Showdown

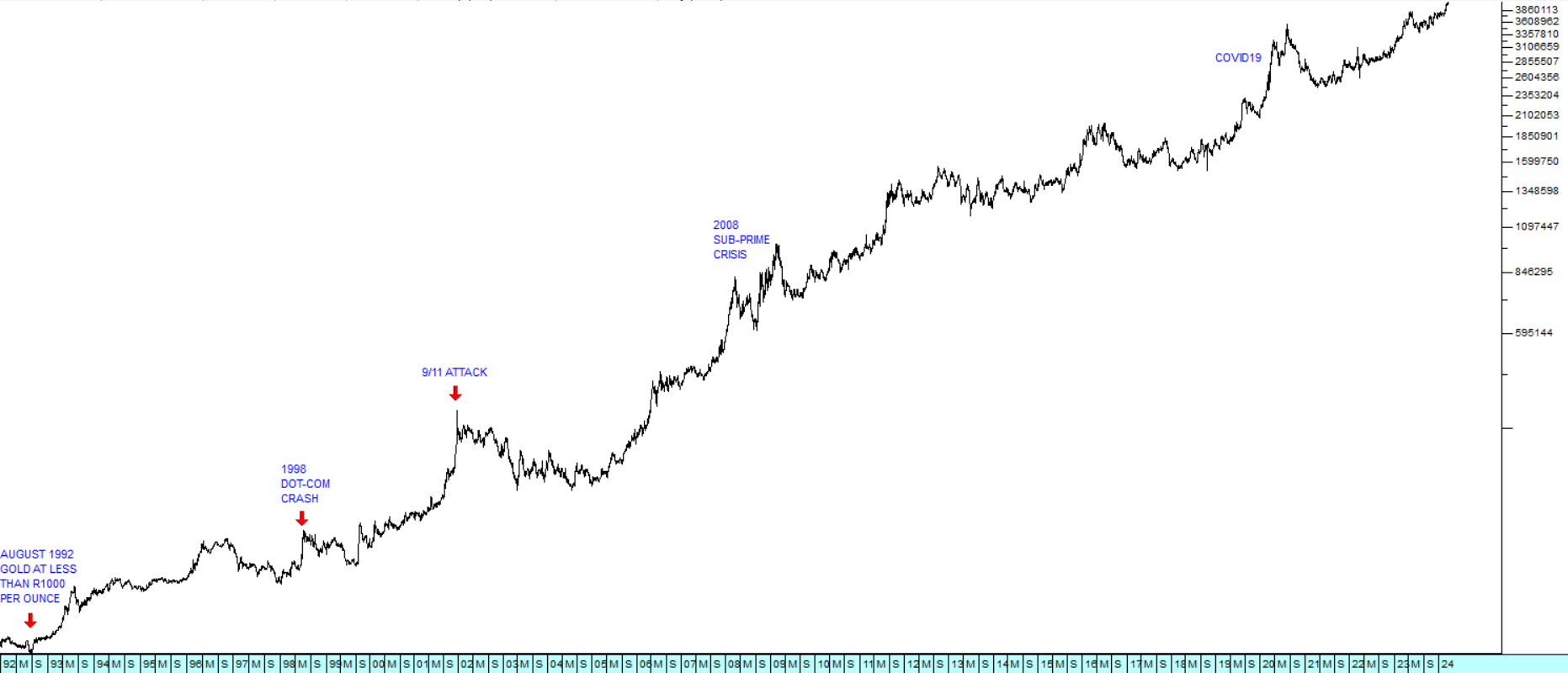

26 November 2018 By PDSNETA showdown is looming in the gold mining industry. On the one side we have Sibanye Stillwater which is now South Africa’s largest gold producer represented by Neal Froneman, and on the other the notorious Association of Mineworkers and Construction Union (AMCU) led by Joseph Matunjwa. Froneman is a tough, experienced mining engineer who has taken on the task of reviving and consolidating South Africa’s ailing gold mining industry. Matunjwa is the leader of AMCU, the man who brought the platinum industry to a complete stand-still for five months. Sibanye is operating at break-even in its South African gold mines with a cost of production around R565 000 - which does not allow for excessive wage increases. Sibanye has already done a deal with the other three unions for an increase of R700 per month for its lowest paid workers – but Matunjwa and AMCU are holding on for R1000. AMCU represents 43% of Sibanye’s work force of 32 000 in the gold industry. AMCU has decided to go on strike for that extra R300 – which would cost Sibanye about R10m a month. Froneman has dug his heals in because the gold division is currently unprofitable. This is partly because of its abysmal safety record which saw 21 deaths with the resulting stoppages and investigations. The affected mines are Kloof, Beatrix and Driefontein, which are all older, labour-intensive mines operating at 2000 meters or deeper. Now Froneman has said that those workers who do not come in for work will not be paid, while Mathunjwa says that AMCU has nothing further to say to Sibanye. So now the workers are not getting paid and, sooner or later, one or the other of these two significant egos has to give some ground. Of course, a stand-off with the unions in South Africa is more-or-less inevitable if President Ramaphosa wants to materially reduce the unemployment rate. Right now employment legislation in this country is far too heavily skewed in favour of the employee and against the employer. The result is that employers, and especially small- and medium-sized businesses, are avoiding employing people wherever possible. Using technology instead of people is becoming more practical as technology advances. It is estimated that in the US approximately 1 million jobs a year will be lost to technology beginning from 2020. Initially, the jobs which will be lost are those of the least skilled – people like truck and taxi drivers and check-out cashiers in supermarkets. In the mining industry, there has been a significant shift towards shallower, more mechanised operations where minimal labour is required. That trend is set to continue. New mechanisms and technologies for extracting minerals at deep level without direct human involvement are being developed. It also seems likely that, if Ramaphosa gets returned with a reasonable mandate in the 2019 election, he will set about reducing the size of the South Africa civil service – because right now the government in this country is disproportionately large – and we simply cannot afford it. The Sibanye share price has declined from a high of R66 in August 2016 to current levels around R9. Turning its back on its unprofitable South African gold operations would certainly see the share price rise, but it would also result in tens of thousands of people losing their jobs. Nobody knows how this conflict will end, but in many senses it is a microcosm of the larger South African problem. As a nation, we desperately need to shift our attitude from one of entitlement to one of productivity.

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: