the JSE’s move – some even suggested it was the next Steinhof. All of this shows that, from a private investor’s point of view, you cannot really rely on the independence of the press and new listings can be very dangerous. It is always safer to wait and watch the first few months of trade while the market decides what the company is really worth rather than participating in a pre-listing issue of shares.CONSOL

Before it was abruptly cancelled, the listing of Consol in May this year was to bring a leader in glass packaging back to the market. Consol was de-listed in 2007. The main purpose of re-listing was to raise about R3bn to pay down debt. The company’s debt position is not good and in six months ending in December 2017 it paid R625m in interest resulting in an R80m loss. The company does have some growth potential when its glass factory in Ethiopia comes on stream at the end of 2018 and when its Nigerian operation begins in 2019. Its largest client was always SA Breweries and it will now have to re-negotiate its contract with AB Inbev – which may lead to tighter margins. The current shareholders of Consol include Brait, Old Mutual, Sanlam and the PIC – so it looks like this would have been another heavily-traded institutional stock – but it was not to be. In the end the institutions indicated that they were not willing to put up the capital and Consol was forced to withdraw.Companies

BANKS

The JSE banking index has been the second best performer on the JSE over the past two years. It rose 26% in 2016 and 24% in 2017. And this is surprising because it has been hammered by Zuma’s firing of Nene, and then Gordhan, as minister of finance and then downgrades by the international ratings agencies. Despite these negatives and some volatility, the banks have offered a very good investment opportunity. This is probably because they were cheap at the start of the period. Two years ago, the banking index was trading on an average dividend yield of 5,22% and a P:E ratio under 10. This is extremely cheap for a sector which is essentially a service industry without significant working capital, most of whose revenue is effectively annuity income. Consider the chart of the banking index over the last two years:

JSE Bank Index April 2016 to April 2018 - Chart by ShareFriend Pro

We believe that banking will now benefit from the significant improvement in the SA economy as Ramaphosa introduces reforms and places competent people in leadership positions. But, as a private investor, you should always be scanning the markets for [glossary_exclude]high[/glossary_exclude] quality investments which are trading at a dividend yield of around 5%.KORE (KP2)

This is a newly listed miner of potash in the Congo – a mineral which is mainly used as agricultural fertilizer. Kore is an Australian company listed on the JSE and in London. It is looking to raise $1,8bn to build its potash mine at Kola in the DRC. It is interesting because it has a huge tenement which may ultimately yield as much as three times what Kore is currently predicting. Of course, new listings, especially in the mining sector and in the DRC, are highly risky, but initial indications are that this could be an opportunity. The share has reasonable volumes traded on the JSE so far and is definitely worth watching (as all new listings are).STEINHOF (SNH)

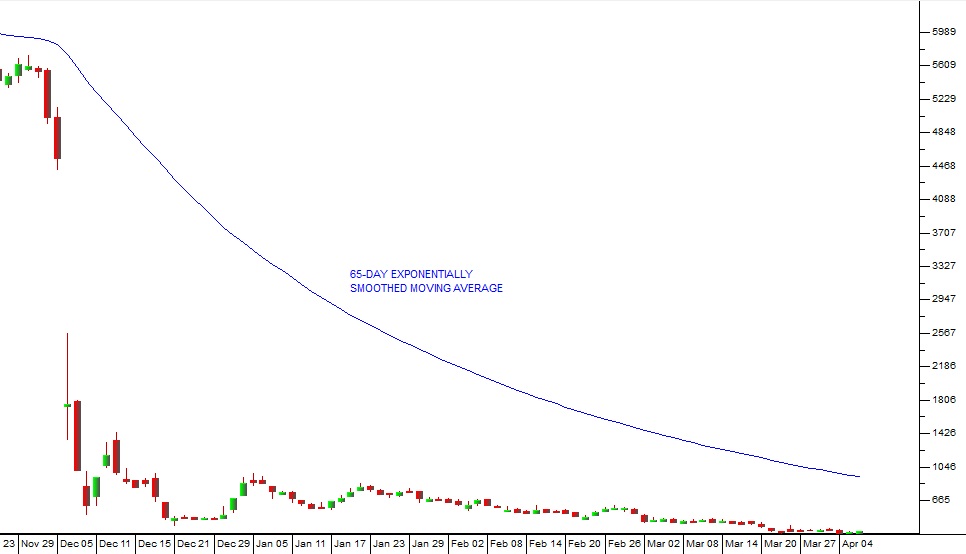

Steinhof has stayed in the news with stories about its property value being worth half of what was originally mooted, substantial payouts being considered for its [glossary_exclude]top[/glossary_exclude] executives and now Wiese himself may be implicated in not following correct “governance and disclosure processes” because he took a 325m euro payment from Steinhof just before the collapse of its share price. The share price has continued to slip to new lows below 200c. There is no certainty about the company’s true value. Its financials back to 2012 have to be reviewed and re-stated – so none of the figures in the public domain can be relied upon. The Johannesburg financial community is busy licking its wounds over Steinhof. Among the big losers are GT Ferriera of RMH fame who has personally lost over R1bn and fund managers Sanlam and Coronation and many others. Clearly, none of these were employing a simple stop-loss strategy which would have had them out of the share for somewhere around R80 per share. At some stage the music will stop and the Steinhof saga will be resolved – one way or another. If it goes into liquidation, it need not concern us, but if it begins to move up and breaks above that 65-day exponentially smoothed moving average, you will have to make a decision. If you stay out, you may be ignoring a highly profitable opportunity running to hundreds of percent – and if you buy you could lose, say, 15% of your capital (assuming you have a strict stop-loss strategy). In any event, every day, the 65-day falls further bringing your buy-in price down with it. It is now at 678c.

Steinhof (SNH) November 2017 to April 2018 - Chart by ShareFriend Pro

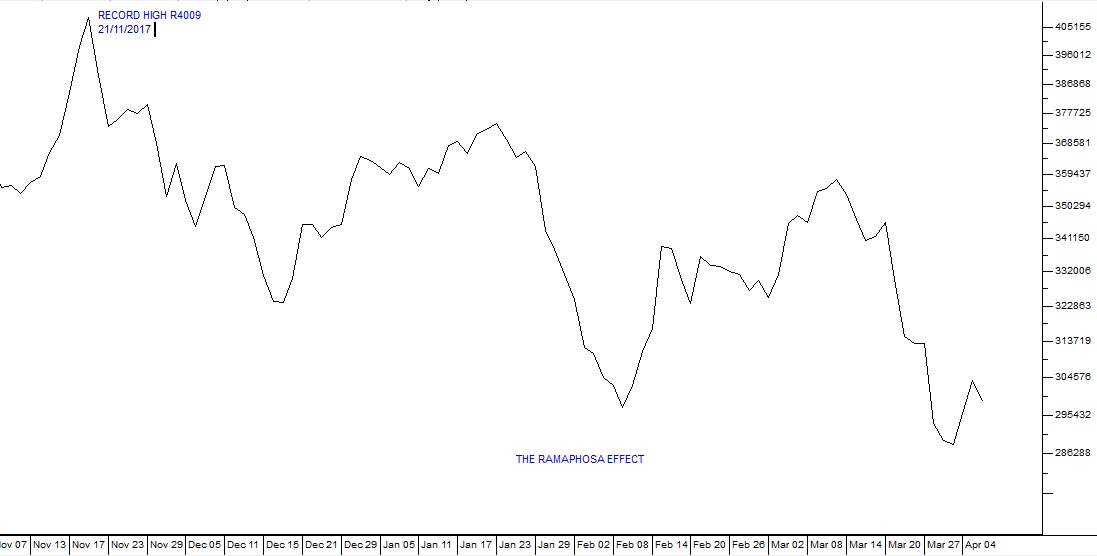

NASPERS (NPN)

Naspers has a market capitalisation of R1,2 trillion and accounts for 19% of the JSE Top 40 index. This means that factors which influence its share price – which may or may not have any bearing on South Africa – can move the JSE Overall index and the Top 40. For example, when Tencent falls because it is influenced by a general sell-off on stock markets due to the potential for a trade war between the US and China, Naspers and the JSE will fall. Another key element here is the strength of the rand. Naspers' main asset is about 31% of Tencent and so if the rand strengthens (as it has since Ramaphosa was elected) then it will fall. Consider the chart:

Naspers (NPN) November 2017 to April 2018 - Chart by ShareFriend Pro

You should also consider that the net asset value of Naspers at current prices is over R5000 per share – so it is trading at a discount of more than 40% to its “sum-of-the-parts” valuation.ACCELERATE (APF)

Accelerate is the property company that is busy developing the new Fourways Mall. The mall, once complete, will be 178 000 square meters and aims to compete with Sandton City. The development will add 90 000 square meters to the existing mall and is expected to be complete by the end of 2018. The addition of KidZania is expected to encourage families to bring their children to the mall and to spend more time there. The question is whether the age of mega-shopping malls is still there. With the steady rise of online shopping, many shopping malls in America have become ghost towns. Another factor is the fact that Johannesburg simply has too many shopping malls. The Mall of Africa found that, once the initial hype had dissipated, it was difficult to keep sufficient traffic coming to the mall to make it viable. Of course, Fourways has many advantages. It is already surrounded by A/B income group housing estates and the Gautrain is going to open a station there in due course. Technically, Accelerate’s share has performed a “saucer bottom” and appears to be on the way up. Certainly it is a stock to watch:

Accelerate (APF) May 2017 to April 2018 - Chart by ShareFriend Pro

SAPPI (SAP)

Sappi began as a forestry and paper and packaging supplier in South Africa. It has grown into a massive international company which is now focusing on a commodity called “dissolving wood pulp” (DWP) which is used for the manufacture of clothes. The demand for paper is declining, but the demand for DWP is rising steadily by about 4,5% per annum. Sappi has a number of mills producing DWP and is planning rapid expansion to cater for increased demand. Demand for DWP comes from the Eastern countries like China, Indonesia and India where most of the world’s clothing and cloth is manufactured. There is a growing preference for clothing made from “vicose” fibres as opposed to polyester – and there is a world shortage of cotton. Sappi has produced profits since 2014. Technically, the share may well be turning, but that massive “double top formation" should make you cautious. Consider the chart:

Sappi (SAP) July 2016 to April 2018 - Chart by ShareFriend Pro

RESILIENT (RES)

The Fakie report on Resilient absolved the directors of all wrong-doing and reported that there was no share price manipulation or other misdemeanors. But the market does not really believe it. The share price rallied quite strongly in anticipation of the report but is falling back as investors understand its limited scope. There are problems which it does not address and no attempt was made by the investigator to interview Resilient’s initial critic, 36One Asset Management. Once again investors are left in the dark and nobody knows what will come out of the various other investigations which are under way. In the meantime, the 65-day exponentially smoothed moving average continues to fall. It is now below R80 (down from over R140) and likely to fall further. But the gap between the 65-day E and the price has narrowed significantly. Sooner or later they will probably cross, giving a “buy signal". Consider the chart:

Resilient (RES) November 2017 to April 2018 - Chart by ShareFriend Pro

PICK ‘N PAY (PIK)

It appears that Richard Brasher’s (CEO) efforts to turn Pick ‘n Pay around are at last beginning to really pay off. A major part of that has been the move to centralised warehousing and a rapid store expansion which has seen a net 124 new stores open in the fourth quarter of last year. The chain had exceptional Christmas sales and probably took market share away from its competitors. R250m was spent on severance packages which left the company leaner and more efficient. Its loyalty program has also been refined and improved. Altogether the report was impressive and the shares shot up over 8% in a single day with a clear “break-away gap". Consider the chart:

Pick 'n Pay (PIK) January 2018 to April 2018 - Chart by ShareFriend Pro

We expect Pick ‘n Pay to continue to perform well.IMPERIAL (IPL)

Following the unfortunate exit of Mark Lamberti, Imperial now looks cheap. It is about to split into two companies, both of which will be listed on the JSE – the logistics division which will continue to be called Imperial, and the motor division which will be called “Motus”. This is the final step in the strategy to release shareholder value which Lamberti set in motion. The decision to list Motus will be taken in June this year. We believe that this is one of those situations where there is an easy 15% to 20% to be made in a virtually risk-free investment. All you have to do is buy Imperial shares and then wait for the unbundling of Motus to make this gain – probably before the end of this year. Of course, Imperial (the combined operation) is an excellent blue chip with strong growth prospects going forward – so you have very limited risk. The splitting of the two companies will enable them individually to focus on their strengths.LIBSTAR (NEW LISTING)

Libstar is set to come to the market on 9 May this year as a diversified food manufacturer. In the year to end-December 2017 it had turnover of R8,8bn with profits of R594m. It produces most of the in-house brands for Pick ‘n Pay, Woolworths, Shoprite and Spar and then it has many well-known consumer brands like Dennys mushrooms, Lancewood cheeses, Goldcrest honey and so on. It will raise a total of R1,5bn to finance organic growth. R800m of that will be by way of an initial public offer (IPO) and the balance by private placing. The company competes with other major food producers like Tiger, RCL, Rhodes and Pioneer. The PIC owns 16,8% of the shares but the controlling shareholder is Abraaj, an investment company which has over 60%. As usual, our advice is to wait and see what the market does with this share before committing yourself.CARTRACK (CTK)

This is a private investor’s dream come true. A high-tech company in the service industry with no working capital and a massive annuity income that puts it into profit before each month even begins. Cartrack is growing its client base all over the world steadily as more and more people see the sense of installing a simple, cheap and highly reliable tracking mechanism into their car which makes it virtually impossible to steal. This share trades on the same P:E as the JSE Overall index and yet it justifies a much higher rating. We believe that it will get that rating sooner or later as the institutional investors begin to take notice. Right now the average daily volume traded is insufficient for them to even look at it seriously (about R1,5m per day on average) but that will not always be the case. In the meantime it is producing nearly R1,2bn of annuity income and has grown its client base by 19% over the past year.NU WORLD (NWL)

This is a diversified consumer goods company selling everything from high-tech equipment to liquor and furniture. In its interim results to 28th February 2018, the company reported earnings per share of just under 400c. Profit was up 28% on a 16% increase in turnover. If it can repeat its performance in the second half (which seems likely) it should have R8 of earnings for the year, which translates into a P:E ratio of about 4,5. And it is on a dividend yield of 6,16%. If the South African economy improves as we all expect it to, then this share could gain recognition as a growth opportunity. At the moment it is probably a little too thinly-traded to attract institutional attention, but that can easily change in the future. We certainly think that this is an excellent share trading at a very reasonable price. The Confidential Report takes place on the first Wednesday of the month. You can add yourself to the mailing list for the next one by clicking here. To view the webinar recording, click here.DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: