The Confidential Report - November 2023

1 November 2023 By PDSNETAmerica

The US economy created 336 000 new jobs in September 2023 – almost 50% up on August’s 227 000 and 80% above the 187 000 that economists were expecting. This shows that the economy is still growing rapidly with companies taking on more staff.

The American economy grew very strongly in the third quarter with gross domestic product (GDP), seasonally adjusted and after inflation, up 4,9% compared to the second quarter’s 2,1% growth. Consumer spending was up 4% in the quarter, the fastest growth in nearly 3 years. Residential fixed investment was up 3,9% showing that the housing market is healthy.

The US consumer price index came in at 3,7% year-on-year in September 2023 – slightly above expectations and slightly down on August’s 3,9%. Core inflation, excluding food and fuel, was 4,1% - above August’s 3,9% which does not bode well for the prospect of an interest rate hike at the December monetary policy committee (MPC) meeting since the Federal Reserve Bank is aiming to bring core inflation down to 2%.

The share market’s progress is determined to a large extent by the quarterly profits of the 500 very large companies that make up the S&P500 index. The figures are reported every three months and are closely followed and anticipated.

At the time of writing, 41,8% (209) of S&P500 companies had reported earnings for the third quarter of 2023 with more than 80% of those reporting earnings per share (EPS) above the average of analysts’ expectations. Total earnings were up 11%, compared to the same time last year.

All of this points to the fact that the massive US economy is not cooling down at all. In fact, it is growing more strongly than ever, creating jobs and generating profits in all sectors. This raises the fear that the Federal Reserve Bank will either raise interest rates further or at least keep them at the current high levels for much longer – because clearly their efforts to cool the economy so far are not having the desired effect.

The consequence of the robust economy has been that bond yields have moved higher with the 10-year US treasury bill rising to above 5% before retreating slightly to current levels around 4,86%.

Ironically, the stock market is also taking strain because higher interest rates are perceived as being bad for the profits of listed companies. Consider the chart:

A month ago, when we reported on the progress of the S&P500 index, it had come down to the third touch-point on an upward trendline, and we predicted that it would bounce off that low point and continue on its upward path.

The index did in fact bounce off that trendline, but then in the middle of October, it became apparent that further interest rate hikes might be necessary to cool the rapid growth in the economy. That expectation derailed the upward move of the previous 10 days and the index turned down. It has now broken convincingly below the upward trendline and is testing support at around 4115.

Technically, the break down through the upward trendline is important. It brings into question the current upward trend which began a year ago. However, we remain of the opinion that the S&P should find a cycle bottom soon. The robust growth in the economy is clearly apparent in the profits of S&P500 companies and ultimately that profitability must be reflected in share prices sooner or later. The fears of a further rate hike will probably subside towards the end of the year and investors’ sentiment should improve, especially now that traditional concerns over October month are behind us. It is also traditional for the S&P to have a “Christmas” rally over the festive season.

So, we see the index turning up again before the end of the year and in time we still see it breaking above its previous cycle high at 4589 made at the end of July 2023.

One of the most positive aspects of the strong economy and massive job creation is that it bodes well for Joe Biden’s campaign to win a second term as US president in 2024. It is well-known that a strong economy always benefits the party in office. At the same time, Donald Trump, who is the front runner in the Republican party’s nomination, faces increasing legal problems which appear to be getting worse as more and more of his co-defendants “flip” and agree to become state witnesses. In addition, the Republicans have damaged their image as a serious political party with their recent difficulties in finding a Speaker for the House of Representatives. The MAGA domination of that party and their persistent denial of the validity of the 2020 election results in the face of overwhelming evidence has become a growing problem for them.

What is of interest to South African investors has been the progress of the JSE overall index. That index made an all-time record high at 80791 late in January this year and it has been falling since. It is as if local investors did not initially believe in the final quarter of 2022 that the downtrend on Wall Street would persist or would be significant. They held onto and even extended their positions driving the JSE to a new all-time record high. In fact, it is only since the beginning of August 2023 that they have been seriously selling out of their positions bringing the overall index down sharply. While this shows that the JSE will always tend to follow Wall Street, it often lags behind major moves.

Notably, the fall on the JSE overall index is now 14% against the 10% decline on Wall Street since its high of 4589 on 31st July 2023. This demonstrates that the JSE is more volatile than Wall Street and will usually ultimately move further in each direction. Consider the chart:

The take-away from this is that the JSE overall index is now falling rapidly and will probably continue to do so until Wall Street turns and begins to move up again.

Ukraine

The war in Ukraine has continued over the past month without much change in the front lines. Ukraine has been fending off substantial Russian efforts to cut off the salient on the Zaporizhzhia front causing the Russians to lose significant quantities of men and vehicles including tanks without much gain. President Zelensky recently said that Russia had lost roughly a brigade in their failed counterattacks. That would mean the loss of about 4000 troops and 400 military vehicles of various kinds, including tanks. The Ukrainians have also crossed to the left bank of the Dnipro river in force and taken several small villages, opening a new front in the South.

In general, it seems to us that Russia is expending an inordinate amount of effort to remain more-or-less in the same place while taking huge losses which it cannot sustain. Both sides are trying to make progress before winter closes in and makes further gains even more difficult.

The sudden eruption of war in the Middle East is, in our view, a subtle and well-camouflaged effort by Russia to draw Western attention away from the situation in Ukraine. Working at arm’s length through its close ally Iran, Russia has orchestrated an unprecedented and very well-organised attack on Israeli civilians. Hamas, on its own would never, in our opinion, have been able to organise such a coordinated and well planned attack without the assistance of Iran and Russia – and the attack has certainly achieved its first goal of drawing attention and resources away from the war in Ukraine. This idea is supported by the recent visit of a Hamas delegation to Russia.

Despite this, we believe that Russia cannot sustain its effort in Ukraine for much longer and, while it appears to be a long drawn-out stalemate, behind the scenes the forces which will bring it to an end are already in motion.

Evidence of this is the fact that the Russian central bank had to increase interest rates by a further 2% to 15% on 27th October 2023. This means that interest rates have doubled in the past 3 months – simply to keep the ruble above 1c US. Clearly this trend cannot persist and sooner or later the ruble will collapse further – and with it the Russian economy.

Political

South African has won the Rugby World Cup and its cricket team is virtually assured of a place in the semi-finals of the ODI World Cup. We are all fiercely proud of these magnificent achievements!

What should we take away from this? We should realise that if we are capable of producing world-class, multi-racial cricket and rugby teams then we are certainly also capable of producing a world class, multi-racial government and economy – things which we definitely don’t have right now and that we all sorely need. What about it?

The 2024 election is just a few months away and that gives South Africans the opportunity to express their needs and wants directly. We need to move away from choosing our leaders for their race and choose them rather for their competence and proven track record. In other words, we need to become a meritocracy in which individuals are chosen purely on merit.

Economy

Gross domestic product (GDP) grew by 0,6% in the second quarter of 2023 – which was better than expected. Growth is expected to be lower at around 0,1% in the third quarter. Mining production has been falling – down 4,4% year-on-year in July and then 2,5% in August. At the same time manufacturing production has been growing – up 2,2% in July and then up 1,6% in August. GDP growth for the whole of 2023 is now expected to be around 0,8%, rising to about 1% next year. Demand for commodities worldwide has fallen off resulting in lower prices and substantially reduced profits for the mining sector. So far this year the World Bank’s metals and minerals index is down 11%. This has led to a sharp drop in tax revenues.

The tax shortfall in the budget is now estimated to be more than R70bn in the 2023/24 tax year. This is the result of:

- The collapse of commodity prices. Platinum group metals (PGM) prices particularly have dropped by 50% in US dollars so far this year. Mining tax revenues are estimated to drop by as much as R60bn in the current tax year compared to last year.

- Rapidly falling company profits as a result of loadshedding, higher interest rates and a generally recessionary economy.

Combined with overspending by government the result of the revenue shortfall is inevitably a much higher budget deficit. The impact of the social relief of distress grant, the civil service pay hike and the cost of taking over R254bn of Eskom’s debt has pushed government expenditure to very high levels at a time when revenues are falling. Transnet only got R5,8bn of the R40bn it asked for in March this year and now needs a further R65bn for debt repayments over the next five years. It also wants to spend about R100bn on infrastructure improvements which are badly needed to maintain the movement of exports to port by rail. The recently constituted new board of directors at Transnet has produced a “turnaround” plan which involves the Treasury taking over nearly half of its R130bn debt and injecting a further R47bn in cash. This will clearly add substantially to the problems of the fiscus in keeping the deficit down to reasonable levels. Like Eskom, the only feasible answer is to allow private enterprise to take control of the railways – and in the meantime, the state will have to shoulder the cost at the worst possible time.

Overall, the fiscal picture is very bad and indicates that South Africa is moving rapidly towards a “debt trap” where government income is insufficient to cover just the interest payments on its debt. Throughout Africa whenever this has happened, governments have inevitably resorted to printing money leading ultimately to a collapse of the currency – with the prime example being Zimbabwe.

The program of expenditure cuts proposed by the Treasury includes reducing departmental budgets by 15% and freezing pay levels. The proposals are the opposite of what the ANC wants to do in the run-up to the general elections next year. Major ANC populist programs like the national health insurance (NHI) are likely to have to wait until the funding situation improves. The deficit, which is currently 73% of GDP, is estimated to reach 80% of gross domestic product (GDP) in the near future unless something is done to reverse the trend. The Minister of Finance, Enoch Godongwana said, “The government has NOT run out of money” and yet the signs are ominous that it may very well soon. Now, in a letter to the President, by over 100 academics and other leaders, the government is urged not to implement budget cuts because of the consequences of such cuts which are expected to slow economic growth and service delivery. But what choice does the government have? How else can it reduce the shortfall?

Social grants cost the government about R22bn a month which is 17% of total tax revenue collected. 13 million children each get R500 a month (which goes to their parents or care givers), 4 million people over the age of 60 each get R2080 a month and about 1 million people with disabilities are paid the same amount. In addition to this the government pays R350 a month to a further 8,5 million people in the social relief of distress (SRD) grant. That is expected to be increased to R490 a month in the mid-term budget policy statement on 1st November 2023. The total cost of all this social spending is massive, but it has prevented millions of people from becoming completely destitute.

The consumer price index rose for the second month in a row in September to 5,4% driven by increased food and fuel prices. Core inflation which excludes these items, fell to 4,5%. Clearly, South Africa is suffering from the twin impacts of a rising oil price and a falling rand. Petrol on the Highveld is now at the highest price that it has been for over a year. Egg and chicken prices rose in response to the massive culling required by the outbreak of avian flu. The increase in inflation is likely to impact the decision of the monetary policy committee (MPC) on interest rates at its final meeting of the year in November 2023, especially when there is now a distinct possibility of a further rate hike in America. The weakness of the rand is another factor making a further rate hike possible.

Retail trade was down for the 9th month in a row in September 2023 showing the decline in consumer spending as the impact of higher interest rates and loadshedding constrict disposable income. Furniture and pharmaceuticals fell sharply, while clothing and footwear trade increased year-on-year.

Private sector credit extension dropped further in August 2023 to 4,4% from July’s 5,9% showing that high interest rates are having an impact on consumer and business behaviour. Consumers and businesses are reluctant to take on more debt in the current depressed economic climate. The softer credit extension figure means that it is less likely that the Reserve Bank will hike interest rates further. We expect credit extension to continue falling as the economy cools.

The ABSA purchasing managers index (PMI) fell to 45,4 in September 2023 from Augusts level of 49,7. This shows that manufacturing activity in the economy is under pressure. This is partly due to increased levels of loadshedding and partly because of the elevated level of interest rates. In general, the economy is in a bad place at the moment, especially considering the drop off in commodity prices which has stifled mining profits. The business activity component of the PMI fell sharply to 41,9 in September from August’s 50.

New vehicle sales fell for the second month in a row in September 2023. Year-to-date vehicle sales are 2,5% higher than they were at the same time last year. Clearly, the effect of higher interest rates is impacting on vehicle sales with consumers under enormous pressure and unwilling to take on more debt. There are plenty of applications for vehicle finance, but far fewer people are being approved.

The BankServ economic transactions index (BETI) dropped by 2% in September 2023 indicating a further slowing of the South African economy. The index reflects persistent negative sentiment arising from loadshedding, high interest rates and high unemployment. Many economic indicators have turned negative in the past 18 months as conditions in the economy have gone from bad to worse. Among these are the purchasing managers indexes and the state of Transnet’s rail logistics. The rand exchange rate has been weak which adds to the inflation rate and causes the petrol price to remain high. Credit extension figures have also been weak, showing that consumers and businesses are unwilling to take on further risk. Bank of America now believes that the monetary policy committee (MPC) will hike rates by a further 25 basis points at its meeting in November 2023.

The BankServ take-home pay index shows that the average take-home pay was 4% higher in September 2023 than it was in September 2022. The average South African household took home R15673 in September 2023. This increase obviously has a direct impact on consumer spending and ultimately on gross domestic product (GDP). Industries are being less impacted by loadshedding than they were as they implement alternative electricity solutions. They have been able to raise wages and salaries to compensate for inflation.

Over the last three months the petrol price has risen by R3,19 per litre while the price of diesel is up R5,53. These increases in the cost of fuel must necessarily impact on the inflation rate and the level of growth in the economy. They may even tip the balance with the monetary policy committee (MPC) to increasing interest rates by a further 25 basis points at its November 2023 meeting. Certainly, they will impact consumer spending directly as consumers will have less disposable income.

South African consumers are taking enormous strain with rising interest rates, rising fuel costs, high inflation, high unemployment and the need to pay for solar power installations. All the major banks are reporting a sharp increase in their provisions for impairments as bad debts rise. Capitec’s provision is up 62%, Standard Bank is up 42%, ABSA is up 60% and Nedbank is up 57%. Most of the defaults are with mortgage bond repayments or loan repayments. Consumers are using their savings or extending their credit facilities to meet monthly grocery expenses. Rising debt levels are impacting on the stability of households with 67% reporting that unmanageable debt is affecting their mental health. Clearly, these adverse conditions, if sustained into next year, must impact on the ruling party’s results in the 2024 elections. Recent studies indicate that the ANC will get only 41% of the vote and so lose control of parliament.

The Rand

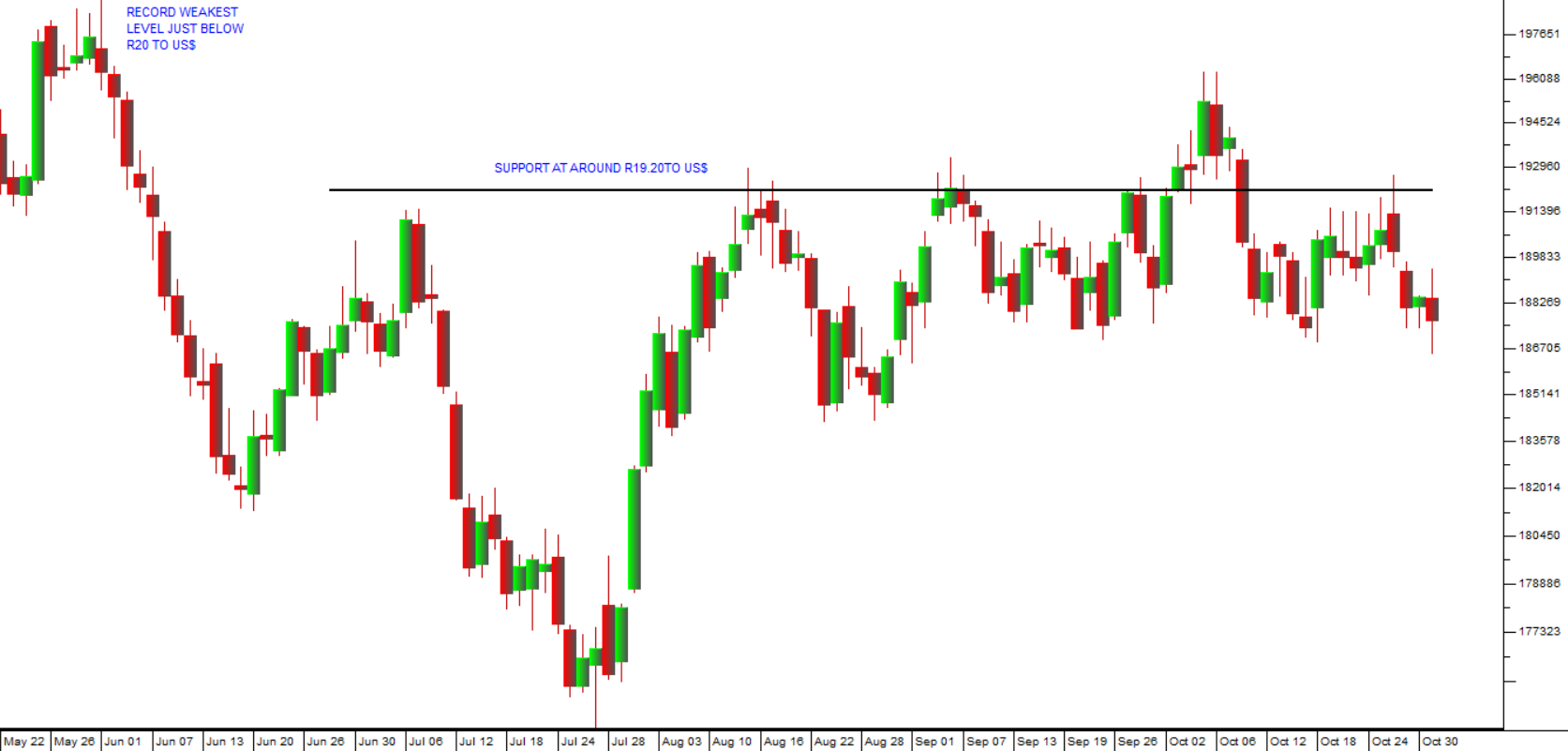

The rand continues to be the “whipping boy” of emerging markets, reflecting every shift from risk-on to risk-off and back again in international investor sentiment. The support level at around R19.20 to the US dollar appears to be holding for now and the rand has strengthened back to R18.80. The long-term trend remains downward as investors discount the internal problems of loadshedding and the uncertain outcomes of the 2024 election. Consider the chart:

In our view it will continue to remain volatile and has the potential to continue falling as growth stutters in the South African economy and the political situation becomes less certain.

International sentiment is currently probably close to its worst for the rand as the S&P500 index plumbs a new cycle low. We can expect that to improve in the coming weeks and the rand is performing relatively well under the circumstances.

General

It is disturbing that as much as 34% of water is being lost to leaks and losses in the Gauteng area. With the impending El Nino weather phenomenon, this year’s rainy season will probably produce far less rain than in previous years. Gauteng’s three metros (Johannesburg, Tshwane and Ekurhuleni) are already having to implement “water-shedding” and other restrictions as demand outstrips supply. Many businesses require a reliable supply of water and the restrictions will inevitably reduce their profitability. The Minister of Water and Sanitation says that R90bn is needed to repair water infrastructure. He added that the system loses 3,7m kilolitres of water every day as a result of leaks.

The bond market and the yield on South Africa’s long-term government bonds are a key indicator of the health of the South African economy. Immediately following the COVID-19 crisis, the yield on our long bond reached 13,3% (March 2020). At the beginning of October 2023 it reached 12,95% mainly because of the cumulative impact of loadshedding and the drop off in tax revenues as a result of the fall in commodity prices. Concern over the long-term stability of the economy and the government is causing investors to demand a higher return.

The ”roadmap” for freight logistics gives the private sector a major role in the maintenance of the railroad system in South Africa. The government will retain ownership of the railway lines and the private sector will get concessions or better rates in return for providing funding for maintenance or funding. Private operators will lease engines and coaches from Transnet or will operate their own. Apparently, this is similar to the arrangement in Germany where there are a large number of private operators. In our opinion this is a positive development because private enterprise is taking over a substantial part of managing the railway system. They are filling a gap which the state has shown it is incapable of managing – which is a process that has characterised the ANC’s period as the ruling party.

It is a severe indictment of the ANC that the growth of one in four South African children is stunted due to malnutrition. At the same time research by Shoprite shows that as many as 52% of people in this country face “food insecurity” which is defined as having several days in each year when they will not eat. This is a consequence of a lack of economic growth which, in turn, is direct a function of the ANC’s mismanagement of the economy during its 30 years in office. Clearly food insecurity and malnutrition of children will have an impact on voting patterns in the 2024 elections – as it should.

The suggestion by US senator John Kennedy that the African Growth and Opportunity Act (AGOA) be extended for 20 years rather than the usual 10 indicates that the major factor in the decision might be the perception that China has been steadily gaining ground in Africa at America’s expense. The BRICS alliance and the massive amount of funding that China is providing to the continent are seen as threatening America’s influence. Certainly, South Africa’s attitude towards the Ukraine and Gaza wars will influence decisions, but the outcome might not be that we are excluded. Rather, it now looks possible that we will remain members of AGOA to sustain US interests in Southern Africa.

America’s decision on whether South Africa can continue to benefit from its African Growth and Opportunity Act (AGOA) will be formally reviewed in 2025. The importance of this decision for this country can hardly be over-emphasised. A massive amount of our manufactured exports, including those from the important motor industry, are dependent on AGOA. Americans are naturally disturbed by our continued relationship with Russia such as our joint military operations and our membership of BRICS. Probably the only factor that will keep us in AGOA is the concern that if we are excluded, we will be forced to move closer to Russia and China.

Eskom

Evidence of Eskom’s gradual but inevitable demise can be seen in the steady decline in the average energy availability factor (EAF). In 2021 the average EAF was 63,2%. In 2022 this had dropped to 59,6% and in 2023 it is averaging 54,4%. This pattern shows that the efforts of private individuals and businesses to install solar power and get away from Eskom are fully justified. In our opinion, the situation is not going to improve. Given the massive increase in electricity tariffs this year it is becoming apparent that Eskom is charging less and less people more and more for their increasingly unreliable product. In the year since August 2022, the amount of roof top solar power being produced by private consumers and businesses doubled to just under 5 megawatts. This is reducing demand for Eskom power and at the same Eskom’s income has dropped by 1% as a result. Municipalities are seeing a sharp fall-off in revenue as their best paying clients have the capital to shift quickly to solar power.

Saldanha Bay municipality is looking to obtain 100mw of power from independent power producers (IPP) within the next 3 years. This will make it completely independent of Eskom and may even enable the IPPs to sell power back to Eskom. Saldanha currently uses about 65mw at peak load. This follows the closure in 2019 of the ArcelorMittal steel mill in Saldanha which cost the community about 15000 jobs directly and indirectly.

Commodities

Platinum group metals (PGM) have fallen about 50% in US dollars this year and about 30% in rands. This has had a direct impact on South African tax collections and on the prices of commodity shares like Sibanye, Northam and Amplats. Consider the following long-term chart of platinum in US dollars:

This shows that platinum has fallen from $1272 in February 2021 to its current level of $900. Palladium, the second most important PGM, has fallen from over $3000 per ounce in March 2022 to current levels around $1135. The falls have caused the price of Sibanye to fall from its high of R75 per share in March 2022 to current prices around R23. Amplats has similarly fallen from a high of R2525 to current levels of R626. Obviously, the decline in the value of the rand against the US dollar has helped soften the blow of falling commodity prices somewhat, but the impact remains very considerable. Sibanye is looking to reduce its workforce by 4000 staff as it closes unprofitable mines in South Africa.

Platinum group metals (PGM) like all commodities have had their ups and down over the years and that is nothing unusual. The question really is whether the current downward trend is going to be more sustained. Coronation fund managers is of the view that PGM prices will continue to fall and has therefore divested itself of all PGM investments. In the long-term the rise of electric vehicle production world-wide has been negative for PGM's because it makes auto-catalysts unnecessary. About 40% of the more than 500 000 people employed in the mining industry in South Africa are involved in the mining of PGM's and the sector is a major contributor to our foreign exchange reserves and to our tax revenues. It also supports a host of sub-contractors and their employees. A continued decline in the price of PGM's will have a huge impact on the South African economy over time.

GOLD

Gold is a hedge against the weakness of paper currencies and geopolitical risk. The sudden and unexpected outbreak of violence in the Gaza Strip and Israel increases the risk in the region substantially. You will recall that in the lead-up to the Russian invasion of Ukraine in February 2022, the gold price rose sharply – but it did not move above its previous cycle high at $2050 in August 2020 which was associated with the COVID-19 crisis. The uptick in the gold price associated with the crisis in Israel and Gaza will provide a good indication of just how serious that conflict is. At times of geopolitical risk, international investor sentiment moves from “risk-on” to “risk-off”. When risk-off prevails the price of gold rises because it is seen as a safe haven asset. Consider the chart:

The chart shows the US dollar price of gold beginning with the spike up in late 2019 and early 2020 as a result of COVID-19. The second spike came in the run-up to the February 2022 invasion of Ukraine and the third was a response to the sharp rise in interest rates in the US which was negative for equities and bonds worldwide. The question that as yet remains unanswered is whether the Israel/Gaza conflict will be considered to be of sufficient importance to cause a significant shift towards risk-on.

Companies

As indicated earlier, the JSE is currently in a downward trend, following Wall Street. This means that most shares, even high-quality blue-chip shares, are falling. There are relatively few buying opportunities and it is a time to be extra vigilant with your stop-loss strategy.

One of the major factors impacting prices on the JSE in recent years has been the net selling by overseas investors. Over the last 7 years foreign investors have sold more shares than they bought in each year. This year they have sold a net R100bn worth of shares with R1bn worth being sold just in the week ending 29TH September 2023. During that same week they sold a net R12bn in government bonds.

All this selling is obviously keeping the rand under pressure. One of the major factors is the current “risk-on” sentiment in world markets which always tends to make international investors sell their emerging market assets. But other local factors, like loadshedding and the general perception that the ANC has lost its way, have definitely impacted the currency negatively. There has been a noticeable loss of international confidence in the South African economy. In our view, the rand and the JSE Overall index will improve once the S&P500 index begins to rally again.

In this mostly negative situation. there are some interesting situations which are worth looking further at.

NEW LISTING - Primary Health Properties (PHP)

Primary Health Properties, a UK company, listed on the JSE on 24th October 2023. It is a real estate investment trust (REIT) which has healthcare properties in the UK and Ireland and generates 90% of its income from government rentals to the NHS and Ireland’s health authority. It is also listed on the London Stock Exchange (LSE) where it has a market capitalisation of R27,83bn. It has 513 properties of which 494 are in the UK with the balance in Ireland. It is listing on the JSE to raise capital and diversify its shareholders. This share is clearly a rand-hedge and will reflect the state of the UK property market. It should become an institutional favourite.

BALWIN (BWN)

Balwin is South Africa’s leading residential property developer which makes most of its money by developing and selling residential units in large secure complexes. It is a share which is sensitive to the state of the economy and the level of disposable income available to consumers, but its product is in high demand, especially for units in the Western Cape where most of its business is currently concentrated. In the six months to 31st August 2023 the company reported that headline earnings per share (HEPS) rose by 4%. The company scaled back its business during the period reducing the rate of construction and cutting costs. It sold 834 units compared with 1360 units in the previous period. At the same time it improved its gross profit margin from 26% to 33%. This shows that ability of this company to respond quickly and effectively to changes in the macro-economic environment. The point that makes this share attractive to shareholders is the enormous disparity between its share price and its net asset value (NAV). The share closed last Friday at 229c and its NAV was up 10% at 849,16c. So the shares are trading at a massive 73% discount to the assets which it owns. And those assets are predominantly in the form of property which means that they are very secure. Consider the chart:

The chart shows that the share has been falling more-or-less since it was listed on the JSE. In our view it now represents exceptionally good value from a fundamental point of view. It is on a P:E of 2,41 and has a dividend yield (DY) of around 5%. Given that the JSE’s average P:E is about 10 this means this share is now very cheap.

CLICKS (CLS)

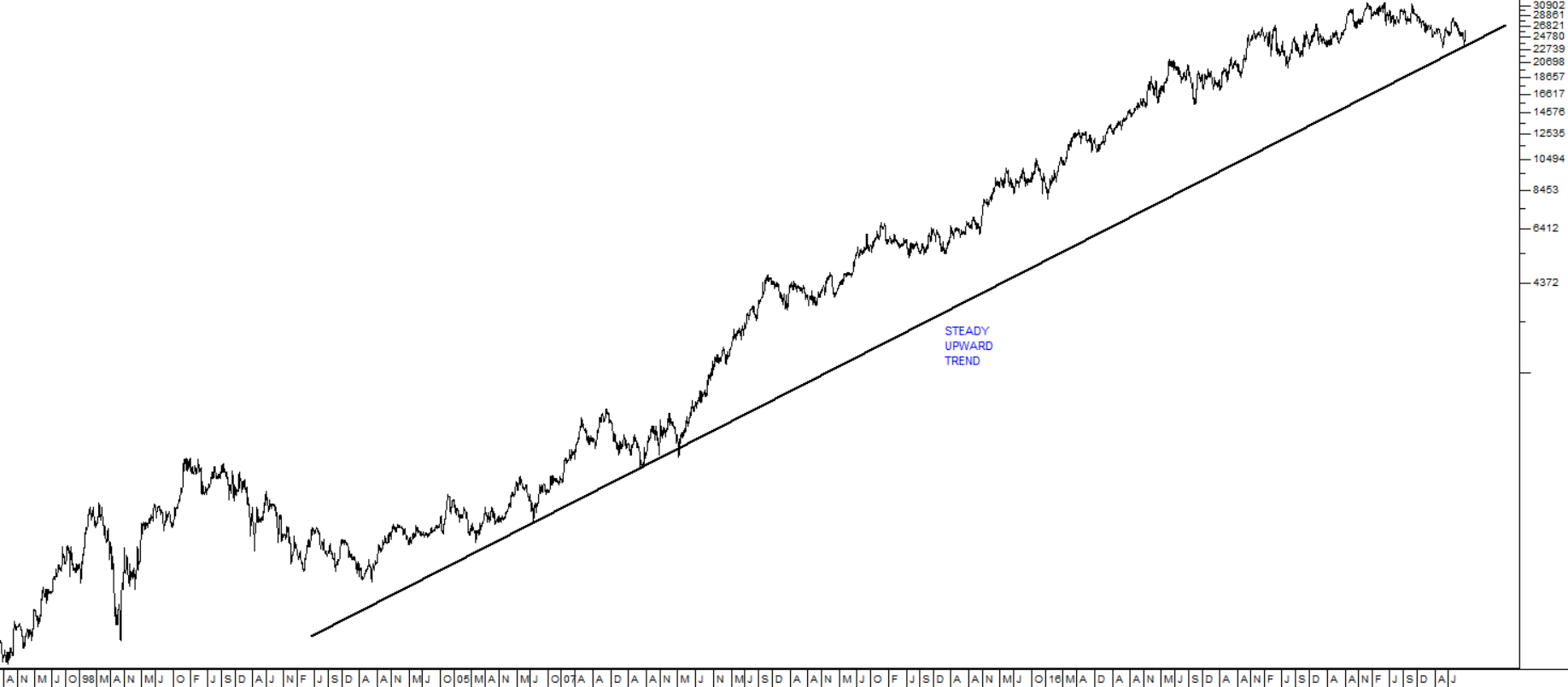

Clicks has once again produced an excellent set of results for the year to 31st August 2023. The company grew revenue by 8,2% with retail turnover up 12,2% and headline earnings per share (HEPS) up 11,5%. This was achieved against a background of rising interest rates, loadshedding and depressed consumer spending – which makes this share very defensive for investors during periods of economic downturn. This is partly because the company is making market share gains in all product categories. It is also growing by acquisition having bought the beauty salon chain Sorbet with 194 outlets, M-Kem a 24-hour pharmacy in the Western Cape and 180 degrees, a pharmacy software development company. In our view this share is a “must-have” for any private investor’s portfolio because of its steady reliable growth and profitability. Consider the long term chart:

This semi-log chart shows the progress of the Clicks share price over the past 28 years. In 1996 you could have bought Clicks shares for 300c each. They closed last Friday at 26456c – and during that entire period they have been paying regular dividends. During the year shareholders were paid 679c per share in dividends.

BYTES (BYI)

This company is one of the UK’s leading software, AI, cloud and IT security specialists. As such it is an excellent rand-hedge reporting in British pounds sterling. During the six months to 31st August 2023 the company reported gross invoiced income of more than GBP1bn – a 37,6% gain on the comparable period. Its earnings per share (EPS) increased by 17% and it paid out a dividend of 2,7 pence which is a 12,5% increase on the previous period. The company reported strong levels of demand for security, cloud adoption, digital transformation, hybrid datacentres and remote working solutions. The company also increased its headcount by 10% during the period and now has more than 1000 employees. Technically, the share has been falling since its high in June this year and it now looks like very good value to us. It is obviously an institutional favourite and enjoys continuous demand. Consider the chart:

This chart shows the performance of the company since it was listed in its current form in December 2020. Although it has been falling for the past 4 months, it is in an overall upward trend and we see it as being good value at current levels.

LIFE HEALTHCARE (LHC)

This is a diversified hospital and medical group which has extensive operations in South Africa. It will produce its financial statements for the year to 30th September 2023 on 16th November 2023. It estimates that normalised earnings per share (EPS) from continuing operations will be between 10% and 29% higher. A major factor in this estimate is the sale of the company’s UK subsidiary, AMG which will release R8,432bn to be returned to shareholders through dividends or share buy-backs. The healthcare business is very defensive and is not usually much impacted by recessions. This share has been falling for the past nine years and has now reached the point where it represents good value. Its P:E ratio has dropped to 17 and it seems to us that it is unlikely to fall much further. The share has considerable support at around 1640c. Consider the chart:

As you can see here the share has been falling since September 2014 – and yet it remains a profitable and recession-proof company, especially now that it has sold its UK subsidiary and is using the proceeds to reduce debt and return funds to shareholders. We believe that it will probably fall to its support at 1640c and then begin a new upward trend.

FAMOUS BRANDS (FBR)

Famous Brands is South Africa’s leading food franchisor with a presence in the UK and a growing business in the Middle East. It has 17 well-known brands which it sells through 2898 restaurants, 86 of which are company owned. The share was listed on the JSE in 1994 and reached a high of 17280c in October 2016. It then entered a downward trend which culminated in March 2020 following the outbreak of the COVID-19 pandemic when the share reached a low point of 2300c. Since then the share has been recovering and closed on Friday last week at 5865c. In its results for the six months to 31st August 2023 the company reported revenue up 10% and headline earnings per share (HEPS) down 7% - mainly because of costs of dealing with loadshedding. The company now has 91,3% of its restaurants with an alternative power source which bodes well for the future. The company has debt of R1,265bn and its interest bill increased by 35% during the period mainly because of rising interest rates. This means that the company is relatively highly geared and therefore risky. However, it is a very well-established business with a proven profitable business model and it is trading on a P:E of 12,43 with a dividend yield of 5,06%. The share may fall further, but it is certainly cheap at current levels. Consider the chart:

This is a share that was performing extremely well until 2016. Since then, it has been faced with a number of challenges including COVID-19, loadshedding and the current high interest rate environment. These factors have forced it to take on additional debt and resulted in it being highly geared. COVID-19 is now behind us, interest rates are probably at or very close to their highs and the company has already paid for alternative electricity supplies for more than 90% of its restaurants. The gearing situation should improve steadily from here. We think it is good value at current levels .

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: