Oil

19 April 2017 By PDSNETThe oil revolution began with the mass-production of motor cars towards the end of the nineteenth century. Since then the world has been burning oil to meet an almost insatiable demand. Oil has become the most important commodity in the world economy. Almost every product and service incorporates an oil component in its cost structure somewhere. Every product has to be delivered, usually by means of an internal combustion engine of some type.

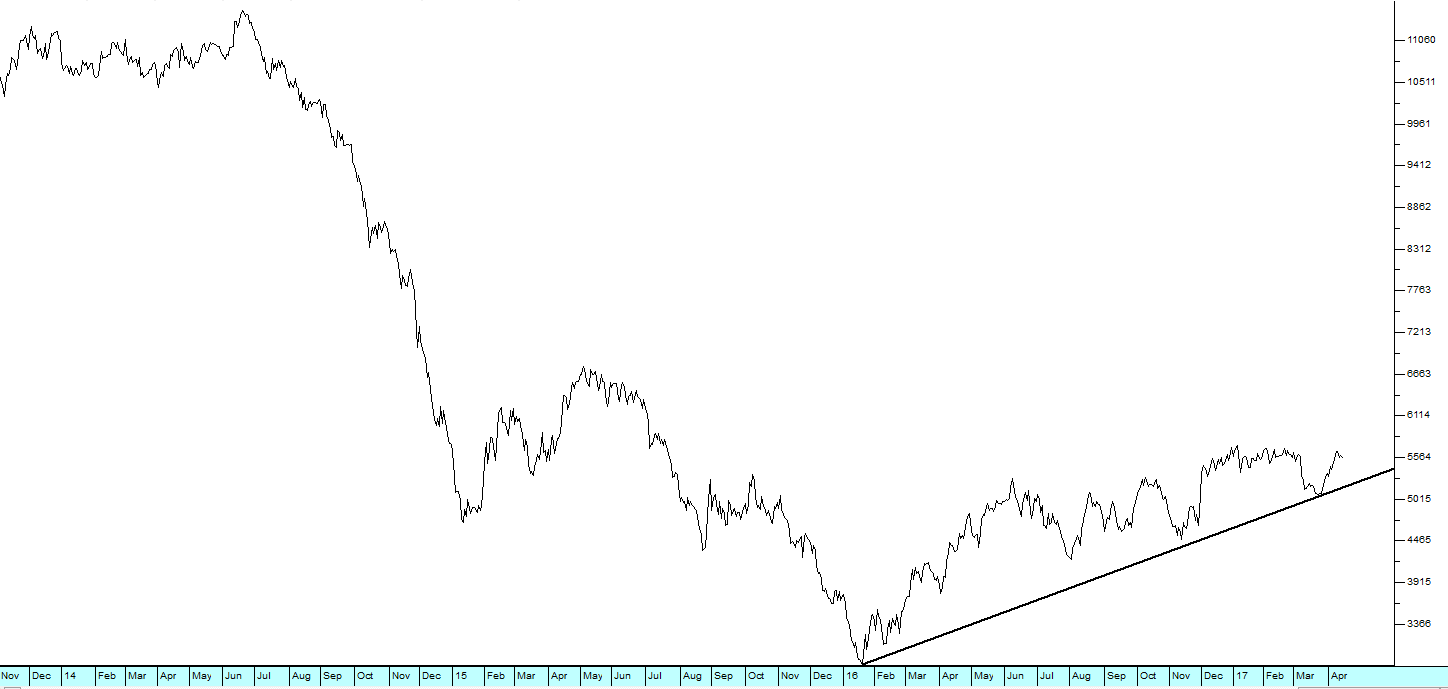

That explains the close link between oil and world economic growth. When the oil price goes up almost every product in the world becomes more expensive, starting, of course, with transportation. Conversely when the oil price drops, every consumer in the world suddenly has more money in their pocket every month. That stimulates demand and growth. The technical innovation of "fracking" opened the door to the production of oil from shale. This caused a price war in 2014 which saw the price of oil drop from about $115 to $28. The OPEC cartel (which was always a leaky structure) finally collapsed. At first this development did not have a good impact on the stock markets of the world, because positive impact was slow to feed through to lower prices and because the world was still recovering from the sub-prime crisis of 2008. But from the start of 2016, the world economy began to respond to this unexpected bonanza. Stock markets, led by Wall Street, began to recognise the positive impact of lower oil prices on demand. By the start of 2017, the US economy, driven by excessive quantitative easing and an extremely dovish interest rate policy, was beginning to recover rapidly, creating huge numbers of jobs and drawing the other economies of the world upwards. The low world inflation which enabled this loose monetary policy was made possible, in part at least, by much lower oil prices. Now in mid-April 2017, we are seeing the demand for oil picking up as the world economy recovers. That has manifested itself in a rising oil price. Consider the following chart of North Sea Brent oil in US dollars:

North Sea Brent oil in US dollars - Chart by ShareFriend Pro

This chart shows the massive decline in oil prices from the middle of 2014 until the end of 2015. The trendline that begins at the start of 2016 shows the steady rise in oil prices since then. That rising trend represents a world economy that is heading inexorably into a boom phase. That boom will discount the massive amounts of money that central banks have injected into the world economy over the past ten years. If you are wondering about Wall Street and whether the 8-year-old bull market will continue, the answer is here. The world is recovering fast. The stock market has recognised that for a long time and the rising oil price confirms it. We believe that the markets of the world are heading into the greatest bull trend in history, fueled by low oil prices, massive technical innovations (like the internet and the smart phone) and unprecedented monetary stimulation.

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: