The Confidential Report - February 2023

America

The new year began with increased optimism that US inflation was under control and therefore the Federal Reserve Bank’s rate-hiking cycle could moderate and pivot during 2023. From a fundamental perspective, this was emphasized when the December 2022 consumer price index (CPI) came in at 6,5% making it the sixth consecutive month that the index had fallen.

We believe that the investor optimism which has followed this trend may be a potentially a dangerous bullish illusion. Despite the fact that inflation rates have been trending down in the US over the last 6 months, we still believe that the inflation “genie” is still far from having been safely returned to its bottle.

A further spike in inflation rates is highly probable during the year ahead. If that materializes, it will result in further rate hikes and a sharp falloff in equity prices. It is well to remember that core inflation which excludes food and energy rose by 0,3% in December 2022 from the previous month and now stands at 5,7% - still well above the 2% goal of the monetary policy committee (MPC).

Most economists in America are predicting that the economy will enter a recession this year – defined as at least two quarters of negative growth in gross domestic product (GDP). In this regard it is well worth reading international economist, Nouriel Roubini’s recently published book, “Megathreats”, which outlines ten major threats which the world economy now faces, some of which will undoubtedly become reality in the coming months and years.

It is notable that by 27th January 2023, 29% of the companies in the S&P500 index had reported their results for the 4th quarter of 2022 and 60% of them had revenue above average expectations and 69% had earnings per share (EPS) above expectations. But the expectations were low. Actual earnings declined by 5% in the 4th quarter – and that is the largest year-on-year decline since the third quarter of 2020. So, S&P500 companies’ profits are falling and so are analysts’ expectations of them going forward. The 12-month forward P:E of the S&P500 is now at 17,8 which is below the 5-year average of 18,5.

The fall in US retail sales in December by 1,1% following November’s fall of 1% unnerved some investors and caused the S&P500 index to drop sharply.

It is the largest single month fall in the year and it was made worse by a sharp fall in business equipment production. Factory output was down 1,3% adding to the picture of an economy in decline. Overall, the data suggests that the US economy is beginning to respond to the Federal Reserve Bank’s aggressive rate hikes and quantitative tightening (Q/T). Ten of the thirteen categories of retail sales fell, and the sales of petrol were down 4,6% despite the fact that prices were down. Clearly, American consumers are starting to take some strain.

Despite this, to us, the US economy still appears to be booming. Non-farm payrolls in December 2022 showed that the US economy had created a further 223 000 new jobs in the month – well ahead of economist’s predictions of 200 000. Added to this the unemployment rate actually went back down to 3,5% - which is surely at or very close to the full-employment level. These statistics show that the rapid increases in interest rates which the MPC has put into effect during 2022 have not yet impacted significantly on the economy and employment levels. In our view this certainly makes a 50-basis point hike in interest rates at the beginning of February a possibility. At this stage, the US monetary policy committee (MPC) which meets on 1st February 2023, is only expected to increase rates by a further 25 basis points. A 50-basis point hike will send the S&P500 tumbling.

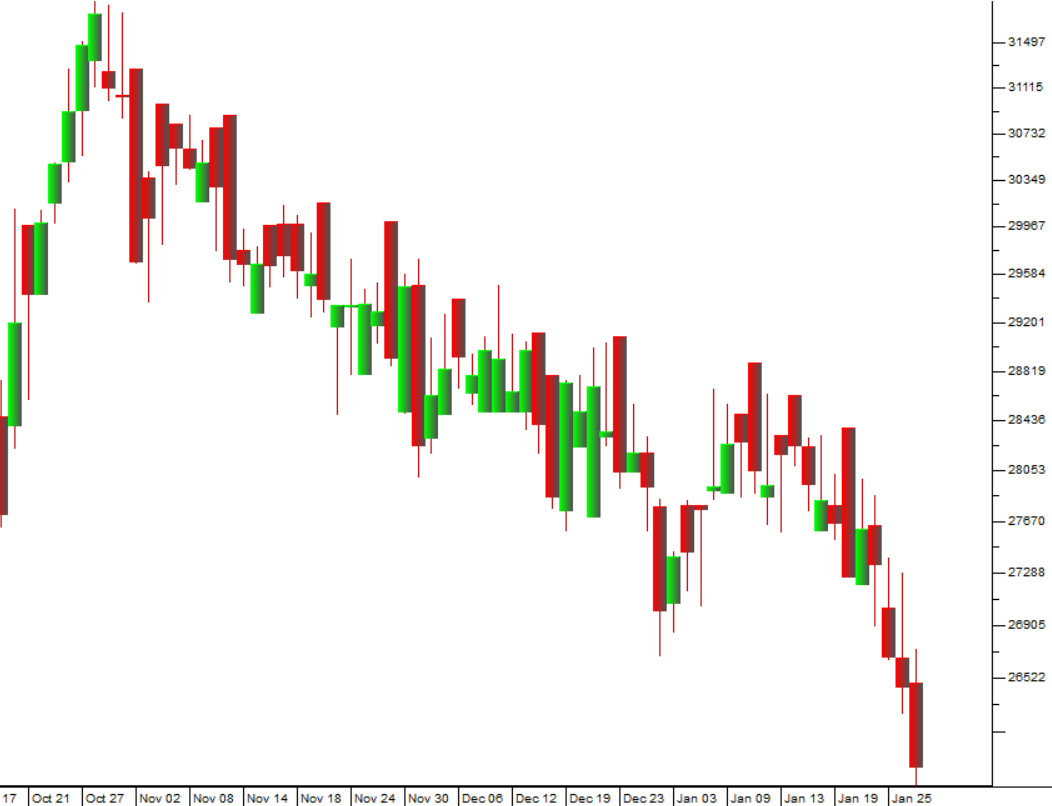

Of course, one major factor in the US markets has been the oil price, which has been rising since early December 2022 – but which remains in a downward trend. Consider the chart:

There are 23 oil shares trading on Wall Street, and they account for about 5% of the S&P500 index. They had a bumper year in 2022, but it seems unlikely that that will be repeated in 2023. We reiterate that to us it still looks like oil is in a downward trend.

Technically, the S&P500 index was at a very critical resistance at its close on Friday last week. It was sitting on the long-term downward trendline which has defined this bear market since the S&P500 peak of 4796 on 3rd January 2022. At the same time it is also very close to a “golden cross” – a widely-followed indicator which says that when the 50-day exponential moving average breaks up through the 200-day moving average, that is the time to buy back into Wall Street. Consider the chart:

You are, by now, very familiar with this chart of the S&P500 index. It clearly shows the long-term downward trend in the index together with the three major rallies over the past year in that market. Also shown are the two major support/resistance levels at 4170 and 3900 as well as the two moving averages which make up the so-called “golden cross”, the 50-day exponential moving average and the 200-day simple moving average.

Following the completion of the third rally, the S&P fell back to trade sideways through the festive season on thin volume. With the advent of the new year, the rally has found new momentum mainly as a result of the relatively benign December 2022 inflation print and it has made what looks to be a double- or triple-top. But now it has reached a critical point – immediately ahead of the Federal Reserve Bank’s interest rate announcement on the 1st February 2023.

Most analysts are predicting a relatively mild rate hike of just 25 basis points, but we believe that the Fed could surprise with a 50-basis point hike which will cause the S&P to fall back sharply from current levels. Obviously, if the S&P continues to climb it will break above its long-term downward trendline and a “golden cross” will form when the 50-day moving average breaks above the 200-day.

While these developments might not amount to a definitive indication that the bear trend was over, they will certainly be an early indication. Our view remains that this is a bear trend and that what we are looking at is the top of a cycle high which will be followed by a new sell-off. Some analysts in America are predicting that the S&P will fall by as much as 37% from current levels.

Political

President Ramaphosa’s speech at the ANC’s annual celebration of their founding on 8th January 2023 was full of the sort of undertakings and promises that long-suffering South Africans have become weary of hearing. The Ramaphosa administration, which began with such hope, appears to have achieved relatively little during its years in office, especially on the energy front. The ANC still appears to be dogged by incessant in-fighting and corruption which is costing the country dearly. To us it now seems extremely unlikely that the ANC will be able to change its image with voters materially in the 18 months which remain before the 2024 general election.

This view was supported by recent polling which suggests that the ANC would be returned with even less than 40% of the vote if the election was held now. President Ramaphosa remains relatively popular, but the party itself is now the focus of a considerable voter backlash. The DA’s march on Luthuli House in Johannesburg was notable for the large crowd which it drew comprising an unusual combination of middle-aged white men, including DA leader John Steenhuisen, and thousands of black supporters.

We believe that the ANC will lose its parliamentary majority in the 2024 election – which will force it to seek a coalition with one of the other political parties. In our view, an ANC-DA alliance is the probable outcome after the elections because no other opposition party has sufficient support or is close enough to the Ramaphosa administration’s policies. As a part of that alliance deal, the DA will probably look to appoint at least one key minister, the Minister of Mineral Resources and Energy.

If this scenario plays out as we expect, then it bodes well for this country’s economy because the management of this key government function by the current Minister, Gwede Mantashe, has been an economic disaster area and the primary reason for our current economic woes. It is just possible that the extraordinary mismanagement of the mining industry and Eskom will come to an end.

Economy

Now that the ANC’s elective conference is behind us and President Ramaphosa’s position is assured for the immediate future, the yields on South Africa’s long bonds have become more attractive to overseas investors, causing an inflow of capital into the country. During 2022 overseas investors sold a net R132bn worth of South African government bonds, but this year could see a strong net inflow which would strengthen the rand and the economy. The yield on our long-term bonds is around 10,5%, which is roughly 7% above the yield on long-term US treasury bills – making them very attractive despite the (now reduced) political risk.

Inflation in December came in at 7,2%, slightly down from November’s 7,4% and October’s 7,6% This was in line with the consensus estimate and indicates that South Africa might have seen the worst. If the oil price remains in a downward trend, it is likely that inflation will continue falling, especially if the rand can hold its ground against the US dollar. The South African monetary policy committee (MPC) has anticipated that America will increase rates by a further 25 basis points at its next meeting on 1st February 2023 and pushed our rates up to match. In our view, the rate hiking cycle is far from over, but South Africa has consistently been well ahead of the trend due to the continued vigilant and responsible efforts of our Reserve Bank. The Bank’s decision to hike rates by just 25 basis points keeps South Africa ahead of the rate hiking cycle in its first-world trading partners.

Power outages reached record levels towards the end of 2022 with as much as half of Eskom’s generation capability off-line. There were more than 180 days of load shedding in 2022, which is a new record. Various senior ANC members are casting about for someone to blame and mostly it seems that the blame has been placed on the CEO, Andre de Ruyter who has conveniently resigned. In fact, the situation is the culmination of decades of mismanagement and rampant corruption within the ANC itself, but they are unlikely to accept that. South Africans can only view the appointment of a new CEO with trepidation and resignation. The increase in loadshedding has spilled over into January 2023 with no significant let-up.

Company liquidations rose by more than 30% in December 2022 showing the immense impact of continuous loadshedding. Small businesses especially employ the greatest number of people in South Africa so these figures will have wide knock-on effects throughout the economy. The December liquidations are probably just the beginning of a wave of liquidations as loadshedding impacts more and more companies. The National Small Business Chamber (NSBC) has called on the government to subsidise diesel and generators for small businesses to reduce the number of liquidations.

The Bankserv take-home pay index showed that in December 2022, the average worker’s pay dropped by 4,8% compared to the previous December, even before taking inflation into account. Given that interest rates rose by 3,5% over that some time period, workers in South Africa are much worse off than they were a year ago. Inflation has also been a problem, hovering around 7% and making basic foodstuffs more expensive. Settlements in industrial action have come in on average below inflation at around 6%, meaning that real wages fell. This is one of the factors feeding into a general discontent with government.

Retail spending over Christmas was badly affected by the sharp rise in load shedding. Many consumers decided to cut back on Christmas spending in order to afford a better power solution for their homes. In addition, consumer spending has been curtailed by rising fuel prices, rising interest rates and high inflation. The combined effect may have made the Christmas of 2022 one of the worst in retail history.

Manufacturing production in October 2022 fell by 6,3%, mainly because of the increase in load shedding. Year-on year, production was up 1% - but well below economists’ expectations of a 4,5% increase. Seven out of ten manufacturing divisions improved production according to Stats SA. There has been a sharp recovery in the motor vehicle industry after the effect of the Natal flood and due to a buildup of inventories. Obviously, the current bout of stage 6 load shedding will have a negative impact. November manufacturing production began to show the impact of loadshedding with a 1% year-on-year decline after 4 months of increases. The production decline was less than generally expected, possibly indicating that many manufacturers have taken steps to reduce their reliance on Eskom. Loadshedding has long been considered to be the greatest single threat to the South African economy and the ANC’s efforts to control it since it began in 2008 have been singularly unsuccessful culminating in 2022 being the worst year ever for loadshedding. In our view, Eskom is a dying organization, and the sooner consumers and businesses divest themselves of its services the better.

Mining production fell 10,4% in October 2022 and then by a further 9% in November. This was worse than the 7% that economists were expecting and is the tenth consecutive drop in production levels. It is partly as a result of poor logistics from Transnet and the strike action there and partly because of a softening of demand for key commodities, but the increased level of loadshedding is also to blame. In October, platinum group metals (PGM) production fell by a massive 32,5% while diamonds were down 22% and manganese was down 10%. The month-on-month drop in mining production was 2,5%. In November PGM's were down 22%. Mining, together with smelters and refineries use about 30% of Eskom’s supply – so they are still very dependent. They will obviously be very badly impacted by the 18,65% increase in Eskom tariffs. The coal export figures for 2022 were dismal. Only 51 million tons were exported at a time when prices were unusually high. This was down from the 2017 figure of 76m tons and was due to the Transnet strike and a major train derailment which caused Transnet to issue a force majeure. In addition, the line to Richards Bay has been plagued by cable theft and the port itself has been notably inefficient. The combined effect has been a massive R30bn loss for the industry. Coal exports are a major earner of foreign exchange and tax revenue for the government. The coal industry also creates many thousands of jobs. Obviously, commodities as a whole are an important part of the government’s tax collections, and these figures imply that the surplus will be sharply lower in the coming year.

The trade surplus in the third quarter was R233bn, down from the second quarter’s R252bn. Merchandise imports increased more than exports. South Africa’s terms of trade have been worsening in recent months as the commodities boom tails off. Gold exports fell 12,6% due to lower prices and reduced demand. As the world economy weakens toward recession, the prices of South Africa’s exports of raw materials are declining. The weakness in the international economy can be seen in the steady fall in the oil price which had fallen from a high of over $125 per barrel (North Sea Brent) to current levels around $86.

There are two bright spots in the SA economy going into 2023:

New vehicle sales in 2022 were about 14% higher than in 2021 and very slightly below the pre-COVID-19 levels of 2019. Cars and commercial vehicle sales in December 2022 were up 16% over the same month in 2021. This shows that the South African economy is still performing despite the fact that 2022 was the worst year so far for loadshedding. Vehicle exports in December 2022 were up 24% over the previous year and 18% over the whole year. There was some switching away from more expensive luxury cars to cheaper cars which is an indication that consumers were being more careful about their spending. The figures are the more surprising given that Toyota, which is South Arica’s leading producers of vehicles had to shut its plant down for four months due to the flooding in Natal.

Three consecutive years of good rainfall have boosted tractor and combine harvester sales. The December 2022 figures show that tractor sales were up by 10% over the same month in 2021. Sales for the whole of 2022 were 17% higher and at record levels. The agricultural sector employs about 900 000 people and contributes about 3% to the country’s gross domestic product (GDP), but the good harvests are far more important because millions of people who are the poorest in the country rely on the production of small crops of maize for their survival. Without a good rainy season, these people are dependent on charity and government handouts for their survival.

The Rand

The rand has been appreciating against the US dollar as international investor sentiment has shifted from risk-off to risk-on in the wake of improved US inflation statistics over the past six months. It now requires R17.42 to buy one US dollar which is a significant improvement on the R18.40 of October 2022. In fact for the last two-and-a-half months since mid-November 2022 the rand has been holding its own very well against most first world currencies. This had had some good knock-effects on the local economy and especially on the price of fuel.

Our concern is that the relatively strong performance may not be sustained. We fully expect that US inflation may worsen in the coming months and that this will result in a return to risk-off sentiment resulting in a further weakening of emerging market currencies and especially the rand. Consider the chart:

You can see here the weakening trend over most of 2022 as the rand felt the international shift towards risk-on as Wall Street settled into a bear trend. That has been followed by some surprising strength since October 2022. As you probably know by now, our view has long been that the rand is undervalued against first world currencies, so we are not really surprised to see some relative strength. Of course, the nemesis of loadshedding will probably be reflected in the rand sooner or later.

Eskom

The resignation of Andre de Ruyter as CEO of Eskom comes as no surprise. It seems clear that Cyril Ramaphosa or his supporters agreed to this as the price for getting Ramaphosa re-elected as head of ANC at the elective conference in December 2022. Unfortunately, it comes at a time of maximum crisis for Eskom where load shedding has reached unprecedented levels. No doubt de Ruyter will find another senior executive position very quickly given his credentials. Throughout his time at Eskom, he had to deal with aggression and a lack of cooperation from the government, culminating in Gwede Mantashe’s uncalled for and unsubstantiated comments publicly accusing him of treason. We expect that this development, together with the retirement of the company’s chief operating officer later this year will hasten the demise of Eskom and accelerate the shift of consumers and private enterprise to alternative renewable sources of power. Indeed, in our opinion, they now have no other option.

The sudden shift to stage 6 loadshedding from 7th December 2022 and the dire predictions of continuous loadshedding in 2023 do not bode well for business, consumers or the country in general. More and more consumers and businesses will seek to do without Eskom’s increasingly expensive and unreliable service by implementing their own, mostly renewable solutions. Eskom will be reduced to an emergency back-up service to top up batteries when the sun is not shining. We have said many times that Eskom is dying – and this is further evidence of that trend. This trend will be made worse by the next Eskom price increase. Eskom asked for 32% against the current inflation rate of 7,6% and received 18,65% which gives consumers of electricity another major incentive to “get off the grid”.

The example of Kaap Agri is relevant. This company installed solar power on the roofs of two of its outlets in the Western Cape at the cost of R1,6m each. It now intends to roll out solar power at all of its branches to:

- Achieve greater energy efficiency,

- Enhance customer experience,

- Manage rampant electricity costs and erratic supply and,

- Move towards a greener energy solution.

This is a good example of what is happening across South Africa as Eskom’s recent price increase and move to stage 6 loadshedding force most consumers and businesses to make alternative arrangements.

The announcement on 24th January this year that Cape Town city would be allowed to buy electricity from private households and businesses with excess capacity is a notable change. Cape Town already buys sufficient power from independent power producers (IPP) to reduce loadshedding in that city by two stages and this development will enable them to move towards their goal of reducing the impact of loadshedding by 4 stages. Clearly Cape Town is leading the way and putting other municipalities and Eskom to shame.

It is notable that Gwede Mantashe’s solution to the Eskom power crisis in South Africa does not even mention renewable energy. He sees the energy crisis being resolved by

- The purchase of power from Karpowership,

- The purchase of power from neighbouring countries,

- The repair of Eskom’s aging coal-fired power stations and,

- Addressing the skills shortage at Eskom.

The fact that he does not see the roll-out of renewable energy as the ultimate solution is a major problem since he is our Minister of Minerals and Energy.

Companies

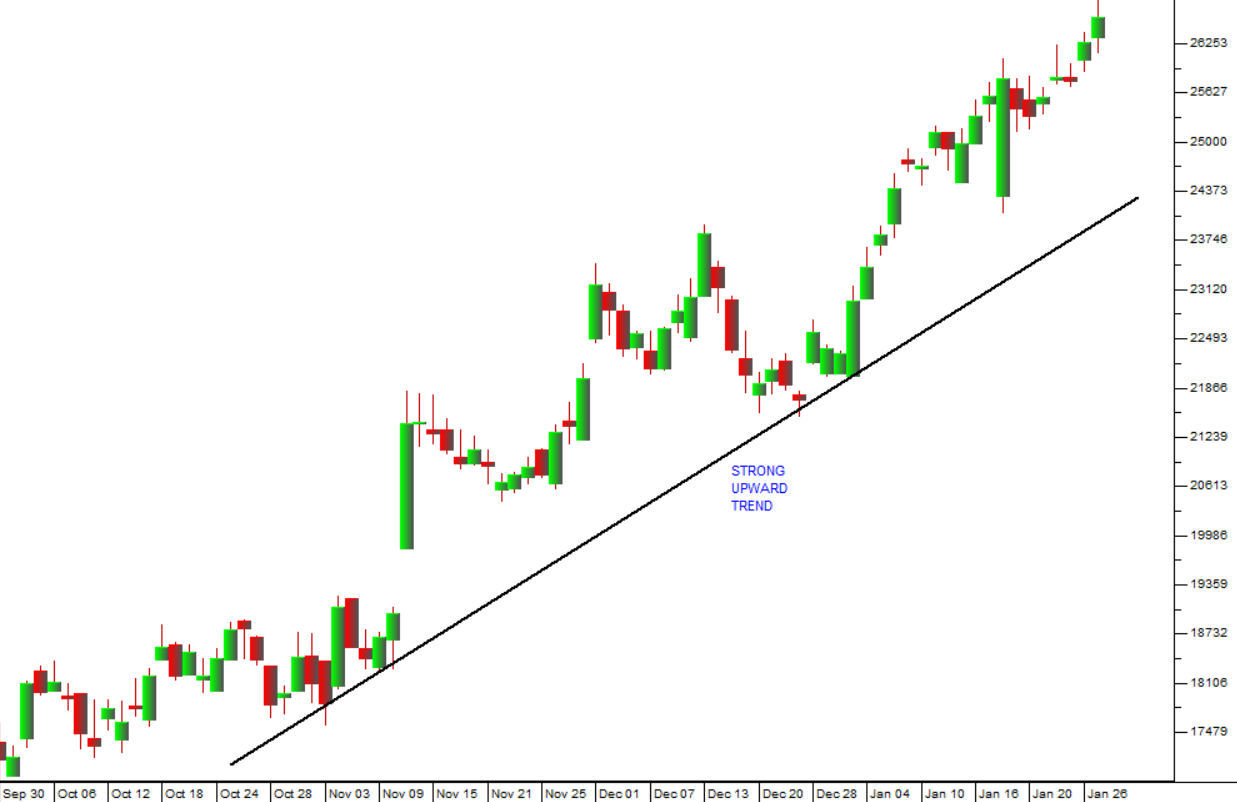

Given the strong rise in the JSE Overall index since the beginning of October 2022 you may be wondering whether the bear trend which still exists on Wall Street is relevant to our local share market. Over the four months (Oct 2022 to Jan 2023) the JSE Overall index has appreciated by 27,7% while the S&P500 has risen by only 11,8% in its third bear-market rally. A little of that has been due to rand weakness, but much of it can be ascribed to the fact that the Naspers and Prosus share prices have both climbed strongly. We originally advised clients to buy Prosus shares in our Confidential Report on the of 1st June 2022 when it was at R756.92. On Friday it closed at R1470 – a gain of 94,2% in 8 months. Our logic at the time was that the share was over-sold and had found solid support at R690. Consider the chart:

Here you can see that Prosus had indeed found solid support at R690 per share and was clearly underpriced at that level. The smart money was filling their pockets with this international blue-chip rand hedge at that price. We still regard Prosus as undervalued and representing good value – even at the current price.

Of course, the strong upward trends in Prosus and Naspers have a significant impact on the JSE Overall index and account for much of its strong performance, especially against the S&P500 index.

TIGER BRANDS

Tiger Brands (TBS) is an iconic South African blue-chip share which has been through a torrid time. The company owns well-known South African household brands such as: Jungle Oats, Tastic Rice, Koo, All Gold, Albany bread, Purity, Oros, Ace, Black Cat, and Fizzer. For decades, since the start of the PDSnet database in February 1985, this has been one of those exceptional companies that was a reliable generator of profits and growth. In fact on 28th February 1985, Tiger closed at 395c and by its peak on 25th January 2018 the share was at 47450c. It had gone up 120-fold in 33 years and at the same time paid regular rising dividends.

Then the Listeriosis crisis struck and ultimately, together with COVID-19, took the share down to a low of just below 14000c by June 2022. What is interesting is that the Listeriosis crisis occurred began in July 2017 and was confirmed to originate at Tiger’s Enterprise Factory in Polokwane in March 2018. More than 200 people died. If you look at the chart you will see a clear “head-and-shoulders” formation with the head on 25th January 2018 at a price of 47450c. The lower right should peaked on 15th February 2018 at 46625c – and then the share collapsed.

This type of head-and-shoulders formation is associated with insider trading. In other words, at least one major shareholder began to off-load serious quantities of Tiger shares during January 2018, about two months before Tiger was officially blamed for what had happened. Of course, any technical analyst will tell you that a break down through the neckline on a head-and-shoulders formation is very bad news (which happened on 22nd February 2018) – so the signs were there for all to see. Consider the chart:

In the July 2022 Confidential Report, we drew your attention to the fact that Tiger had at last broken up through its downward trendline on 15th July 2022 at 15422c and looked like it was heading up again. Since then, the share has appreciated strongly to levels around 20442c. We see this blue-chip share regaining some of its earlier lustre. It is worth noting that in its financials for the year to 30th September 2022 the company reported revenue up 10% and headline earnings per share (HEPS) up 51%. The company also did a R1,5bn share buy back and paid a dividend which was 18% up on the previous year.

RICHEMONT

Richemont (CFR) is the world's second-largest supplier of luxury goods controlled by the Rupert family in Stellenbosch. Its sales are entirely located overseas so it is an excellent rand-hedge. Its luxury brands include Montblanc, Cartier, Lancel, Jaeger-LeCoultre, Van Cleef and Piaget. It has boosted online sales to 21% of turnover by acquiring Yoox-Net-A-Porter (YNAP), Watchfinder, a UK online group and entering into a joint venture with the online giant Alibaba, to develop apps to penetrate the Chinese market and offer its line of luxury goods. At the same time, its luxury goods are offered through Alibaba's Tmall Luxury Pavilion. In its results for the six months to 30th September 2022 the company reported sales up 24% and profit from continuing operations up 40%. On 18th January 2023 the company announced that sales in the third quarter (ending on 31st December 2022) were up 5% in constant currencies and 8% in actual currencies while sales for the 9 months to 31st December 2022 were up 18%. The company also revealed that its net cash position had improved by 0,6bn euros during the third quarter to 5,5bn euros. This is a company that is doing well despite the slowdown in the world economy. We like the share and consider it a good buy. Consider the chart:

BHP

BHP is a world-wide commodities company with its headquarters in Melbourne, Australia. It processes minerals, oil and gas and it has 80 000 employees, mostly in the Americas and Australia. It produces copper, iron, coal, oil, and gas. BHP owns 57,5% of the Escondida mine in Chile which is one of the world's largest copper producers and also produces some gold and silver. It owns 33,75% of Antamina in Peru which produces copper and zinc. It owns 100% of Pampa Norte which produces copper cathode in the Atacama Desert in Northern Chile. It owns 50% of Samarco in Brazil which produces iron ore. It owns mineral rights in Saskatchewan in Canada which contains one of the world's largest unexploited potash deposits. In Australia, BHP owns Olympic Dam which is one of the world's largest copper, uranium, and gold ore bodies. It also owns Western Australia Iron Ore which is a system of five mines connected by more than 1000km of railway lines. It owns Queensland Coal which comprises the Mitsubishi Alliance and Mitsui Coal. It also owns the Mt. Arthur open-pit coal mine in New South Wales. It owns Nickel West which is a nickel mine with smelters, concentrators, and a refinery. In the petroleum field it owns high quality resources in the Gulf of Mexico, Australia, Trinidad, and Tobago. In its results for the year to 30th June 2022 the company reported revenue up 14% and headline earnings per share (HEPS) up 54%. The company said, "Reliable operational performance at WAIO, with record sales (on a 100% basis) for the third consecutive year and the South Flank Project ramp up ahead of schedule. Escondida achieved record material mined and near-record concentrator throughput. Profit from operations of US$34.1 billion, up 34% from the prior year, and record Underlying EBITDA of US$40.6 billion at a record margin of 65% for continuing operations". This is a diversified international mining company which benefits directly from rising commodity prices and hence from any recovery in the world economy. The share has been rising steadily since the commodity cycle turned upwards in January 2016 but fell sharply into a V-bottom with the coronavirus pandemic. Since March 2020 it has continued its strong upward trend with new record highs. We expect this trend to continue for as long as commodity prices continue to rise despite the fact that it is currently at a cycle bottom. Consider the chart:

Here you can see the long-term chart of BHP going back to February 1999. We have marked the impact of the 2008 sub-prime crisis, the start of the commodity boom in January 2016 and the COVID19 downward spike. Now at a new record high it is clear that this share benefits both from its extraordinary diversification and its rand hedge status.

TRUWORTHS

Truworths (TRU) is a clothing, footwear and accessories retailer that operates in Southern Africa and the UK and is listed on the JSE and the Namibian Stock Exchange. It makes 70% of its sales in South Africa on credit - so its credit management strategies are critical. It is in a highly competitive industry where everyone is selling clothes from Woolworths, Checkers and Pick 'n Pay to the Foschini Group, Mr. Price, Ackermans and Pep. It is an industry constantly beset by the entry of overseas brands like Cotton On and which is entirely dependent on consumer confidence and spending. Its sales are also dependent on a fine appreciation of the rapid changes in the fashion industry. All these factors make it very difficult for the company to keep profitable. Truworths has a very conservative approach and is constantly refining its business model. It has 754 stores in South Africa with 31 in the rest of Africa and 92 stores in the UK, Germany and Ireland. The company acquired Barrie Cline ladieswear which had been supplying Truworths for 30 years. In its results for the 53 weeks to 3rd July 2022 the company reported headline earnings per share (HEPS) up 50% and R1,6bn worth of share buy-backs. In an update on the 26 weeks to 1st January 2023 the company reported group retail sales up by 13,7%. The company estimated that HEPS would rise by between 8% and 11%. Technically, the share fell on COVID-19 but we suggested waiting until it broke above its downward trendline. That break came on 4th September 2020 at a price of 3195c. Since then, the share has appreciated to 6595c. We still consider it to be good value at current levels on a P:E of 8,46. Consider the chart:

Despite the considerable difficulties inherent in its business, especially in South Africa, the Truworths share has made an excellent start in 2023. It remains one of the best-managed retailers on the JSE.

OUTSURANCE (OUT)

This is what is left of RMI after all their other interests have been stripped out. All that remains is the insurance business of OUTsurance – so it is in effect a new listing which the big institutions are still digesting. As they appreciate the company’s value and potential, the share price is climbing steadily. On 26th January 2023 the company published a voluntary trading update for the six months to 31st December 2022. In that update they said that it had been positively impacted by a significant increase in Youi’s earnings resulting from an increase in premium income and a decline in their perils claims. Shareholders are advised that earnings will increase by at least 20% excluding the impact of the company’s stake in Hastings. Clearly, institutional fund managers like what they are seeing…and so do we. Consider the chart:

CLICKS

Clicks is one of our favourite shares because over the decades it has just kept on going up consistently. It is also a favourite with the big institutional fund managers because of its steady performance. But right now it has for some reason fallen a little out of favour and the share price has dropped from its high of R264.50 to last Friday’s close of R258.83. The fall brings its P:E ratio down to 25 – which is the lowest it has been since December 2016 – 7 years ago. The recently published trading update for the 20 weeks to 15th January 2023 was good. Turnover was up 7,8% and retail sales rose by 12,2% (excluding vaccinations). The CEO said, “Clicks reported particularly strong growth in beauty, personal care and baby”. Of course, there might be something which we do not know about going on, but we believe that sooner or later the Clicks share price will return to a P:E of over 30. So, if you have been interested in acquiring some of these very highly regarded shares, you should be watching the daily market action closely to choose your moment to buy. Consider the chart:

← Back to Articles