Resistance

The concept of resistance is a very important part of the private investor's understanding of the market.

Resistance occurs where a share or an index (or any financial data stream) reaches a top where it has been before - and then the question arises, "Will it penetrate that level?"

Perhaps there are large sellers who have standing orders with their brokers to sell out when and if the share reaches that level. That means that as soon as that level is reached, the share will fall back on increased selling.

This process of the market bumping its head against a ceiling can lead to a double top or even a triple top. Sooner or later, however, the situation will be resolved. Either the level will be penetrated convincingly on the upside or the market will become afraid and fall back. So resistance levels inevitably cause a period of uncertainty as everyone waits to see what will happen.

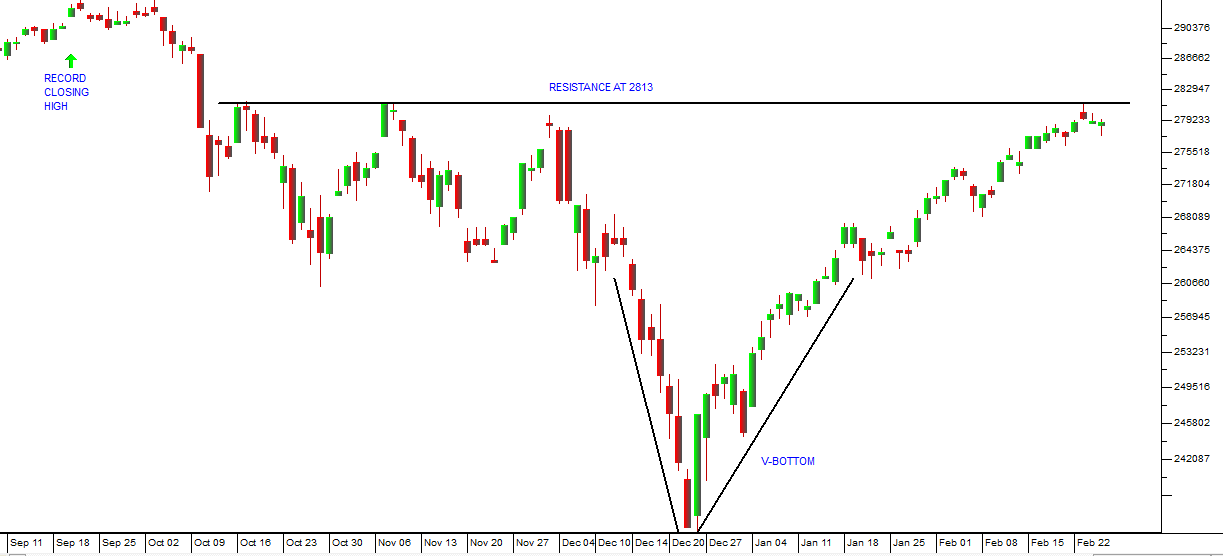

This exact drama is playing out with the S&P500 index on Wall Street right now. Consider the chart:

Here you can see that following its record closing high of 2930 which occurred on 20th September 2018, the S&P entered a corrective phase. That correction was exacerbated by Trump when he effectively shut the US government down in December. The US shut-down resulted in a "V-bottom" because as soon as investors came back from the year-end holidays they bid the market back up steadily.

Now the S&P has reached the resistance level of 2813 - a level which it had previously "bumped its head against" on 16th November and 7th November last year - a resistance level.

As you can see from the chart, the market found that resistance again in an intra-day move on 25th February 2019 and since then has fallen back. Investors are fearful that the level may not be penetrated and so they are waiting on the sidelines to see what will happen.

In our view the powerful boom in the US economy will sooner or later overcome their fears and the market will move strongly above that resistance. When a resistance level is broken like that there is usually a strong upward move as investor confidence in the bull trend returns. Of course, if the market fails to penetrate the resistance there will be a fall on disappointment.

So watch the S&P500 to see what follows. We think the resistance will be broken within a week or two - and then that the S&P will go on to make a new all-time record high above 2930. If we are right, then the JSE should follow Wall Street up.

← Back to Articles