The Confidential Report - November 2025

5 November 2025 By PDSNETAmerica

Amazon’s strong results caused the share to rise 9.6% on Friday and lifted the S&P500 index as investors celebrated the announcement that its cloud computing unit's revenue grew by 20% in the third quarter. CEO, Andy Jassy said that Amazon Web Services (AWS) is "growing at a pace we haven't seen since 2022" and that there was strong demand for core infrastructure and AI. The company has announced plans to cut 14000 jobs as AI adds efficiencies and makes some functions redundant. Other tech shares also climbed, with Tesla up 3,7% and Netflix up 2,7%. The market is still adjusting to Jerome Powell’s remarks on Wednesday following the monetary policy committee’s (MPC) decision to cut interest rates by a further 25 basis points. Powell said that the Fed would not necessarily cut rates again in December – taking some of the wind out of investors’ sails. Earlier in the week Nvidia produced strong results saying that the AI market had “turned the corner” and announcing a series of new partnerships. Nvidia became the first share in the exchange’s history to reach a market capitalisation above $5 trillion. Apple also increased its market capitalisation to above $4 trillion.

In our view, the rising US stock market is in a similar place to where it was in July 1998. At that time there was immense excitement around the development of the internet. That resulted in a strong upward trend in the share market, and especially in those shares that were directly involved in the internet. The possibilities for increased productivity and profits arising from the internet seemed almost limitless and investors piled into any internet startup that managed to list. In effect we had a runaway new listings boom.

Obviously, the level of investment eventually became too much so that the relationship between share prices and the profits of the companies which they represented broke down. Right now, a similar thing is happening with artificial intelligence (AI). Nobody really knows what the impact of AI will be on the long-term profitability of S&P500 companies – but everyone is enormously optimistic – so share prices, and especially those in the NASDAQ are making new record highs on a regular basis. The level of investment in AI may be becoming excessive and that makes some kind of a market correction more and more likely.

This can perhaps best be seen by some of the circular transactions that are now starting to take place within the AI industry. Nvidia and Open AI did such a transaction recently where Open AI is buying chips from Nvidia but it can’t afford to pay for them – so Nvidia invests $100m with Open AI. Open AI then uses the funds to pay for the chips that it buys from Nvidia. This deal is very similar to a deal which Open AI did with AMD to buy their chips with money that it got from buying AMD shares and then profiting from the rise in AMD shares when the deal to buy its chips was announced.

The point to understand is that after the 1998 internet bubble popped, share prices collapsed, but the technology on which it was based persisted. The internet today is stronger and better developed than it has ever been and it is certainly impacting the profits of all companies around the world. So, AI definitely will certainly survive the current bubble – but right now there seems to be a serious over-investment in AI which is becoming circular, self-fulfilling and hence probably not sustainable. We are becoming more and more concerned that there may be a 1998-style crash in tech share prices at some point within this bull trend.

As far as the stock market is concerned, in my experience, US government shutdowns do not have a major impact. There have been 19 shutdowns over the past 50 years which have lasted for an average of 8 days. Generally, a shutdown of longer than 2 weeks is seen as damaging to the economy and may reduce growth – and it might impact on the monetary policy committee’s (MPC) decision regarding interest rates. Both Republicans and Democrats are motivated not to allow the shutdown to continue for too long because that begins to impact their performance in the polls. Already Americans are being affected by cancelled flights as air traffic controllers are working without pay.

This government shutdown is now the second longest in history at more than 30 days. This is getting close now to the longest shutdown that occurred during Trump's first term. That shutdown lasted 35 days. So far, the shutdown has not really impacted the lives of Americans that much. However with effect from 1st November 2025, that changed because that was the date when many of them had to renew their health insurance under the Affordable Care Act (ACA) in many states. Of the 24 million people who typically select open enrolment, 22 million could see their premiums more than double on average. Some people will have to face much steeper increases. For example, the average 60-year-old couple making $85,000 a year will see their annual premiums increase by more than $22,600 in 2026. Clearly, this will impact the upcoming mid-term elections next year since more than 57% of ACA marketplace enrolees live in Republican-controlled states. The Republicans are refusing to extend the subsidies under the ACA which make this type of health care accessible to those individuals.

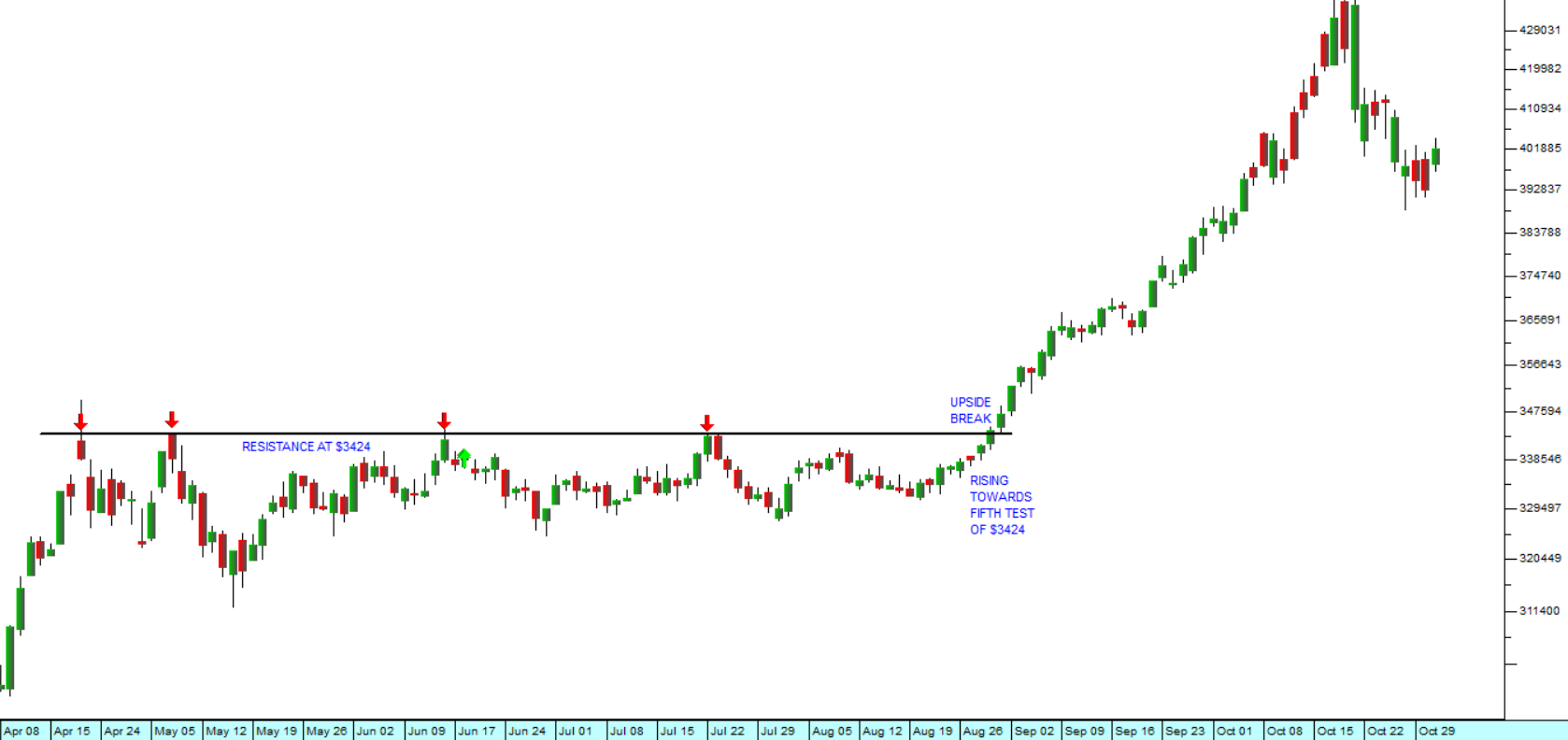

Trump’s knee-jerk reaction to China’s increased control over its rare-earth elements industry was to impose 100% tariffs on US imports from China. China defended its position on its rare earths industry but did not impose counter-tariffs. Trump’s new tariffs had a major impact on Wall Street, causing the S&P to fall 2.7% in a single day – however, we always believed that the move was an over-reaction and would be reversed as investors sought to “buy the dip”. In general, Trump’s ability to exert even a medium-term impact on Wall Street is declining. Investors have come to realise that he almost always backs down – and the issue with China has proved to be no exception. The great bull trend continues to be mainly driven by the spread of AI solutions throughout the world economy. Consider the chart:

As you can see we are currently in the middle of the fifth mini-correction in the past six months on the S&P500. None of them has taken the market down by more than 3%. In most cases the market has recovered quickly and gone on to make a further series of new all-time record highs. Investors are now intent on “buying the dip” and taking a quick profit.

The strong quarterly results, especially from the “Magnificent Seven” companies have combined with the reduction in interest rates to push investor enthusiasm to new heights. None of that should blind you to the growing risk of a larger correction as AI investment accelerates.

Your best defence remains a strict stop-loss strategy. Obviously, it is great to participate in a great bull market, but as the market goes higher you need to appreciate that the probability of a sharp correction increases and prepare yourself accordingly.

Ukraine

President Zelensky’s October meeting with Trump in Washington was a success according to the Ukrainian leader – probably mostly because, as a master of diplomacy, he focused on flattering Trump and appealing to his indomitable ego. Clearly, Zelensky has learned from his previous acrimonious encounter with the US leader and used his charm to get as much as possible from the meeting. Ukraine needs ammunition for the US patriot missile system and the Tomahawk cruise missiles to continue and extend their attacks on Russian oil infrastructure. They also need more aid from the US and tighter economic sanctions on Russia – so Zelensky is riding the wave of Trump’s current disillusionment with Putin’s stubborn refusal to come to the negotiating table. Of course, everyone is aware of just how fickle Trump can be, but at this stage Zelensky appears to have the upper hand in international diplomacy.

The damage to Russia’s oil infrastructure continues with some analysts estimating that as much as 38% of their production capacity has been taken offline either temporarily or permanently. At the same time, the war on the front lines has become a dangerous cat-and-mouse game of drones and counter-drones which relies on keeping the exact position of troops and equipment hidden. As soon as the location of even a single individual soldier is known the other side can immediately call in a precision artillery strike or take him down with a “first person view” (FPV) drone. Land drones are also now being used to resupply frontline troops with food, medical supplies and ammunition – as well as for the evacuation of wounded soldiers.

Drones are now being used to destroy other drones in a battle of innovation and technology with AI becoming a major factor. More and more, the individual drones are becoming less reliant on human guidance systems and capable of making their own battlefield decisions as well as coordinating with other drones in combined attacks. The effective range of drones and their higher payload also means that they are becoming a very reliable and more effective replacement for expensive long-range missile systems. Drone swarms are now being used in combined attacks to disable or distract air-defence systems in order to allow other drones to destroy high-value targets. Russia’s oil infrastructure is dispersed over a wide area making it almost impossible to defend effectively against drone attacks. Oil is Russia’s primary source of cash to continue fighting the war – and of course, fuel is essential for the continued effectiveness of their frontline troops.

In our view this war cannot continue for much longer. Both sides are exhausted and some sort of decisive conclusion appears inevitable. The odds definitely favour Ukraine because of its continuing support from European countries most of which have economies which dwarf the Russian economy. In the end all wars finally come down to a matter of economics – who can last the longest. And in that battle Ukraine seems to have the upper hand.

Economy

The Consumer Price Index (CPI) increased to 3.4% in the year to the 30th September 2025 – up from August’s 3.3% and up 0.2% month-on-month. Core inflation (excluding food and fuel) was also up slightly at 3,2%. Economists expect inflation to go as high as 3.8% later this year. These figures are above the Reserve Bank’s recently imposed inflation target of 3%. Both housing and utilities, as well as food and non-alcoholic beverages increased by 4,5%. Meat rose by 11.7% while dairy, oils and processed foods were cheaper. Fuel prices fell by 2.2% and 0.3% in the month. The Bank’s target of 3% is ambitious but generally perceived by economists and the business community as positive. The low level of inflation continues to boost take-home pay and, in turn, consumer spending.

The Reserve Bank says that the imposition of tariffs by the United States on South Africa could reduce gross domestic product (GDP) growth by as much as 0.4% and result in the loss of 40 000 jobs. A significant share of South African exports are now subject to tariffs averaging around 30%. South Africa’s eligibility for duty-free access under the U.S. African Growth and Opportunity Act (AGOA) has been revoked. Many agricultural and manufacturing products are affected. Aluminium and copper products are facing tariffs of 50%. Coal and platinum group metals (PGM) are excluded. The motor manufacturing industry faces the worst consequence making them less competitive in US markets. Agriculture will also be severely affected, losing ground to key competitors like Argentina, Peru, Chile and Australia whose citrus exports are tariffed at 10%. The Reserve Bank cut its growth forecast to 1.2% for 2025 – down from a previous estimate of 1.7%.

The international ratings agency, Moody’s, is expecting growth in South Africa to reach 1.6% in 2026 – which is probably the most optimistic forecast of future gross domestic product (GDP) growth. Moody’s optimism stems from reforms in electricity generation and logistics and from greater involvement of the private sector to provide capital and skills. Moody’s projected level of growth is still way below the average growth in sub-Saharan Africa of 5% and the government of national unity’s (GNU) objective of 3%, but it is considerably better than the growth rates of around 1% which have been a feature of the South African economy for the past decade. Moody’s says that stronger growth will enable the government to reduce the national debt to more sustainable levels. In our view, the higher level of growth is mostly due to the steady improvement in the real take-home pay of most households – largely as a result of the low inflation rate and falling interest rates.

Retail sales increased by 2.3% in the year to 31st August 2025. Hardware, paint and glass were up 8.1% - showing that consumers are beginning to spend on home improvements. Low inflation has increased real take-home pay, which is now feeding into higher retail sales. The drop in interest rates is also a factor providing additional income for bondholders. In our view, the economy is gradually improving as the impact of economic reforms introduced by the government of national unity (GNU) take hold. We expect this pattern to continue, especially if the Democratic Alliance wins control of key metros in next year’s municipal elections. The International Monetary Fund (IMF) has increased its prediction for gross domestic product (GDP) growth to 1.1% this year. BankServ’s Economic Transactions Index (BETI) increased for the fifth consecutive month in September and is now 3% higher than it was a year ago. Low inflation and reduced interest rates are major drivers of the rising BETI.

Shoprite’s Food Security Index, published in its latest financials indicates that South Africa is at its worst level of food insecurity in more than ten years. 21% of children under five years old show signs of growth problems due to malnutrition. The figures reflect the painful transition that most households are going through from spending on credit to repaying debt. The level of real interest rates in South Africa makes spending on credit less practical and reducing debt has become essential. This shift is the result of the South African Reserve Bank’s conservative inflation management. South Africans are gradually moving from being a nation of spenders to a nation of savers. While the shift is painful, ultimately, it should result in a stronger economy, lower unemployment and higher levels of real income.

Agriculture continues to play a major role in the South African economy. It only contributes about 3% of gross domestic product (GDP) officially, but it has a disproportionate impact on the economy because hundreds of thousands of subsistence households rely on growing a few acres of maize and other crops to supplement food production and avoid starvation. In a bad year, these households are dependent on charity or government subsidies to survive. The latest estimates from the Department of Agriculture show that this year the summer grains and oilseeds crop will be around 20 million tonnes – about 28% more than last year. Good rains resulted in a strong harvest and lower maize prices. This, in turn, reduced the cost of animal feed. Agricultural exports rose by about 10% year-on-year, resulting in an inflow of foreign exchange. However, outbreaks of foot-and-mouth disease have reduced slaughter rates, placing upward pressure on meat and dairy prices.

Private sector credit extension (PSCE) was up 6% in the year to 30th September 2025. Corporate credit rose by 8.6% while households credit grew by only 2.9%. General loans to businesses rose by 13.9%, indicating that companies are becoming more optimistic. At the same time, household credit expanded by less than the inflation rate, showing that households are still repaying debt. Over time, household credit growth is likely to strengthen as real take-home pay rises, supported by low inflation and steady wage gains, which should bolster consumer confidence.

Factory production declined by 1.5% year-on-year to 31 August 2025, worsening from a revised 1.3% year-on-year drop in July. The basic iron and steel, non-ferrous metals, metal products, and machinery section fell by 5.9% while food and beverages production fell by 3%. On a seasonally adjusted basis, production in August was up 0.4% month-on-month, and for the three-months ended 31 August production increased by 1.5% compared to the previous quarter. The manufacturing sector remains under pressure amid difficult conditions. Business confidence remains subdued, suggesting that factory managers remain sceptical that conditions are improving.

New vehicle sales in September 2025 were at their highest level in a decade with 54,700 new cars and commercial vehicles sold. That’s up 24.3% from the same month last year and a 15.6% rise year to date. Sales of exported vehicles were also up by 32.9% compared to September last year. Passenger car sales rose by about 28% and vehicle-finance applications surged. The rising level of real incomes in South Africa coupled with lower interest rates, are clearly encouraging consumers to buy big-ticket items on credit. However, Trump's tariffs are expected to impact negatively on motor vehicle exports.

Overseas investors were net sellers of R165 billion in South African shares in the first eight months of this year, up from R93 billion in sales during the same period last year. The sell-off reflects weak local economic growth, ongoing instability in the Government of National Unity (GNU), and concerns over a 30% tariff imposed by the US on South African exports. Despite the sell-off, the FTSE/JSE All Share Index has hit new record highs in recent weeks, as domestic investors snapped up shares they judged to be undervalued. In our view, the JSE will continue to track Wall Street up and the rand will continue to appreciate.

The latest South African Reserve Bank Bulletin shows that South African companies are sitting on R1.8 trillion in cash – up about R700 billion from the pre-COVID-19 levels of 2019. This enormous cash pile indicates that businesses in the country are being very conservative, choosing not to invest their profits, but instead holding them and benefiting from the high interest-rate environment. Growth rates in the economy are not yet sufficient to persuade most businesses to invest, and the current wisdom is to hold large cash reserves to protect against any unexpected problems that may arise. The high cost of electricity, bottlenecks in transport and port logistics, the failure of most municipalities to provide services and competition from low-cost imported products prevent local businesses from taking the risk of further investment. In our view, these massive stores of capital will only begin to be released when gross domestic product (GDP) growth is consistently above 3% per year.

Tax collections for the first six months of the fiscal year are R18 billion or 2% above the budget estimate. The increase is partly due to R6 billion in additional revenue generated by withdrawals under the new two-pot retirement system. The increased collection will make it easier for the Minister of Finance, Enoch Godongwana to produce the Mid-Term Budget Policy Statement (MTBPS) which is due on 12th November 2025. Much of the increase also stems from improvements at SARS and higher levels of voluntary tax compliance. Meanwhile, the economy is also showing signs of improvement as real take-home pay rises amid falling inflation. This puts the government in a stronger position to pursue debt consolidation without the need for further tax increases.

The CEO of Anglo American, Duncan Wanblad, told the mining conference in Johannesburg that South Africa has had unfriendly policies towards mining exploration for the past 20 years and that has led to the country being under-explored. It typically takes about 17 years from discovery to first production and a further five years to reach full profitability. This suggests that South Africa has effectively missed an entire generation of new mine development. Anglo American has divested most of its South African operations, retaining mainly Kumba Iron Ore and a stake in De Beers. Political stability, good transport and port logistics are essential during the development phase of a new mine. The cost and reliability of electricity supply is also a critical factor. Spending on mining exploration in South Africa has dropped from R6,2 billion in 2006 to just R780 million last year.

The Standard Bank report on the informal sector in South Africa finds that about 80% of businesses are unregistered, and most operate almost entirely in cash with limited use of formal banking facilities. Many informal businesses simply operate using the personal banking facilities of the owner. The draft Licensing Bill of 2025 would enable municipalities to create new by-laws and designate special trading areas for informal businesses. To us this just appears to be the introduction of more bureaucratic red tape and corruption – especially since the organisations tasked with this function are to be the municipalities which are already notoriously corrupt and disorganized. In South Africa, in many cases, informal business activity overlaps with unregistered or undocumented economic activity, which complicates tax compliance. Perhaps the best example is the minibus taxi industry where inadequate traffic control and policing allows taxis to flaunt the rules of the road with impunity. Informal settlements—where many of these businesses operate—often do not comply with building codes or existing by-laws on health and safety. And yet, despite all this, the informal sector does perform a vital function in South Africa because it provides employment opportunities for millions of people enabling them to survive. In some senses, the informal sector is the epitome of laissez-faire capitalism. Its power is precisely that it is not constrained by rules and government interventions. As a small business grows, there will inevitably come a time when it gets large enough that running it without a bank account becomes impractical – and that is the time when SARS can become aware of it and bring it to the formal sector by making it a part of the tax base. At the same time, authorities should more effectively enforce existing traffic, building and health regulations to prevent the unregulated expansion of informal settlements and unsafe practices on roads.

Online gambling has become big business in South Africa. Casinos, and even some retailers, report that sports betting and online gambling are eroding their business. Casino revenue fell by 4.1% last year, and the National Gambling Board estimates that online gaming accounts for about 60% of the gambling market. Gambling is an activity which is completely unproductive as far as the economy is concerned. It simply redistributes wealth, but it produces nothing. The formal gambling industry does create jobs and generate some tax revenue. The problem is that some recipients of social grants in South Africa are now spending their small incomes gambling online. Many illegal online gambling sites are controlled from outside the South Africa. As with other challenges in South Africa, inadequate policing and enforcement are contributing factors. Easy access to online gambling sites is a function of the availability and spread of smart phones and the internet. Over the past year, betting revenue grew by about 45%.

One of the most important functions of any government is to create an environment within which business can operate efficiently and profitably. By doing this a government can attract overseas capital to invest in local industries. The government remains hamstrung by inefficiency, inertia and corruption, despite the formation of the Government of National Unity (GNU). Nowhere is this more evident than in the motor industry, where delays in appointing leadership for the Automotive Production and Development Programme (APDP) appear to be contributing to the local industry losing ground to fully built imports from China and India. Imports now represent about 65% of all new light vehicles sold in South Africa, and the local vehicle-manufacturing sector is under significant pressure as a consequence. Manufacturers face sluggish government policy implementation and steep increases in power costs from Eskom. Reportedly, power costs in China are significantly lower than in South Africa. Chinese and Indian manufacturers can manufacture and transport complete motor vehicle assemblies to South Africa for much less than local manufacturers can make them locally. These can then be quickly assembled here and sold for prices well below local manufacturers’ cost of production. Meanwhile, government delays in appointing dedicated leadership for the APDP continue to hamper the sector.

Eskom is warning that its cash flow will be hit by huge unpaid municipal electricity bills and the fact that the National Energy Regulator (NERSA) has cut its price increases in coming years leading to a R250 billion shortfall. By 2030 Eskom estimates that municipal debt will reach almost R330bn. So, despite the fact that it made a profit of R24bn in the year to 31st March 2025, it will have a R550 billion cashflow shortfall over the next five years. Obviously, much of this is due to the inefficient way that Eskom has been run over the past 30 years. Thousands of consumers and businesses are moving rapidly to renewable energy alternatives so that its future profitability is increasingly in doubt. It also turns out that Eskom has lost at least R20bn through the illegal bulk production and distribution of electricity tokens, with the collusion of some Eskom employees. An investigation is currently under way into the online vending system which has allowed this criminal activity to take place.

Johannesburg water has a backlog of R27 billion for infrastructure – which means its supply is increasingly unreliable. Water outages are particularly acute for some businesses which have not had water for as long as three months and are having to spend a considerable amount on bringing water in to keep their operations running. DA Federal Council Chair Helen Zille, a candidate for Johannesburg’s next mayor, visited affected factories and contracted water-sector experts to assess the problem. The ANC-led administration has been widely criticised for its delayed response. Mayor Dada Morero says his administration plans to raise R100 billion over the next five years to repair water pipes and infrastructure, but ongoing outages are already forcing some factories to shut down or relocate from the city.

The world’s average life expectancy has risen by more than 9 years since 1990 from 64.5 years in 1990 to 73.8 years in 2023, indicating massive improvements in medical treatment. During the same period South Africa’s average life expectancy declined by more than a year to 66.5 years from 67.8 years in 1990. This is partly because of the impact of HIV/AIDS and the rise of lifestyle deaths from type 2 diabetes and heart disease. These non-communicable or lifestyle diseases (NCD) have taken over as a leading cause of death in the last ten years. Worldwide, NCDs are now the leading cause of death and have displaced infectious diseases.

The ANC’s policy of Black Economic Empowerment (BEE) has been and remains one of the greatest impediments to economic growth and job creation in South Africa. It has resulted in massive corruption and the looting of state funds at almost every area of government procurement. President Ramaphosa signed the Public Procurement Act into law in the middle of 2024, but it has yet to come into effect because, absurdly, the regulations still have to be promulgated. In the meantime, the DA has put forward an alternative government procurement act which does not require tenderers to be of a specific race group. It is in effect a completely race-free piece of legislation where government tenders are allocated based on an outcomes scorecard which focuses on the tender price and whether there is value for the money spent. Aside from the price, job creation, the impact on the environment, the impact on low-income groups and the skills training involved still remain key factors determining the winner. The proposed Act cuts much of the red tape and cost involved in the current BEE scorecard. Needless to say, the ANC will oppose this idea, and it may become a key factor in next year’s municipal elections. BEE procurement is thus a major point of contention between the DA and the ANC.

The Rand

As expected, the rand has broken convincingly above the resistance at R17.50 to the US dollar and is now trading at around R17.30. It has been as strong as R17.10 on Wednesday last week. Consider the chart:

The currency’s continued strength is a function of the general switch in international investor sentiment to risk-on which is also reflected in the series of new record highs recorded on the S&P500. We expect that the rand will continue to strengthen in the medium term, though this trend may be interrupted if overseas investors turn cautious on emerging markets.

Commodities

GOLD

Gold went above $4,000 per ounce on 8th October 2025 for the first time ever. This is equivalent to about R70 000 per ounce. The rally has been driven by the falling US dollar which has lost ground against most other hard currencies this year and the general perception of political instability that currently pervades. Consider the chart:

The sharp rise in the price has been a bonanza for South African gold mines which together produce about 100 tonnes of the metal each year. The gold price has risen almost 60% from the levels seen in 2024. This has caused the prices of gold producers to rise sharply, and it has been a great opportunity for private investors on the JSE. In our view, gold will continue to appreciate over time because it is widely regarded as a safe-haven asset and is being accumulated by Central Banks everywhere. Gold producers in South Africa have seen their revenue rise by 22% this year. Many of top performers on the Winning Shares List are now gold shares such as Pan African (up 347%), Harmony (up 193%) and Goldfields (up 208%). We expect gold to continue to perform well.

OIL

The North Sea Brent oil price continues to wallow at low levels just above support at $60 per barrel. Consider the chart:

As you can see the downward trend in the price of oil has accelerated and over the past month it has again tested support at $60 per barrel. As the world moves steadily away from fossil fuels the Middle East and Russia find themselves sitting of a lake of oil that less and less people want. We expect that trend to continue interrupted by periodic efforts by OPEC to restrict production and regain some sort of control over the market.

The falling oil price is very bad for Putin and Russia, but it is very good for South Africa, where the petrol price has just come down again, and for consumers around the world. Lower oil prices free up cash in everyone’s budget to be spent on other things and that is part of the reason for the rising levels of world economic growth.

Companies

NEW LISTINGS

The fintech company Optasia has successfully listed on the Johannesburg Stock Exchange (JSE), raising R6.5 billion through an initial public offering (IPO) and private placement. The IPO was priced at R19.00 per share, the top end of the announced range of R15.50 to R19.00, and was several times oversubscribed. The company now trades under the share code OPA on the JSE’s main board in the Consumer Lending – Finance Credit Services sector.

Optasia offers an AI-enabled platform for micro-lending and airtime distribution in emerging markets, with 49 distribution partners and access to over 860 million subscribers. In the six months ending 30 June 2025, the company reported revenue of $117 million and EBITDA of $53.8 million. The listing implies a market capitalization of R23.5 billion, with a free float of just over 30%.

On 27 October 2025, FirstRand announced a R4.7 billion investment to acquire a 20.1% stake in Optasia, signalling strong confidence in the company’s business model and growth prospects.

Meanwhile, Coca-Cola HBC (CCH)—a bottler of Coca-Cola products in 43 countries—is reportedly planning a secondary listing on the JSE by the end of 2026. This follows its proposed acquisition of a 75% stake in Coca-Cola Beverages Africa, in a deal valued at $3.4 billion. The listing is expected to demonstrate CCH’s commitment to South Africa and the broader African market, and would likely become a major institutional rand-hedge share if it proceeds.

BOXER (BOX)

Boxer’s latest results for the 26 weeks to 31st August 2025 show turnover up almost 14% and trading profit up 15%. The company has just launched its loyalty program. Twenty-five new stores were opened, bringing the total to 547. The company said, “Capital investment for the period totalled R539 million, up 73.9% on H1 FY25’s capital investment of R310 million. The increase was the result of the substantial acceleration of new store openings.” Clearly this is a company which is growing very quickly in a highly competitive market – which indicates superior management and decision making. Technically, the share broke above its resistance at R73 and has been moving up. Consider the chart.

The upside break in the share price shows that it is gathering institutional interest and showing promise for the future. We believe that it will continue to perform well despite some profit-taking following its listing.

ANGLO AMERICAN (AGL)

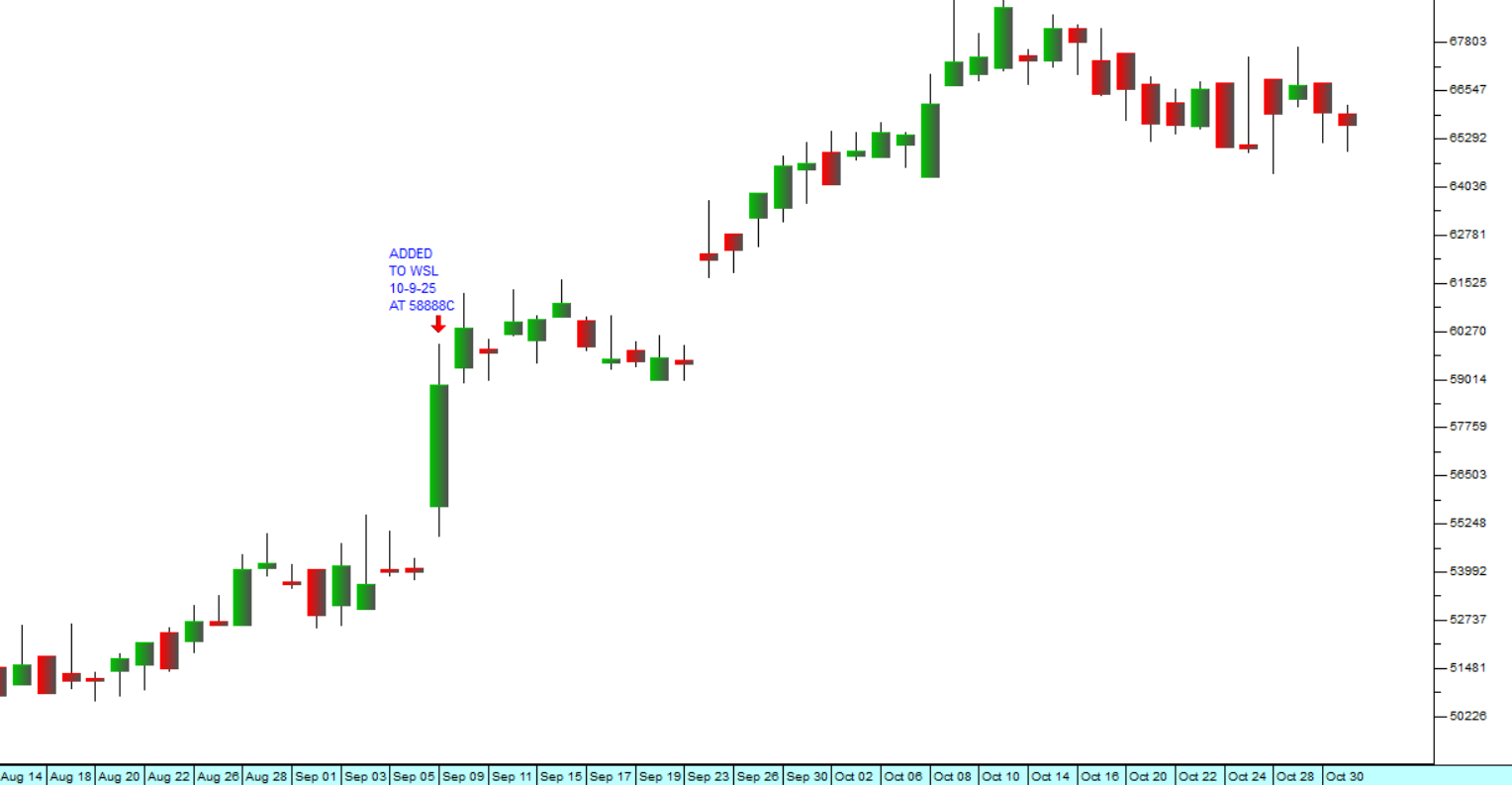

Anglo American, the multinational mining house, has been being doing very well with its manganese assets recently. In the three months to 30th September 2025 manganese production rose 140%. The company also produces copper, iron ore, diamonds, steel-making coal and nickel. Kumba’s iron ore production has been benefiting from improved rail logistics as Transnet gets its act together. The company has sold off its remaining platinum group metals shares in Valterra raising $2.5 billion. Consider the chart:

As you can see, we added this share to our Winning Shares List (WSL) on 10th September 2025 – about seven weeks ago. In that time it has moved up 11.5% and we expect it to go further. However, it remains a commodity share, dependent on international markets and hence volatile.

FORTRESS (FFB)

Fortress is a real estate investment trust (REIT) which specializes in properties which are used for logistics, offices and computer retail. It also holds shares in NEPI. On 14th October the Business Day carried article about the company’s move into renewable energy, stating that it had installed 401 inverters and 9310 solar panels. This initiative forms part of Fortress’s broader sustainability drive, which has now generated over 100 million kilowatt-hours of renewable energy since its first rooftop solar installation in 2017.

The share has been moving up steadily since we added it to the Winning Shares List (WSL) on the 19th of June 2024 at 1664c per share. It has now reached 2330c and looks to go further. Consider the chart:

FORTRESS (FFB) : June 2024 - 31st of October 2025. Chart by ShareFriend Pro.

STEFANUTTI (SSK)

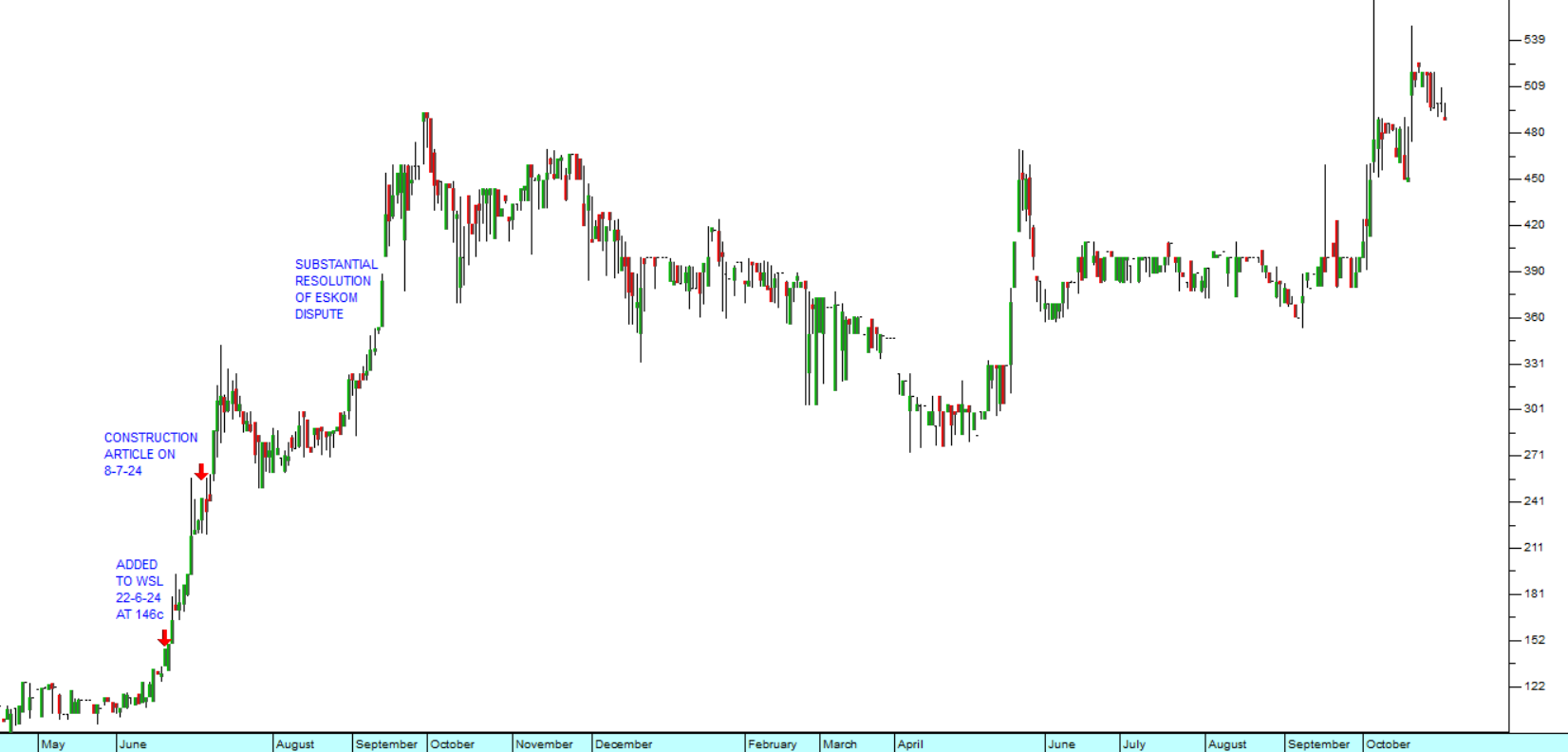

Stefanutti is a share which we first added to the Winning Shares List on 22nd June 2024 – just over 16 months ago. Since then it has risen from 146c to its current level at 490c – a gain of 235%. Consider the chart:

Much of the rise in the share price can be attributed to the settlement of its dispute with Eskom on 16th October 2025 which resulted in its being awarded a payout of R685m on the Kusile power project. Over and above this the company’s results for the year to 28th February 2025 showed revenue up 8% and headline earnings per share (HEPS) of 109c compared with a loss of 56c in the previous year. In a recent announcement the company has reported that it has negotiated a facility of R850m with Standard Bank which indicates its financial stability and provides it with funding for debt repayment and future growth. In our view this share should continue to be a sound investment.

SPEAR REIT (SEA)

In its results for the six months to 31st August 2025 Spear reported distributable income up 55,7% and revenue up 25,7% Headline earnings per share (HEPS) rose by 11,9%. All of this is impressive and would make the share worthy of your attention, but the really exciting figure is their loan-to-value ratio which is just 13,85% - which basically means that they have almost no debt at all. We added this share to the Winning Shares List (WSL) on 26th June 2024 – at 888c. Over the past 16 months the share has risen to 1140c and is still trading below its net asset value (NAV). Consider the chart.

Obviously, Spear is not the most exciting investment on the JSE – but it is one of the lowest risk investments and it does have considerable upside potential because it invests in properties exclusively in the Western Cape – which is the fastest growing province in South Africa. We expect this share to continue to gain institutional patronage and to continue moving up steadily.

iOCO (IOC)

Previously called EOH, iOCO produced results for the year to 31st July 2025 in which they reported revenue growth of 4% and headline earnings per share (HEPS) of 40c compared with a loss of 10c in the previous year. This is a significant turnaround for this IT company and has been marked by a steady improvement in the share price. Consider the chart:

The share made a double bottom in February and April last year before beginning a steady recovery. We added it to the Winning Shares List about a year ago on 6th November 2024 at a price of 220c. Since then, it has climbed steadily to reach 420c – a gain of 45%. In our view the company has definitely turned the corner and should continue to perform well.

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: