Our Club Portfolio

6 September 2021 By PDSNETLast year, on the 14th December 2020 we wrote an article about our Investment Club software and our in-house company portfolio which we run on that software. As we said in that article, running this portfolio has proved to be a highly motivating exercise for our staff. The diagram below shows where we were on 11th December 2020 and compares it to where we were on Friday last week (3rd September 2021):

| 11th Dec 2020 | 3rd Sep 2021 | ||||||||

| Number | Price | Value | Number | Price | Value | Percent | |||

| of shares | Rands | Rands | of shares | Rands | Rands | Gain/-Loss | |||

| Capitec | 7 | 1403.32 | 9823.2 | 7 | 1839.96 | 12879.7 | 31.11 | ||

| Transcap | 430 | 23.62 | 10156.6 | 430 | 37.66 | 16193.8 | 59.44 | ||

| Prosus | 11 | 1700.12 | 18701 | 11 | 1309.53 | 14404.8 | -29.82 | ||

| Clicks | 46 | 241.75 | 11120.5 | 87 | 301.66 | 26244.4 | 24.78 | ||

| Afrimat | 260 | 44.2 | 11492 | 260 | 55.42 | 14409.2 | 25.38 | ||

PDSnet Investment Club: Summary of Portfolio Holdings - 11 December 2020 - 3rd September 2021.

Since 14 December last year, there has been just one change to the portfolio, when the Clicks share price fell at the beginning of 2021, we decided to take advantage of the situation and bought an additional 41 shares – which brought our average cost for Clicks down.

Aside from this one change, the portfolio has remained the same.

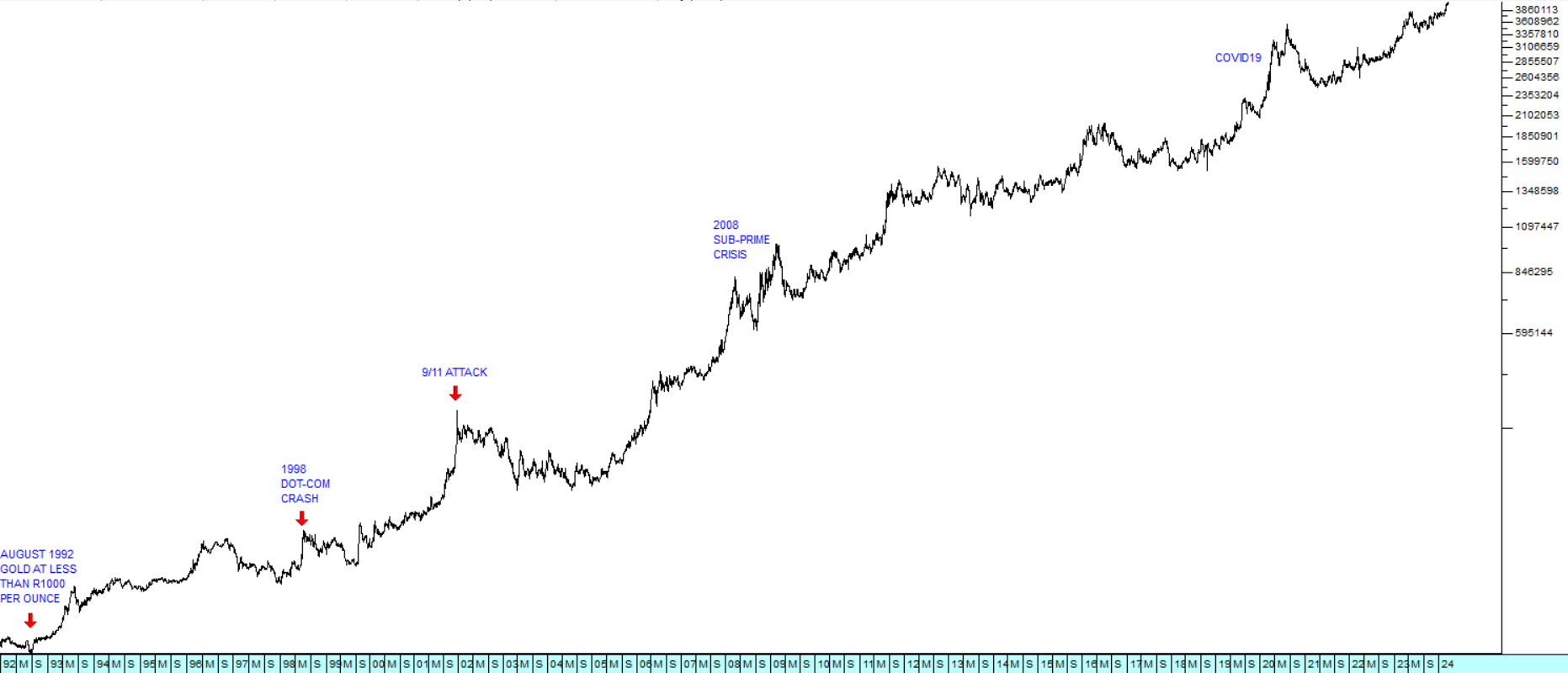

Capitec has appreciated sharply as that company increased its market share and continued to grow rapidly. Our investment has grown by 31% since December last year and is now up over 100% since we first acquired the shares. Capitec has been a been a remarkable investment since it was listed in 2002 growing a hundred-fold from 180c to R1800 per share. Consider the chart:

.png)

Transaction Capital is up almost 60% over the 10 months since December 2020 and we believe it will continue to grow. Its two primary businesses - mini-bus taxis and buying up debtors’ books - are both likely to continue benefiting from the conditions that prevail in South Africa. The company is very well run and conservatively managed.

Prosus has fallen out of favour with institutional investors since we bought our shares mainly because of the clamp-down by Chinese authorities on the business of Tencent and also because of the recent highly complex transaction that Prosus executed with its parent company Naspers. We think that both of these negatives will cease to impact the share price in time and that Prosus will continue to release shareholder value and benefits from its acquisitions (like the recent acquisition of BillDesk in India). It is our intention to buy more Prosus shares when we have sufficient funds so as to bring our average cost down.

We regard Clicks as an iconic share which should be accumulated on any weakness and should be a part of any portfolio. The company has proved that it is almost immune to national calamities like the pandemic and the civil unrest of July. We were happy to buy more of these shares at the lower prices which prevailed in March this year. We regard it as a highly defensive and conservatively managed growth share that will continue to expand its store base and grow steadily.

Afrimat is somewhat risky because it is exposed to commodity prices, but the company has executed an amazing transition from being a construction company to being a producer of base metals and minerals. Other construction companies, like Aveng and Murray & Roberts, were gutted by the destruction of the construction industry following the 2010 World Cup. Afrimat has managed to completely re-invent itself showing remarkable perspicacity and management acumen.

You can see that our approach is typical Warren Buffett. We try to find high-quality blue-chip shares and buy them when they are out of favour with the big institutions. We are not in any sense traders, we are investors. Like Buffett, when one of our shares falls, we celebrate because that enables us to buy more at lower prices and bring our average cost down. We did that with Clicks, and we are about to do it with Prosus.

Overall, the portfolio is up just over 40% since its inception and the whole process of running an investment club has become highly motivating for our staff.

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: