Quarterlies

One of the major differences between the US equity markets and the JSE is that listed companies in America are required to report every 3 months, not every 6 months as they are on the JSE. The quarterly reports of the S&P500 companies are closely followed by investment analysts and predictions are made for their profits.

So, for example, we are now in the middle of the “earnings season” for the 4th quarter of 2024 and 61% of the companies in the S&P500 index have reported their results. The average annualised level of earnings per share (EPS) is 13,1% above the previous year and also well above the average of analysts’ predictions, which was 8%.

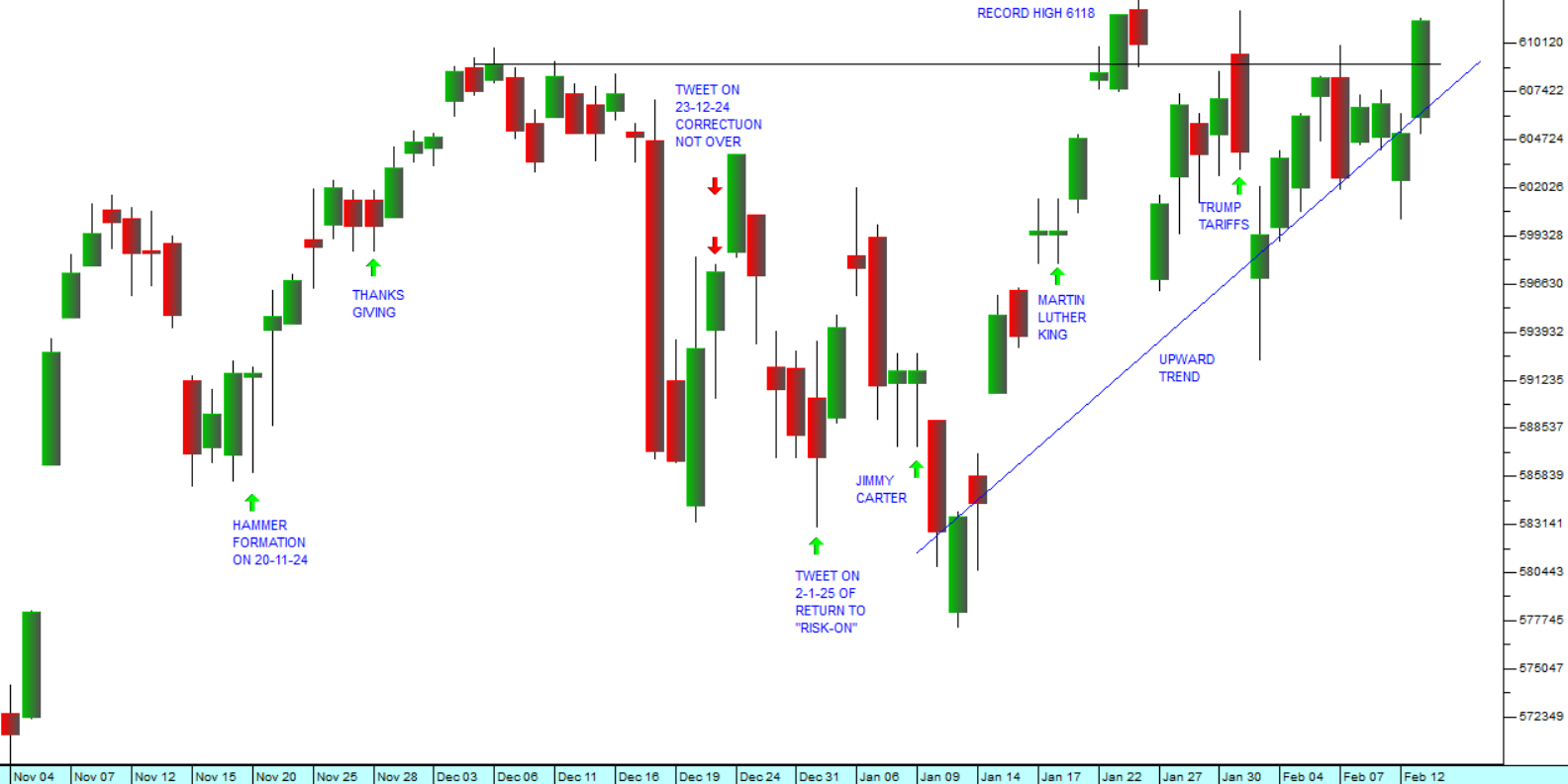

This is the primary reason that the S&P500 index continues to be in a bull trend. Investors are discounting stronger and stronger profits into the prices that they are willing to pay for shares – especially those shares in the tech sector known as the “magnificent seven” (Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA and Tesla) whose EPS is up 19% on average so far in the 4th quarter. Consider the chart:

This shows that so far in 2025 the S&P has been volatile, mainly because of the radical and on/off nature of Trump’s various statements on the subject of tariffs. Perhaps the best summary of our perceptions of the S&P is in our tweets:

23-12-24: “While we still believe that the upward trend is in progress, there will likely be a continuation of the current correction”.

2-1-25: “...we can expect the #SP500 to perform better as sentiment switches back to #riskon. Our view: the bull trend remains intact, and a new record is imminent.”

28-1-25: “The reaction to #DeepSeek was clearly overdone. Tech was over-bought and looking for a reason to correct. #Nvida is not threatened. The #Chinese were always going to copy Nvidia - just as they copied #Apple and #smartphones. Expect the #SP500 to rise to a new record high shortly.”

3-2-25: “Trump's #tariffs are the 2nd shock to markets in a week. Expect their impact to be short-term. We are still looking for a resumption of the upward trend in due course. The #SP500 has run quite hard, so the tariffs provide the justification for a pull-back. But the bull remains.”

About half of the companies that have reported on the 4th quarter have referred to the impact of Trump’s tariffs which are expected to cut the EPS of S&P500 companies by between 1% and 2%. Gross domestic product (GDP) is also expected to come in 1% lower as a result.

Despite this, the productivity gains being made by companies implementing artificial intelligence (AI) is substantial. Meta, Amazon, Microsoft and Google are expected to spend about $320bn on AI tech in 2025 to boost their capabilities. Every sector of the economy is benefiting from AI. Retailers are using it to improve stock levels and reduce working capital, Banks are using it to identify and reduce fraud, industrial companies use it for predictive maintenance and healthcare companies are using it for drug discovery and diagnostics.

Altogether, it is clear that profits are being pushed up despite the implications of Trump’s tariffs – which may or may not actually be implemented - and this pattern is likely to continue.

We continue to be bullish on both the S&P500 and on the JSE. The JSE Overall index is in the process of breaking up out of the broadening formation that has been in progress since September last year. Consider the chart:

← Back to Articles