The Confidential Report - July 2020

America

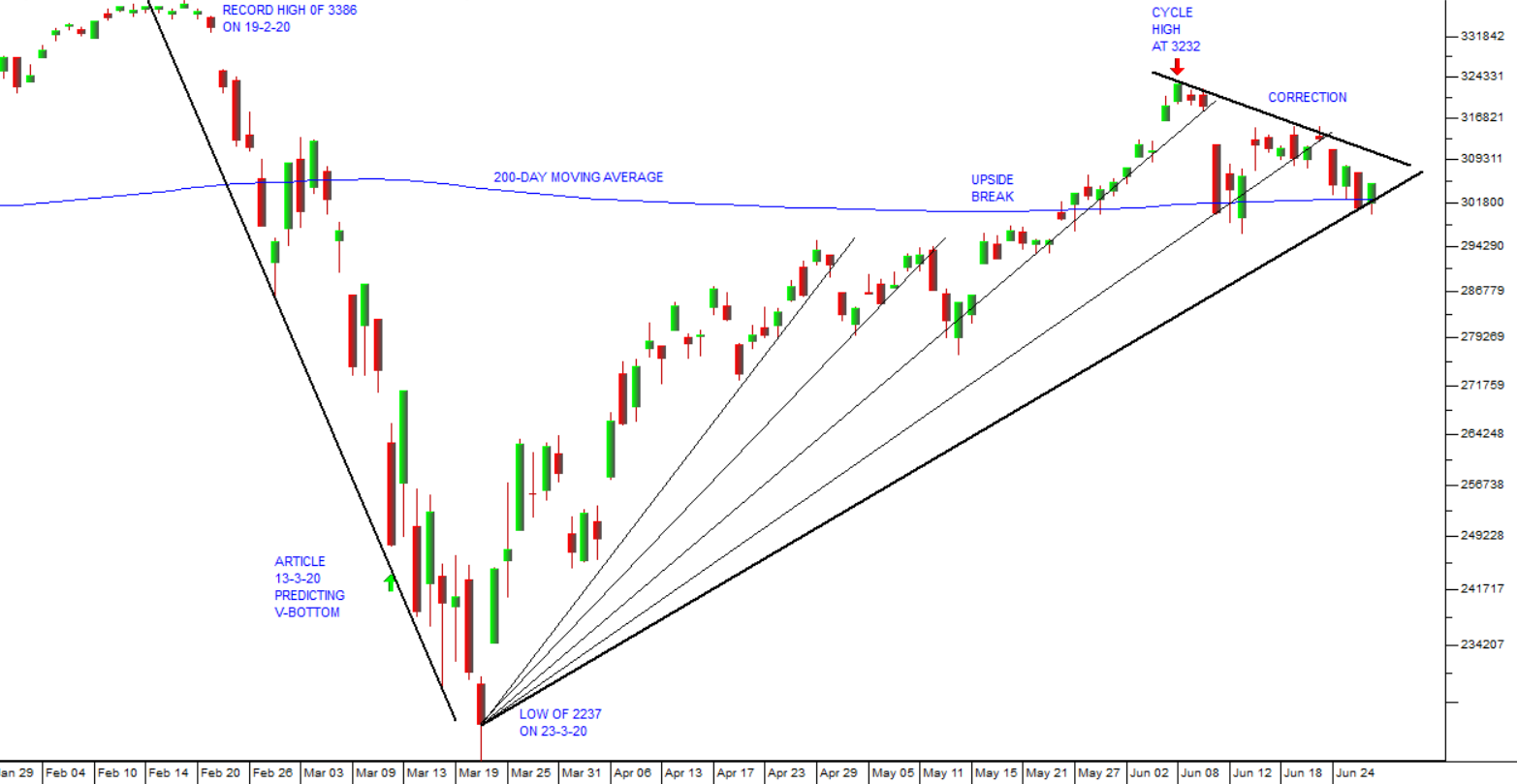

A week ago, world markets were discounting a rapid recovery from the COVID-19 pandemic. Then the number of cases in America began to spike up. Until the middle of June there had been a steady downward trend and then suddenly the number of cases began to rise with 31 000 on the 20th of June, 33 000 on the 23rd, almost 39 000 on the 25th and 44700 on the 27th. Investor perceptions that the pandemic was under control evaporated and the S&P fell in response. From an intermediate high of 3117 on 22nd June, the market fell 3,5% to 3009 at the close on Friday 26th. It is now 6,9% below its cycle high of 3232 made on 8th June 2020 and 11% below its all-time record high of 3386 made on 19th February 2020. Consider the chart:

Here you can see the anatomy of the recovery on the S&P500 index. Since the recovery began on 23rd March 2020, technical analysts have been forced to keep adjusting the steepness of their trendline, making it progressively shallower and shallower as investor perceptions of the recovery became less optimistic. The cycle high made on 8th June 2020 at 3232 was just 4,5% below the all-time record high of 3386 made on 19th February 2020 – indicating that the rally was not the “B” wave in an ABC bear trend. Following that cycle high, investors have discounted their fear of a second wave of the pandemic resulting in a correction in the S&P. Technically, we see the current correction encountering support at around 2970 (the level at which the S&P encountered resistance in April and May this year). You will also notice that on Friday last week, it broke back down through the 200-day moving average.

We have always said that the market would follow investors’ perceptions of the progress of the virus - and that is what we believe it is doing. Investors now fear that major parts of the US economy may have to return to some form of lockdown - and that is being discounted into the S&P.

Before the panic of the last few days, there was a growing gap between what the media was presenting and how investors were behaving. The media and various economists were painting a dire picture of collapsing economies, shrinking GDP and a second wave of coronavirus infections. They were emphasising how long it would take to recover from the pandemic. And until the last few days, investors were busy pushing up the S&P500 index and markets all around the world (including the JSE) towards the record highs that they made immediately before COVID-19 struck. So, the media story and investor perceptions were in direct opposition. Of course, doom and gloom scenarios always make for the best attention-grabbing headlines and they are always the preference of the media. In our experience, economists usually tend to simply extend the current economic trends and suggest that they will persist into the future – but they have limited expertise in the behaviour of markets.

It is also true to say that economists and journalists do not suffer financially when they are wrong. The same cannot be said for investors. They have billions, if not trillions, of US dollars on the line. Their mistakes translate into an immediate and significant loss. This means that investors are highly motivated to do their homework and to be as sure as possible about what the future holds. Furthermore, they make their investment decisions based upon their perceptions of where the economy will be at least a year in the future, not where it is now.

The problem is that no one can really know the full effects of the disjointed and clumsy mismanagement of the virus in America. At the moment, some sort of second lockdown, with a consequent impact on the economy, appears inevitable. But at the same time there are very encouraging indications that a vaccine is imminent. It seems probable to us, that in a year from now a massive campaign to vaccinate all adults in America (and elsewhere) will be underway.

As a private investor you need to try to balance the consequences of this recent spike in American cases against the distinct possibility of an effective vaccine by early next year. What seems to be clear whatever happens is that sooner or later, probably by the middle of next year, perceptions of the pandemic will cease to have the impact on markets which they currently do. Investors across the world are adjusting their positions to reflect what they see as the reality. Most of them had thought that the pandemic was declining in significance until the bad news of the last few days.

So how can you assess the situation? It seems clear to us that in the short term the spike in cases in America is likely to continue and perhaps get worse. But unlike the initial spread of the virus in March this year we now know what to do, to mitigate infection. We wear masks, practice social distancing and sanitise at every opportunity. These practises have been shown to reduce the rate of infection by 50% or more, which results in a far slower spread of the virus. So, we believe that this resurgence of the virus will not have the impact on markets that its first appearance had. Various states and cities in America will implement stricter measures, but it seems unlikely that the US economy will go into anything resembling a full lockdown. At the same time, we believe that the probability of a viable vaccine will steadily increase and be factored into investors’ decisions.

For these reasons we regard the current downtrend, once again, as a buying opportunity – but you must try to make your own assessment and decide how you want to respond.

We continue to believe that the pandemic is essentially a completely unpredictable “black swan” event within the greater long-term bull trend which began in March 2009. We believe that by the middle of next year that bull trend will once again be the dominant factor in markets - but that in the meantime, we will experience some quite sharp volatility.

Our Economy

In past Confidential Reports we have spoken of the three areas of reform which the government needed to address:

(1) The selling off of state-owned enterprises (SOE’s).

(2) The reduction in the size of the civil service.

(3) A shift in labour legislation to make it more employer-friendly.

All 3 reforms will bring the government into conflict with the unions. One of the effects of COVID-19 has been to bring these reforms sharply into focus as the government tries desperately to balance the budget without resorting to quantitative easing (Q/E). The easiest reform is to sell off or shut down some of the SOE’s. This will reduce the government’s need to be constantly bailing them out and provide some much-needed cash for the fiscus.

Tito Mboweni tabled his “adjustments” budget on 24th June 2020. This was an almost impossible balancing act because of the parlous state of government finances before the massive hit of COVID-19. SARS is expected to collect R304bn less than was projected in the February 2020 budget and then there is the plan to cut spending by R230bn over the next 4 years – on top of the R160bn reduction of the civil service wage bill tabled in February. There is R40bn in tax increases planned for the next 4 years, but no detail on these. The government has raised $7bn from the IMF, World Bank and other international sources. All these factors will together leave us with a budget deficit of 15,7% - more than double what was expected in February 2020 budget. What is clear from this budget is that the direct cost of managing the pandemic itself was always far less than the cost to the economy of the lockdown – and that cost will only really be felt as the year progresses and into next year. Surprisingly, the treasury still believes that GDP will only shrink by 7,2% this year. At the moment, a major point in our favour is the fact that only 10% of the government’s debt is in hard currencies - the rest is rand-denominated. The only easy solution to the government’s funding shortfall would appear to be some sort of quantitative easing (Q/E) – but that is strongly opposed by the Governor of the Reserve Bank.

Both Tito Mboweni (Minister of Finance) and Lesetja Kganyago (Governor of the Reserve Bank) have warned that South Africa’s national debt is too high and unsustainable. There is a danger of the government falling into a “debt trap” where it will not even be able to pay even the interest on the debt. Kganyago says that South Africa is in danger of following in Argentina’s footsteps where they recently defaulted on some of its $65bn of international debt. The Governor warned that South Africa was potentially entering an era of much lower growth and lower incomes as it struggles to repay debt. At the same time Mboweni warned of a sovereign debt crisis over the next 4 years which would necessitate IMF funding.

To meet the requirements of Tito Mboweni’s adjusted budget, he says that structural economic reform is required, by which he probably means a significant cut in the size of the civil service and the rationalisation of state-owned enterprises (SOE). Mboweni is calling for “zero-based budgeting” which means not using the previous year’s budget allocations as a starting point and re-thinking allocations for everything in the light of current realities. This involves a great deal of additional work, but it is necessary in order to find the savings which he envisages. Every line item in the budget needs to be re-thought from the ground up. So, as usual, the question will come down to whether the government can actually implement what it has said it will. Theoretically, the budget has been approved by parliament and so should be put into practice, but often the reality ends up being substantially watered down. Implementation has never been the ANC’s strong point.

The ANC will have to re-think many of its “holy cows” and try to decide whether they are still relevant in the post-lockdown era. Those holy cows include the retention of hundreds of pointless and often unprofitable state-owned enterprises that have been, and promise to continue to be, a drain on the fiscus. It means thinking again about the balance between labour and employers to balance the legal framework more in favour of the employer. It means the acceptance of the idea that the government cannot and should not try to solve the unemployment problem by employing more people. Rather it should do everything it can to encourage the private sector to grow and create jobs. The imminent showdown with the civil service unions should reveal much about how the ANC will be able to reinvent itself.

The civil service unions have already rejected Tito Mboweni’s R160bn unilateral adjustment of the government agreed 3-year wage deal with them and are engaged in legal action. The lockdown temporarily postponed this matter and now Mboweni has delegated Titus Mchunu, Minister of Public Service and Administration, to handle the court actions and arbitration which have arisen as a result. Mboweni’s problem is that a reduction of the civil service wage bill is the only practical way to balance the budget without resorting to Q/E.

Letsetja Kganyago, governor of the Reserve Bank, is of the opinion that South Africa is “not yet” in a position where it needs to resort to quantitative easing (Q/E). He notes that those countries which were currently undertaking Q/E had run out of other monetary policy solutions whereas South Africa had not yet reached that point. This statement does, however, envisage a point where Q/E will become appropriate and we believe that it is inevitable given the government’s lack of funds and our low inflation rate. Kganyago says that we will only employ Q/E if the economy is facing a deflationary cycle. But inflation has now fallen to 3% in April 2020 (the lowest level for 15 years) – so maybe Q/E will begin. The printing of money in this way obviously offers the government an easy mechanism to get around its funding problems and, with inflation falling to record lows, it seems unlikely that it will result in a major loss of purchasing power of the currency – at least in the short term.

Following the 2008 sub-prime crisis, the government was able to put together an R800bn stimulatory package to help the South African economy. In 2020, the government could only muster R500bn and R130bn of that had to be taken from the existing budgets of various government departments. Given the effects of inflation, the current R500bn package is less than half of the 2008 package – which is a clear indication of the depletion of government resources in the intervening 12 years – mostly due to the Zuma/Gupta administration.

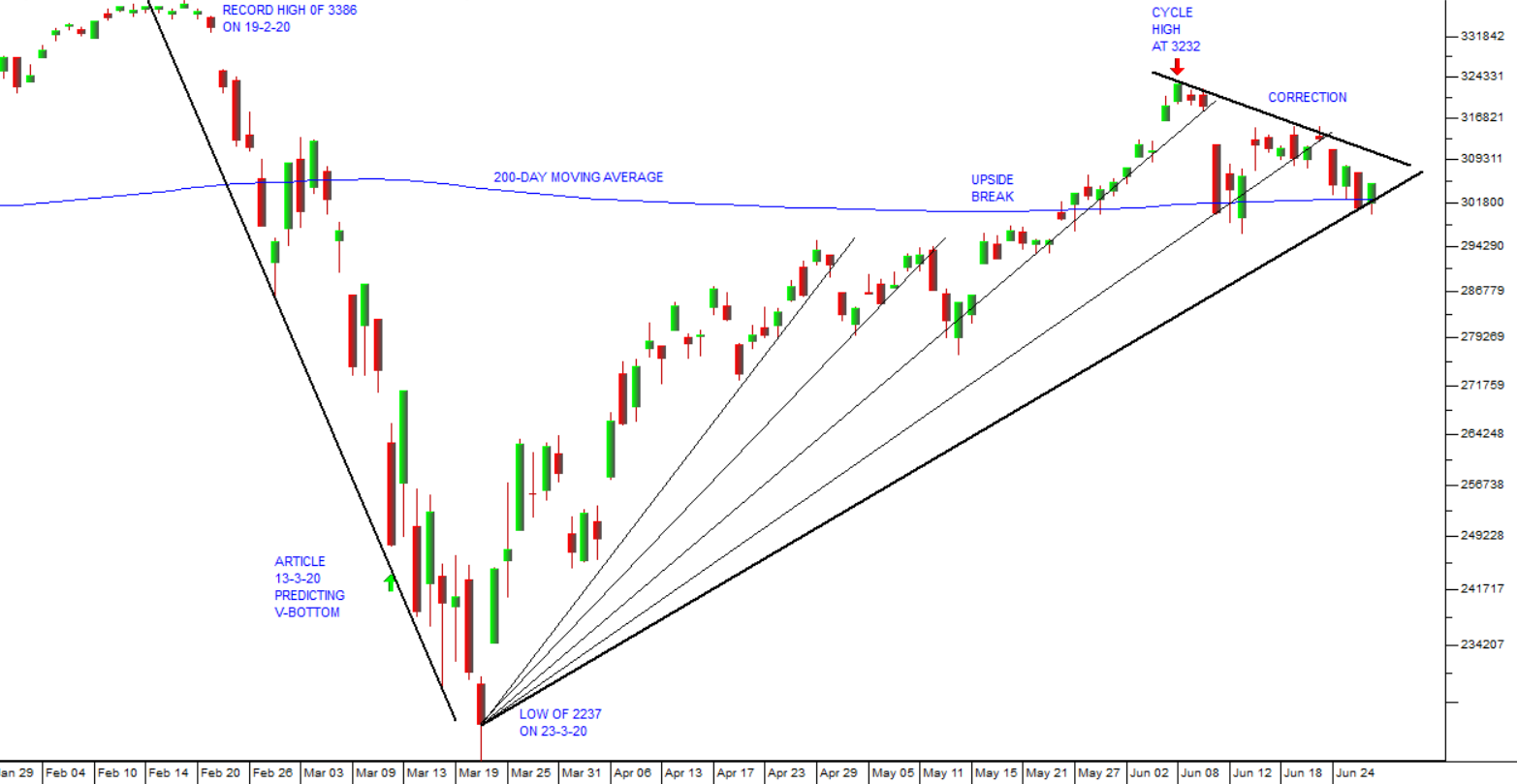

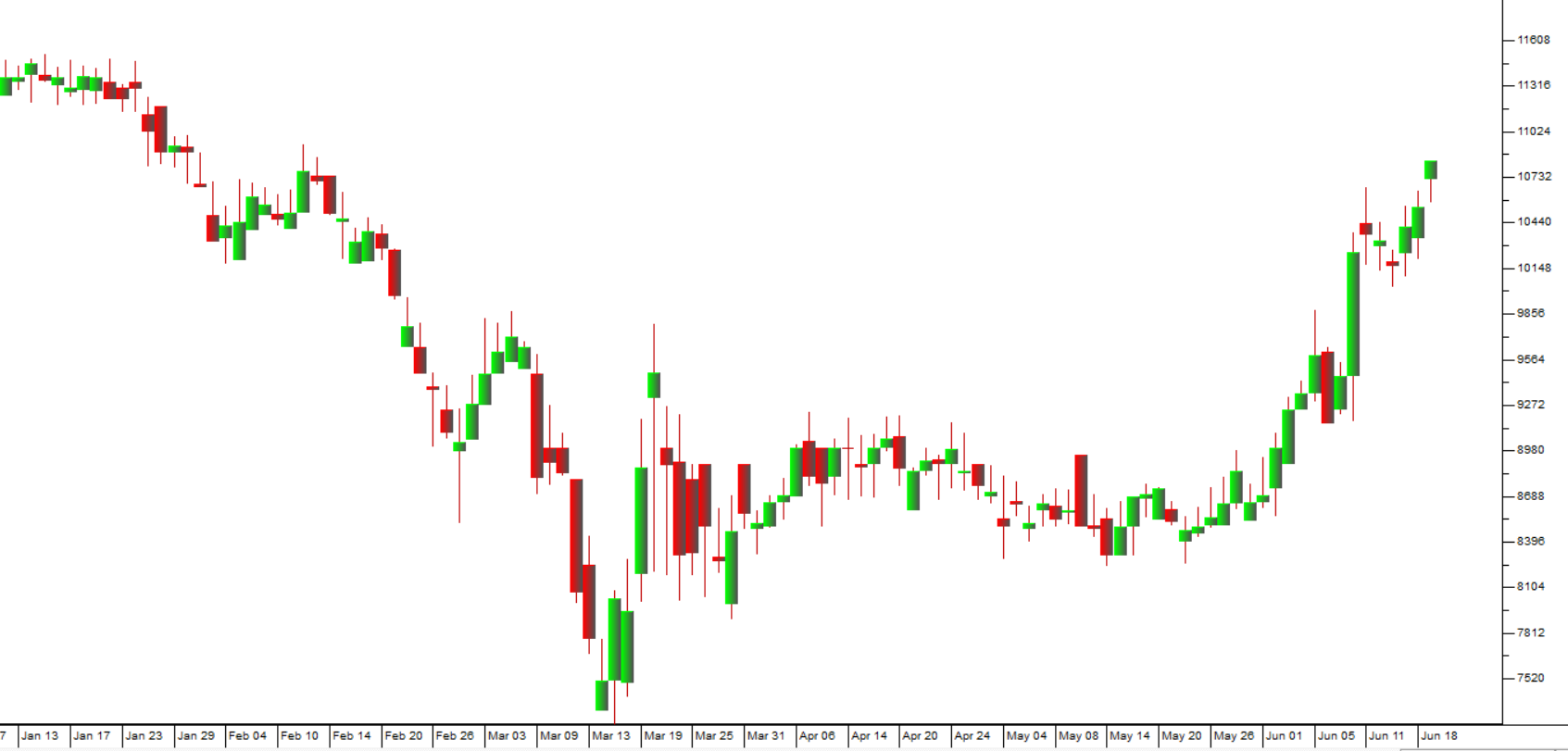

The unemployment rate in the first quarter of 2020 rose to 30,1% - a new record high. If those who have given up looking for work are included, then the number rises to almost 40%. Obviously, these numbers do yet not reflect the impact of COVID-19. That will only become apparent in the second quarter – which will hopefully be the worst quarter. In the third and fourth quarters some recovery should be evident. At the same time, the Reserve Bank’s leading indicator fell by 5% in April month compared to March – the largest single-month fall on record. Obviously, April was a month of full lockdown when business throughout the country was brought to a virtual standstill. Again, we can expect better figures in May and June. In our view, the recovery will be relatively sharp – and that can already be seen in the JSE Fin30 index:

This chart clearly shows the “V-bottom” in the JSE’s 30 largest financial and industrial shares. It shows that investors are anticipating a very rapid recovery in the economy. This is probably because of the expected rapid take up of unutilised capacity which now exists.

The government’s plans to revive the economy post-COVID-19 will take the form of infrastructure projects. An initial list of 55 projects has been selected from 188 possible projects. These projects will be private-public partnerships which should reduce the need for government financing or guarantees. The projects are for the development of roads, housing developments, ports, and energy. Obviously, if this plan is put into effect, it will impact on the decimated construction industry – which has lost much of its skill base over the past ten years. Nonetheless, companies with the required expertise will be undoubtedly found and projects like this will certainly create rapid employment. But the plan is similar to the plans of the Minister of Economic Development, Ebrahim Patel, in 2014 to undertake about 650 infrastructure projects – most of which never got beyond the planning stage. Hopefully, the government’s current initiative will be pursued with more enthusiasm.

The internal “discussion document” prepared for the ANC on the question of funding for infrastructure projects in the post-COVID-19 economy is understandably vague. But it does talk about reducing the cost of finance through requiring asset managers, especially the public investment corporation (PIC) to invest directly in these projects – which is in effect a system of “prescribed assets”. The system of prescribed assets was introduced by the National Party when it was in power when it forced pension funds and other asset managers to invest a percentage of their funds into government bonds thus helping to finance government projects at lower rates of interest than market rates. Big institutions already invest heavily in government bonds, but they do so through the bond market at market-related yields which take into account the risk inherent in investing in South Africa. Obviously, the recent downgrade to “junk status” has pushed up the cost of financing for the government which makes it far more expensive to fund infrastructure projects. With the governor of the Reserve Bank dead set against any type of quantitative easing (Q/E), prescribed assets offer a potential solution – but are disapproved by the investment community generally because they are an interference in a free market and artificially lower interest returns.

The R26bn that it will take to pay off all the debts of SAA and then recapitalise it as a “new” airline in terms of the business rescue plan is ludicrous. It comes on top of the R30bn which the company had previously received in bailouts. Firstly, of course, it will not be a “new” airline in any real sense since the idea is to buy all the shares of the existing company and take on its existing staff. The net effect of this will be that SAA has cost the taxpayer more than R50b over the past 20 years. The rescue plan says that the government supports the plan because SAA is a “national flag carrier” – which shows that this action is all about ego – an ego which this country simply cannot afford at the moment. Notably, nothing was said of the R26bn rescue of SAA in Tito Mboweni’s adjusted budget on 24th June 2020. Apparently, the Treasury and the Ministry have to produce a letter of commitment by 15th July 2020 for an initial R10,4bn. Hopefully that won’t be forthcoming, and they will allow SAA to go into liquidation.

Vehicle sales and manufacture are a good proxy for the economy’s recovery. The last two vehicle manufacturers began production again at the beginning of June 2020 and will ramp up production in the coming months. April had almost no vehicle sales, but May was considerably better. Up to the end of May, however, exports were running 41% behind last year. At this stage it looks like vehicle sales for 2020 will be about 25% lower than last year. Local sales and sales to the rest of Africa were already depressed before the lockdown. There will probably be some pent-up demand, especially from key export markets.

The Democratic Alliance (DA) is proposing a radical shift in economic policy including selling off or closing unprofitable state-owned enterprises (SOE), opening the electricity market to free competition, abandoning the policy of land expropriation without compensation, abandoning the national health insurance (NHI) and black economic empowerment (BEE). What is interesting is that they make no mention of reforms to labour legislation in favour of employers. Obviously, South Africa, in the wake of COVID-19, cannot afford anything which is not productivity enhancing. The economy needs to be rapidly streamlined for growth. However, most of the DA’s suggestions are probably politically impossible for the ANC even in the face of COVID-19. What is clear to us is that the government needs to cease being the source of jobs in the country and focus on encouraging private enterprise to create jobs. The essence of this is the understanding that only private enterprise creates surpluses in the economy – everyone else lives off those surpluses, including the government and all its employees. The larger the government gets, the smaller private enterprise gets. Adam Smith famously stated this in his concept of a “laissez-faire” economy where the least government was the best government.

A footnote to Tito Mboweni’s budget was the fact that R3bn had been allocated to bail out the Land Bank which carries 29% of South Africa’s agricultural debt. Mboweni had no choice in this matter since the Land Bank’s defaults had triggered defaults on about R50bn of state guaranteed debt. Apparently, the bank had allowed its interest received to fall below its interest paid over a number of years. This is an example of bad banking. Every bank charges more interest on what it lends out, than it pays on money that it borrows. That is known as the “mismatch factor”. And this year is shaping up to be one of the best for agriculture with massive surplus production which can be exported to generate foreign currency. It seems to us that the Land Bank has been badly mismanaged.

The full impact of the lockdown on the economy can be seen in the National Payment System which now shows that 13% less was paid in salaries and wages in May 2020 than in May 2019. This indicates that thousands of people lost their jobs during the lockdown or drew a lower income from their employers. This comes immediately after the publication of the unemployment statistics reaching a record high above 30%. Obviously, this will reduce consumer spending in the coming months.

The Rand and the Long Bond

The rand/US dollar exchange rate and the effective yield on our government long bonds provide a good benchmark for the attitude of overseas investors towards South Africa. If the rand is falling and the yield on the long bond is rising, then that shows that overseas investors are dumping their South African assets and taking their money out of the country – and vice versa.

The yield on the long bond spiked up during the early stages of the COVID-19 pandemic as overseas investors shifted rapidly from “risk-on” to "risk-off” taking their money out of emerging markets and putting it into safer assets like US treasury bills. Since the initial spike, however the yield has come back down to more normal levels, partly because of the Reserve Banks interventions, but mostly because of a return of overseas enthusiasm for the yield to be obtained, especially after our relatively low inflation rate is taken into account. The current resurgence in corona cases in America has caused a slight return to risk-off sentiment which can be seen in the rising effective yield on the R186 in recent days. Consider the chart:

What is clear from this chart is that while the yield has certainly increased in recent days, it remains at levels which existed before the pandemic – which indicates that sentiment remains positive towards emerging markets and South Africa in particular. You should watch this yield, however, for any sign of a strong return to risk-off sentiment.

The rand/US dollar rate is influenced by a complex array of factors – but it essentially shows the same thing as the yield on the long bond. Are overseas investors bringing their money into this country or taking it out? Consider the chart:

In last month’s Confidential Report, we showed that a “double top” had formed and that had been followed by a period of renewed strength in the rand. The surge of new cases in America has recently reversed that trend and the rand has fallen back – but so far that fall has not been marked and certainly nowhere near the initial fall in March and April this year.

We believe that both the rand and the long bond show that there has been a return to risk-off, but that it relatively mild and should dissipate in time. However, everything depends on investors’ perceptions of the progress of the virus.

General

The maize crop in South Africa is expected to be as much as 15,5m tons – the second highest on record and well above the average consumption of 11m tons. This means that South Africa will not need to import but will be able to export around 3m tons. Some of this will undoubtedly go to Zimbabwe which needs to import about 1m tons. Agricultural exports generated about R10bn in revenue for South Africa in 2019 and this year should be better. Officially, the sector accounts for about 3% of GDP and employs close to a million people. But having a good agricultural season is more important than this because many subsistence farmers in the rural areas grow maize for their own consumption and it is a key element of our economic fortunes. In a bad season they have to rely on government handouts and charity to survive. A good season also obviously improves the balance of payments considerably. The price of maize will also come down significantly which means lower feed costs for the chicken industry and lower food inflation.

The recent surge of bad debts at African Bank (which is not listed) shows that the financial effects of COVID-19 are starting to come through. The CEO says that the bank will be managing credit more prudently from now on. The bank reported an after-tax loss of R311m compared with a profit of R69m in the previous period. Provisions for COVID-19 related bad debts were over R600m.

The statement by Eskom’s new CEO, Andre de Ruyter, that the company does not intend to approach the government for further financial support this year is encouraging. He says that Eskom is busy cutting all unnecessary expenditure and has plans to reduce costs by about R16bn. He also said that the company hopes to have 3 days or less of load-shedding this winter (which is the coldest winter in 10 years). The period of the lockdown allowed the company to do some of its maintenance and to bring more capacity online. De Ruyter says that during June 2020 the company was operating at an average 70% of its capacity.

It has been suggested that as many as 30% of small, medium and micro enterprises could go out of business as a result of COVID-19. Since these businesses are major employers, this would have a devastating impact on the unemployment rate. Our view, however, is that the damage will not be as bad as that. We are expecting businesses to recover relatively rapidly and demand in the economy to pick up quickly, now that the worst of the lockdown is behind us. Some industries like tourism will suffer, but we expect that the private sector will be growing strongly off a low base by next year – both here and internationally

Commodities

The 47,3% decline in mining production in April 2020 was expected and comes on top of an 18% decline in March 2020. Platinum, iron, gold and manganese production were all down by more than 50% in the lockdown’s first full month. Coal fared the best because it was considered an essential service, but even that was down by over 9%. The figures for May and June are likely to be better because the mining sector was allowed to resume partial, and then full production.

The ramping up of our mining industry in South Africa is a slow and costly process with about half of the 450 000 employees having returned. Of those about 525 have tested positive for COVID-19. 7500 employees have been tested on their return and they are then screened every day when they report for work. About 10% of them are foreign nationals. It is estimated that the total cost of lost production and other costs is expected to reach around R100bn. A good proportion of that is in lost salaries. Roughly one third of the 650 employees reporting for work at Mponeng gold mine have tested positive for the virus and all of them were asymptomatic – which means that they have unknowingly been spreading the disease in their communities. Asymptomatic cases cannot be picked up by screening. All of this means that the mines will only be able to reach full production after some time.

Companies

The JSE Overall index is up 43% from its low point on 19th March 2020. Some of this is because of heavyweights like Prosus and Naspers, but essentially the JSE has been following Wall Street and other international markets up. Investors are anticipating a rapid recovery in 2021 followed by further strong growth in 2022. The buying opportunity offered by the virus is rapidly dissipating and investors should be wary. Certain sectors, like the banking sector remain cheap with the average P:E on the JSE Banks index at 6,22 and the dividend yield at 9,53 – but nobody really knows the extent of bad debts which they will have to face going forward. In our opinion, economic activity will resume rapidly and there will be a surprisingly low increase in bad debts. Some of this is because South Africa was already in recession before the start of COVID-19 and so consumers were already repaying debt and holding on to cash rather than spending. In any event, it seems probable that the Banks index will move up strongly over the next two years.

One of the more unexpected casualties of the coronavirus has been the estate agency business. Indeed, any industry that relies on face-to-face sales is going to have a hard time, but the estate agents have been faced with a growing online business which has made the commissions traditionally paid to salespeople difficult to justify. The impact of this can be seen is the fact that Pam Golding is being forced to downsize rapidly, retrenching head office staff and possibly even closing some of its branches. Business is being forced to switch to online solutions rather more quickly than is comfortable, by the virus.

NEW LISTING

Bushveld is a vanadium mining company whose assets are primarily located in South Africa. It is listed on the London Stock Exchange (LSE) and is looking to have a secondary listing on the JSE possibly before the end of this year, but more likely in 2021. Vanadium is a key component of the manufacture of steel and there is a shortage of the metal developing in world markets. As the world economy recovers, we expect the price of vanadium to rise. The company is already producing and is profitable, but that profitability should increase steadily as it ramps up production and the price of vanadium increases. We suggest that you keep an eye out for this promising new listing.

CAPPREC (CTA)

This share appears to be “bucking the trend” in the share market. It actually benefits from COVID-19 because of the additional on-line facilities that it can offer the banks. Caprec (CTA) is a fintech company offering payments and payment infrastructure as well as software and services. It is owned by Patrice Motsepe's African Rainbow Capital (ARC). The payments side of the business is done through African Resonance and Dashpay. The software side involves systems development and consulting. The company owns 17,5% of Resonance Australia - a start-up business. In its results for the year to 31st March 2020 the company reported revenue up 15,4% and headline earnings per share (HEPS) up 28,1%. The company's net asset value (NAV) rose by 14,4% to 109c. The company said, "The COVID-19 pandemic has had limited impact on the Group's financial results in this reporting period. Growth continues across all business units. Synthesis' excellent performance continues with expansion into new verticals and geographies. Synthesis' AWS Advanced Consulting partner status expanded to include Financial Services and DevOps specialities, Well Architected Frameworks and SaaS Partner. Continued market share gains in payment infrastructure solutions. Payment terminals in the hands of clients, up 32.1%". The company has all the major banks in South Africa as clients. The share trades at a P:E of 8,43 and a dividend yield (DY) of 4.44%. Roughly R560 000 worth of shares change hands each day - which makes this share quite feasible for private investors. The company appears to be well-managed, profitable and cash-flush - which means that sooner or later it will begin to attract institutional interest. Consider the chart:

HYPROP

Hyprop (HYP) is a leading property real estate investment trust (REIT) that specialises in high-quality shopping malls in South Africa and has some interests in Eastern Europe and Africa to the North. It owns some of South Africa's best-known shopping malls like Rosebank, Canal Walk, Hyde Park and Clearwater. It has been impacted to some extent by the fall-off in consumer spending through lower trading densities. This share is currently trading on less than a quarter of its net asset value (NAV) of R95.78 – which, in our view, makes it a good buy. Its loan-to-value (LTV) is relatively low at 34,2% and it only has 1,6% of vacancies in South Africa and 0,2% in Eastern Europe. We have advised applying a 200-day simple moving average and waiting for a clear upward break-out, but the share has made an extended “island formation” and now appears to be rising. Consider the chart:

We see this share as very cheap and ready to take advantage of the recovery of the economy in stage 3 of the lockdown and beyond.

LABAT (LAB)

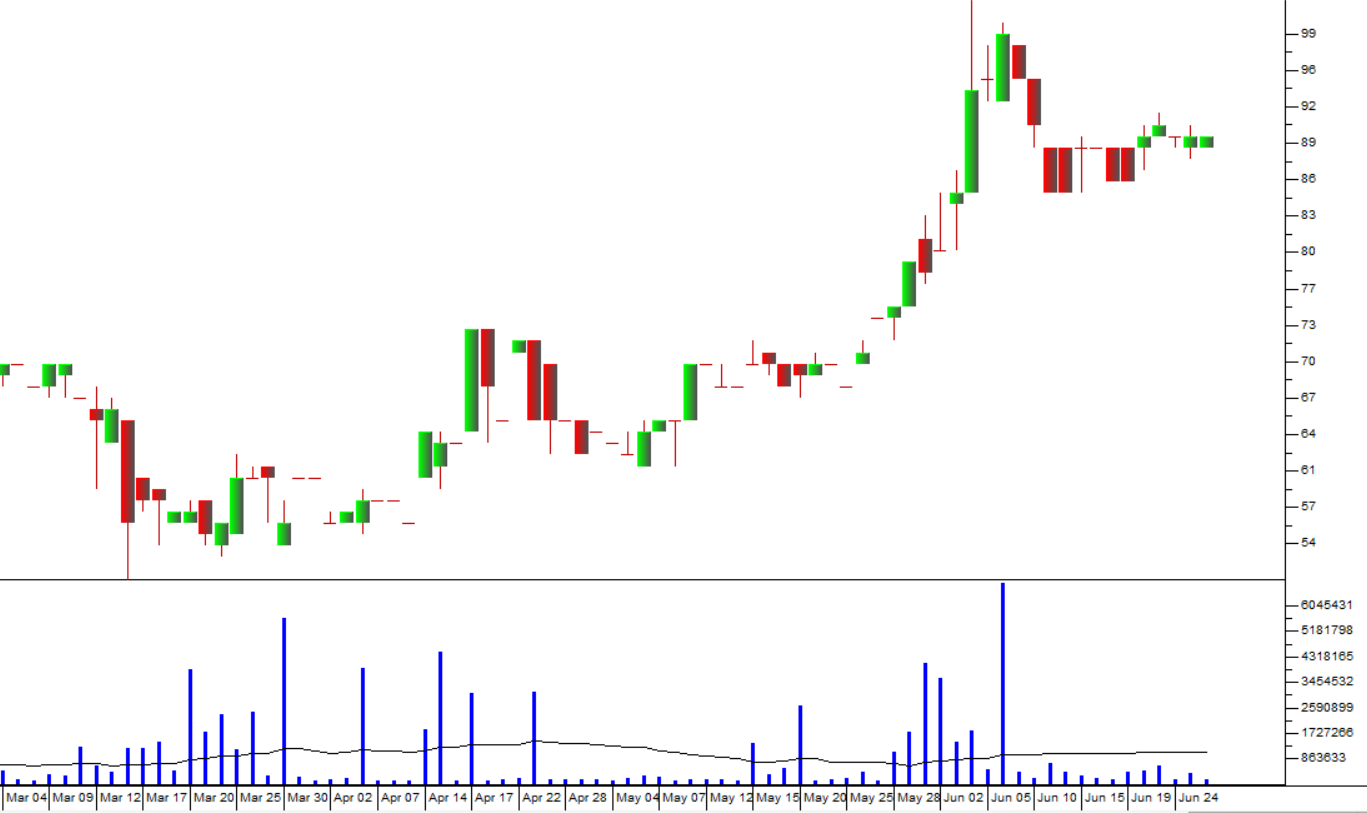

On 22nd June 2020 (about 10 days ago) we published an article on Labat and the buy signal that it had given in On Balance Volume (OBV). The volume traded on a share is a critical indicator of insider trading which is often ignored by private investors to their cost. In every company there is a group of people who have close inside information about critical events in the business long before the rest of the market knows about them. These people inevitably trade on their inside information which results in a sharp rise in volumes and a slow rise in prices. This combination of massive increases in volume and small price increments is a classical sign of insider trading – but it is clearly visible in the charts. The OBV was developed by Joseph Granville to highlight this type of opportunity. It adds the volumes traded on days when the share price rises and subtracts them when it falls from a running total. A sharp rise in the OBV is a clear buy signal. Consider the chart below:

Here you can see a candlestick chart of Labat on the top, an OBV chart in the middle and the volume histogram at the bottom. The candles show how the price began to rise on 12th June 2020 accompanied by sharply higher volumes.

The fundamental reason for this activity is that Labat has moved out of the fuel business and into commercial production and exploitation of cannabis for medical and other purposes. This is potentially an unexploited growth industry that could perform very well in the future. On 14th April 2020 the company bought 70% of Biodata, a company in East London which focuses on using cannabis for healing purposes. Ultimately the market for cannabis products in South Africa is expected to be worth about R27bn and shares in Labat offer a way to exploit that situation. Various cannabinoids have the potential to be sold overseas in a growing export market. A potential problem is that the sale of cannabis faces various legal hurdles in South Africa – but once those are cleared out of the way, the industry could see rapid growth. At the moment the share averages over R100 000 in trade on the JSE every day – which makes it viable for an investment of up to R30 000 by private investors. We consider this as a risky but interesting and potentially profitable investment opportunity.

Since our article, Labat has risen by 38% in just four trading days.

MULTICHOICE GROUP (MCG)

Multichoice, a spin-off from Naspers, has been one of the best performers on the JSE during COVID-19. It is Africa’s largest pay-TV company with about 20 million subscribers in 50 African countries. The company is adding to its traditional satellite base with an internet-based platform. It is adding content from Netflix and Amazon to make its offering more attractive. Showmax which belongs to MCG says that it increased its subscriber base by just under 40% in the year to end-March 2020. About half of Showmax’s content is local which may account for its success.

The chart shows the resilience of MCG during the COVID19 pandemic. We see this upward trend continuing.

TELKOM

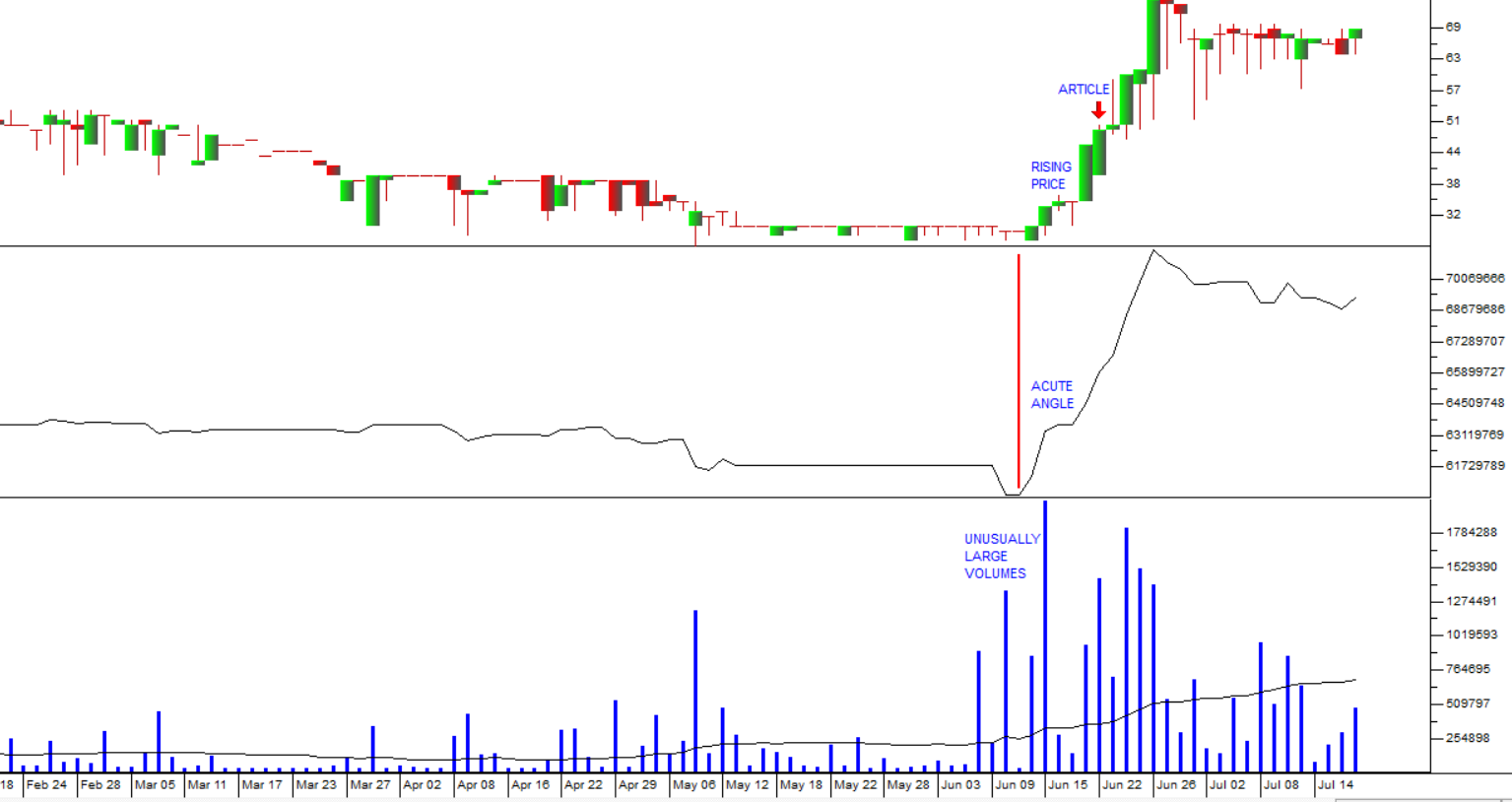

Telkom is a government-controlled communications company that is trying to get away from the shrinking fixed line voice business and into cell phones. It has some significant advantages and disadvantages which it inherited from its history as a government department. Firstly, it has had to subsidise its competition to the tune of about R70bn through the termination rates according to its CEO, Sipho Maseko. Secondly, it has inherited a massive property portfolio of over 1300 properties which it is planning to list separately as “Gyro” in due course. But the interesting aspect of Telkom is technical. Its shares have been falling for over a year (since June 2019) and the share is now trading for about a quarter of its peak price. We advised clients some time ago to apply a 65-day simple moving average to the chart and wait for it to break up. That happened on 2nd June 2020 at a price of 2178c. It has subsequently moved up to 2870c and looks set to climb further. Consider the chart:

← Back to Articles