The Confidential Report - June 2020

3 June 2020 By PDSNETAmerica

From an economic perspective, America seems to experiencing the first signs of return to normality. The following is a selection of the more visible signs:

- Panic buying of toilet rolls, disinfectants and food is down by over 60%.

- Clothing and accessories sales are up over 600%.

- The Texas Manufacturing Outlook survey jumped 34% from April to May.

- Road traffic is down 5% in May from last year compared to April’s 13%.

- Car sales are up sharply towards the end of May.

- Internal flights are up 50%.

- Weekly unemployment claims are down 46% from their peak in April.

In April the official unemployment rate reached a high of 14,5% and consumer spending fell by 13,5%, but the economy has enormous surplus capacity which will be taken up very quickly as already-trained employees return to work and already built factories resume production.

And then we need to add into that mix the enormous fiscal and monetary stimulation which has been applied by the government. Investors are already discounting the impact of this into share prices.

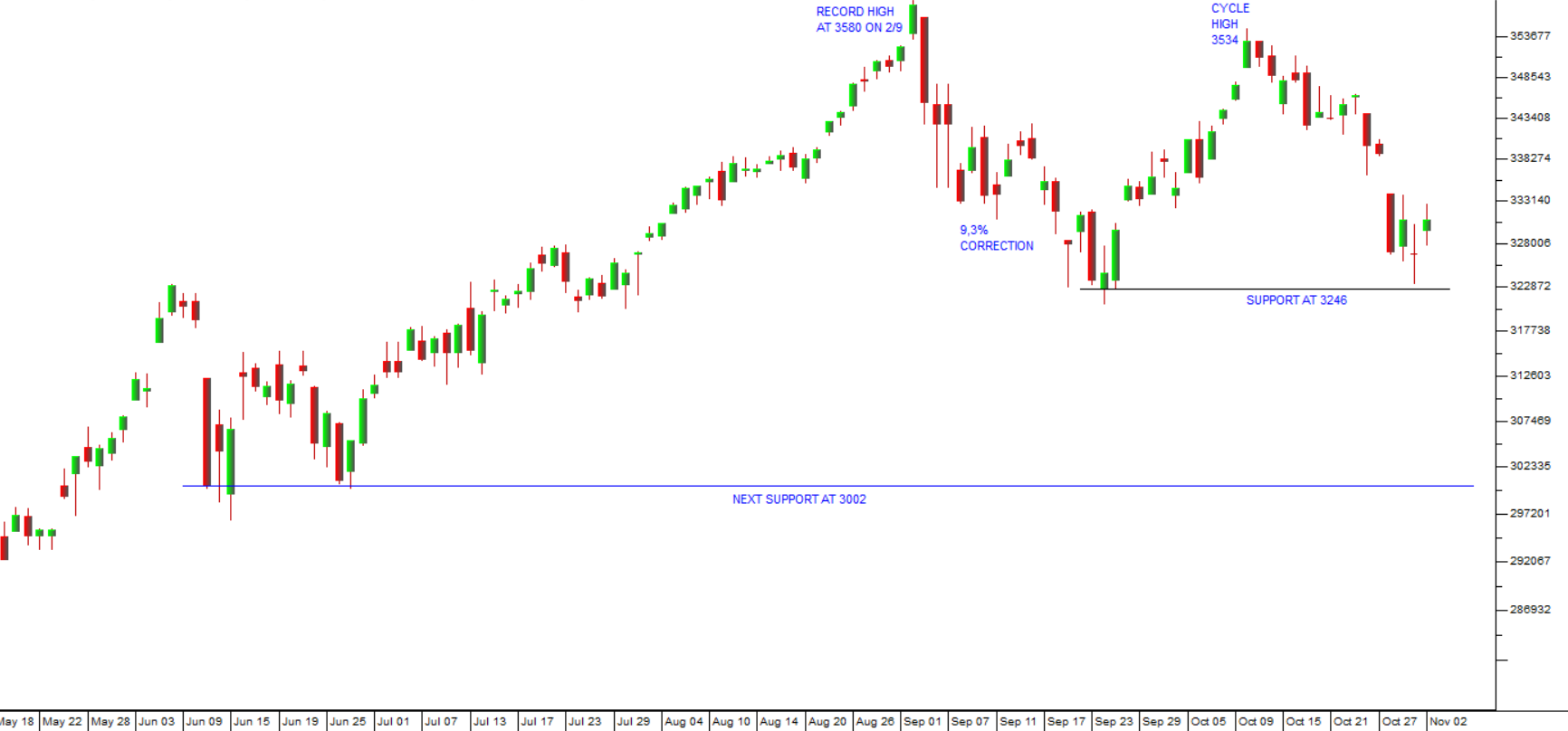

The “V-bottom” which we predicted in March 2020 at the start of the corona bear trend is now well on its way. The S&P500 index has recovered about 70% of what it lost in the downward trend – which means that it is unlikely that we are not looking at the “B” wave of an “A-B-C” downward trend. Such “B” waves seldom show a gain of more than 50%. Consider the chart:

You can see that the upward side of the V-bottom is not quite as steep as the downward side, but that is to be expected. During April month there was a period of “backing and filling” before the index broke decisively upwards in May.

You can also see from this chart that the index has broken clearly up through the 200-day simple moving average which is a much-followed technical indicator in the United States.

Technically it looks like the chart should break above its previous high of 3386 within the next few months.

The shape of this “bear trend” and the sharpness of the “V” have a lot to do with the fact that central banks around the world learned from the 2008 sub-prime crisis. They applied both fiscal and monetary stimulation rapidly and without argument – with the result that the wealth-destroying impact of the downward trend was very substantially and very rapidly mitigated. For example, this time the European central bank had no hesitation in accelerating its quantitative easing (Q/E) program whereas in 2008 it was reluctant and hesitant to begin Q/E. The US applied a strong combination of fiscal and monetary stimulation very early on in the crisis. Most countries around the world have engaged in a combination of monetary and fiscal stimulation.

We suggested at the start of the bear trend that the chart would follow investor perceptions of the progress of the virus. Now that most countries are busy moving away from lockdown and opening up their economies, investors can see that the recovery will be relatively rapid – and they are discounting that into share prices which is creating the right-hand side of the V-bottom.

Our expectation is that the world economy will recover very rapidly because it currently has substantial spare capacity which can easily be taken up. But we also expect that business will be qualitatively different after the pandemic. Some sectors and industries will emerge as a shadow of their former selves while others will become overnight giants.

For example, it seems unlikely that the restaurant business will ever be the same as it was before corona. It also seems probable that there will be a massive shift towards doing everything online to avoid social contact. The online industry which was slowly taking hold on the imagination of consumers and businesses before the pandemic is now front and center as meetings give way to video conferencing and footfall in shopping centers gives way to online retail.

We believe that what has happened is not so much an economic disaster as an inevitable shift in business culture that opens the way for more dramatic growth in the future. Our perception is that the S&P will not only exceed its previous record, but will accelerate as the efficiencies inherent in new technologies and cheaper energy take hold. In other words, we believe that it is now apparent that this was indeed a “black swan” or isolated event which, in time, will be seen as part of the great bull trend which began in March 2009.

Economy

The consortium that is advising the government estimates that COVID19 deaths will run to between 40 000 and 48 000 by November 2020 when the pandemic peaks in this country. The same modelling indicates that the country will run out of ICU beds in June. These type of projections normally err on the conservative side – and are extremely difficult to make with any real accuracy because of the unknowns in the equation. Firstly, they are based on the official case numbers which may be way out given the recent discovery of 19 asymptomatic cases (17 of which were in the local community) at a mine in Mpumalanga and 164 asymptomatic cases that were discovered at Mponeng gold mine. These startling discoveries indicate that asymptomatic COVID19 may be far more prevalent than the official case numbers suggest – but also that the pandemic may be far less deadly in South Africa than previously thought. We are also aware that there is a substantial backlog of tests which the testing agencies cannot apparently clear which puts some doubt on the official figures.

The government’s strategy has been that the purpose of the lockdown was simply to buy time to allow the country to build up its medical facilities to cope with an expected deluge of cases at the peak in September and October. So, obviously, there has never been any real expectation of completely containing the spread of the virus at any point. It is expected to eventually run its course ultimately resulting in a rising herd immunity.

There is, of course, the hope that a vaccine will be developed and available quickly. The news, broken on 18th May 2020, that an American company, Moderna had positive early results from a test vaccine for COVID19 pushed the S&P500 index up 3,3% in a single day. The results showed that the vaccine produced a similar immune response in test subjects as had been found in people who have recovered from the virus. Wider tests are now being conducted. It appears probable that this vaccine will begin to be available by the end of the year. Obviously, it will take some time before it is generally available world-wide. Our view is that South Arica is unlikely to benefit from this or other vaccines before the middle of 2021 at the earliest – by which time projections show that the virus will have substantially run its course in this country.

So, all that we have really achieved with our lockdown is to slow the progress of the virus down and buy some time – at an enormous cost. Hopefully, the economy has not been too badly the damaged by our efforts to “flatten the curve”. The damage to the economy is estimated in the various projections for GDP growth in 2020 which are obviously all negative. The Reserve Bank now predicts a -7% decline in GDP while the IMF predicted -5,8%. These predictions are dwarfed by the treasury’s prediction of up to -16% and now the Business For SA (B4SA) prediction of between -10,3% and -16,7%. As many as 4 million jobs could be lost. These predictions are based on economic models and again, they are not really reliable, but there can be no doubt that 2020 is going to turn out to be the worst year for GDP growth rates in history.

The most immediate fallout from the shrinking economy is a sharply lower tax collection. Edward Kieswetter, the SARS Commissioner predicts that SARS will collect as much as R285bn less than the budgeted figure. This obviously severely constrains what the government can do to revive the economy once the pandemic is behind us. The deficit will be much larger than projected in the February budget and will have to be financed at higher rates of interest because of the downgrade of South Africa to junk status.

Obviously, South Africa, as a fully paid-up member of the IMF can and almost certainly will get a loan, but that will certainly come with strings attached. Another possible solution to the government’s funding problem is for the Reserve Bank to simply “create” the money by buying government bonds directly from the government (i.e. without going through the secondary market). This is “quantitative easing” (Q/E) and was done extensively by most first world countries in the 2008 sub-prime crisis. The rationale is that the one advantage that South Africa has as an emerging economy is its very low inflation rate. BNP Paribas has drawn attention to the fact that South Africa is very likely to miss its inflation target range to the downside over the next six months. The official target range is between 3% and 6% and BNP Paribas says that inflation could fall as low as 2,8%. The Monetary Policy Committee (MPC) already predicts inflation at 3,6% with the risks to the downside.

Because of our unusually low inflation rate, it is argued that we have considerable room to undertake Q/E without creating runaway inflation. Creating money in this way is, in effect, a form of taxation because over time, as the new money washes through the economy, the purchasing power of the rand in your pocket will go down while the government gets to spend the money which is created. Because South Africa is close to exhausting all its borrowing options, the only alternatives in the current situation are to radically reduce government spending or to increase taxes. Increasing taxes is probably politically impossible because South Africans are already very heavily taxed, and the government cannot really reduce government spending while the pandemic is in progress. That leaves Q/E – which the governor of the Reserve Bank, Lesetja Kganyago, is dead set against because it effectively interferes with the independence of the Bank – but we believe that some sort of Q/E will have to be undertaken sooner or later.

In the meantime, there has been considerable pressure on the government to open up the economy rapidly – or face a jobs bloodbath. Business for South Africa (B4SA) says that, unless the economy is opened up quickly, the 30% unemployment rate which existed before the pandemic took hold, could spike up sharply with the loss of between 3 and 7 million jobs. In addition, in the first quarter of this year, due to the downgrading to junk status, non-residents sold R102bn of South African assets. The suggestion is that the government move quickly through the various stages of lockdown towards normalising the economy. B4SA says that the economy is entering what looks more like a depression than the recession that was already in existence before the pandemic. Clearly, the President has had some very difficult decisions to make in this critical balancing act. After the relaxation to stage 4, the progress of the virus did not stabilise, and now, as we enter stage 3, the number of cases and deaths is definitely accelerating. If the objective of the lockdown was simply to allow for the health services to make preparations before the flood of cases, then presumably we have done what could be done and must now face the coming onslaught.

It is becoming clear that the virus is and will decimate the populations of the various informal settlements around South Africa where social distancing is virtually impossible. Poverty together with the existence of pre-existing conditions such as AIDS and tuberculosis means that death rates are likely to be higher than average. Many of these people have lost their jobs and are now dependent on food parcels or social grants. With no resources to fall back on and with pre-existing medical conditions, they are the most vulnerable.

Manufacturing accounts for 13% of South Africa’s gross domestic product (GDP). During the stage 5 lockdown almost all manufacturing activities were closed. In stage 4 some manufacturing resumed and in stage 3 about 80% of people are back at work, but the damage has been substantial. This still leaves 20% of those who had work before the pandemic struck at home – over and above the 30% unemployment rate which already existed. The ABSA purchasing managers index (PMI) shows that business activity and new sales orders fell to record low levels during the lockdown. Expectations of business conditions for the next six months also fell heavily. Obviously, as manufacturing resumes there is substantial unutilised capacity which will be taken quickly up so the recovery should be fairly sharp – which is probably why the Reserve bank is forecasting 3,8% growth next year. But there can be no doubt that substantial damage was done, and some of the more marginal manufacturers have been pushed out of business. Many have also retrenched staff in an effort to stay afloat and hopefully those companies will re-employ most of their former staff now that some semblance of normality is returning.

Of course, it is the nature of capitalism that periodic “clean-outs” like this are cathartic. During tough times the weakest businesses fail while those that have been more conservatively managed survive. In the long run, that process is healthy because the economy is left with the stronger and better managed companies resulting in an increase in overall efficiency and productivity. But none of that is of any direct benefit to the squatter who has lost his job and now cannot feed his family.

We must ask the question, “What is being done to mitigate the economic fallout?”

It is obvious that consumer spending is going to take a knock for the rest of 2020 and into 2021. A survey has shown that 60% of consumer families have experienced a decline in their income. Hopefully, much of that will be temporary as the economy slowly opens up again – but the probability is that consumer spending is likely to be far lower for the rest of this year. Next year should be far better – and the Reserve Bank is expecting growth of 3,8% as consumers world-wide get back to work and the enormous unutilised capacity in economies begins to be used again. But here in South Africa, we can expect that the economic adversity will last long after the virus is brought under control. As in the period following the sub-prime crisis in 2008, consumers are likely to pull in their horns and conserve cash while paying off debt. This will persist until economic conditions improve enough for them to regain confidence.

The economic indicators which we normally use to evaluate the state of the economy are all going to be at radically low levels from April 2020 and the months which follow. We will have to establish new benchmarks to assess what they mean. For example, the recently published Production Management Index (PMI), produced by HIS Markit, plunged to 35 from 44,5 in the previous month – where any reading below 50 indicates contraction. Other economic indicators such as the cash withdrawals from ATMs and the level of vehicle sales also showed a sharp contractions. ABSA’s PMI also showed a strong downward move.

New vehicle sales in South Africa both to the local market and for export virtually stopped in April month. This was obviously due to the lockdown which prevented dealerships from operating. We expect that vehicle sales will pick up again from May and thereafter, although at a lower level. The sales that would have been done in April will probably be done over the following months and so boost sales to the end of the year, but we can expect vehicle sales to be depressed for a while due to the collapse of the economy and the postponement of big ticket purchases by both consumers and businesses. A major factor in vehicle sales is level of interest rates.

The Monetary Policy Committee has now cut interest rates by a total of 275 basis points (2,75%) this year in four separate cuts. It has indicated that the cutting may be near the end. The impact of these rates cuts on the economy will be significant, especially if they are sustained for a considerable time. Every person with a mortgage bond on their property now has to pay thousands of rands less in interest every month. Some bond-holders will choose to keep paying their bonds at the same rate so that the capital portion of the bond comes down more quickly. That is clearly the sensible approach if you can do it. Others will take the opportunity to spend the saving – which will tend to stimulate vehicles sales and all aspects of the economy – as intended by the Monetary Policy Committee (MPC). The problem is that the pandemic has resulted in many people losing their jobs – which tends to negate the effect of lower rates on their bond repayments. If you have no income, any bond repayment becomes a major problem.

Now the legacy of state capture and government corruption is becoming critical. The financial position of various state owned enterprises (SOE) is now a major problem and has been exacerbated by COVID19. The latest SOE to ask for government support is the Airports Company of South Africa (ACSA) which has been brought to a virtual standstill by the lockdown rules. ACSA says it will need R3bn in the medium term and maybe as much as R11bn in the longer term. The Land Bank requires R22bn and its default may trigger further defaults on a further R50bn worth of government guaranteed bonds. Eskom’s financial problems have been made far worse by a 50% drop in electricity consumption since the lockdown. Denel is unable to pay salaries and wages. Some analysts are predicting that the government’s debt will be double the 6,8% predicted in the February 2020 budget. Clearly, that is unsustainable without commensurate support from outside the country. If President Ramaphosa can manage this situation without resorting to quantitative easing (Q/E), it will be very impressive.

In the midst of this financial crisis, there is the astonishing SAA debacle. Whether SAA’s business rescue process has been mismanaged by the business rescue practitioners or not, the suggestion that the government should or even could create a new national airline to replace SAA is nothing short of risible. They are proposing that this new airline would have a competitive edge in safety, quality and costs over other privately owned airlines. Quite how they can think of launching a new airline into an environment where airlines all over the world are folding is really difficult to understand.

The aviation industry is in a dire position with almost no flights within South Africa and very few overseas flights permitted. Stage 3 from 1st June 2020 will improve the position, but we believe that air travel will be drastically reduced for some time to come. This industry supports a net of smaller businesses which are now also in jeopardy. Support industries are estimated to have 23000 jobs and to contribute about R50bn to GDP. If this industry receives no support, then by the end of June month it is estimated that about half of the businesses will have had to enter business rescue. It also seems likely that companies will find ways to avoid air travel in the future – such as video conferencing - and that may mean that the airline industry never recovers to its former size. In the midst of this, Pravin Gordhan has joined the unions in proposing that the government establish an entirely new airline.

Apparently, the R5,5bn spent on the business rescue process of SAA was completely wasted – and yet Gordhan refuses to countenance the shutting down or liquidation of this business nightmare. The crazy idea that a new airline can now be launched must surely involve more billions of taxpayer money which could certainly be allocated to better projects. Gordhan says that keeping SAA is “a matter of national interest” but has yet to explain exactly why he thinks that. When has a government department ever been able to run a business more efficiently than private enterprise? Would any businessman in his right mind think of launching a new airline now? Surely one of the few benefits of CORVID19 is that it finally put paid to further efforts to revive SAA? There can surely be no good reason for trying to resurrect SAA aside from pure ego – a luxury that we can ill-afford right now. It would make far more sense for the government to rescue Comair by giving it the funds which are owed to it by SAA rather than try to start a new airline.

A footnote in the current crisis is that the Minister of Mineral Resources and Energy, Gwede Mantashe, has finally published changes to the regulations which allow municipalities to produce their own electricity or source it from suppliers other than Eskom. This is actually a massive step forward for South Africa and long overdue. It will force Eskom to become competitive with a multitude of independent power producers (IPP) and should ultimately bring the price of electricity down. In the short term, however, it may well certainly put some additional financial pressure on Eskom. Applications by municipalities will still have to be approved by the Minister – which will allow him to delay the process further if he has a mind to.

The Rand and Long Bond

Overseas investor sentiment is clearly “risk-off”, which means that they have been avoiding emerging markets like South Africa since the pandemic took hold. But gradually, as more positive news comes out about the re-opening of first world economies and the potential for a vaccine, their attitude shifts back towards “risk-on” and they start looking again at the real return to be had from investing in South African equities and bonds. The extremely low and falling rate of inflation in this country now becomes a critical metric because it means that, even after having reduced interest rates by 2,75%, we can still offer overseas investors a real return on their money. This has resulted in foreign investors taking less of their money out of the country and more recently to the tentative return of some of those funds. As the flow of funds becomes more positive for South Africa, both the rand and yield in the bond market improve. Consider the yield on the R186:

Here you can see that prior to COVID19, the yield on the R186 was falling steadily as overseas investors began to believe that the Ramaphosa administration could and would improve the future of the South African economy. The yield spike caused by the virus reached a peak with yields as high as 11% as risk-off sentiment took hold world-wide, before turning and falling to levels well below pre-COVID19. This fall in yields has obviously been reduced by the 275 basis point reduction in interest rates, and made stronger by the buying of government bonds by the Reserve Bank, but the sharp fall also represents the fact that overseas investors still regard this as a good place to obtain a real return on their funds.

This improvement has been mirrored by a significant improvement in the rand as funds flowed back into emerging markets generally and South Africa in particular. Consider the chart:

You can see here the resistance level at R15.50 which was broken in late February 2020 when the virus became a major factor. That culminated in a “double top” formation in April and then a sharp recovery – which is still going on. Obviously the 275 basis point reduction in the repo rate is bad for the rand because it makes the return on South Africa assets lower, but despite that the rand has shown good strength in the last five weeks. The strength of the rand is solid evidence that South Africa is perceived by overseas investors as one of the best emerging economies.

In any event, we believe that the rand will continue to strengthen steadily, with hiccups, every now and then – which is obviously not good for rand-hedge shares.

Commodities

After collapsing to below $18 per barrel, North Sea Brent oil has stabilised at around $36. Consider the chart:

You can see here that North Sea Brent fell below a key support at $15.50 per barrel and reached prices below $20 in April 2020. This has then been followed by a fairly rapid recovery in the price as the world returns to normality and more countries re-open their economies. We expect that the upward trend in the oil price will continue as the world economy gradually resumes normal business activities. In fact, we believe that the oil price is a very good indicator of the world recovery. We do not expect oil to go back to pre-COVID19 levels of around $55 for some time – and maybe never. The steady growth in alternative energy sources, the advances in battery technology and the steady growth in the electric car market make this relatively unlikely. In the next ten years we believe that oil and coal will be substantially replaced as the world’s leading energy source.

A new spirit of communication and cooperation seems to have entered the negotiations between the Minerals Council of SA and the Department of Mineral Resources and Energy. It is now believed that the legal battle over the 3rd mining charter could be abandoned and a new investor friendly document produced and agreed. The main stumbling block was always the “once empowered, always empowered” principle which the department says only applies to existing mining operations and that buyers of mining licences will have to re-establish empowerment levels even if those had already been achieved by the previous owners. This idea is obviously a major deterrent for would-be buyers of South African mining operations and generally militates against further investment in our mining industry. Apparently, the relationships established during the talks on COVID19 have opened the door for a more conciliatory approach.

The Minerals Council of SA says that the mining sector could lose as much as one tenth of this year’s production due to the lockdown. This will result in a commensurate loss of wages and income and contribute to the general economic malaise. But overall, the mining sector is one of the least affected sectors of the economy. Shares in mining companies have performed relatively well compared to the rest of the market.

Companies

As a private investor you should now be focused on looking for shares which have fallen heavily during the corona bear trend and which are likely to return to their former ratings once the crisis is substantially behind us. Industries which seem unlikely to recover rapidly include the airline industry, the restaurants industry, the hotel industry and those elements of the entertainment industry which rely on large gatherings of people – such as the sports stadium business, casinos and cinemas. Industries which could benefit from CIVID19 include any kind of online retail business and those property companies which rent space to them, companies involved in supplying online entertainment or communication like Prosus and its parent, Naspers. Almost every listed share is impacted by the virus in one way or another, but some businesses have done much better than others during the lockdown. For example, service businesses generally have found it far easier to arrange for the staff to work from home. They also tend to have a high percentage of their income in annuity form which has protected their cash flow from the worst effects of the lockdown.

EDCON

The business rescue process which replaced judicial management is designed to try to recover viable businesses for the benefit of the economy. A company in business rescue is relieved of having to pay its creditors until the business rescue practitioners decide whether it is worth trying to save – and thereafter if they do. About two-thirds of companies which are put into business rescue end up in liquidation, but for those that survive, the process is probably worthwhile. In the case of Edcon, the business rescue practitioners have said that they believe that the company can be rescued – although it is not yet clear how they plan to do this. Edcon is a clothing retailer and as such was deemed non-essential under the COVID19 rules. Going forward it seems unlikely that selling clothes is going to be a great business for a while – and there is very stiff local and overseas competition. We are not optimistic about the company’s prospects, but if the business rescue practitioners can pull it off it will be a remarkable achievement and a ratification of the business management process.

IMPERIAL (IPL) and MOTUS (MTH)

IPL is a massive logistics and motor business. It operates in 32 European and African countries and employs 49 000 people. The company was split into two separate listed entities to unlock value. These are Motus, which was listed on 22nd November 2018, which contains all the company's motor interests, and Imperial Logistics, which continues to be a supplier of logistics services. The separation of Motus from Imperial in November 2018 gives us a great opportunity to examine the impact of COVID19 on these two businesses. Consider the following chart:

Here you can see that since the two companies separated and Motus was separately listed, Imperial (the top chart) was drifting downwards. The lower chart shows a comparative relative strength of Imperial against Motus and you can see that following the unbundling and separate listing of Motus, Imperial had been generally underperforming it. With the advent of the COVID19 bear trend, however, Motus suffered badly from its exposure to motor dealerships – all of which had to close during the lockdown. Now, as the economy opens up, we can expect the relationship between the two shares to move back to what it had previously been. This shows the usefulness of the comparative relative strength as a simple indicator which can radically improve your understanding of developments in the market.

SIBANYE (SSW)

Sibanye has done something very unusual – it has pulled off not one, but two, brilliant acquisitions in the difficult business of precious metals. In the process it took enormous risks that looked very scary from the outside. The first coup was the acquisition of Stillwater in America for $2,2bn. This acquisition stretched Sibanye’s balance sheet to the absolute limit at a time when the future of platinum group metals (PGM) was far from certain. As time went by, the price of PGMs improved, especially palladium and rhodium justifying the acquisition and enabling Sibanye to begin reducing debt levels. A little later the company acquired Lonmin in exchange for R4,3bn which was paid in shares. At the time Lonmin was still trying to recover from the Marikana disaster and faced an increasingly angry and unhappy community and workforce. Now in 2020, the acquisition of Lonmin is beginning to really pay off. It has been renamed to Marikana and become a major contributor to Sibanye’s bottom line. In March quarter of 2020, Sibanye generated a record R11bn in earnings before interest, taxation, depreciation and amortization (EBITDA). The company uses the ratio of debt to adjusted EBITDA as its primary ratio to measure gearing and that has dropped from 1,25 to 0,75 – a much more comfortable position. The company is now talking of reinstating its dividend payments much to pleasure of shareholders. It’s been a high-risk ride with Neal Froneman at the helm, but he has managed to pull it off in fine style. Technically, the share reached its lowest point in July 2018 and since then it has been moving upwards. There was a brief hiatus in March/April of 2020 because of the corona bear trend – but this looks to be slipping into the past very quickly. Consider the chart:

MIXTEL (MIX)

We have always encouraged private investors to seek out companies in the service industries which have little or no working capital and which receive most of their income in the form of annuities. Such companies have none of the usual problems with stock and debtors and they have the significant advantage that their annuity income means that when the month starts their overheads are already covered and they have probably made a profit. Such companies have proven their worth more than ever during the corona pandemic because their cash flows have been left almost unaffected. A good example of such a company is Mix Telematics.

Mix is a company which specialises in vehicle tracking technology and has operations in South Africa, Australia, the UK, the US, Brazil, Thailand, and Romania. It can expand its global footprint virtually without limit and does not have a cumbersome workforce or huge amounts of capital tied up in assets. In its results for the year to 31st March 2020 the company reported subscription revenue up 9% and the addition of 68 000 subscribers. The number of new subscriptions was curtailed because of lockdowns in most countries and the temporary closure of motor dealerships. The CEO said, "MIX’s fourth quarter performance was solid in the context of the unprecedented uncertainty caused by the COVID- 19 pandemic, significant related exchange rate volatility and challenges in the oil and gas market. Although the near-term demand environment is uncertain, with our continued investments in our strategic initiatives, we strongly believe MIX is well positioned to meet our long-term subscription revenue growth and profitability targets as global economic conditions begin returning to normal." The share is currently trading on a P:E of 22,15 - which appears fully priced - but we believe that, like its competitor, Cartrack, this company has substantial "blue sky" potential and justifies its rating. What is interesting is that the volumes traded have increased substantially and now average over R300 000 worth of shares changing hands every day. This means that institutional investors are now beginning to take notice and invest in this share. It is becoming an "institutional share". This will result in it becoming even more highly rated in our opinion.

OLD MUTUAL (OMU)

OMU is a premium African financial services group that offers a broad spectrum of financial solutions to retail and corporate customers across key market segments in 17 countries. Old Mutual's primary operations are in South Africa and the rest of Africa, and it has niche businesses in Latin America and Asia. This company is what is left after Quilter, Brightsphere and most of Nedbank, were unbundled from the original Old Mutual Plc which was listed on the London Stock Exchange (LSE). Some estimates indicate that Old Mutual is about 30% below the company's embedded value. Currently, the company has about R1,1 trillion under management and it still owns what it describes as a "long-term strategic investment" of 19,9% of Nedbank after the unbundling. The company has sold its Latin American businesses effective 1st April 2019 which leaves it only with a presence in 13 African countries. In its results for the year to 31st December 2019 the company reported headline earnings per share up 5% and return on net asset value up 7%. The company said,

In a trading statement for the six months to 30th June 2020 the company estimates that headline earnings per share (HEPS) will be at least 20% lower than in the comparable period. The company is also expecting a higher level of claims. The company said, "Many of our tied advisers have been unable to sell during the lockdown period due to the partial closure of the branch network and lack of access to customer’s homes, worksites and branches. The majority of our branch consultants are unable to work from home and therefore the necessary closure of the majority of our branch network has slowed loan disbursements and negatively impacted funeral, savings and credit life sales." We believe that this is a newly listed blue chip share which is not yet fully understood by the market and is now probably trading at a significant discount. On a PE of 5,06 and a dividend yield of 8,04% we see this blue chip share as very cheap now.

MAS (MSP)

MAS is a real estate investment trust (REIT) which invests in office, commercial, logistics, retail, and hospitality properties in Europe and the UK. This REIT was started by Martin Slabbert and Victor Semionov who are well known for establishing NEPI - which merged with Rockcastle. They are very highly regarded as European property experts. The company is involved in a program to "restructure and grow" its balance sheet. This was to be done by selling properties in Western Europe and buying income-generating properties with good growth potential in Central and Eastern Europe (CEE).

The company said, "Property in CEE performed very well. CEE income properties acquired directly or developed in the DJV for EUR415.2 million were valued at EUR516.2 million on 31 December 2019, of this increase EUR39.76 million was recognised in the six months to 31 December 2019. Like-for-like (LFL) retail sales per square meter increased by 8.2% in the six months to 31 December 2019 (7.8% in the twelve months), resulting in a 10.6% overall occupancy cost ratio."

In a voluntary trading statement on 27th May 2020 the company said, "Authorities in all jurisdictions where MAS operates have introduced pandemic regulatory restrictions, which have resulted in the closure of all non-essential retail property and hospitality operations for different periods depending on jurisdiction. In CEE, 28.6% of the rental income is generated by essential retailers and other tenants with uninterrupted operations. These tenants were invoiced normally, and the Group collected 76.9% of invoices issued to these tenants in respect of rental income and service charges for March, April and May. To enhance liquidity, MAS drew down in full the available bank debt facilities at the start of the COVID-19 crisis in Europe, and, as a result, had €468.2 million of secured and unsecured debt as at the end of April 2020. Of this amount, €30.2 million is repayable by 30 April 2021 and a further €61.7 million is repayable by 30 April 2022." The company has tripled the size of its asset base since 2016. In our view, this is one of the better REITs on the JSE and well-worth looking at if you want to buy a property stock in the rapidly expanding European property sector. Obviously, this is also a rand-hedge.

SYGNIA

Sygnia (SYG) describes itself as a "specialist financial services group". It is South Africa's largest provider of exchange traded funds (ETF) and has a number of unit trusts. In its results for the year to 30th September 2019 the company reported assets under management (AUM) up 7,1% to R238,4bn and turnover up 20,4%. Headline earnings per share (HEPS) rose by 27% and net asset value (NAV) was up 2,5% at 438.4c. In a trading statement for the six months to 31st March 2020 the company estimated that HEPS would rise by between 86% and 105%. The company has R235,9bn under management and appears to be taking market share away from other asset managers. Sygnia Itrix makes it possible for Sygnia to attract funds looking for off-shore exposure. The share drifted down for most of 2018, entered a sideways market, and now looks to be turning, on a dividend yield (DY) of around 4,8% on a P:E of 11,38. The fact that Sygnia was able to increase assets under management during such a difficult time, indicates that it has caught the attention of fund managers. The company's revenue is a function of its ability to continue to attract funds for management. We believe that this company could be quite similar to Coronation in early 2012 - when that company was relatively cheap and subsequently grew four-fold.

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: