The Confidential Report - August 2020

US Economy

A picture is beginning to emerge of the performance of the US economy as the pandemic progresses. The second quarter’s statistics point to a very sharp contraction, as was to be expected, but the second quarter was probably the worst quarter. The US economy’s gross domestic product (GDP) shrank by 9,5% in the quarter – which was expected given the widespread lockdowns. The weekly unemployment claims which were around 200 000 before the pandemic, initially spiked up to over 6 million in March 2020, but have now settled back to a more stable 1,4m. Consumer spending fell by 10,1% in the quarter.

Big technology firms like Amazon and Apple have, however, been booming. Amazon’s online sales increased by 40%, resulting in its profit for the quarter doubling to $5,2bn. The company spent $9bn on expanding its warehouses and capacity because of increased demand. Apple too has made impressive gains with $11,2bn in profits in the second quarter. Sales of iPads and Mac computers were very strong and total sales were up 11%. Technology shares generally have been driving Wall Street back up. It appears that one of the enduring legacies of the pandemic will be a noticeable shift towards technology solutions and away from traditional methods. This can be seen in the “work-from-home” culture that is developing rapidly worldwide and at the same the “educate-from-home” approach to schooling. Offices are being made redundant and business meetings are being held online. These changes will bring with them far greater productivity in time.

From time to time, Donald Trump has been creating volatility in the market with his on-again, off-again trade war with China. On Wednesday and Thursday last week he managed to derail the S&P with tweets about sanctions on China, but then on Friday said he would not implement them – yet. Wall Street recovered rapidly towards the end of the trading day. Apple gained 5% on the day.

The S&P500 index is now just 3,4% below its all-time record high of 3386 made on 19th February – just under 6 months ago. Consider the chart:

The “V-bottom”, which we predicted back in March, is rapidly becoming a reality. It now seems almost inevitable that the S&P will pass that record high well before the November elections – which could have a bearing on the result. Technically, there is bound to be some resistance at the record high and so we should expect some “backing and filling”. There is also a small chance of a “double top”. We think that is unlikely, but until that record high is convincingly surpassed, we cannot know for sure.

Political

There can be little doubt that the pandemic has changed the political landscape in South Africa. The war within the ANC appears to have subsided somewhat in the face of this crisis, and Ramaphosa does not appear to be fighting for his political life quite as much as he was. Potentially, this opens the way for the kind of economic reform which has been made necessary by the virus and its impact on government finances. Tito Mboweni’s adjusted budget on 24th June 2020 was approved by parliament – but is it politically feasible? Only time will tell. The cutting of R230bn off government expenditure in addition to the R160bn which he already proposed in the February 2020 budget must mean a sharp reduction in the size of the civil service. We anticipate powerful union opposition, followed probably by considerable strike action before the dust settles on this. Perhaps some kind of compromise will eventually be reached, but the financial viability of the country depends on these cuts in government spending, so it will ultimately be a test of political will.

Clearly, the ANC is now bumping its head against the fact that the South African public lacks discipline – mainly because it has not really had to be disciplined since the ANC took over. This can be seen from the rampant flouting of the rules of the road and the fact that less than 4% of all traffic fines are now being paid. That collapse of the system to control and monitor road usage is a symptom of a generalised absence of discipline in all areas. At the same time, the Ramaphosa administration must recognise the inefficiency and ineffectiveness of its civil service after 25 years of nepotism, corruption and black economic empowerment (BEE) which has resulted in officials being appointed for reasons which have nothing to do with their competence. Clawing our way back from the current situation will be arduous.

Economy

The ratings agencies, Standard & Poors and Moodys have expressed similar doubts. They do not believe that Mboweni will be able to make the drastic cuts to government expenditure that he has committed to. The political implications will be substantial. In the past the ANC has proved incapable of making significant economic reforms because of the power of the union movement which consistently opposes such changes. But Mboweni would not have included this into the supplementary budget unless he had support from Ramaphosa. The economic situation following COVID-19 is drastic and calls for drastic action, but it remains to be seen whether Ramaphosa and his team have the political fortitude to see it through. Notably, no details have yet been given of exactly where the R230bn in spending cuts will be made. Obviously, there is a growing case for a planned and controlled quantitative easing (Q/E) program to help finance the government’s debt in these exceptional circumstances. We remain fairly certain that sooner or later the Reserve Bank will have to engage in Q/E.

GDP shrank by 2% in the first quarter of 2020. That is the third quarter in a row that GDP has fallen – before the impact of COVID-19. This was due in large part to the load-shedding which occurred during the quarter and which always has a strongly negative impact on GDP. Obviously the second quarter of 2020, during which the lockdown was at its height, is likely to be far worse. In fact, it seems probable that GDP will continue to shrink until the end of the year. Thereafter, depending on the progress of the virus, growth should begin again off a low base. And that growth should be fairly rapid because of the spare capacity which exists in the economy.

Perhaps the most comforting aspect of the Monetary Policy Committee (MPC) meeting was the fact that it did not significantly change its estimate of GDP in 2020. The forecast was for a fall of 7,3% compared to 7% previous forecast. This, of course, compares with private sector economists who have been talking about 10% or more. The Reserve Bank still sees positive growth in 2021 of 3,7% - clearly off a very low base. Governor Kganyago said that conditions in the economy had improved. We agree that GDP will shrink sharply this year, but we expect next year to be somewhat better than most economists are forecasting. The latest 0,25% cut in interest rates brings this year’s cuts to 300 basis points and leaves the repo rate at 3,5%. As the months go by, the accumulated impact of 3% lower interest rates will make those households with a mortgage bond far better off. In time, they will certainly begin to spend again reviving the economy. Of course, those who have lost their jobs are in a parlous situation. Their spending can be expected to shrink dramatically as they desperately try to re-establish themselves.

In an open letter to parliament 100 economists and academics have called for the supplementary budget to be rejected on the grounds that it does not allow for sufficient government spending to avert the COVID-19 crisis. Kuben Naidoo, deputy governor of the Reserve Bank, recently said in response that because of the mis-management of government finances over the years of the Zuma era, there was insufficient room for the government to do more than was in the supplementary budget. He said we could not allow our deficit to be more than the budgeted 15,7% of GDP because that would probably result in a default. He gave the example of Argentina which has recently defaulted on $65bn of debt. Then he made a key point “As surely as the sun will rise tomorrow, at a point we will have to repay the debt”. This point is not fully understood by many South Africans – that borrowing money and spending more now inevitably means repaying and spending less in the future. But every householder knows that if you are in debt, you cannot extract yourself from it by borrowing more and going on a wild spending spree – very much the opposite. Tito Mboweni, our esteemed Minister of Finance, says that we cannot borrow and spend our way out of the COVID-19 economic crisis. This is the populist approach which is being punted as an alternative to his restructured budget of 24th June 2020.

The fact that the Reserve Bank bought about half as many bonds in June (about R5bn) as in May shows that the economy is normalising. At this stage, the Reserve Bank holds about R36bn worth of government bonds and it has indicated that it intends to sell these back into the market in time. The Reserve Bank has indicated that it does not need to engage in quantitative easing (Q/E) at this stage because it still has other monetary policy tools available to it. This, in itself, is positive because Q/E should always be the last resort and it shows that, despite the desperate state of the economy, the Reserve Bank can still provide support. If the government can get through this period without resorting to Q/E we will be suitably impressed, but we are not hopeful.

The renewed clamp-down on alcohol sales and the imposition of a curfew should help to reduce the strain on the healthcare system as it struggles to cope with a rising number of cases in Gauteng and other provinces. It has obviously prejudiced the liquor industry which is calling it a “disaster” and saying that as many as 1 million jobs are at risk. They claim that they lost R18bn in the first lockdown and that this latest move would stimulate the illegal trade in alcohol and further reduce tax revenue. It will also destroy thousands of businesses which depend on alcohol sales to survive. The liquor industry is asking for each of the 34500 taverns (read shebeens) in SA to be given a once-off R20 000 to get through the period.

The opening sentence in a Business Day article by Chris Gilmour on 15th July 2020 reads as follows: “The economic fallout from the coronavirus pandemic is likely to be far worse than originally forecast both globally and in the SA context”. This is typical of the sensationalist approach taken by the media both here and overseas. In last month’s Confidential Report, we discussed the dichotomy between media reporting and the strong upward trend on Wall Street. Clearly, investors do not agree with journalists about what the future holds. The S&P500, on the day before Gilmour’s article, soared by 1,34% to reach a point just 5,6% below its all-time record high of 3386 made on 19th February 2020. It has subsequently risen further. It certainly does not appear that investors are expecting the economic fallout to be “far worse than originally forecast” as Gilmour suggests. Very much the opposite. So as a private investor, you need to consider which of these two opinions you think is correct. Our view is that the media is writing sensationalist material because, in their business, that sells. Good news does not. But then, unlike investors, they do not have billions of dollars riding on whether they are right or wrong. We believe that the investors are right and that both the world economy and the South African economy will be doing well by next year.

The consumer price index (CPI) fell to just 2,1% in May 2020 – the lowest it has been for many years and well below the lower limit of the Reserve Bank’s target range from 3% to 6%. It is also far below the Reserve Bank’s forecast of 3,2% for the year. Clearly, this did encourage the monetary policy committee (MPC) to cut rates by a further 0,25%. We think that this is probably the end of the rate-cutting cycle and that rates will probably stabilise now before moving up again as the economy begins to recover – probably in 2022.

The IMF has approved the loan which South Africa applied for of $4,3bn which is about R70bn. The interest rate is just 1% - which compares to the 9% which the government is currently paying on long-term government bonds. The loan will help, of course, but it is not nearly enough to deal with South Africa’s fiscal problems. In return, Treasury has promised to look for consensus on a “debt ceiling” to limit the extent of future government debt. Establishing a legal debt ceiling for the government is an existing DA policy. This year, the tax shortfall is expected to be over R300bn alone. Many economists (including Bank of America) have said that South Africa is headed for a “fiscal cliff” – a position where it will be unable to repay the interest on its debts, let alone the capital. We believe that, given our extremely low inflation rate, the government should seriously consider short-term quantitative easing (Q/E) and literally print the money it needs to deal with this crisis.

Retail sales in April fell by 50% compared to 2019 but recovered significantly in May to be only 12% below May last year. June should be even better because the country moved to level 3 lockdown. But not all the news is bad. In addition to the 3% which has been cut off interest rates, the price of petrol has fallen quite sharply and promises to fall further as the rand strengthens. Right now, consumers are naturally reluctant to spend money on anything which they do not absolutely need. They are conserving cash and repaying debt. In the short term this means less sales, but in the longer term it means a financially stronger consumer. Our view is that the economy is recovering more rapidly than most economists expected and that it will continue to do so. Certainly, the Reserve Bank appears to agree with us given their forecasts for this year and next year. The pandemic has destroyed many marginal businesses in the economy – particularly those with high debt levels (like Edcon). The better-managed and capitalised businesses that are left will rapidly take up the slack as the economy recovers. This is a normal process in a capitalist economy, and it has significant longer-term benefits.

The decision by Tshwane (Pretoria) municipality to give in to populist union demands (Samwu) for a 6,25% increase will have significant ramifications across the country. The increase is more than three times the official inflation rate of 2,1% and is now being touted by other municipal unions as the benchmark for union demands. At this time to be granting pay increases which are so far above inflation makes no economic sense – especially for the majority of municipalities, many of which are close to bankruptcy and behind on their payments to Escom. The Tshwane increase will cost that municipality an additional R45m a month which they can ill afford. If Tshwane’s lead is followed by other municipalities it will quickly gobble up the additional R20bn which President Ramaphosa allocated to them to fight COVID-19.

The Bankserv Africa take-home pay index shows that South Africans took home about 21% less money in June 2020 than in the same month last year. About 30% of the index consists of government employees who (absurdly) suffered no loss of income – so the impact on the remaining private sector employees was commensurately higher. The index covers about 36% of the workforce – thus it is a very representative sample. This loss of income is the true and long-term impact of COVID-19 and will feed directly into lower consumption expenditure. That, in turn, will impact company results over time, especially in the retail sector. Many people have also lost their jobs. Estimates are of between 2m and 3m job losses. Obviously, as the economy re-opens and business moves back towards normality, we can expect a fairly sharp recovery. Many people who lost their jobs will get them back as the spare capacity in the economy is brought back into production. The impact of the virus on our economy has, however, been substantial.

The allegations of widespread corruption in the government tenders, which have been issued to obtain personal protective equipment (PPE) for use in the fight against COVID-19 as well as corruption in the distribution of food parcels, highlight the problems of decades of systemic corruption within the ANC and the use of tenders to make excessive payments to politically connected people. In fact, COVID-19 has exposed the weakness of the government and its relative inability to enforce and implement its decisions because of a generally corrupt and incompetent civil service. Over the nine years of Zuma/Gupta control, the civil service was populated with nepotistic appointments and grew to an excessive size while at the same time becoming less effective. Now we have a civil service that is at least 30% too large, heavily over-paid and far less able to implement government policy.

The decision by Escom to take control of the bank account of Maluti-a-Phofung Municipality is a significant step in the recovery of more than R30bn owed by municipalities to Escom. Since Andre de Ruyter took over as CEO, Escom has been load shedding mainly in those areas where there are a high level of illegal connections and it has been pursuing municipalities for its outstanding debts. Escom obtained a court order to seize Maluti-a-Phofung’s bank account in 2018, but nothing was done until now. It is clear that de Ruyter is determined to fix the broken Escom debt collection system and ensure that everyone who gets power has to pay for it. In the long term, this is the beginning of a solution to the Escom problem.

It appears that Denel is going down the same path as SAA. It received a R1,8bn bail out in 2019 followed by R576m in 2020 but is still cash-strapped and only paying about 40% of salaries. The union is instituting a court action to force it to pay salaries, but in the absence of support from the Treasury and with its CEO resigning last week, it looks like Denel is going to have to apply for business rescue or liquidation. Tito Mboweni cannot give more bailouts to state-owned enterprises – nor should he. There is no good reason for the government of South Africa to be running an arms manufacturer. The government (like any company) needs to decide what business it is in.

The Rand

Our view on the rand is that it is considerably under-valued, and we anticipate a strengthening trend against the US dollar for some time to come. Since the last Confidential Report, the rand was on a steady strengthening trend until Donald Trump, in his effort to draw attention away from his disastrous management of the pandemic, decided to revert to tweeting about his trade war with China. That caused a two-day sell-off on Wall Street and a second shift in investor sentiment back to risk-off. Trump then inexplicably reversed his position on Friday – which enabled Wall Street to recover substantially, but the rand is still showing the impact of increased international nervousness.

In this chart you can see the steady strengthening trend in the rand against the US dollar which has been going on since the “double top” in April at the height of COVID-19 fears. That trend has been broken, temporarily in our view, by Trump’s latest tweets. However, we believe that the underlying trend will re-assert itself soon and the rand will continue to strengthen.

Commodities

Mining output decreased by about 30% in May 2020 compared to May 2019. This is a significant improvement on April’s 50% decline, obviously because the country moved to lockdown level 4 in May. On a seasonally adjusted basis mining production was 45% higher in May than in April. June month should be even better as full production was allowed on level 3. As mining resumes and output levels increase the benefits will flow through to the broader economy. South Africa’s economic prosperity has always depended on our exports of raw materials. Our economic recoveries are inevitably export-led for this reason. So, the steady recovery in mining is very positive.

One of our clients, Mr. Koot Jordaan, drew our attention to the fact that the rand price of silver, which has been underperforming gold since 2011, may be making an upside breakout.

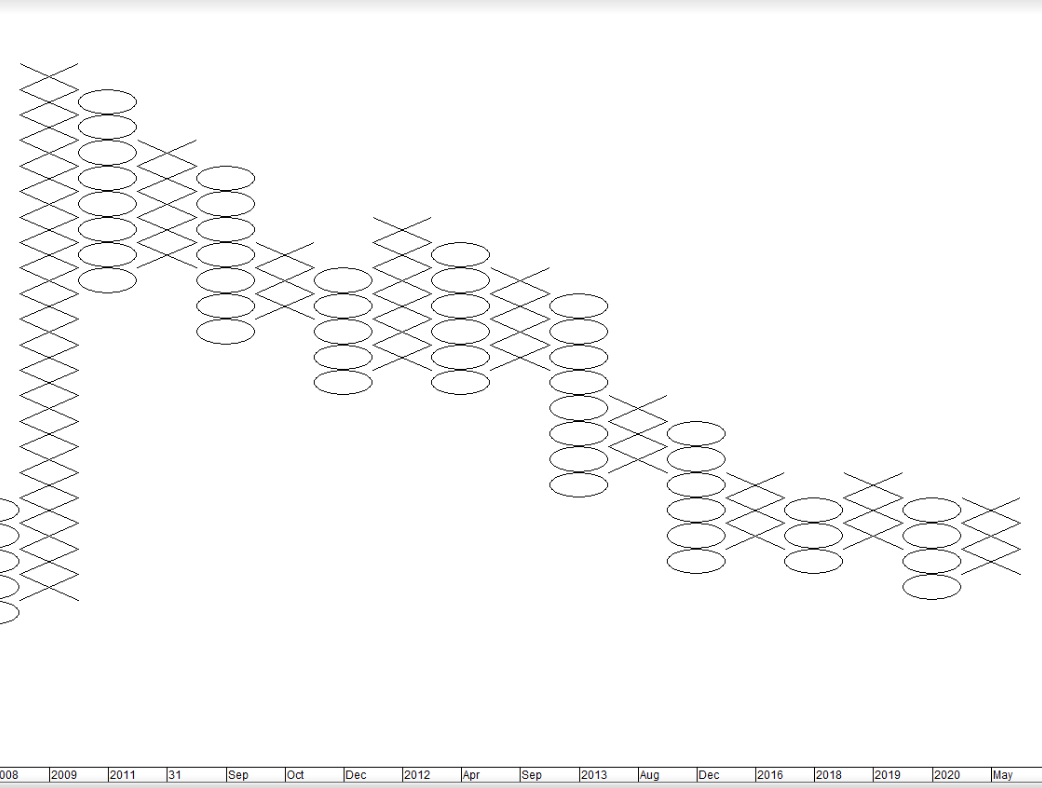

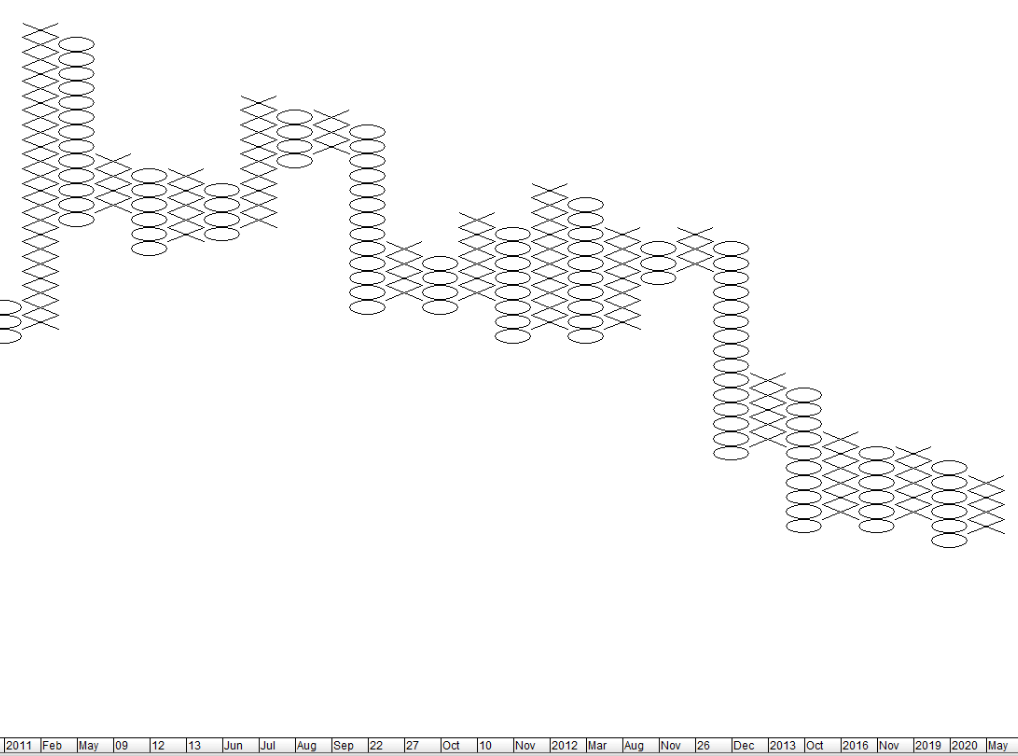

Mr. Jordaan suggested that silver in both rands and US dollars had been moving in an extended sideways pattern and might be due for an upward break. Consider the charts:

Silver in US dollars

(We regard the downward break in March 2020 in the US dollar chart as an aberration.)

Silver in rands

You can see here that silver has been moving sideways in US dollars since September 2014 and in rands since 2011. Both charts also show an upside breakout in the last week or so.

Sideways markets like this are periods of consolidation. The price is “backing and filling” while it waits for new direction. The longer the sideways pattern continues, the further up the price will go once there is a clear upside breakout. That is the basis for the horizontal count method of point & figure (P&F) charting.

If you are unsure about horizontal counts in P&F refer to our article No. 49 “Upside Target” published in December 2016, https://www.pdsnet.co.za/

Using Metastock, we tried various box sizes to find an unbroken horizontal count. The following charts show our results:

Silver in US dollars

Silver in rands

In both charts you can see there is an extended sideways pattern in the most recent years with an unbroken horizontal count of 6 in each case.

In US dollars, the horizontal count gives an upside target of $45.92 – more than double its current price.

Mr. Jordaan points out that historically it is normal for gold to move before silver. So, it is entirely possible that in the next few weeks, silver will catch up with gold as it has done in the past.

The only problem is that while both the rand and the US dollar line charts show an upside break, neither yet shows that break in P&F – which is necessary for the horizontal count target to be valid. Valid horizontal count targets in P&F are more than 70% accurate and usually conservative in our experience.

Companies

FOCUS

The legendary management consultant, Professor Philip Kotler, said that the most important question that a business can answer is, “What business are we in?” This question is very important because it determines the company’s area of focus. The secret of business is to do one thing and do it exceptionally well. Companies which lose focus inevitably fail or produce terrible results until they can regain their focus. Perhaps the best current example of this is Edcon. This company was ostensibly in the business of retailing clothing and yet in 2002 it paid R141m to buy CNA. There does not seem to be any logic to this decision. What possible synergies can there be between CNA and Edcon? The only thing that they have in common is that they are both retailers – but the products that they retail are as different as chalk and cheese. Now Edcon has finally been put into business rescue and the business rescue practitioners have sold CNA for R1 (with all its debt) to a consortium of management. And that raises the issue of exactly what business the new owners of CNA think they are in. Originally, CNA was the central news agency that sold newspapers, magazines and cards. But today it is very difficult to know exactly what they are trying to do in that shop. Are they a sweet shop? Are they a computer shop? Are they a music shop? Do they sell books or stationery – or perhaps toys? Nobody seems to know. In fact, CNA is probably the least focused retailer in South Africa – which accounts for its relative lack of success. It will be interesting to see whether the new owners who are also the previous management can focus the business.

BANKS

We would like to stress again that the major banks are currently very cheap, and you should definitely look at buying some of the high-quality blue-chip shares before they recover. The banking index (SAPY) is trading on a P:E of just 6,47 – which is as cheap as it has been since the 2008 sub-prime crisis. The banks generally are far better capitalised than they were going into the 2008 crisis. For example, Nedbank, the weakest of the big four banks, says that it had 8% in tier 1 capital in 2008 whereas today it has closer to 11% - a massive difference. In our experience, once confidence returns to the institutional fund managers, they will be big buyers of banking shares and will drive the P:E of the SAPY back to more normal levels around 12. That represents a way for private investors to make a substantial gain (about 75%) over the next few years with almost no risk. It is also notable that Allan Gray, one of the largest fund managers in South Africa with R518bn under management, has begun buying up Standard and FNB shares.

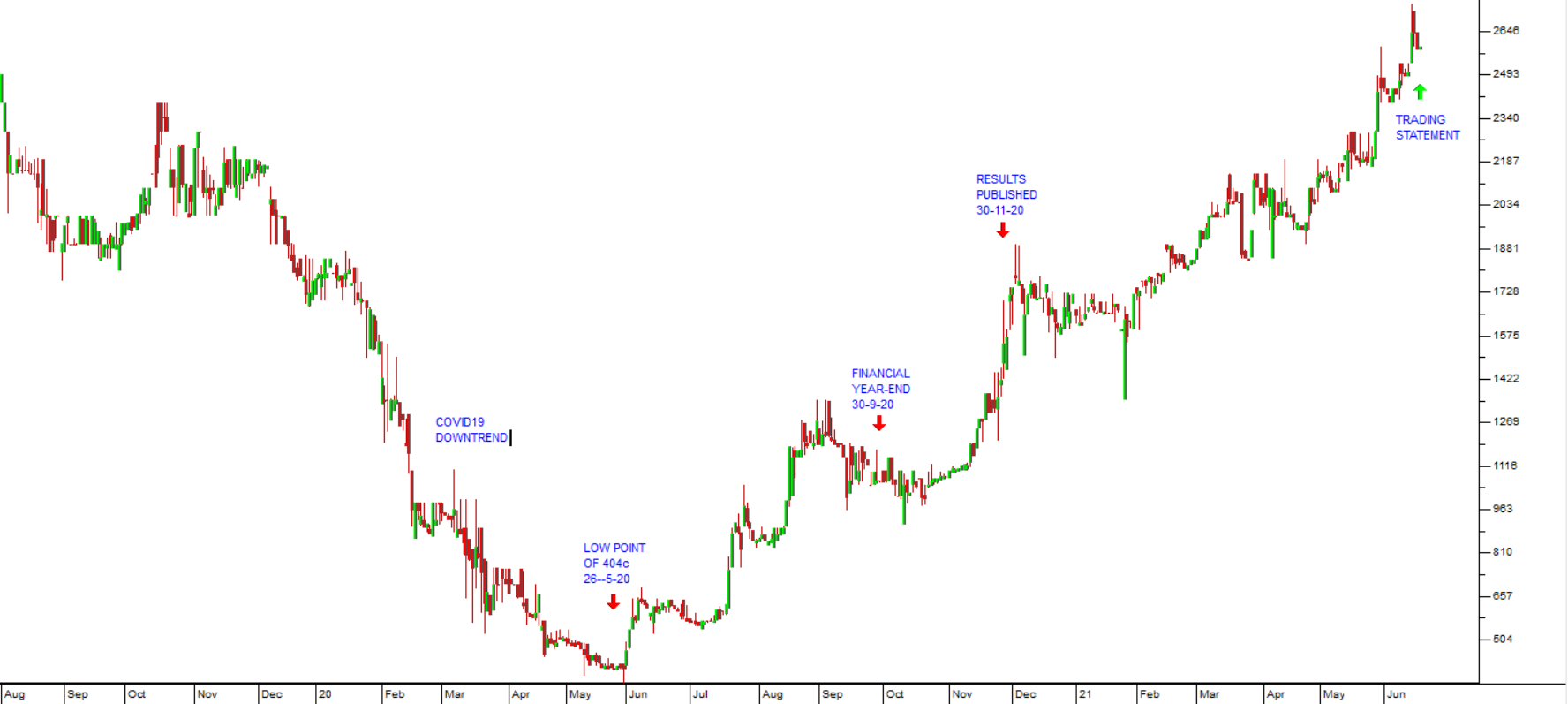

STADIO

One of the companies that is benefiting from COVID-19 is the tertiary education provider, Stadio. In its most recent financials for the year to 31st December 2019 the company reported that turnover had increased by 29% and student enrolments by 7%. Then in a trading statement for the six months to 30th June 2020, the company said that enrolments were up by 10% to over 31000 – of whom about 25000 are distance learning students. This share has previously been the most highly rated share that has ever traded on the JSE – reaching a price: earnings multiple (P:E) of as much as 300 in September 2018. This was because of its “blue sky” potential to extend and expand its business almost without limit. The share price has come down to a much more manageable P:E of around 16 at which level it looks relatively cheap. We believe that Stadio will benefit directly from the post-COVID-19 period because there will be an emphasis by consumers on obtaining higher education to improve their earning capacity and their ability to work from home. Consider the chart:

Here you can see the long-term downward trendline and the upside break which occurred in June 2020. We believe that this could be the beginning of a new upward trend.

MTN

This is the second largest cell-phone provider in South Africa (after Vodacom) but the largest in Africa. It has operations in 21 countries with Nigeria, Iran and South Africa being the largest. In the past it has had some difficulties with the authorities, especially in Nigeria and had to pay a $1bn fine in that country. But in the post-COVID-19 period MTN should be one of the JSE-listed companies that does well because it supplies data – and data is going to be increasingly used as more and more people work from home and meetings are held online. There is also a massive and growing use of data for entertainment. Technically the share has fallen from a peak of R260 in September 2014 to a low of R30 in March this year. From there it has begun to climb steadily. But it is still trading close to its net asset value of R46 and looks like a good buy to us. Consider the chart:

OBV

In last month’s confidential report, we drew your attention to the importance of following the On-Balance Volume (OBV) indicator as a mechanism for highlighting and exploiting insider trading. In that report we gave the example of Labat which had climbed 36,7% in the 5 weeks since we alerted you. In this report we draw attention to three more examples of OBV signals that would have proved highly profitable:

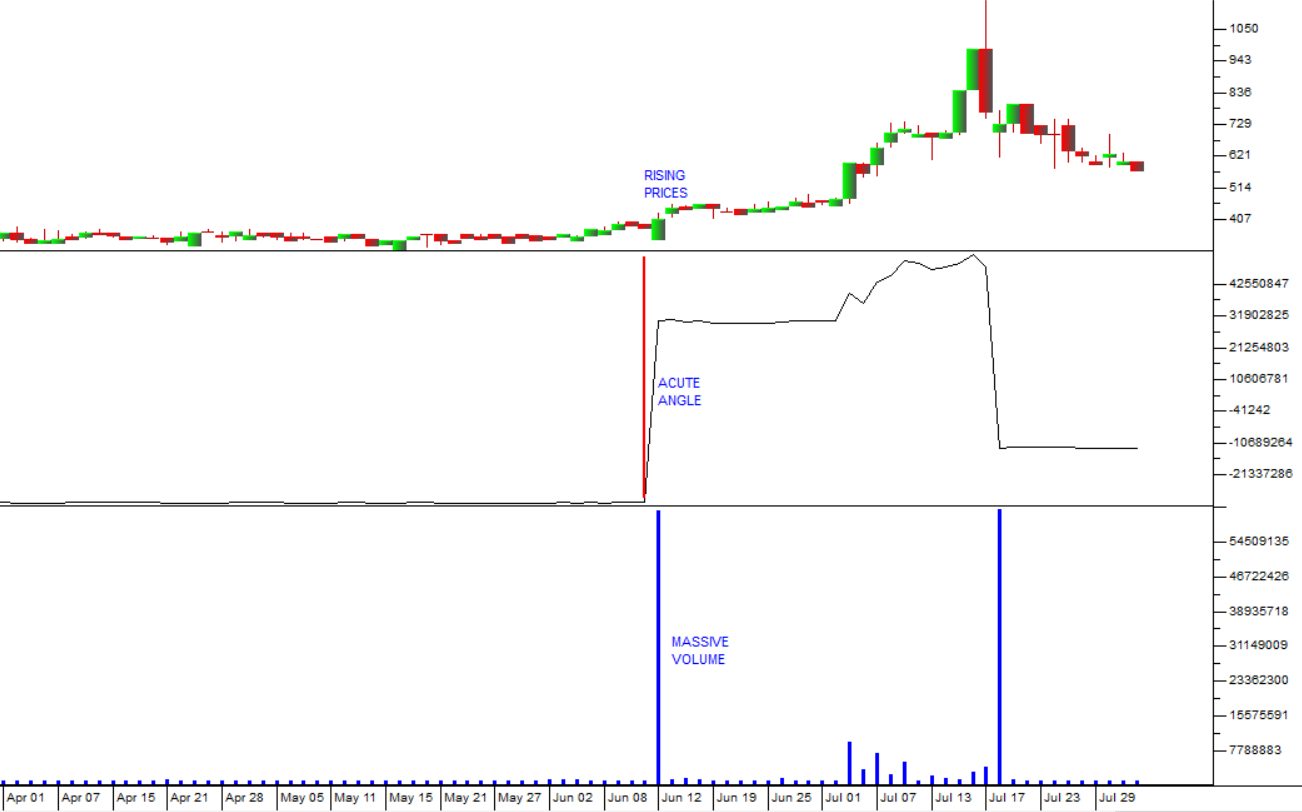

QUANTUM FOODS (QFH)

Here you can see the jump in the OBV (middle chart) which began on about 11th June 2020 when the share closed at 375c. The excitement has been caused by a possible take-over – something that the insiders clearly knew about before everyone else. The volume spike combined with a small increase in price showed that the insiders were quickly mopping up all loosely held shares in anticipation of a major move. Today the share is trading for 702c – a gain of 87% in just 18 trading days. So, you should always keep an eye on OBV.

INVICTA (IVT)

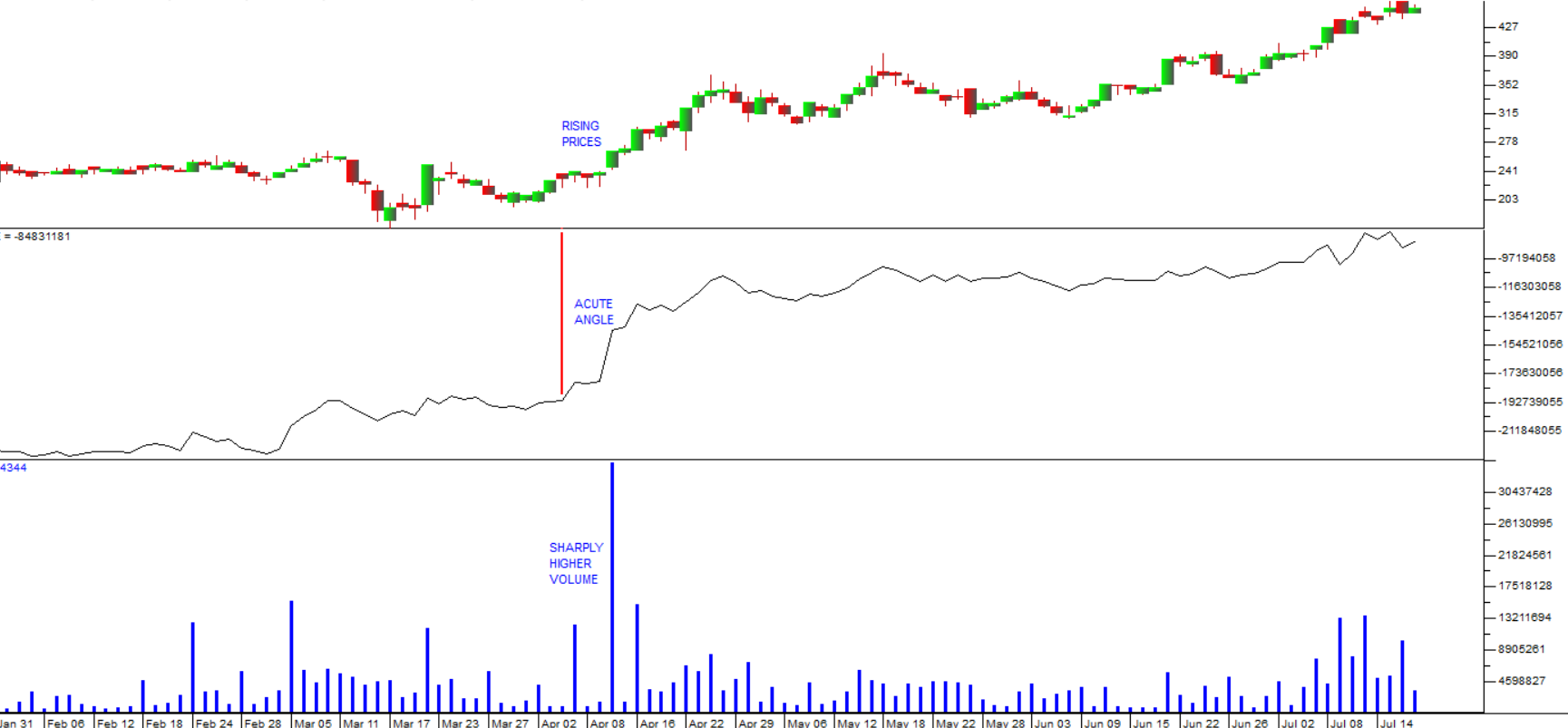

In our article of 20th July 2020 (“On Balance Volume”) we drew your attention to three shares (Labat, Pan African and Quantum) which had given clear OBV buy signals before rising sharply. Invicta offers a fourth example. This company is controlled by Christo Wiese and has been in the process of paying down its debt of R2,2bn to more reasonable levels. On 20th July 2020 it announced the sale of three of its subsidiaries for a total of R607m in cash – which will be used to reduce its debt. From a technical perspective, however, the company gave a clear OBV buy signal on 5th June at 644c per share when it had sharply higher volumes and slight increments in price. Consider the chart:

You can see here the classical “acute angle” buy signal given in the OBV chart (the middle chart). You can also see that prior to that date, the volumes were low and the OBV had done nothing. This shows the validity of Joseph Granville’s assertion that “volume leads price” – in other words a sharp increase in volumes accompanied by small increments in price usually come before a sharp rise in prices. Since giving the OBV buy signal, the share has risen to 884c – a rise of 37%.

PAN AFRICAN RESOURCES

Pan African Resources is planning to build a 10mw solar power plant to provide energy for its plant at Evander. This project will cost R140m and take a year to build. The company estimates that it will pay for itself in 4 years and thereafter supply electricity more cheaply and more reliably than Escom. They are also looking at a second plant at Barberton. This is clearly the way that businesses are going now. They are building their own power plants to get away from Escom. This will obviously reduce the load on the grid, but it will also mean that Escom has less and less customers for its expensive and unreliable electricity. In our view, Escom is a dying operation. The only real question is how long it will take.

This share is Pan African, and you can see here the same sort of pattern of rising prices accompanied by a large increase in volume leading to a sharp upward move in the OBV.

← Back to Articles