Mental Posture

26 September 2022 By PDSNETI am often asked what separates those people who succeed in the share market from those who do not. Over the more than 50 years that I have been watching markets and teaching investors I have found that the answer to this question is what I have come to refer to as “mental posture”.

Your mental posture is your emotional response to the market in general and to your shares in particular. Perhaps you do not think that you have an emotional response to your shares but you do.

Imagine that you bought a share three months ago for R10 and now it has fallen to R8 – what are you feeling inside? You are feeling anguish; you are feeling pain. And you are saying to yourself,

“I cannot sell the share now because then I will lose money”

Or worse than that,

“I have not lost any money until I sell the share.”

These thoughts are absolute nonsense of course. You have already lost money – you just don’t want to admit it. A share is only worth what you can sell it for in the market today.

But by taking this attitude, you are making the price which you paid for the share 3 months ago the single most important factor in your decision about whether to hold it or sell it now. And the price which you paid for the share 3 months ago is completely and absolutely irrelevant. The only thing that matters now is whether the share will go up or down from here.

If you make an irrelevant fact the key to your decision you cannot hope to succeed.

Now imagine that you had bought the same share 3 months ago, but instead of paying R10 for it you had paid only R6. This would mean that instead of a loss of R2 per share you would be looking at a profit of R2 per share. Your emotional position would be diametrically different. So, you definitely do have an emotional response to your shares, and it has a major impact on your decisions.

Whether we like to admit it or not, we are very emotional creatures. We do not buy and sell shares – we get involved and we break-up; we get married and divorced. Accepting, understanding and learning to control your emotional responses is the key to your success in the market.

You have two primary emotions which dominate your decisions in the share market – fear and greed. Fear to lose what you have and greed to acquire that which you do not have.

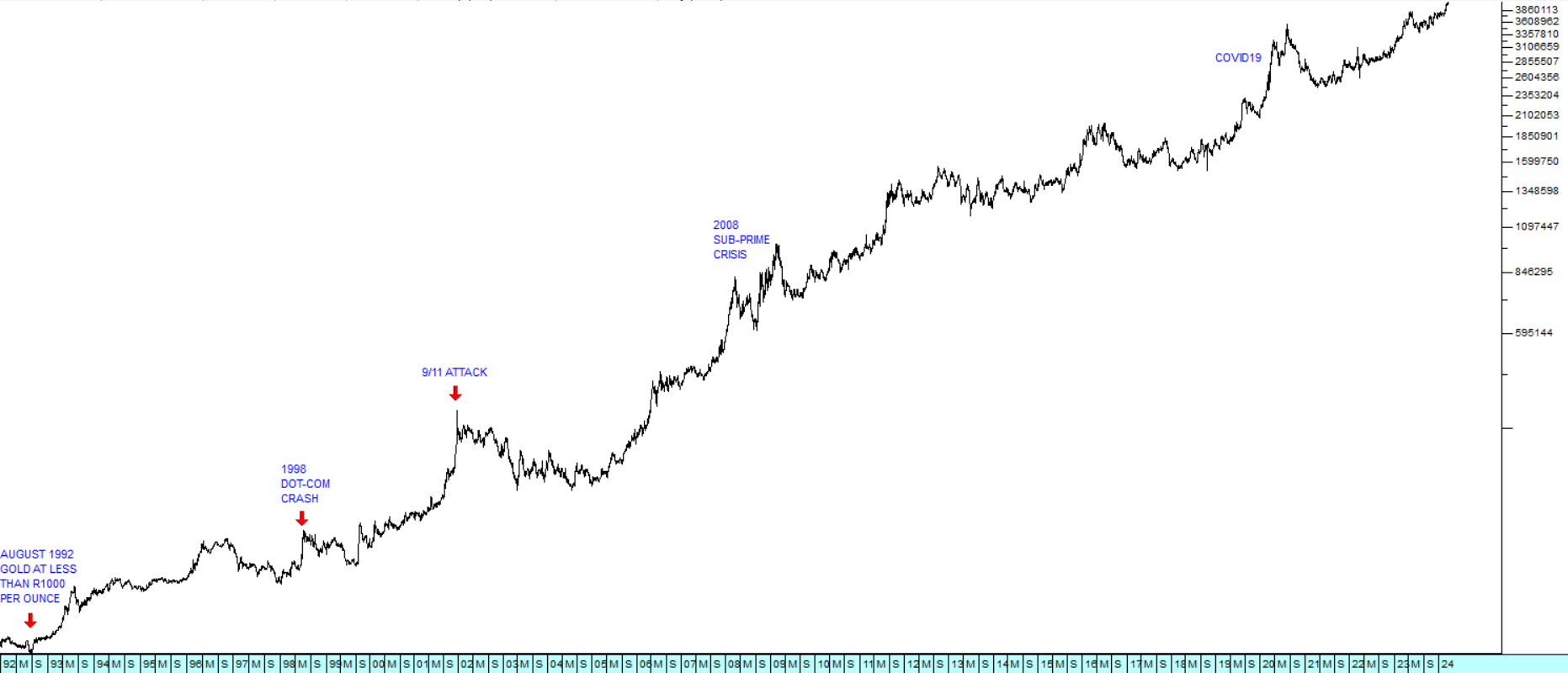

For most investors, the current bear trend is the first bear trend that they have ever seen. For the almost 13 years from March 2009 to January 2022, the market has been rising and so it is only the old timers, who have been in the market for many decades, who know what is happening. And even they are not certain, because this bear is likely to be very different from previous bears.

In 1987 the stock markets of the world crashed. Wall Street lost 23% of its value in a single day (19th October 1987) – which was double the fall on “Black Thursday” (24th October 1929). The 1929 crash on Wall Street ultimately saw shares fall to just 11% of their peak value. It also marked the start of the Great Depression which was to last for the next ten years.

So, in 1987, investors were in a state of shock and emotional disbelief. Nobody knew what to do. Here in South Africa the authorities desperately tried to calm people down. The governor of the Reserve Bank stood up on television and said, “Don’t panic.” The Minister of Finance said, “Don’t panic.” The president of the JSE said, “Don’t panic.” But in the end, the simple truth of the matter was that those who panicked first and sold out of their shares did best.

The current bear trend on Wall Street is different from the 1929 and 1987 bear trends because it did not begin with a single day massive fall. This bear trend is more like the 1969 bear trend. In that bear trend the market just kept on falling 1% or 2% each day, interrupted periodically by misplaced bursts of optimism.

The stale bulls kept trying to “buy the dip” but were always overcome sooner or later by the underlying bearish sentiment. The market dribbled away value. Investors who held onto their shares kept hoping for the market to turn. In the end, it took the JSE twenty long years to reach the same level in inflation-adjusted terms that it reached at its peak in 1969.

Now you can say that you are a long-term investor, but in my experience a long-term investment is often just a short-term investment that went wrong. The most powerful ability you can develop in the share market is the ability to recognize and act to rectify your mistakes when you make them. Success in the share market is not so much about making money as it is about not losing it.

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: