Sell in May and Go Away

8 May 2023 By PDSNETThe latest US monetary policy committee (MPC) meeting raised interest rates by the expected 25 basis points. It was the MPC’s 10th rate hike and brought the total of rate hikes in this cycle to 5%. The 0.25% increase was fully expected by the market, but Chairman Jerome Powell’s remarks after the announcement were not.

The complicating factor was the trouble in the banking sector where three banks have failed in the last two months. To this must be added the fact that PacWest Bank’s share price dropped sharply by 28% during the day (3rd May 2023) and after the meeting while other small banks also fell.

Powell indicated that the difficulties in the banking sector made it difficult to determine the way forward. He said that the exact effect of the bank failures on credit extension was not clearly understood and was difficult to quantify. But it became clear to the market that without the bank failures, he would certainly have talked about further rate hikes.

So, in the end, his remarks did not suggest any kind of “pivot.” The discussion was between “pausing” the rate hiking cycle and continuing to raise rates – depending on the impact of the bank failures in the future economic data.

This was disturbing for the market because the market has been pricing in at least two rate cuts before the end of 2023 – and if that perception changes, we can expect a sharp sell-off. Indeed, the sharp fall from the day’s high of 4145 on the S&P500 to the closing low of 4090 suggested that those perceptions might already be changing.

In the world of investor perceptions, there is a battle constantly in progress between the bulls and the bears. As in the political world, there are “die-hards” at both extremes. There are investors who have convinced themselves that the future is either very bad for share prices or very good – similar to the Maga Republicans in America and the life-time Democrats. Between these two extremes there is a large middle ground of investors who are simply uncertain. They are like the “independents” in politics whose votes could go either way.

Jerome Powell’s remarks following the MPC meeting had an immediate impact on that middle ground of investors, causing them to swing wildly from being bulls to being bears, sometimes within just a few minutes. At 2.41pm on 3rd May (last Wednesday) the bulls were strongly dominant and the S&P was at the day's high of 4145. The market was up 0,63% on the previous day’s close (4119). An hour and twenty minutes later, following Powell’s remarks, the market closed down 0,7% at 4090. Tens of thousands of bulls had suddenly become bears.

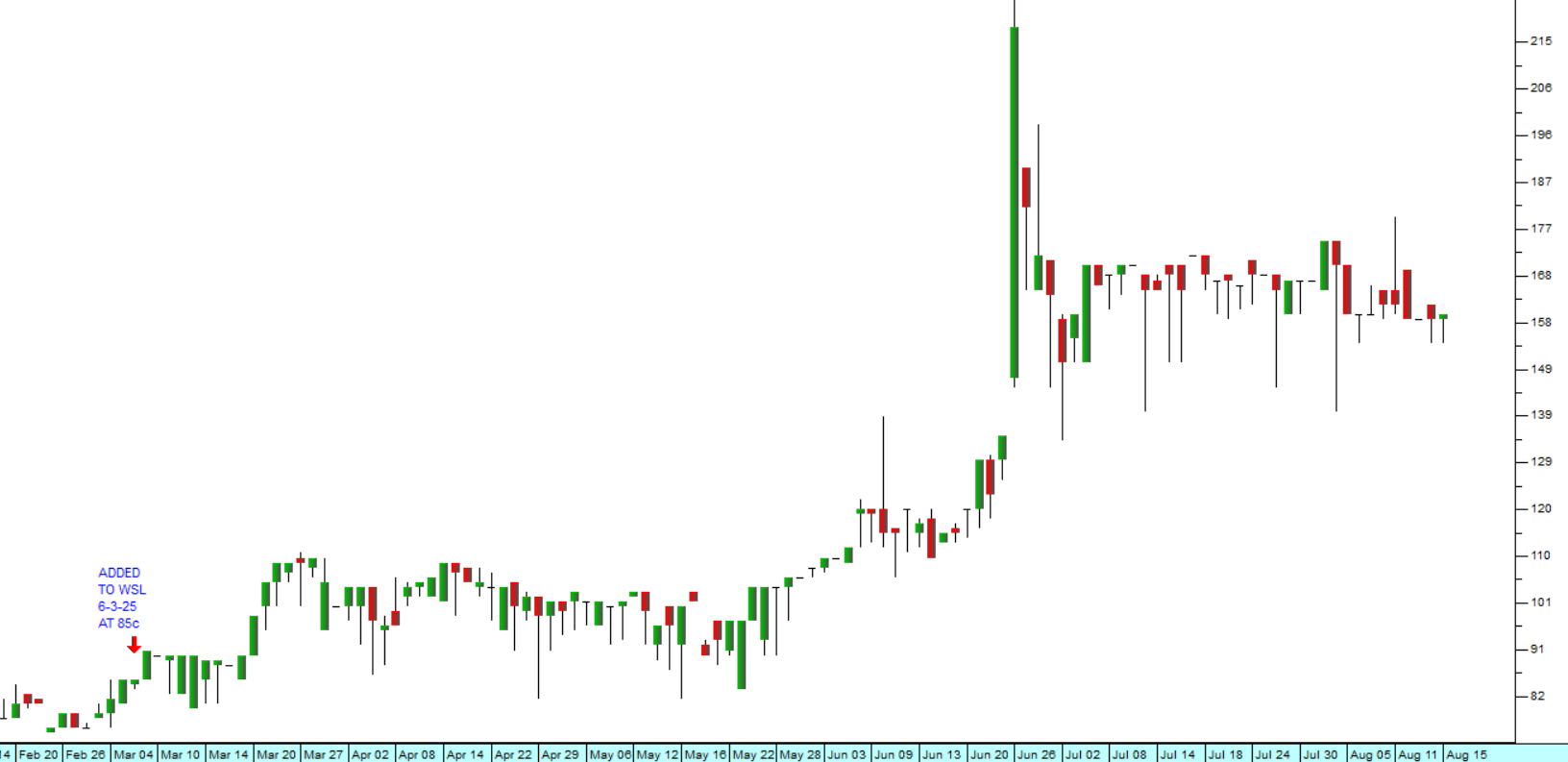

Look at the intra-day chart:

Chart available at: https://www.google.com/finance/quote/.INX:INDEXSP#scso=_OIBvXeSCL7aq1fAPq6m6iAw6:0

You can see that until 2.41pm (UTC-4) the “independents” in the market were strongly bullish, but they switched sides quickly when Powell made it clear that he was definitely not thinking about any scenario which included rate cuts.

In our view, (and we belong to the die-hard bear faction) the market is already in a bear trend and is only being held up by excessive and unwarranted bullishness. We believe that having failed to penetrate the resistance at 4170, the S&P500 will now drop fairly rapidly and ultimately break the cycle low at 3577 made last year on 12th October. Consider the chart:

As a private investor, you need to look at the available facts and make up your own mind about where you stand longer term. Whatever your view, if you decide to remain invested in this market, we urge you to have and maintain a strict stop-loss strategy. In our view, the old Wall Street wisdom which advises: “Sell in May and go away” has never been more appropriate.

Postscript

On Friday the April 2023 figures for the US labour market came out. Unemployment was back down at 3,4%, the economy generated 253 000 new jobs and average hourly earnings rose by 0.5% - all three of these statistics were stronger than had been expected – showing that the economy is still in a strong growth phase. This “good news” must surely make the prospect of rate cuts even less likely – and yet the bulls took control of Wall Street on Friday and drove the S&P up 1,85%. To us this is a clear indication of the current power of irrational bullishness. The market is now discounting at least two 25-basis point cuts before the end of this year – an expectation which now looks very unlikely. We believe that the Fed will continue to tighten while the labour market is tightening. That means that sooner or later the market will have to face reality and sell off sharply.

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: