The Confidential Report - December 2022

America

The Democrats’ surprising performance in the US mid-term elections is a huge blow to the Republicans and may even signal the demise of Trump’s "Make America Great Again" (MAGA) movement and an irreversible reduction in his influence over the Republican party. He is increasingly seen as presiding over a pattern of electoral defeats since he lost the presidential election to Joe Biden in 2020. He is even being painted as a “loser” among Republicans - and that is probably about the worst reputation for any budding fascist to have. He has many looming legal problems and his much-vaunted idea of running for president again in 2024 must now be in question. In our view, while he will undoubtedly retain some die-hard “bittereinde” supporters, we believe that he is now probably a spent force in American politics.

The monetary policy committee (MPC) of the Federal Reserve Bank (the Fed) raised interest rates for the fourth time during November by seventy-five basis points. The governor, Jerome Powell, gave a speech on the 30th of November in which he said that the Fed might begin to moderate its rate hikes as early as December this year. From what he said, the MPC might raise rates by fifty basis points at its next meeting and then reduce that further to 25-basis point hikes in time. Because of this his speech was construed by the bulls as being somehow “dovish” and they drove the S&P500 index up over 3% on the day.

What they appear to have lost sight of is his persistent and oft-stated determination to reduce inflation to 2% and the fact that the economic effect of interest rate hikes is cumulative. So far, the Fed has raised rates by 3,75%, a figure which can only rise as further, albeit smaller, rate hikes are added. Nobody, including Jerome Powell, is able to say what the peak of this hiking cycle will be – or for how long it will stay elevated once it gets there. What we can be certain of is that much higher interest rates will certainly have a direct impact on businesses and consumers to the point where spending declines sharply and the unemployment rate begins to rise noticeably.

It is clear to us that the economy is beginning to show some of the early effects of the steep and persistent rise in interest rates. This is especially noticeable in the property market. Pending homes sales were down 4,6% in October, the fifth consecutive monthly decline and there has been some flattening off of the consensus estimates of the profit growth in S&P500 companies.

However, at the same time US Gross domestic product (GDP) rose by a revised 2,9% in the third quarter and the economy generated 263 000 new jobs in November 2022 – well above the consensus forecast of 200 000 jobs. There are now 1,9 jobs for every available worker – a situation which must result in further wage and salary increases. Clearly, the US economy is still thriving, and demand is nowhere near the point at which it will have a material impact on the inflation rate. The drop in the inflation rate to 7,7% in October 2022 is definitely an improvement on the 9,1% it reached in June 2022, but it still has a long way to go, given the evident strength in the job market. We would not be surprised to see inflation tick up again in the coming months. And if that happens it will certainly have a sharp negative impact on the S&P500, especially at the cycle highs where it is now.

Powell said that he still believes that it is possible for the US economy to have a “softish landing.” In other words, he thinks that the pattern of interest rate hikes can be moderated from here on in such a way that a major recession could be avoided. But from what we understand, the US economy is definitely headed into a recession by the middle of next year. The only question really is how “soft” or “hard” that landing will be.

Our primary reason for predicting a recession is the record yield inversion.

The yield curve is the difference between the effective yields on 10-year and 2-year US Treasury bills. Normally, the 10-year would command a higher yield than the 2-year because the investor’s money has to be tied up for a much longer period. Sometimes, however, there is an inversion of this pattern and the 2-year trades at a higher effective yield than the 10-year. This clearly indicates that investors as a group believe that the economy is heading into recession in the near term. On Tuesday last week, the 10-year was trading at a yield of 3,752% and the 2-year was at 4,481% - which means there was an inversion of 73 basis points (448 – 375)– which is one of the highest inversions in decades.

In our experience this is a sure early sign of an impending recession – and we do not believe that the S&P500 index is currently pricing that in. The “excessive bullishness” which we have spoken about in previous Confidential Reports and articles is very evident in the positive response of the market to news which would normally be regarded as bearish – such as the idea that the US Fed will only increase rates by fifty basis points at its next meeting rather than 75.

The S&P500 was in a rally at the last Confidential Report published on 2nd November 2022 and it is still in that rally. The rally has taken it almost back to the bear trend’s dominant downward trendline. Consider the chart:

Here you can see the bear trend from the 3rd of January high at 4796, together with its rallies. The pattern of lower highs and lower lows, together with the overarching downward trendline makes it indisputable that we are in a bear trend, despite the excessive optimism which we spoke of earlier. Trendlines are not a precise measure, but history shows us they are often surprisingly accurate as an indication of just how far a rally can go. After all, what are the odds that the four tops connected by the trendline in the chart above would line up so precisely? We might not have put the trendline in exactly the right place, but the direction of the trend is basically beyond dispute.

The chart also shows us that the next move in the S&P500 index is almost certainly going to be down. You can believe that the bears in the market are rubbing their hands in anticipation of a substantial gain as they short the index at least back to its previous low and probably lower.

You will also note that the 65-day exponential moving average, although moving up in response to the current rally, is nowhere near breaking above the 200-day simple moving average to give us a “golden cross” signal. If you are not clear on concept of the golden cross go back and read our article published on 17th October 2022.

Ukraine

The decision by Russia to withdraw its forces from Kherson can be seen as a major victory for President Zelensky, but it masks the intensified fighting in the Donetsk region. Russia appears to be trying desperately to make some significant gains in that area to compensate for its humiliating losses further South. Evidence has emerged of a stronger relationship between Iran and Russia whereby Iran has been supplying Russia with drones and other support. It is notable that Putin has not made any comment on Russia’s withdrawal from Kherson and appears to be trying to distance himself from the humiliation. Instead, Russia’s tactics have shifted to the cowardly bombing of civilian infrastructure which they can do remotely without any further risk to their troops. The gains made by Ukraine in the South are impressive and even the Russian propaganda machine is finding it difficult to continuously be talking about “strategic withdrawals,” the most recent of which has been their withdrawal from the strategic town of Zaporizhzhia.

It seems inevitable now that the Ukrainians will cross the Dnipro River and begin to push Russian troops in the South back towards Crimea. All appearances are that they do not intend to take a break over winter. Further humiliation for Putin seems inevitable. The call-up of 300 000 untrained and ill-equipped troops has resulted in massive casualties at the hands of the now highly experienced and NATO-equipped Ukrainians.

In considering the situation in Ukraine it is important to take cognisance of the following key points:

- The importance of Chechnya, whose people have been the subject of various wars with Russia over their independence. Many Chechens regard Ukraine as heroic in its determination to defend its independence and they wish for the same outcome for Chechnya. Tens of thousands of Chechens are now part of the Ukraine army and fighting against Russia. Putin’s call-up of 300 000 new soldiers has accelerated the movement of Chechens to Ukraine and even resulted in the start of what could become an insurrection in Chechnya against Russia.

- Putin’s health problems are becoming increasingly obvious, despite his best efforts to conceal them by using look-alikes. Apparently, he has colon cancer and recently fell down some steps and soiled himself in public. Together with evidence of Parkinson’s disease and given the enormous stress that he must currently be under it seems apparent that he cannot sustain his position as tyrant for much longer. He faces more and more public dissention at home and criticism from key allies like the head of the Wagner Group, Prigozhin, and his own Chechen puppet, Kadyrov. Like Trump, Putin is being painted as a “loser” which for a fascist is far worse than being a liar, a murderer or a megalomaniac. In our view, Putin’s remaining days in office can probably be counted in months rather than years.

- Following on from that, President Biden has recently offered to talk to Putin about the situation in Ukraine. In our view, this can only mean that the White House is sensing Putin’s desperation and weakness. Obviously, if Biden could negotiate a resolution of the Ukraine war it would be a massive achievement which would have a significant impact on his status. To us it is significant that he has chosen this moment after almost ten months of the war to make this approach.

It is unnecessary to describe the impact of a cessation of hostilities in Ukraine on the world economy and stock markets around the world – except to say that it would be positive in the medium to long term once the damage done in Ukraine is repaired and Russia re-joins the world economy. The war remains a major negative which Western nations, like Germany, are and will be increasingly able to mitigate.

Political

The fact that Cyril Ramaphosa has received over 2000 nominations from the ANC’s 3500 branches all over the country was a clear indication that he would have won the nomination for president at the ANC's elective conference on 16th December 2022 without the Phala Phala complication. His nearest rival, Zweli Mkhize, only got just over 900 nominations. This has all been thrown into jeopardy with the report by a parliamentary panel which indicates that Ramaphosa has a case to answer in the Phala Phala affair. It is clear that on Thursday 1st December 2022 the president came very close to publicly announcing his resignation and was only held back by some of his inner circle supporters. The impact on the markets has been dramatic with the rand falling intraday over 4% and the yield on the 10-year government bond rising to more than 11%. During his time in office, Ramaphosa is not beyond criticism, but he is generally regarded as the most stable option to lead South Africa going forward. His decision not to resign will be a relief to many investors who would undoubtedly have reviewed their investments in this country. In our view, having stepped back from the edge of the cliff, he has been persuaded to remain and take the parliamentary report on review. But he has only done that because he feels that he still has sufficient support within the ANC to survive the ANC's elective conference in less than two weeks and so now some intense canvassing is in progress by his supporters.

At the elective conference, the nominations are for the top six positions in the ANC – the so-called national executive committee (NEC), which makes most of the decisions in South Africa. Of course, Ramaphosa’s biggest problem, should he decide to remain and if he is re-elected, will be to fight the general elections scheduled for 2024, where most analysts predict that the ANC’s support will fall well below the 50% needed to control parliament. Such a result would force the ANC to seek an alliance with one of the other parties. The strong support that Ramaphosa enjoys should hopefully put to bed the long-running and damaging in-fighting within the ANC.

The suggestion by the Gauteng Premier, Panyaza Lesufi, that the R5bn owed by Soweto residents to Eskom be written off further entrenches the idea that people do not have to pay for their services. In our view, President Ramaphosa’s support for the idea is a thinly veiled ploy to garner votes for the 2024 election. Notably about R8bn of Soweto’s Eskom debt was written off before the 2020 election for the same reason. Clearly, people living in Soweto, like state-owned enterprises (SOE) have come to rely on regular government bailouts for their survival. The suggestion makes a nonsense of the government’s “user pays” principle and opens the door for other groups to demand the same treatment. In our view, writing off this debt would be a major step backwards and it is incorrect for the President to support it.

A poll conducted on 2000 voters has found that the ANC has 41% support. This means that if an election were held today, the ANC would get the largest support, but would fall below the 50% which it needs to control parliament. This, in turn, means that it would have to create a coalition with another party. In our view, that would force the ANC to make a coalition with the DA as its policies are not far from those of the ANC and it is large enough to give the combined entity a clear majority. Such an outcome would, in our opinion, ensure reasonable political stability for the 5 years following the 2024 general elections.

The National Executive Committee (NEC) of the ANC is in favour of increasing the Social Relief of Distress grant (SRD) from R350 a month to R480 to bring it into line with the Child Support Grant. In the recent budget the Minister of Finance, Enoch Godongwana allowed the SRD to be extended for a further year at a cost to the fiscus of R44bn. The objective is to cushion the poorest people in the country from rising inflation and interest rates. The Treasury, which will have to agree to any change, is trying to bring the government’s debt down in the face of falling commodity tax revenues. In his closing speech to the NEC, President Ramaphosa said that the ANC would continue to try to reduce the triple problems of “poverty, unemployment and inequality,” but the true problems of South Africa are productivity, corruption, and state indebtedness. In our view a further expansion of the SRD program beyond the year that has been agreed is unaffordable for South Africa.

Economy

The jump in the inflation rate in October 2022 to 7,6% was above most economists’ expectations and has resulted in a further 75-basis point hike in the repo rate in November which takes it to 7%. Given that inflation rates around the world are on the high side, with the British inflation rate above 11%, Europe at over 10,5% and America at 7,7%, the Reserve Bank will be inclined to be more hawkish to keep our government bonds attractive to overseas investors. Core inflation, which excludes food and energy, was back at 5% in October having risen 0,3% month-on-month. The governor of the Reserve Bank, Lesetja Kganyago, said that at 7% the repo rate was still “accommodative” although some economists would disagree. In our view, the monetary policy committee (MPC) has acted effectively and decisively to contain local inflation and maintain the relative attractiveness of South African government debt instruments and it has done this in the face of rising opposition.

Private credit extension rose sharply in September 2022 to 9,7%. This was well above the average economists’ projections of 8,15%. The rise shows that consumers are spending on credit cards and overdraft facilities, while businesses are investing in growth. Consumers are under pressure from rising interest rates, loadshedding, higher costs of fuel and food. Some of the business expenditure is the cost of implementing renewable energy systems to replace Eskom. Consumer credit card debt increased by 20,5% showing that consumers were forced to use this very expensive form of credit to pay for food and fuel. Overdrafts rose by 13,1% as consumers battled to meet monthly expenses out of their income. Household debt is two-thirds of income – a figure which has come down significantly since COVID-19 – but which is now moving up again. The Debt Busters Index shows that unsecured debt has risen by 25%. The index shows that people earning above R20 000 a month have a debt ratio of one-and-a-half times their income – the highest level on record. A combination of rising fuel prices, rising interest rates and worse unemployment is pushing consumers into a debt trap.

The unemployment rate in the third quarter of 2022 dropped by 1% to 32,9% from the second quarter’s 33,9%. Stats SA reports that the country has added an impressive 1,5 million jobs in the past year – more than 80% of them in the formal sector. The sectors which are creating the most jobs are manufacturing, construction, transport, and trade – while the financial sector, mining and agriculture are losing jobs. The sharp improvement in the unemployment rate suggests that the economy is booming – which we all know is not the case. So, until we have further figures as evidence of unemployment coming down or the economy booming, we will regard the third quarter figures with some scepticism.

The trade account is part of the balance of payments and shows the value of South Africa’s exports less its imports. So far this year, the trade account has shown a surplus of R175,5bn – which compares to R347bn at this time last year. So South Africa is still running at a profit, exporting more than it imports – but less so that last year mainly because of the drop off in commodity prices. The September 2022 surplus was a surprising R19,7bn – more than double August’s surplus of R7,2bn and way above economists’ average projection of R5bn. The level of imports has been subdued because of rising interest rates, loadshedding and other constraints on the local economy.

Motor vehicle sales in October rose by 11,4% year-on-year with new passenger car sales up 10,4% and exports up 16,1%. Year to date, car sales are up almost 20% and exports are up 14,5%. These numbers appear to defy the recessionary conditions that the South African and international economies are experiencing. Both are dealing with rising interest rates and considerably higher fuel costs. Generally, increased motor vehicle sales are an indication of growth in the economy because consumers and businesses usually cut back on major capital expenditures during a recession.

The Just Energy Transition (JET) plan has been finalized to move South Africa from coal-fired power stations to renewable energy. The plan is expected to cost about R1,5 trillion over the next 5 years of which the private sector is expected to fund about one third. The European Union and various EU countries have already agreed to supply $8,5bn, but much more will need to be raised. The World Bank has put up almost $500m for the closure and transition of the Komati power station. Obviously, there is still a huge funding gap, but now that there is a plan, raising those funds will become easier.

Tractor sales hit a 40-year high in October 2022 at 1268 units, nearly 50% above last year, indicating that farmers at least are investing in South Africa. Agriculture accounts for 3% of the GDP and employs around one million people. The good start to the rainy season means that South African grain production should be high and could even be a record. The war in Ukraine has pushed the prices of grains up and that has benefited farmers and helped them to reduce their debt.

The unilateral implementation of the 3% wage hike for civil servants has been rejected by most of the civil service unions. The one-day strike and march on Thursday 10th November 2022 probably did not have much impact, but the letter which they delivered to the government gave them 7 days to respond positively – something which, of course, did not happen. The unions then declared a second one-day strike for Tuesday 22nd November 2022 which was even less effective than the first. Forcing through the 3% wage hike is a display of Finance Minister Godongwana’s determination to reign in the civil service wage bill. It is seen as a victory for the government and has left the unions looking weak and divided.

Mining production fell for the 8th month in a row in September 2022, down by 4,5%, following August’s 6,4% drop. It is clear now that the commodities boom of the last few years is rapidly ending – and with it the tax surpluses that have enabled South Africa to reduce its government debt. Iron ore output fell 23% compared with a 15% drop in August. The combination of loadshedding and Transnet’s inability to deliver ore to ports are having a major impact. At the same time, most commodity prices are declining.

Manufacturing production continues to defy expectations, rising 2,9% in September 2022. This is the third month in a row that production has increased, indicating that this sector at least is growing, despite loadshedding and other constraints. Economists were predicting that manufacturing production would fall by 2,5% in September – which makes the print even more impressive. Unfortunately, manufacturing is only about 15% of gross domestic product (GDP), so the impact on the entire economy will not be substantial.

Following the President’s suggestion that the R5bn debt which Soweto residents owe to Eskom be scrapped, the SA Local Government Association (SALGA) is proposing that when the government takes on a major proportion of Eskom’s debt it should, at the same time, take on an equal proportion of the R140bn which municipalities around the country owe to Eskom. These ideas are clearly a move away from the “user pays” principle which the government has been trying to implement for several years. They are a move towards populism and if implemented will result in more and more government bailouts going forward.

The Organisation for Economic Co-operation and Development (OECD) has released its economic outlook for 2023 and expects growth in the world economy to come in at around 2%. Inflation in OECD countries is expected to be more than 9% and the war in Ukraine is expected to continue impacting the oil price. As far as South Africa is concerned, the OECD expects our inflation rate to continue declining steadily and gross domestic product (GDP) growth is projected to be 1,7% in 2022, 1,1% in 2023 and 1,6% in 2024. This compares with Investec’s projection that South African GDP will grow by just 1,3% in 2023.

Initial indications are that sales on the Black Friday weekend were significantly higher than last year and focused mainly on groceries and food – which may indicate that consumers were buying consumables, the sales of which could be lower in coming weeks. Black Friday sales are an important part of retail sales for most retailers and can translate into higher profits, at least in the short term. This year there was a swing towards online buying with many consumers opting to avoid crowded shops and long queues.

The imminent financial collapse of the Post Office has not stopped the parastatal from pursuing its banking license. The company is technically insolvent and has inadequate internal systems and controls to be awarded a banking license. In our view the idea of the Post Office running a bank is absurd. It is simply another failed state-owned enterprise that can only continue to exist with huge government bailouts. Another example of a failed SOE is SAA which, according to Pravin Gordhan, still needs further funding to stay afloat. SAA resumed flights in September 2021 but needs further financial support. This time that will have to come from the private sector since the government has already provided all the support that it is willing to supply. We believe that South Africa does not need these two failed SOE's and should not provide any further government bailouts for them.

Transnet, like Eskom, is getting into financial difficulties and for the same reasons. Years of inefficiency and corruption in their operations has left them with a dilapidated infrastructure, high debt levels and offering an increasingly expensive and unreliable service. Now they are approaching parliament for a bailout – as in Eskom’s case, the government does not really have an alternative because the mining industry needs an efficient and cost-effective rail service to transport its ore to port. Transnet is suggesting that instead of pricing its services by the weight of the goods that it transports it should be allowed to charge according to the value of those goods. In our view, the real problem is a management problem and not a pricing problem.

ABSA says that in the 5 weeks to 8th November 2022, the prices for commodities have fallen by 4,6% from last year and 13,8% from the September quarter. This is a clear indication that the commodity boom is coming to an end which will have significant consequences for tax collections going forward. The recent mid-term budget policy statement (MTBPS) was based on a massive increase in collections which enabled the Treasury to reduce government debt and engage in some social spending. The next budget will see a far smaller overrun and may even see a deficit. Lower commodity prices will also impact on South Africa’s terms of trade and may even result in a deficit on the current account of the balance of payments.

Eskom

Eskom’s position is becoming increasingly untenable. Its energy availability factor (EAF) is well below the 75% which it needs and likely to stay there for the near future. Eskom COO, Jan Oberholzer said that the company could no longer afford the diesel necessary to keep its emergency generation fleet going and had already spent R1bn more than was budgeted for the fuel for the entire year. A major problem is the R53bn owed to Eskom by the municipalities – a debt which is still growing. The company has been operating with a 58% EAF – which accounts for the frequent loadshedding in recent months. This, of course, has a direct impact on productivity and gross domestic product (GDP). The company has also lost about half a dozen of its most senior and experienced staff, some of whom have left because of the enormous pressure of the job. Eskom’s return to stage 5 loadshedding mid-November 2022 was depressing for South African businesses and consumers but will have the effect that even more of these power-users, who are Eskom’s primary market, are likely to seek alternative sources of power.

In the short term, Petro SA is to give Eskom 50 million litres of diesel so that it can run its open-cycle gas turbines and supplement its increasingly shaky fleet of coal-fired power stations. This is obviously a temporary stopgap and does not address the underlying problem which is that Eskom desperately needs new power generation capability – preferably from renewable energy sources. The 50-million litres will last Eskom about 2 weeks. Clearly, the Treasury will have to provide additional funding to Eskom to buy more diesel so that South Africa can move back from stage 4-5 loadshedding to stage 2-3. The impact of high levels of loadshedding on productivity and GDP growth is substantial.

South Africa is now completing about one gigabyte of renewable energy production per annum which is about 10% of what the country needs to overcome its dependency on coal. Eskom is beginning to decommission coal-fired power stations as they reach the end of their lives leaving an energy gap which is not yet being filled by renewables. On 15th November 2022, EDF Renewables announced that it had cleared the remaining obstacles to beginning to build two 140mw wind farms under bid window five. It ultimately wants to have three such farms generating a total of 420mw. The breakdown of coal-fired power plants has resulted in ten years of loadshedding, which will continue until the generation gap is closed. Eskom estimates that by 2030 R130bn will be needed to build new capacity and add transmission lines.

The fact that Transnet Freight Rail is asking for proposals from the private sector to implement renewable energy solutions is significant. A parastatal is seeking to get away from Eskom because of its cost and unreliability. In our view, this confirms the fact that Eskom’s days as a generator of power in South Africa are numbered. The private sector has been moving away from Eskom for several years now and even looking at getting into the power generation business to replace Eskom more broadly. Loadshedding continues and Eskom continues to prosecute its attempt to get a 32% price hike out of NERSA. The direction of the trend is clear. The private sector and now even the government sector are looking for alternatives.

The frustration that Eskom CEO, Andre de Ruyter, is experiencing with entrenched criminal syndicates operating within Eskom is significant. He recently said that the activities of these syndicates are resulting in loadshedding being as much as two stages higher than it would otherwise be. He says that the criminal justice system is not supporting the efforts of Eskom’s security to bring these criminals to justice, and he is concerned about the resignations of top executives at least partly due to the threats that they are receiving to their safety and that of their families. Clearly, it is impossible for de Ruyter to make progress at Eskom without the active and effective support of the police and judiciary.

More than 130 days of loadshedding this year so far are taking a toll on small businesses with many unable to keep their doors open. Combined with rising interest rates, the effect of loadshedding has been a rising level of liquidations. In the year to September liquidations increased by 11,8%, showing the stress that companies are under. Smaller companies typically have weaker balance sheets and so are more vulnerable than larger companies. The combination of rising interest rates, rising fuel prices, weaker international economies and loadshedding is having a serious negative impact on business at all levels, but especially on smaller companies.

The Rand

The rand has been at the whip-end of both local political developments and the risk-on and risk-off effects of developments in the international economy, especially in America. The general trend has been one of weakness – which matches the bear trend in world stock markets and the broad shift towards risk-off as interest rates rise throughout the world. Within that there have been periods of relative risk-on sentiment as markets rallied resulting in periods of rand strength.

The most recent rally in the S&P500 has seen the rand gain ground against the US dollar since its low point at the beginning of November 2022 at around R18.40 to the dollar. That strengthening pattern has been interrupted by Ramaphosa’s threatened resignation because of the parliamentary panel’s report into the Phala Phala affair. Now that Ramaphosa has decided not to resign, investors are calming down, but we expect the rand to begin weakening in response to a new downward trend on the S&P500 accompanied by risk-off sentiment and followed by other markets around the world. That weakness could easily take the rand to around R20 to the US dollar over the next few months. It is notable that despite the confirmation that Ramaphosa is to stay to contest the ANC’s elective conference on 16th December 2022, the rand has not strengthened back to where it was a few days ago before the report was publicised, below R17 to the US dollar.

Old Mutual has made a prediction that the rand will strengthen dramatically from current levels and “settle around R15.20 to the US dollar” by the end of 2023. This prediction is made based on two assumptions – that the interest rate hiking cycle in America is nearing an end and the fact that South Africa has managed to reduce the government’s debt in the most recent budget quite significantly. We agree that the budget published in October was good for the rand and projected a significant reduction in government debt, but we are not at all convinced that interest rates in America are close to peaking. After the fifth 75-basis point hike, rates in the US are at around 4% against an inflation rate of 7,7%. The recent half percent drop in the inflation rate does not necessarily mean that inflation is coming under control and the Federal Reserve Bank is likely to continue with hike rates in the coming months. In general, our view is that the rand is undervalued against the currencies of first world countries, but we think that the shift to risk-off is not over yet.

Companies

NEW LISTING

Zeda, a car rental, sales, and fleet management company is to list on the JSE on 13th December 2022. The company is being spun out of Barloworld. The company manages an average of 57 000 vehicles, operates in 10 African countries and has fourteen car dealerships in South Africa. In the year to 30th September 2022 the company reported turnover up 6,6% to R8,1bn with a margin of 15,5%. Operating profit rose 160% to R1.2bn. This a clearly a well-established and well-managed secondary company that should do well on the JSE.

GLENCORE (GLN)

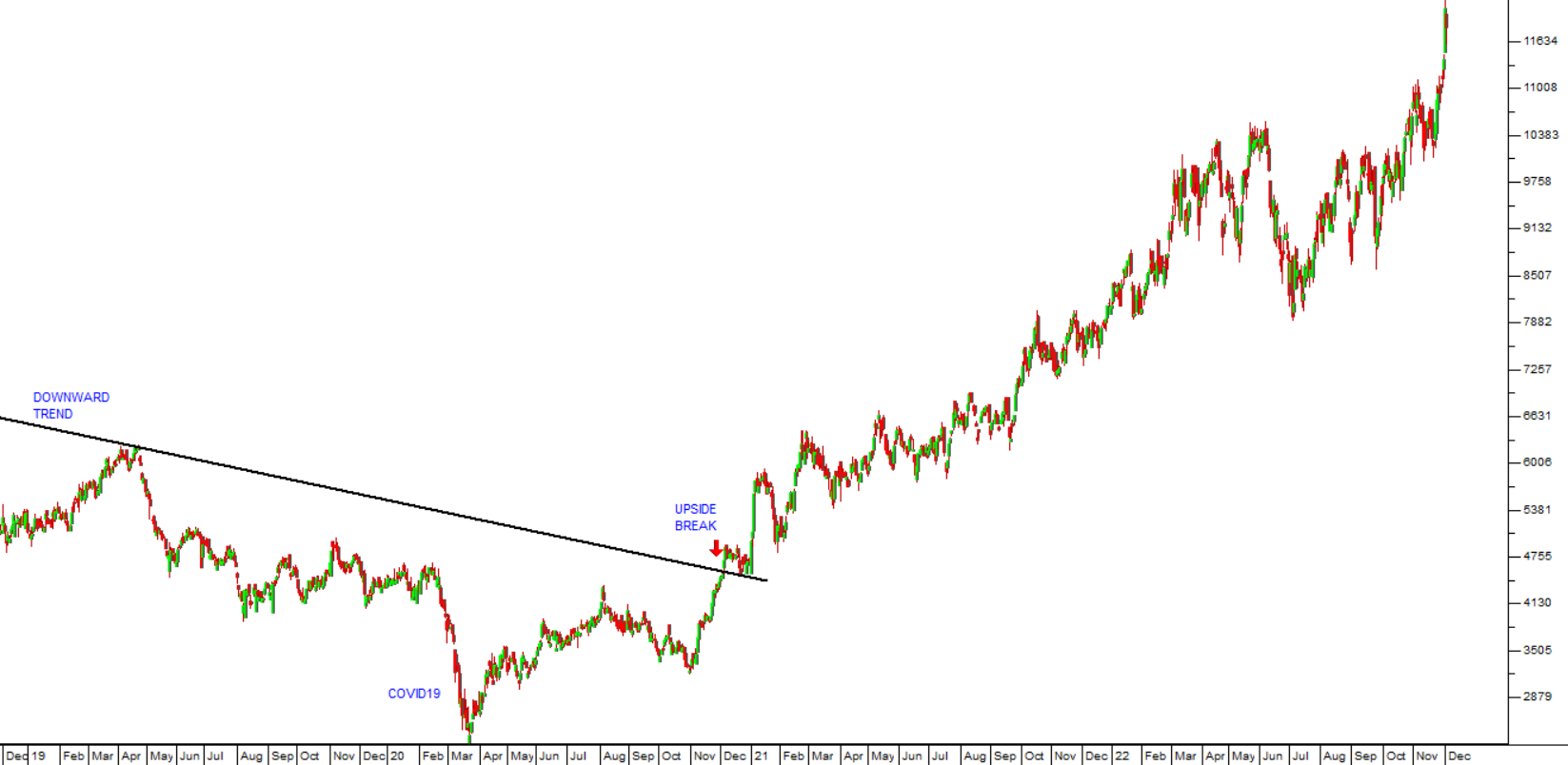

In its recent financials for the six months to 30th June 2022, Glencore made the following observation, “Global macroeconomic and geopolitical events during the half created extraordinary energy market dislocation, volatility, risk, and supply disruption, resulting in record pricing for many coal and gas benchmarks and physical premia, underpinning a $10.3 billion increase (119%) in Group Adjusted EBITDA to $18.9 billion". That was followed in the 3rd quarter report by the following statement, “Operational performance over the third quarter was impacted by a range of events including extreme weather in Australia, industrial action at nickel assets in Canada and Norway (since resolved) and the emergence of significant supply chain issues in Kazakhstan stemming from the Russia/Ukraine war". These statements give a good idea of the volatility and range of factors impacting on a diversified international mining conglomerate like Glencore. We originally advised investors to wait for a significant break in the share's price above its long-term downward trendline. That break came on 2nd December 2020 at a price of 4530c per share. Since then the share has risen to 11836c – a gain of 161,3% in two years. Consider the chart:

CAPCO (CCO)

Capco, which owns Covent Garden in London, is trading at less than half of its net asset value (NAV). In its recent financials for the six months to 30th June 2022, the company said, “There has been strong operational progress at Covent Garden with high occupancy levels and excellent demand across all uses. Leasing activity for the first half was 9% ahead of Dec 21 ERV resulting in a 5% valuation uplift". And then, in an update on the 4 months to 30th September 2022 the company reported, "Strong customer line up and new brands introduced to the estate including Mejuri and Hoka - High occupancy levels maintained with 3 per cent EPRA vacancy and positive footfall and sales metrics". To us it looks like this British property company may be turning the corner and certainly it is a very cheap rand hedge. Technically, it has recently made a “double bottom” at 1925c and looks ready for a new upward trend. Consider the chart:

ARGENT (ART)

Argent manufactures and beneficiates steel and aluminium into a variety of products for a wide range of industries in South Africa. In its recent results for the six months to 30th September 2022 the company reported turnover up 13,5% and headline earnings per share (HEPS) up 22,4%. Despite being in a strong upward trend for the past two years, the share is still trading at 60% of its net asset value (NAV) and on an extremely low P:E of 3,96. We regard this share as really good value at current levels. Consider the chart:

SOUTHERN SUN (SSU)

Southern Sun has been spun out of Tsogo and separately listed. We have felt for some time that the share is undervalued and a good buy. In its results for the six months to 30th September 2022 the company reported that even with occupancies of only 46% it was making a good profit. The company said, “Overall, the group’s trading results have improved significantly from the prior comparative period, however, this is in the context of the Delta wave of Covid-19 infections which was accompanied by provincial travel restrictions and alcohol bans, as well as the civil unrest and violent protests in KwaZulu-Natal (KZN) and Gauteng both of which occurred in the prior period”. Technically, the share broke up through its downward trendline on 22nd February 2021 at 178c. Since then it has moved up to 416c and still looks cheap to us. If it can get occupancies up to a more normal 60% then it should be highly profitable. Consider the chart:

OLD MUTUAL (OMU)

After Quilter, Brightsphere and most of Nedbank were unbundled, Old Mutual was left as an African financial services company with interests in South Africa, twelve other African countries and China. In a voluntary update on the 9 months to 30th September 2022 the company reported Life APE sales up 17% and funds under management down 6%. Gross written premiums increased by 12%. The company said, "Sales in the current period benefitted from strong issued sales across all channels and improved credit life sales in Mass and Foundation Cluster. Sales growth was also driven by higher group risk and annuity sales in Old Mutual Corporate as well as higher retail and corporate sales in Namibia". In our view this share is very cheap on a price:earnings (P:E) multiple of 4,74 and a dividend yield (DY) of 5,86%. The share appears to be in the process of breaking up through its long-term downward trendline. Consider the chart:

OMNIA (OMN)

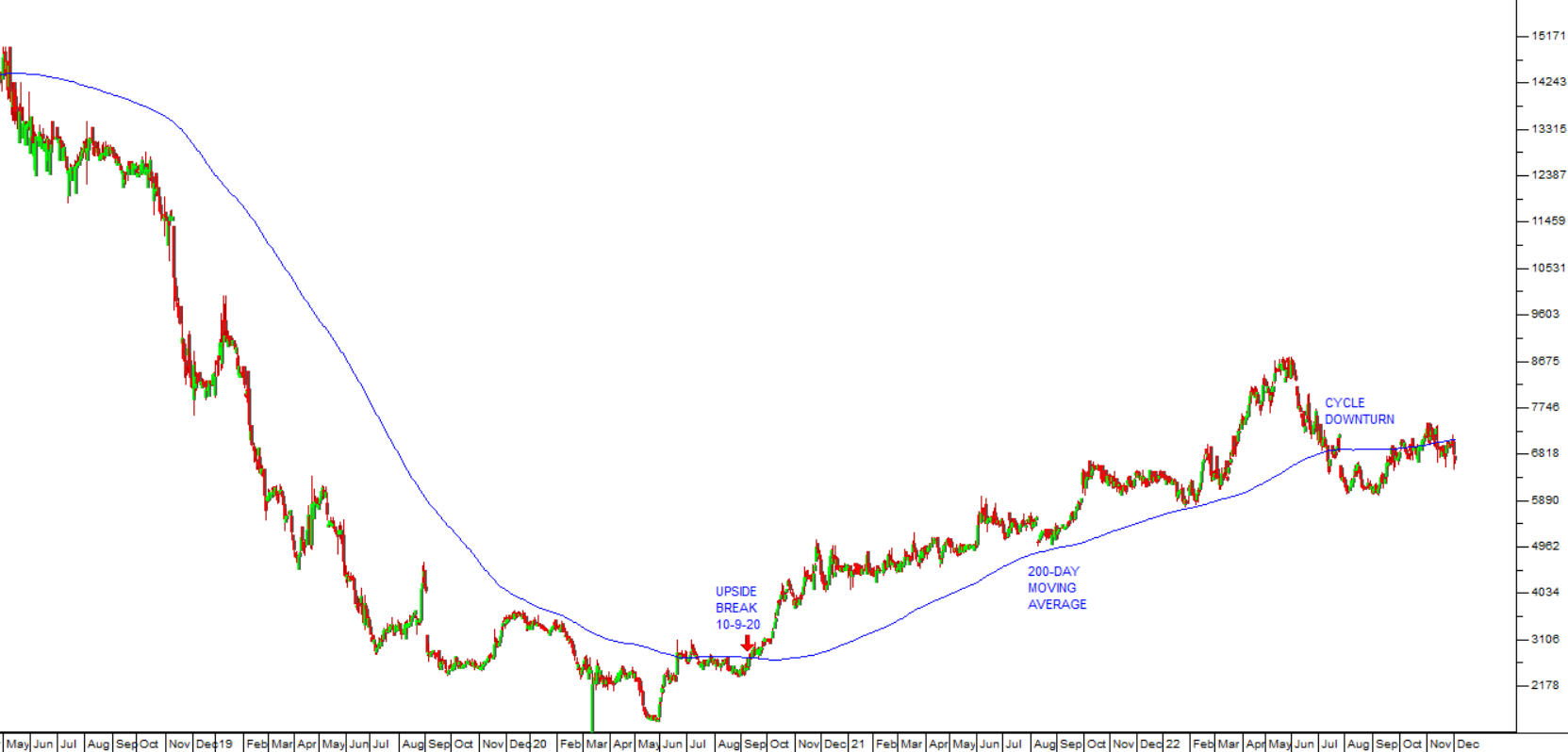

The chemical, fertilizer and explosives company, Omnia, produced results for the six months to 30th September 2022 with revenue up 19% and headline earnings per share (HEPS) up 32% - excluding Zimbabwe. During its recent downward trend, we advised applying a 200-day simple moving average and waiting for a clear upside break. That break came on 10th September 2020 at a price of 2747c. Since the share has moved up to 6749c and appears to be in a sustained upward trend despite a recent cyclical downtrend. On a P:E of 10,6, the share looks like good value to us. Consider the chart:

LEWIS (LEW)

Lewis remains one of the best opportunities on the JSE for private investors. Its most recent results for the six months to 30th September 2022 show revenue up 4% and headline earnings per share (HEPS) up 19,2%. The company still has an almost ungeared balance sheet and is trading on a multiple of 5,37 with a dividend yield of 6,74%. The company is extremely well-managed and is engaged in an aggressive share buy-back program. The directors believe that the shares are undervalued by as much as 30% and we think that is conservative. We have been recommending this share since it was R29 and today it is R49 and still represents good value. Consider the chart:

We wish you and your family all the best over the Festive Season.

The next Confidential Report will be published on the 1st of February 2023.

← Back to Articles