The Confidential Report - May 2023

3 May 2023 By PDSNETAmerica

We have now seen three relatively small American banks fail – and then First Republic Bank (FRB) disclosed that 40% of its deposits were withdrawn in the first quarter. Its share price was down 97% so far this year – despite the $30bn which was recently injected into the bank. Even though the failure of regional banks is not unusual in America, these bank failures feel to us like the tremors which often precede a major earthquake.

The Federal Reserve Bank (the Fed) will most likely push interest rates up again by 25 basis points when its monetary policy committee (MPC) meets on 3rd May 2023 – despite the failure of FRB. If it does, then it will have raised interest rates by a total of 5% in 10 rate hikes over a period of just over a year. The full impact of those rapid rate hikes has not yet been felt in the economy - and does not yet appear to be appreciated by the investing public.

The banks which have failed were heavily invested in US Treasuries and other bonds – supposedly very secure financial assets. The problem is that when interest rates go up, the value of bonds (including US Treasuries) falls until their effective interest rate comes into line with what is currently available. So, these banks were caught between a rise in customer withdrawals and a fall in the value of their assets. They were forced to sell those treasuries at a loss to meet their clients’ demands.

A recent paper by the National Bureau of Economic Research shows that the market value of bank assets is approximately $2 trillion below what the banks paid for them (i.e., their book value). This could become a problem if bank clients decide to take their money out of the bank. That would force the banks to sell their bonds at a loss. Smaller banks with this problem will fail, while larger banks will be supported by the Treasury because they are deemed “too big to fail”. As interest rates rise, many bank clients will withdraw funds because they can get a better rate of interest elsewhere. This will put pressure especially on small banks. So, we expect more small banks in the US to fail in the coming months – which will lead to a sharp loss of investor confidence.

In our view, Wall Street ended last week in the grip of significant short-term bullish buying sentiment, encouraged by better-than-expected quarterly results. When it comes to the economy, the market is taking the view that “bad news equals good news”. In other words, negative economic data such as low jobless claims and stubborn core inflation, are paradoxically seen as good news because investors believe that they will hasten an end to the Fed’s rate-tightening policy.

The recently announced 1,1% growth in gross domestic product (GDP) in the first quarter was well below most analysts’ expectations of 2%. Yet this was seen as “good news” by investors because it potentially brings the much-vaunted “pivot” in Fed policy that much closer. But is it really good news?

As the Fed continues to raise and sustain higher interest rates, we can expect more businesses in the economy to crack. Companies will begin to find it more difficult to get the cash they need to continue. When they seek to renew and roll over their existing loans, they will find that the interest cost has about doubled. Gradually, but with increasing speed, the effects of higher interest rates will proliferate through the economy until they begin to impact directly on consumer spending and the labour market.

As things stand, consumer spending rose by 3,1% in March 2023 over March 2022 – but that does not take into account inflation. Inflation for the year remains high whichever way it is measured – hence real consumer spending is actually negative. For the 12 months ending in March 2023, the all-items price index increased by 5%. Shelter and food were up for the year by 8.2% and 8.5%, respectively.

At the same time jobless claims of 230 000 in the week ending 22nd April 2023 surprised to the downside. Analysts were expecting 249 000 – so this shows that the labour market remains fairly tight. There is no indication yet that the rise in interest rates so far is having a material impact on labour markets.

Right now, the first quarter earnings for S&P500 companies have been better than expected, especially among the “big tech” companies that reported last week. The sharp rise in the S&P500 index on Thursday and Friday last week was driven by the so-called “big tech” shares. Microsoft and Apple now together account for about 14% of the S&P500’s market capitalization. If you add in Meta (previously Facebook), Amazon, Nvidia and Alphabet, there are now just six shares accounting for 25% of the value of the index.

Microsoft and Apple alone have added about $1 trillion to the S&P’s value this year alone which is about half of its total gain. On an historical basis Microsoft is trading on a P:E of 28 and Apple on a P:E of 27. Amazon is on an astonishing P:E of 38. We find the concentration of value in “big tech” shares on Wall Street very disturbing. At the very least, these shares look “fully priced” to us – and yet they continue to trend higher.

Last week ended with sharp improvements in Exxon and Intel, both of which had improved results. Overall, by the end of the week, analysts were expecting S&P500 companies to report earnings down 1,9% - which is a substantial improvement on the fall of 5,1% which they were expecting at the beginning of April 2023.

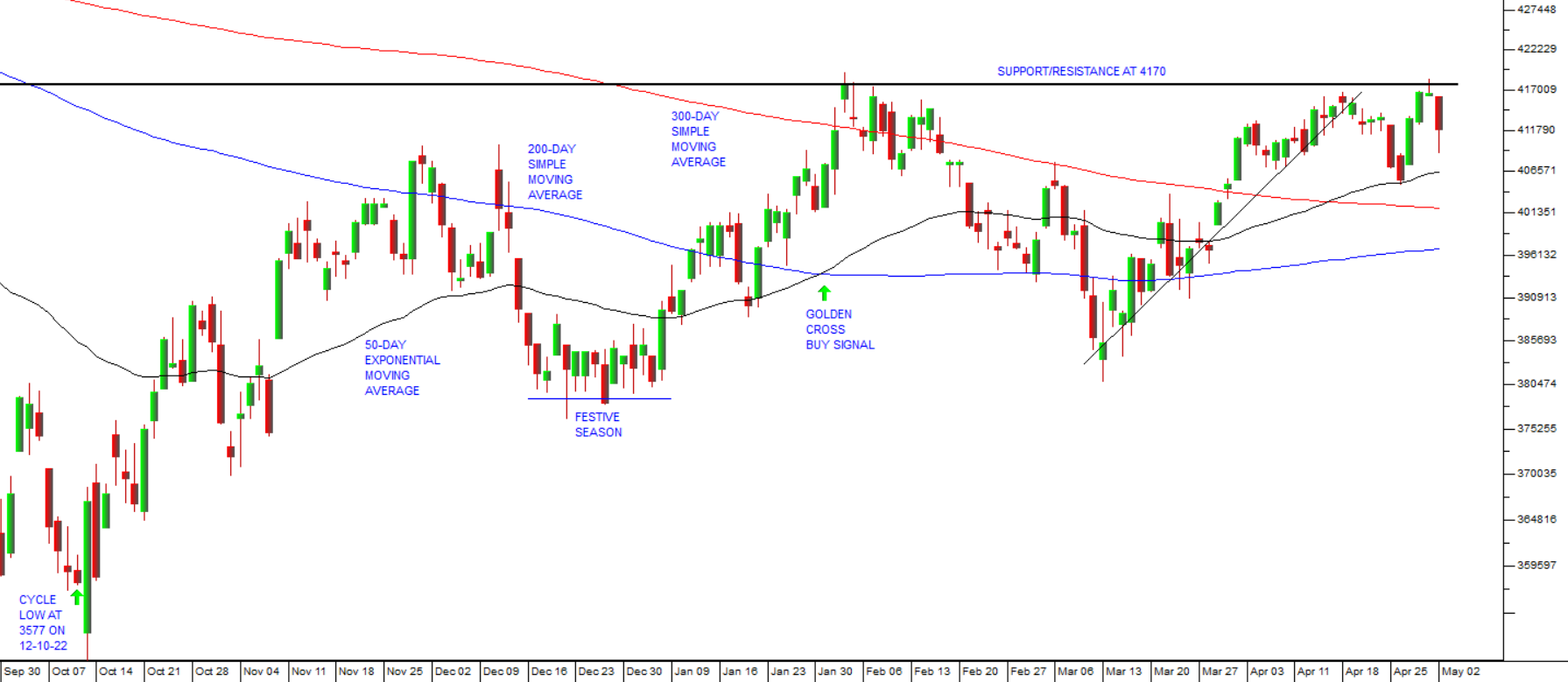

Our view is that the cumulative impact of the Fed’s rate hikes will only begin to be felt in the economy in the second half of this year. As indicated in previous Confidential Reports, the S&P500 is testing resistance at 4170 and we believe that it will fall back to lower levels. Ultimately, we are expecting the cycle low of 3577 made on 12th October 2022 to be tested and then broken. Consider the chart:

Wall Street has become dominated by a generation of first-time investors who have no personal experience of a major bear trend. They are addicted to “buying the dip” whenever the S&P falls. Many of them entered the market for the first time in the last five years. They have learned to rely on the fact that the Fed will always come to their rescue. Many believe that it has become politically impossible for a major recession to occur in America.

However, in this recession the Fed will have a much more difficult task “coming to the rescue” because core inflation remains stubbornly high. There is no room to maneuver as there was in the past. As the economy moves into recession (which we believe may well happen before the end of this year) the Fed will find it very difficult to lower interest rates if inflation is still “sticky” at around 3% or 4%.

To sum up, we believe that the US economy is about to enter a recession, and this will have a substantial negative impact on share prices. The Fed’s 25 basis point hike on 3rd May this year in just a few days’ time could well be the final straw that triggers that recession. Bank of America is predicting that the recession will begin within weeks. When Wall Street falls, other markets around the world, including the JSE fall. So, you have been warned. Do not get swept up in the euphoria which is currently sweeping markets. If you are still holding shares, make sure you have a tight stop-loss strategy to protect yourself against a downturn.

DE DOLLARIZATION

There has been a considerable amount of media talk about what has come to be called “de dollarization” of the world economy. In other words, a move away from using the US dollar as the medium of exchange in international trade. In our view, it is extremely unlikely that the US dollar will lose its role as the international currency any time soon. It may happen in years or decades to come, but right now most international trade is done in dollars and over 60% of central bank reserves throughout the world are held in US dollars. The idea that the Chinese yuan or some new currency invented by the BRICS countries is going to replace the dollar is, in our view, more fantasy than reality. Look at a chart of the US dollar against the euro over the last 16 years:

You can see that, while the dollar/euro exchange rate has been volatile, during that time the dollar has steadily appreciated against the euro from 63 euros to over 90. The euro is the only other currency in the world which could arguably replace the US dollar in any material sense as the world’s preferred medium of exchange.

South Africa

2023 must certainly be the year when most South Africans, both individuals and companies, of all race groups and political persuasions, realised finally that the most important and growing problem in this country was loadshedding. It is a problem that the ruling party has consistently and signally failed to address in any meaningful way since it began 16 years ago in 2008.

No doubt the ANC will pay a heavy price for that in the 2024 elections, but in the meantime everyone in this country must formulate a plan to obtain a reliable and cost-effective alternative power source. The boards of directors of listed companies must develop such a plan and communicate it to their shareholders in their financial statements and other communications.

Private investors need to add this critical factor to the other criteria by which they evaluate shares on the JSE. A company’s degree of dependence on Eskom is now a key element of its risk profile. Investors will be anxious to know what concrete plans they have to get off the grid and what the expected capital cost will be.

The shares of companies which are heavily dependent on Eskom’s power supply and have not made sufficient alternative arrangements will inevitably fall sooner or later. Almost every sector of the economy has been impacted by power outages to a greater or lesser extent. The key realization for all of us is that, despite the inevitable protestations of our government, ITS NOT GOING TO GET ANY BETTER.

In every boardroom across the country discussions are being held about installing alternatives to Eskom. Many companies have already invested heavily in renewables, especially in solar farms. Those that have not are blind to the reality and are falling behind. The financial statements of listed companies need to address this question more directly, explaining their current reliance on Eskom and what plans they have for other arrangements.

Eskom

Eskom has become by far the most pressing problem in the South Africa today. Our apparent inability to provide reliable, cheap electrical power for businesses and consumers is now more important than COVID-19 was in 2020. Our view is that the ANC’s failure to recognize this problem timeously and deal with it effectively may well lead to its political demise. It must certainly be seen as their greatest failure since they took office.

In 1994, Eskom provided one of the cheapest and most reliable power supplies in the world. Today, in 2023, it

- is only able to achieve an energy availability factor (EAF) of around 54% of its capacity,

- is regularly at stage 6 loadshedding, which means that users have no power for at least 10 hours a day,

- has increased its price by 3 times the inflation rate this year and

- is bankrupt with a debt of R420bn and growing – more than half of which is now to be paid by the taxpayer.

The massive erosion of the ANC’s support base is clearly linked to this and other problems with service delivery.

The building of two massive coal-fired power stations (Medupi and Kusile) has not improved the situation – instead it has pushed Eskom into a debt trap from which it must now be rescued by taxpayers.

But there now are definite signs that the ANC is belatedly implementing the solutions which will eventually resolve the problem. The latest “bid window” for renewables is a massive 14,7 gigawatts. That is just under one third of Eskom’s current installed capacity.

Together with strong tax incentives to business and consumers to move “off the grid”, we anticipate that over the next few years, South Africa will move substantially away from fossil fuels. This will benefit us in several ways. Ultimately, it will be both cheaper and more reliable.

However, that solution will almost certainly be too late to rescue the ANC in the 2024 elections where they will, quite rightly, bear the brunt of their decades of mismanagement.

The energy availability factor (EAF) shows the average percentage of Eskom’s installed capacity that is operational. The EAF has been declining steadily since 2020. In that year the EAF was 65% of capacity. In 2021 it fell to 61,7% in 2021 and then it fell to 58,1% in 2022. This year so far it has been at around 53%. The Eskom Chairperson, Mpho Makwana, says that Eskom will achieve its target of bringing the EAF back to 65% by the end of March 2024, in terms of its “generation recovery plan”, but we are very doubtful that this will be done. In fact, we expect the EAF to decline further during the rest of this year.

The decision by the national executive committee (NEC) to support the Electricity Minister’s proposal that the schedule of retiring old coal-fired power stations be modified mat have some short-term benefits, but it will alienate those European countries that have promised us $8,5bn in cash to fund the “just energy transition”. In our view it is a step backwards – and a populist measure perhaps aimed at boosting the ANC’s flagging support for the 2024 election. The ANC will be the last organisation apparently to accept that Eskom is basically dying.

The pre-tax loss at Eskom for the year to 31st March 2023 is expected to be R32bn – more than double the loss that it made in the previous year. This is attributed to declining sales volumes as well as rising costs. These results show that Eskom in its current form is unworkable. It is losing customers in droves as businesses and consumers find alternative solutions to source their power needs elsewhere. The only bright spot in the results is that the separate transmission company is finally going to be established, probably by the end of March 2023 with regulatory approval.

The Treasury’s decision to exempt Eskom from reporting wasteful and irregular spending has drawn sharp criticism. The Treasury exempted the state-owned enterprise (SOE) from reporting such waste for the next three years. Eskom must surely rank as the SOE with the worst track-record of corruption, mismanagement, and waste – so to exempt it from reporting its misdemeanors seems simply absurd.

Large parts of Pretoria East and Mamelodi, including the industrial areas of Silvertondale and Waltloo, have been without power after 7 pylons collapsed because of theft of their steel by organized crime. The collapse of the pylons also closed the N4 highway. This type of uncontrolled theft of critical infrastructure by crime syndicates has become endemic in South Africa and adds significantly to the inability of Eskom to supply reliable power to industry and consumers. The Ford factory, which employs 4600 people, has been brought to a standstill, not to mention many other factories in the area. The inability of the police to curtail these crime syndicates seriously impacts the country’s productivity and will negatively impact President Ramaphosa’s efforts to encourage foreign direct investment (FDI) into the country.

Loadshedding has caused 66% of spaza shops to reduce their staff and many have gone out of business according to a survey by Nedbank. Those which produce food and drinks have been the worst affected. Spaza shops employ 2,6 million people in South Africa and are estimated to contribute about 6% to gross domestic product (GDP). Most spaza shop owners cannot afford to implement alternative power systems although many have bought generators.

The Minister of Electricity told cabinet that the next bid window for renewables would be for 14,8 gigawatts of power. This is almost triple the size of the previous window. In addition, companies will be able to deduct 125% of the cost of installing renewables for tax purposes and individuals will get a 25% rebate on the cost of solar panels up to R15000. These incentives are a significant step forward. The ANC has finally embraced the inevitability of renewable energy.

Economy

The South African consumer price index (CPI) rose to 7,1% in March 2023 driven mostly by higher food prices. In an environment where food prices worldwide have been falling, the rise in local prices is seen as being caused by the need to implement alternative energy solutions in the face of widespread loadshedding. The decline in the rand to over R18 to the US dollar has also impacted inflation, keeping petrol prices high and rising. The Reserve Bank is still saying that the CPI will come back inside the target range of 3% to 6% in the final quarter of this year. We are expecting interest rates to increase by a further 25 basis points after the next MPC meeting on 25th May 2023.

The monetary policy committee’s (MPC) most recent 50-basis point increase in interest rates in April brought the total increase so far in this hiking cycle to 4,25%. The MPC has remained consistently ahead of the current rate hiking cycle of first world countries, most notably America. In our opinion, the Reserve Bank has been managing the South African money supply very effectively given the recessionary conditions in the economy. They have not given in to political pressure to debase the currency and have maintained its relative strength among emerging market currencies. This has had the effect of keeping inflation down and sustaining international confidence in our financial management.

The treasury has made it clear that the additional R37,4bn required to fund the 7,5% increase for civil servants this year will have to be funded from existing department budgets – not from an increase in the government deficit. Government departments will have to find the money even if they have to reduce headcounts. Clearly, the Treasury is going to try to stick to its deficit reduction targets and the government departments are going to have to cut their other expenditures to finance the pay increase. This will involve trade-offs including retrenchments or cutting back on existing departmental programs.

SARS missed its target for tax collections in the year to 31st March 2023. Loadshedding is thought to have resulted in a R60bn drop in tax collections over the year. The indication is that the budget deficit will be close to the 4,5% of GDP that Finance Minister Godongwana estimated in the February 2023 budget. Companies took advantage of tax breaks associated with implementing roof-top solar power systems, but loadshedding reduced profits across the board - and hence taxes. Mining companies’ tax dropped by 5% reflecting the drop in commodity prices. The top 10 solar panel importers paid R3,8bn in tax. SARS has improved compliance and widened the tax base.

President Ramaphosa is going to find it very difficult to get overseas investors to invest further into the South African economy at his investment summit. His aim was to raise R2 trillion in foreign direct investment (FDI) and local investment over a period of five years. Loadshedding has resulted in many overseas and local companies reducing or cancelling plans to invest further in the economy. The installation of renewable energy solutions has mitigated this somewhat.

Manufacturing as measured by ABSA’s purchasing managers index (PMI) weakened further in March 2023. The print was for an index of 48,1 down from February’s 48,8 – and well below the 50 level which separates growth from decline. This was confirmed by Stats SA who reported that manufacturing production fell 5,2% year-on-year in February 2023. This shows the impact of loadshedding on the first quarter of 2023. But there was some optimism because the sub-index, which measures business conditions six months down the road, showed a surprising up-tick. This indicates that managers are taking strain but expecting things to improve.

Sales of new cars and commercial vehicles fell in March 2023 when compared with the same month last year. This may be because rising interest rates are making new cars less affordable. The prime overdraft rate was recently raised to 11,25% which is the highest that it has been since the sub-prime crisis in 2009. Altogether over 50 000 vehicles were sold last month, which remains a very strong number given the current weakness of the economy. The EFF’s “National Lockdown” on 21st March 2023 made the figures worse and loadshedding has been a major factor.

The Post Office has finally been placed in provisional liquidation by one of its creditors. It has been technically insolvent since 2013 and owes more than R4bn to creditors. It was given a R2,4bn bailout in the budget in February 2023. Provisional liquidators have been appointed. The liquidation will be made final on 1st June if no one comes forward to prevent it. In our view the Post Office, along with SAA, Denel, and many other state-owned enterprises (SOE) should be allowed to go into liquidation since they are no longer productive and have become a continuous drain on the fiscus and hence the taxpayer.

Mining production in the year to February 2023 was down by 5% mainly because of loadshedding. Coal production fell 12,6% and diamonds were down 45%, but Iron ore was up more than 30%. The mining industry has almost 10 gigawatts of renewable power under construction which will come on stream over the next decade. Another major problem facing mining companies is the inefficiency of the rail system which makes it difficult for them to get their products to port.

The average level of pay in South Africa declined in 2022 by 11,4%. Some of this decline can be attributed to the fact that people who lost their jobs during COVID-19 took on lower paying jobs in 2022 just to have an income. Average monthly pay across the whole country was R16370 – R2100 less than in 2021. Many of the 1,4m jobs created in 2022 were at lower pay. Lower levels of pay obviously impact directly on spending patterns and result in consumers using more unsecured credit just to survive.

The fact that South African individuals and corporations have been linked to a massive international money laundering network by the United States comes as no surprise, but it will make it more difficult for us to get off the Financial Action Task Force’s (FATF) “grey list”. It is further evidence of this country’s inability to retain its status as a reputable member of the international community. More and more we are being painted as a “banana republic” where the rule of law is completely arbitrary. Over time, this perception impacts on foreign direct investment (FDI) making it more difficult for this country to raise much-needed capital.

The Rand

The rand remains in a weakening trend, buffeted by the local loadshedding and periodic bouts of “risk-off” sentiment in international markets. The Reserve Bank has done a good job of keeping interest rates comparatively attractive to overseas investors, but the endemic pattern of loadshedding has scared many would-be investors away. In the short term, it seems probable that the government will find ways to alleviate power outages leading up to the election, but the medium-term outlook is not good. The rand’s weakness relative to the US dollar means that the price of fuel continues to rise, which is ultimately reflected in our inflation rate.

Commodities

OIL

In last month’s Confidential Report, we drew your attention to the fact that the price of North Sea Brent oil had broken above its long-term downward trendline. Since then, the price spiked upwards before coming back to the trendline which appears now to be a resistance level.

There is some evidence that various alternative energy sources are beginning to impact on the oil price, but we expect oil to continue to be the world’s dominant energy form for some time. The big oil companies are resisting the shift to other forms of energy. Consider the chart:

GOLD

In the last two Confidential Reports we have drawn your attention to the fact that gold and high-quality gold shares may well be about to move up significantly. Consider the chart:

The US dollar price of gold is very close to breaking above its long-term resistance at $2050 and the rand price of gold has been one of the best investments over the past 18 months. International investors are becoming increasingly concerned that equities are over-priced and that the bear trend, which began in January 2022, is about to experience another sharp decline before the end of this year. Gold is the ultimate safe haven when paper currencies and other assets like equities are risky.

Following its “triple bottom” in October last year, the gold price reached a cycle high of $2038 on 13th April 2023. In the last two weeks it has been trending lower in the face of renewed optimism about the imminence of the Fed’s interest rate pivot.

In our view, as we have explained above, that optimism is probably misplaced. We expect the S&P to fall back from current levels. If we are right, then that downward move should be accompanied by a surge in the dollar price of gold. We expect the price of gold to reach $2300 in due course.

Bitcoin

The price of Bitcoin has been trending up since it formed an island at around $17000 over the end of the last year and the start of 2023. We see the price of Bitcoin as being in lockstep with the S&P500 index. You will notice from the chart below that it too has reached a long-established and major resistance level at around $29000 per coin. If that level is penetrated, we can expect more upside, but we believe that it will not exceed that level convincingly. If the S&P500 falls back from the resistance at 4170, you can expect the price of Bitcoin to fall in tandem.

Companies

As a private investor it is important to grasp that the world economy, including South Africa of course, is beginning to feel the impact of higher interest rates. This is impacting both consumers and businesses. While some economies are still growing (like the US economy) it is almost a certainty that more and more will enter recession sometime in the next year. A world recession will cause the prices of commodities to fall and will result in sharply lower consumer spending and rising unemployment. If you agree with our perception of where things are headed, then you need to think about how you should structure your portfolio to avoid unnecessary losses.

BANKS

The effect of rising interest rates is beginning to impact on business with the banks reporting rising impairment rates as companies and consumers battle to repay loans. ABSA reported a 61% increase in impairments in its most recent financials for the year to 31st December 2022 and other banks are in a similar position. Capitec is the most affected because its loans have historically been given to lower income groups which are seen as being more vulnerable to rate hikes. Banking shares, which had an excellent year in 2022, may well be less profitable this year and next with the impact of rising interest rates.

GOLD SHARES

On 27th March 2023 we published an article in which we drew your attention to the fact that the US dollar price of gold was probably going to break up through resistance at $2050. If the oil price rises and the US dollar falters, we expect gold to break above this critical level and head on upwards. Since then, the oil price has fallen back to support at around $80 per barrel and this together with the excessive bullishness on Wall Street has temporarily slowed the upward trend in gold. However, we still believe that gold is headed up and this means that precious metals shares like Sibanye, Anglogold and Anglo itself represent buying opportunities. Our personal favourite is Sibanye, but here are four commodity shares that look good to us:

SIBANYE

This share may be one of the most under-valued commodities companies in the world right now. Sibanye (SSW) is a mining house which accumulated platinum and gold mines in South Africa and America and is now broadening its scope to include base metals and minerals, especially so-called "green" metals. The company is run by Neal Froneman who is well-known in the mining industry for his toughness, expertise, and experience. The acquisition of the Stillwater palladium mine in America was a risky, but brilliant move. Sibanye is now one of the world's largest producers of platinum group metals (PGMs). Froneman has said that he intends to retire in about 2024/5 but has plans to double the size of the company before he does. Sibanye has moved into the base minerals used in motor vehicle batteries like vanadium, copper, nickel, and lithium. On 1st June 2021 the company announced a share buy-back program to repurchase up to 5% of its issued shares. In its results for the year to 31st December 2022 the company reported a profit of R19bn compared with R33,8bn in 2021. We believe that Sibanye will continue to make new all-time record highs due to superb strategic management - so this drop in the share price is probably a buying opportunity. Froneman believes that Sibanye shares are undervalued, and we agree with him. Consider the chart:

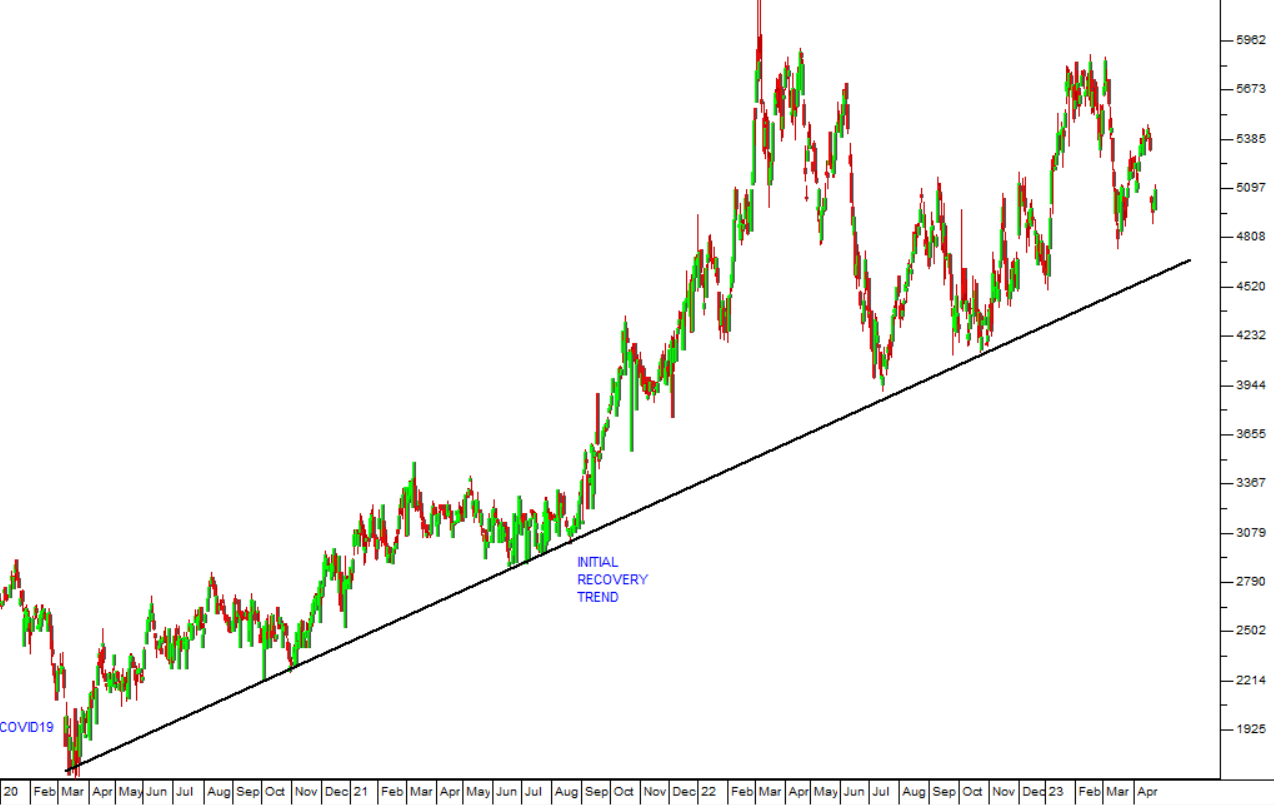

SOUTH 32

South 32 (S32) was spun out of BHP Billiton in 2015 and contained all of BHP's South African coal assets. It is, in its own right, a diversified miner of base metals and minerals such as zinc, coal, aluminium, silver, lead, nickel and manganese. It operates in South Africa, South America and Australia. The company bought the remaining 83% of Arizona Mining which it did not already own. Arizona Mining has extensive interests in zinc, manganese and silver described by South 32's CEO, Graham Kerr, as "...one of the most exciting base metal projects in the world". In our view, South32 is an excellent mining conglomerate with good medium-term potential to exploit any recovery in base metals and minerals. The company is continuing with its $1,4bn share buy-back. The company is working to supply its Hillside smelter with renewable energy and plans to transition away from Eskom over the next 10 years. In a report on the 3 months to 31st March 2023 the company said, "Group copper equivalent production [1] increased by 7% year to date, as our recent investments delivered strong growth in copper and low-carbon aluminium [2], and Australia Manganese achieved record production. Improved market conditions supported higher prices across most of our commodities quarter-on-quarter". Technically, the share has been in an upward trend since COVID-19 which we see as continuing. Consider the chart:

AMPLATS

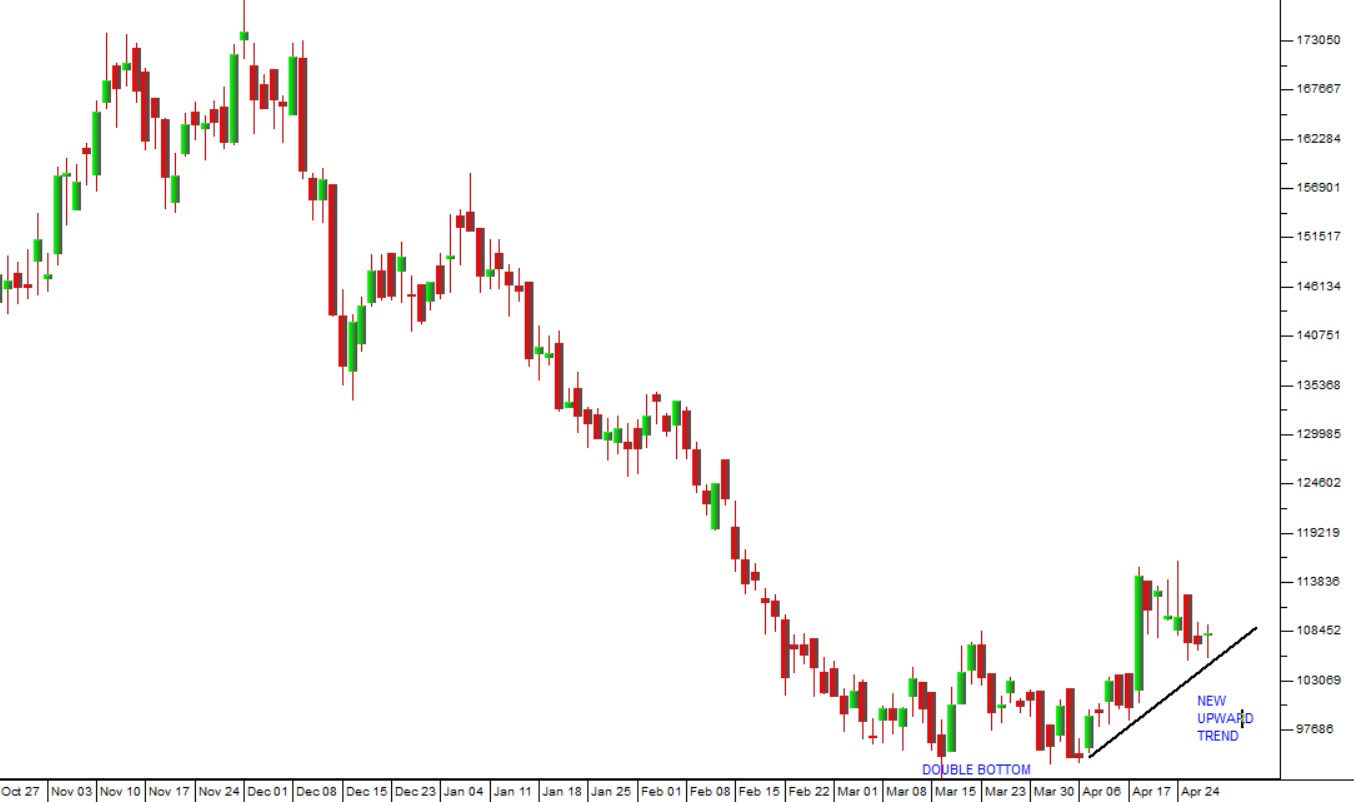

Anglo American Platinum (AMS), or Amplats, is one of the world's largest platinum producing companies in the world (after Sibanye). It is owned 78.78% by Anglo American. The Mogalakwena open-cast operation is a palladium-rich operation with costs in the lowest quartile in the platinum group metals (PGM) industry world-wide. Amplats also recently bought out Glencore's stake in their joint venture Mototolo mine and the adjacent Der Brochen property for R1,5bn. Mototolo is a highly mechanised shallow mine which can be extended into Der Brochen without putting in new surface infrastructure. The platinum price has been plagued by an effective re-cycling industry which produces about 2 million ounces a year by recovering from old auto catalysts. We believe AMS is the best of the pure PGM shares on the JSE - but it remains a commodity share and thus volatile and unpredictable. In a production report for the quarter to 31st March 2023 the company said PGM production was down 6% and refined PGM production was down 13% with sales down 17%. The company said, "Eskom load-curtailment (scheduled power outages) impacted both concentrators and smelters resulting in increased work-in-progress inventory of c.26,500 PGM ounces during the quarter". Technically, the share has been falling for the past 1 months, but it recently made a “double bottom” at around R945. It now appears to be rising off that base and we believe it may now be under-valued. Consider the chart:

KUMBA

Kumba (KIO) is a highly successful iron mining operation which is owned (69%) and controlled by Anglo American. Importantly, exports make up a large proportion of the company's total sales - which means that it is not heavily dependent on local sales but is vulnerable to any strengthening of the rand and the effectiveness of rail transport to ports. The company is planning to build a 100mw solar park over the next 3 years to reduce its reliance on Eskom. The company has had to contend with heavy rain and bad rail performance. In a production report for the first quarter to 31st March 2023 the company said volumes increased 14% and sales were maintained at 9,5m tons. The company said, "Average realised free on board (FOB) export iron ore price of US$121 per wet metric tonne (wmt) equivalent to US$123 per dry metric tonne (dmt), compared to the average benchmark price of US$110/wmt or US$112/dmt". The share trades at a multiple of 7,79 and a dividend yield (DY) of 8,22% - which seems to us to more than compensate the investor for the commodity risk in this rand-hedge share. Consider the chart:

You can see here that, like most commodity shares, Kumba is volatile. It made a double bottom in October last year and then rose strongly. In January and February of this year it made a triple top and then fell. Now it appears cheap to us and looks like it may be at or close to the bottom of its cycle.

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: