Naspers Value

Naspers is something of an anomaly on the JSE because it accounts for roughly 20% of the JSE Top 40 index. This is because of an inspired decision by Koos Bekker to acquire a 33% stake for $32m in what was then a small internet/social media company called “Tencent” back in 2001. This investment has performed beyond even Bekker’s wildest expectations, exploiting the Chinese penchant for social media and gaming. On the 22nd of March 2002 you could have bought Naspers “N” shares for just 1245c. Today they are trading for around R2750 – and we consider them to be highly under-valued at current levels.

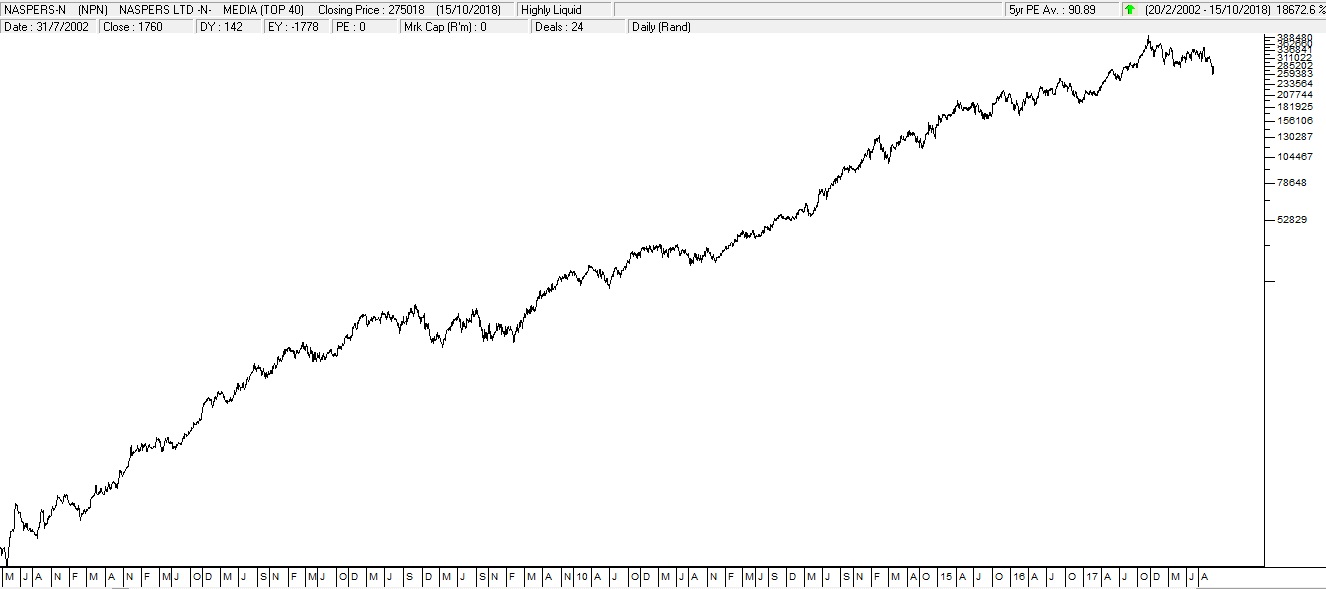

Consider the semi-log chart:

Naspers (NPN) Semi Log Chart March 2002 to October 2018 - Chart by ShareFriend Pro

This makes the Naspers “N” share a “Diagonal Share” in that it goes from the bottom left-hand corner of your screen to the top right-hand corner over a period of 16 years. This 16-year period has seen wild fluctuation in the rand, the corruption and mis-management of the Zuma decade, the collapse of world markets in the sub-prime crisis and many other lesser disruptions. And yet through all of these it has performed well, giving investors an excellent return. For the past ten years, the company’s dividends have gone up every year consistently. The share peaked at R4090 in November of 2017 and has been tracking lower since then. The decline in its price has been caused by three issues:- The Chinese government’s intervention and regulation of the gaming industry in that country.

- The recent sudden fall of tech shares on world markets and especially of the FANGs (Facebook, Amazon, Netflix and Google) on Wall Street.

- The recent Tencent results which were disappointing and the prospect that the results for the September quarter may also disappoint.

← Back to Articles