The Confidential Report - June 2023

7 June 2023 By PDSNETWall Street

The idea of market breadth has suddenly become very important for the analysis of what is happening on Wall Street.

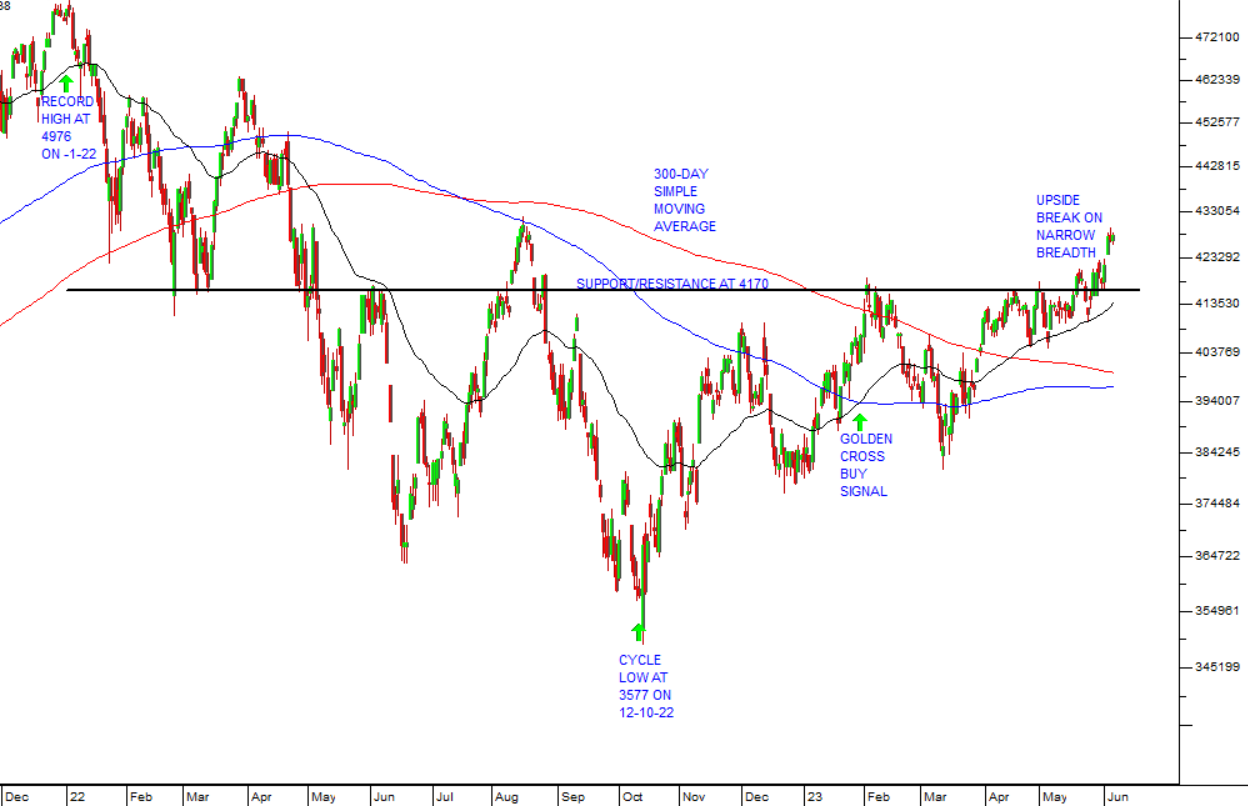

We have all seen the S&P500 index rise convincingly to new cycle highs in the last week or so, breaking comfortably above the long-established support/resistance level at 4170. Consider the chart:

The chart shows the S&P500 going back to December 2021. Superimposed is the long-term support/resistance level at 4170. You can see that this resistance level has been convincingly broken in the last week or so. Also the 300-day simple moving average is still falling.

Does this mean that the bear trend is now over and there is a bull trend in place? We think not because Wall Street is being taken higher by very few mostly high-tech shares while the bulk of the market remains flat or bearish.

The breadth of a market move refers to whether a move is supported by most of the shares in the market or just a few. One way to measure this is to look at the percentage of shares which are currently beating the market average, on a trailing three-month basis.

Right now, only 20,3% of the shares which make up the S&P500 index are trading above that index, measured over the past three months. In other words, 80% of the S&P500 is performing below the average because that average is being dragged higher by just a few shares with very large market capitalisations. The strength of the few is obscuring the weakness of the many.

Apple and Microsoft together account for about 14,5% of the S&P’s total market capitalisation. Both shares are rising rapidly pulling the index up. If you add in the next 7 shares, Alphabet (Class A and Class C shares), Amazon, Nvidia, Berkshire Hathaway, Meta, and Tesla, most of which are high-tech shares, then you have 28,6% of the S&P’s performance being determined by just 8 brand name companies.

The lack of breadth in the current surge on Wall Street can also be seen when comparing the S&P500 to the Nasdaq and the Dow Jones Industrial indexes. The Dow Jones (DJ) is a simple average of the 30 largest companies trading on Wall Street and it includes both Apple and Microsoft – but they are only given the same weighting as the other 28 shares in the index because it is a simple average. The DJ has risen by just 1,5% since the beginning of this year.

By contrast, the S&P500 which is a weighted average of the 500 largest companies on Wall Street, also obviously including Apple and Microsoft but now weighted for their market capitalisations, has risen by 12% since the beginning of the year.

Finally, the Nasdaq, which is a weighted average of about 2500 non-financial shares mostly in information technology (IT), has risen by 26% so far this year. Historically, rises in the S&P500 which are not broadly based involving more than half of the constituent companies tend to be like the “seeds that fell on the stony ground”. They inevitably “shoot up and then die in the sun”. The DJ, S&P and Nasdaq are the most widely followed indexes on Wall Street. In our view, the tidal wave of investor optimists driving Wall Street higher simply does not have the depth of experience to appreciate the significance of market breadth.

One of the most popular reasons given for the massive advance of high tech shares on Wall Street is much-anticipated impact of artificial intelligence (AI) on corporate profits. This is said to be especially important for Nvidia, which has risen 167% since the start of 2023, and has pushed up the prices of all high-tech shares. In our view, AI is certainly important and will undoubtedly have an impact on corporate profitability in the future, but we believe that this impact will affect the general productivity of the entire market, perhaps with a more noticeable effect on high tech shares. For example, there can be very little doubt that AI has and is playing a significant part in the growth of Tesla’s profits and its ability to out-perform its competition.

But we believe that this factor alone is insufficient to justify the current surge in high-tech shares. And certainly, the advent of AI will not negate the fact that the US economy is heading inexorably into a recession caused by the cumulative impact of rising interest rates. The surge in optimism around AI looks very similar to us to the optimism which dominated markets during the 1998 dot-com boom. And that ended with a crash that took many IT companies into liquidation or down over 90%.

So we urge you to view the current upward trend with some trepidation. If you intend to invest or are invested, make sure that you maintain a strict stop-loss strategy.

US Economy

Our observation of the US economy is that it is not yet responding significantly to the cumulative impact of rising interest rates. For example, private payrolls increased by 296 000 in April 2023 – well ahead of analysts’ expectations of 133 000. This does not look like an economy that is shrinking or taking strain from higher interest rates.

At the same time, Bank of America says that consumer spending in April 2023 was down 1,2% on April 2022. The biggest losers were furniture, luxury fashion, home improvements clothing and retail. Since 70% of US gross domestic product (GDP) comes from consumer spending, this statistic indicates that the US economy is probably already in recession. The bank also noted that unemployment in the US was highest among the higher income groups. There has been a 40% increase in higher income households getting unemployment benefits. This makes this recession a “white collar” recession. Lay-offs have occurred at Microsoft, Disney, Meta and Google. Higher income households account for 60% of consumer spending.

The consumer price index rose by 4,9% year-on-year in April 2023 – slightly below analysts’ expectations and well down from its peak level of 9,1% - mainly due to a drop in food and energy prices. Core inflation, which excludes food and energy prices, was “sticky” at 5,5% - it has hardly come down at all since interest rates began to rise.

It is now becoming clear that, far from “pivoting” the question is whether the Fed will even pause in its rate-hiking cycle. In other words, there remains the distinct possibility that it will raise rates further. The latest data coming out of the economy suggests that it is beginning to “cool”. Gross domestic product (GDP) was only 1,1% up in the first quarter and now retail sales have come out and are up only 0,4% in April 2023 – against expectations of 0,8%. So, there is still growth in sales but it is muted.

The Republicans and Democrats have been arguing about the debt ceiling – which always tends to unnerve the market. To this must be added the negative predictions of Home Depot which reported results on 16th May 2023. All in all, it is beginning to become apparent that the bullish sentiment which has dominated markets for the last two months is misplaced and is beginning to wane.

During the past month we have seen America have one of its regular “debt ceiling” crises. There have now been 103 times that the debt ceiling has needed to be raised since it was made a requirement in 1917 – roughly one a year. Sometimes these crises, which require a bi-partisan agreement between the Democrats and the Republicans, temporarily become a major issue and the media makes much of what would happen if an agreement were not reached. This frightens some investors, especially those who are relatively new to the markets, but in our experience an agreement is always reached, often after some “brinkmanship” but inevitably the parties work out their differences sufficiently to allow the government to raise its debt limit once again . The most recent crises did initially have some negative impact on the S&P500 and then added to bullishness when it was predictably resolved. Read our article on The US Debt Ceiling here.

Ukraine

President Zelensky addressed the G7 meeting in Hiroshima and the members agreed to further tighten sanctions on Russia and to continue supporting Ukraine for as long as necessary. The war inside Ukraine had been largely stagnant for some time as everyone awaited Ukraine’s Spring offensive.

This stalemate has now suddenly been broken with a growing number of attacks inside Russia including in Moscow – both by drone and across the border. Ukraine is taking the war to the Russian people. This is very significant, because Putin originally came to power on the back of promises that he was able to protect the Russian people. Now, suddenly, attacks like this make it apparent that he cannot. They also inevitably force Russia to re-deploy some of its forces away from Ukraine to the affected areas.

At the same time Prigozhin, leader of the Wagner mercenary group, is becoming more and more outspoken in his criticisms of the Russian Military. No one has ever dared to be as openly critical of the Russian government. It looks as though he is heading for some kind of showdown with Putin. In our view, Russia no longer has the ability to mount any kind of significant land-based attacks in Ukraine or gain any further territory. Their war effort has been reduced to the regular missile and drone attacks most of which fail to find their targets because of Ukraine’s increasingly sophisticated and effective Western air-defences.

We expect that, using its recently acquired weaponry from Europe and America, Ukraine will recapture significant swathes of territory probably including Crimea in its long-awaited counter offensive. Politically, Putin, who is already under pressure from the wave of attacks inside Russia, will probably not survive the loss of Crimea. And as we all know, in his absence, the war will almost certainly come to an end. The end of the war will eliminate a major drag on the world economy, but by the time it happens, we are expecting that the world economy to be firmly in the grip of a recession.

Political

The DA’s telephonic geographically representative poll of 1700 South Africans indicates that it will gain in both Gauteng and Natal in the 2024 elections. In Gauteng its support will increase from 27% to 37% and in Natal from 13% to 20% assuming a two-thirds voter turnout similar to the last election. The poll suggests that the ANC will fall from 50% support in Gauteng in 2019 to 34% in 2024 and from 54% in Natal to just 37%. The survey has a margin of error of 4%. Obviously, there is still a considerable amount of time before the 2024 elections so these numbers could change. What does seem clear, however, is that the ANC will lose its majority in parliament next year and be forced to make an alliance with one or more of the other parties.

South Africa’s claimed neutrality in the war between Ukraine and Russia may well be open to question by Europe and America – two of our largest trading partners. The latest move which has seen the Minister of the Department of International Relations and Cooperation declare “diplomatic immunity” for all attendees at the BRICS meeting in Johannesburg in August this year. Russian president Putin could be among those guests and there is a warrant for his arrest issued by the International Criminal Court (ICC). Despite that diplomatic immunity, South Africa is required to arrest him as soon as he arrives. If he is welcomed by South Africa there could well be consequences which would directly impact on the country’s economy – something we can ill-afford. President Ramaphosa is to send a high-level delegation to the G7 to explain South Africa’s non-aligned position with regard to Russia. The Reserve Bank has warned of the potentially dire economic consequences of our apparent friendliness towards Russia – together with other factors such as loadshedding and the grey listing of the country by the Financial Action Task Force (FATF).

The US ambassador said that America believes that the Russian ship which docked in Simonstown in December 2022 loaded weapons and ammunition bound for Russia. More recently it has been reported that senior elements of South Africa’s military are in Moscow for talks on “combat readiness”. This together with our government’s refusal to take a firm stance against the Ukraine war is endangering our participation in the African Growth and Opportunity Act (AGOA). South Africa enjoys a privileged trade relationship with America which is now in jeopardy due to our extremely foolish foreign policy. We would do well to consider the potentially enormous cost to our economy if the US decides to sanction us. If Western sanctions were applied to this country it could lead to massive capital outflows and economic collapse.

The probable expulsion of Ace Magashule from the ANC will mean that the policy of “Radical Economic Transformation” (RET) will come to an end. He has been in a leading position in the ANC for more than 15 years and was instrumental in getting Zuma appointed to the presidency to replace Thabo Mbeki. At the 2017 ANC elective conference the RET faction was supposed to prevent Ramaphosa’s election, but failed. In our view, both the ANC and South Africa will be a better place without Magashule in a position of political influence.

The South African government’s inability to run large critical state-owned enterprises (SOE) effectively is best demonstrated by Eskom and more recently Transnet Freight rail. The passing of the National Health Insurance (NHI) bill through parliament paves the way for a massive new SOE which will manage and control health care in the country and severely limit the role of medical schemes. The state of South Africa’s existing government-controlled hospitals is a clear indication of how such a scheme would impact on the standard of health care in this country. If the NHI is ever brought into effect, it could also result in a flight of top medical doctors and specialists out of this country – something we can ill afford.

Economy

The monetary policy committee’s (MPC) decision to increase interest rates by 50 basis points was insufficient to prevent the rand slipping sharply to over R19.75 to the US dollar. The rate hike was widely anticipated, but less than some analyst’s expectations of a 75 basis point hike. The MPC warned that it expected further currency weakness. The hike will put further pressure on the economy and reduce consumer spending further. The decision was also a function of the higher levels of loadshedding since late last year and the consequent need for the South African economy to switch very rapidly to renewable energy. Notably, the rate hiking cycle in South Africa now totals 4,75% - which compares to the 5% of rate hikes so far passed in America. Clearly, our MPC has to keep local interest rates in line with those in America in order to retain the relative attractiveness of our government bonds. There is, of course, now a heightened risk that the economy will go into a recession.

The consumer price index (CPI) slowed to 6,8% in April 2023 while core inflation rose slightly to 5,3%. This indicates that the Reserve Bank is being successful in curtailing inflation, but that core inflation remains unaffected by recent increases in interest rates. Obviously, a major factor is the weakness of the rand against the US dollar and other first world currencies. It fell below R19 to the US dollar on 11th May 2023 and then to R19.75 on 25th May 2023. Some of this decline is due to a current or anticipated shift towards “risk-on” in international markets but we believe the current weakness is due more to the severe loadshedding which has been in place this year. The rand’s weakness has the effect of increasing the price of imports, most importantly fuel. The Reserve Bank also has to be cognisant of the need to keep the real interest rates on our long government bonds attractive to overseas investors. Notably, the Reserve Bank has now increased its expected inflation rate for this year to 6,2%.

The ABSA purchasing managers index (PMI) came in at 49,8 in April, above March’s figure of 48,1, but still indicating that the sector was contracting. Given the level of loadshedding during the month, we are surprised that the PMI did not fall. This is an indication, possibly, that manufacturing has made considerable headway towards implementing its own alternative power solutions. In a report on 9th May 2023 ABSA revised its growth forecast for 2023 down to 0,3% from 0,7% due to the severity of loadshedding. This compares with the IMF’s forecast of 0,1% growth and the Reserve Bank’s estimate of 0,2%. Loadshedding is expected to cut at least 2% off GDP growth this year.

The BankServ take-home pay index shows that the average South African took home 4,2% less in April 2023 than April 2022. Average take-home pay was R14500 per month compared with R15170 in the previous year. The real drop in take-home pay was worse because of the 6,8% inflation rate. So South Africans are considerably worse off now than they were last year. The effect of this is to sharply reduce consumer spending and economic activity generally. Poverty will increase as will the crime rate. Perhaps the most important result will be that the ANC loses further support in the 2024 elections.

Of the 257 municipalities, only 38 came out with clean audits this year compared to the 41 with clean audits in the previous year. The mismanagement of municipalities has continued to deteriorate leading to worsening service delivery across most of the country. 21 of the 38 clean audits were in DA-led constituencies in the Western Cape – another factor that is likely to have an impact on the outcome of the 2024 elections. The ANC has clearly failed to find a remedy for the mismanagement of municipalities despite years of poor audit performances.

Surprisingly, in the midst of all the doom and gloom which is the South African economy, new car sales rose 15,6% in May 2023 compared to April 2023 and a 10% rise compared to May 2022. This is surprising because interest rates rose by a further 50 basis points last month making the purchase of a new car less affordable.

Tourism in the first quarter has shown that visitors to South Africa have more than doubled compared to this time last year. There were 2,1m international visitors in the first quarter – which is still below pre-COVID-19 levels, but improving rapidly. There were 387 000 visitors from Europe and 104 000 from America. We had 1,6m visitors from the rest of Africa. Foreign direct spending is up 144% over last year so far.

South Africa’s unemployment situation got slightly worse in the first quarter of 2023 with about 180 000 people losing their jobs. The figures show that we now have just under 8 million people unemployed with an unemployment rate of about 33%. Youth unemployment is much worse with about 62% of young people unemployed. This is a direct cost of loadshedding which is forcing businesses and households to retrench staff. The mining and manufacturing sectors have been worst affected, but households have let about 85 000 go – probably because of a drop in household income.

Surprisingly, Standard and Poors did not further downgrade the South African economy on Friday 19th May 2023, despite the sharp deterioration in the country’s energy management and its dealings with Russia, which could result in it becoming isolated from US and European trade deals. The international ratings agency may still drop the rating as the true impact of loadshedding on the economy becomes more apparent, later in the year. The fall in the rand this year shows that international investors have definitely adjusted their perceptions of this country in response to the electricity situation.

Private sector credit extension increased by 7,1% in April month, below expectations for a 7,3% increase. Household credit eased to 7% with both home loans and vehicle financing down from the previous month. This shows that the economy is slowing, probably as a result of loadshedding and rising interest rates.

ABSA’s purchasing managers index (PMI) shows that manufacturing contracted for the 4th month in a row in April 2023. This shows that pessimism in the manufacturing sector is increasing with the current high levels of loadshedding. Obviously, the falling PMI impacts directly on the country’s gross domestic product (GDP) and will ultimately result in lower levels of employment. With Eskom predicting that loadshedding could go to stage 8 during this winter and the possibility of a complete shut-down of the grid, most manufacturing concerns are scrambling to implement their own power solutions which do not require Eskom. Ultimately this will result in cheaper more reliable power, but in the short term there is bound to be some pain.

Eskom and Transnet

The probability of stages 7 and 8 loadshedding this winter will take Eskom’s problem and its impact on the economy to a new level. It will obviously impact directly on manufacturing and to a lesser extent on mining, reducing growth levels and exacerbating unemployment. It will also accelerate the trend towards distributed renewable energy generation in which the private sector is taking over electricity generation from government and switching to renewables. For the next two or three years this will negatively impact the economy and probably cause inflation to rise – but thereafter the economy should benefit from more reliable and cheaper energy. The most immediate result of the increased loadshedding will almost certainly be political. It is highly unlikely that the ANC will win a majority in parliament after next year’s elections. President Ramaphosa says that 10 gigawatts of power will be added to grid from various sources in the next few months and that ultimately 19 gigawatts of renewables will be added. The problem is that South Africans have seen these types of promises remain unfulfilled too often.

Eskom has reported that the cost of its purchases of diesel have more than doubled to R21,4bn for the year to 31st March 2023. In the previous year it spent R10bn. This cost has been exacerbated by the fall in the rand against the US dollar. The rand has fallen 17% so far this year and may well breach the R20 to the US$ mark in the near future. The increased costs take Eskom further into debt (it now owes more than R420bn) and makes its ultimate recovery less likely. Unbelievably, our Minister of Energy and Mining, Gwede Mantashe, is proceeding with his plan to build 2,5 gigawatts of nuclear energy plants. This is despite the fact that nuclear energy is now clearly more expensive than renewables. Mantashe argues that South Africa will need more “base load” to compliment the variable power from renewables.

In their negotiations with management the Eskom unions are demanding a 12% pay increase and management have recently increased their offer from 3,75% to 4,5% before settling on 5.25%. Given the high levels of loadshedding and general mismanagement at the SOE it is amazing that any pay increases are contemplated at all. The company should be engaged in a large-scale retrenchment to cut costs.

Everyone is very aware that Eskom is collapsing with huge consequences for every aspect of the economy. But, at the same time Transnet Freight Rail’s has also been collapsing with the Johannesburg – Durban line only able to carry about a quarter of the freight it normally does because of poor maintenance, theft of infrastructure and a shortage of locomotives. Transnet’s inefficiencies are forcing many companies to transport their raw materials and finished goods by road – which is about four times as expensive. This additional cost often makes South African products uncompetitive on world markets. Some of the companies affected are Lewis, Astral Foods, and BMW (which has had to reduce motor vehicle exports by rail). The increased load on the highways is also causing problems. Transnet is yet another government agency which is collapsing with a massive knock-on cost to the economy and consumers.

Cable theft on the 860km railway line which transports iron ore and other minerals from the Northern Cape to Saldanha Bay has forced Transnet to suspend operations there. This has severe financial implications for the state-owned enterprise which is already in financial difficulties. Until recently, most cable theft problems have been in Natal with the rail lines from Gauteng to Richards Bay. These new thefts have taken place in the Northern Cape near Olifantshoek. The immediate impact has been on Anglo American’s Kumba iron ore mine, which has its principal Sishen iron ore mine in the Northern Cape. Kumba has lost about R10bn worth of profits in its most recent financial year due to Transnet problems.

The minister of electricity, Kgosientsho Ramokgopa’s plan to get private enterprise to invest in the country’s aging fleet of coal-fired power stations will almost certainly fail. This is because private enterprise is under pressure to move away from fossil fuels and it is almost impossible to get funding for such projects. Asset managers, Allan Grey and Future-growth have already ruled out investing and now Standard Chartered Bank has said the same. Basically, financial institutions cannot provide any funding for any energy project which is not renewable.

The report by the Presidential Climate Commission indicates that South Africa needs to build about 8 gigawatts of renewable energy per annum until 2030 accompanied by battery storage. This would result in renewables representing 40% of power generated in South Africa and would allow us to reach our climate change commitments. Right now, renewables account for 7% of energy and about 80% is from coal. The commission also says that the idea of refurbishing old coal-fired power stations and extending their lives is viable for a maximum of two years at most and nuclear power (Gwede Mantashe’s favourite) too prohibitively expensive. The report calls for a major revision of the current Integrated Resource Plan which requires the 12 gigawatts of coal-fired power be removed from the grid by 2030.

The Rand

The rand has been one of the weakest emerging market currencies this year mainly because of the impact of persistent loadshedding. So far it has fallen about 17% against the US dollar and further against both the British pound and the euro since the beginning of the year. Currently it is trading above R19 to the US dollar and at the lowest level since COVID-19. Consider the chart:

It is becoming increasingly clear that the fall to above R19 to the dollar is an immediate result of the heightened levels of loadshedding this year. By 11th May 2023, South Africa had seen more days of loadshedding than it saw in the whole of 2022.

A falling rand causes inflation to increase because it impacts directly on the price of petrol. The Reserve Bank has said that it expects our consumer price index (CPI) to come back inside the 3% to 6% target range by the 4th quarter, but this may not happen if loadshedding persists. The monetary policy committee (MPC) was forced to raise interest rates by 50 basis points when it met at the end of May. It estimates that the impact of loadshedding on inflation will be about 0,5% in 2023. The country also now faces the risk of US sanctions due to its stance on the Ukraine war and its on-going relationship with Russia.

It is also important to realise that the latest rand weakness comes at a time when the dollar has been falling against other emerging market currencies. We would certainly be facing a further sharp rise in the petrol price if it were not for the continuing decline in the price of oil.

General

The deal which Investec Bank has made with the Johannesburg Roads Agency to provide power during loadshedding to two traffic lights at major intersections in Sandton is an indication of the way forward. Each traffic light uses between 300 watts and 500 watts of power – which is really very little when compared with the enormous cost of the traffic disruption at major intersections during loadshedding. If more private companies take responsibility for individual traffic lights in the vicinity of their offices, the impact on the economy over time would be substantial. This is yet another example of private enterprise stepping in where government has been shown to be incapable.

Efforts to update and improve the government’s integrated financial management system (IFMS) have so far taken ten years and cost R2,4bn with no concrete improvement – a classic ANC debacle. During that ten years technology has, of course, advanced significantly and the government is now looking to implement an integrated cloud-based system. This would replace the current fragmented and out-dated system currently being used. The inability of the government to implement modern computerised solutions to its database problems is depressingly consistent with almost everything it has tried to fix, from managing the electricity situation to revitalising SAA, Denel, SABC and the Post Office. The incompetence and corruption of the government institutions and their demonstrable inability to make improvements is systemic. The IFMS is simply another depressing example.

The Progress in International Reading Literacy Study (PIRLS) is conducted every 5 years to determine the ability of grade 4 children (9 and 10 years old) to “read with comprehension”. The study is conducted in 57 countries including South Africa. Our literacy at that age is the worst of all the countries in the study and has deteriorated since 2016. Children learning in English and Afrikaans have not deteriorated, but those in other languages have. Approximately 81% of South African grade 4 children cannot “read for meaning”. Some of the deterioration is due to the school shut-downs during COVID-19, but much of it is also due to a noticeable drop in educational standards. The ability to read for meaning is important because it impacts the child’s ability to go further with their education. After grade 4 it is assumed that children can understand what they read and so most of their education is conveyed in written form from then on.

The outbreak of cholera in Hammanskraal north of Pretoria (Tshwane) is a direct result of the mismanagement of the country’s water and sewage systems. The 23 deaths are tragic because they could easily have been avoided by the well-known and understood maintenance of the basic systems which are essential to the functioning of any modern economy. More than anything else, this outbreak (now added to the complete mismanagement of our electricity system and the consequent loadshedding) shows how South Africa is slipping inexorably towards third-world status. The ANC inherited working first-world water and sewage systems when they took over in 1994. They have mismanaged these systems to the point where now we are facing the outbreak of a disease which is completely unheard of in first world countries.

Commodities

OIL

The oil price has resumed its downward trend and now looks close to breaking below support at around $72. Consider the chart:

This development is significant because it will have the combined effects of reducing world inflation, boosting economic growth and putting further pressure on the Russian economy. All of these objectives are in line with the goals of the Biden administration and immediate needs of the US economy. The Federal Reserve Bank’s efforts to reduce inflation will be assisted by lower oil prices and that may result in a more dovish stance on interest rate policy going forward. Here in South Africa the falling oil price is help cushion the effect of the drop in the rand against the US dollar. If oil breaks below $72, it could fall further.

GOLD

The gold price remains in a strong upward trend. Consider the chart:

You can see that since the previous Confidential Report, the gold price in US dollars has made a new cycle bottom at around $1943 and is now trending up again. This confirms the underlying upward trendline with a third touch point. And it is in line with gold’s role as a hedge against the weakness of paper assets and particularly equities. Some investors (including ourselves) view the current effort to push the S&P500 to new highs as ill-fated and potentially misplaced. This is because the US and the world economies are almost certainly headed into a recession in the second half of 2023 and in 2024. We expect gold to remain in an upward trend in the immediate future.

Companies

REINET

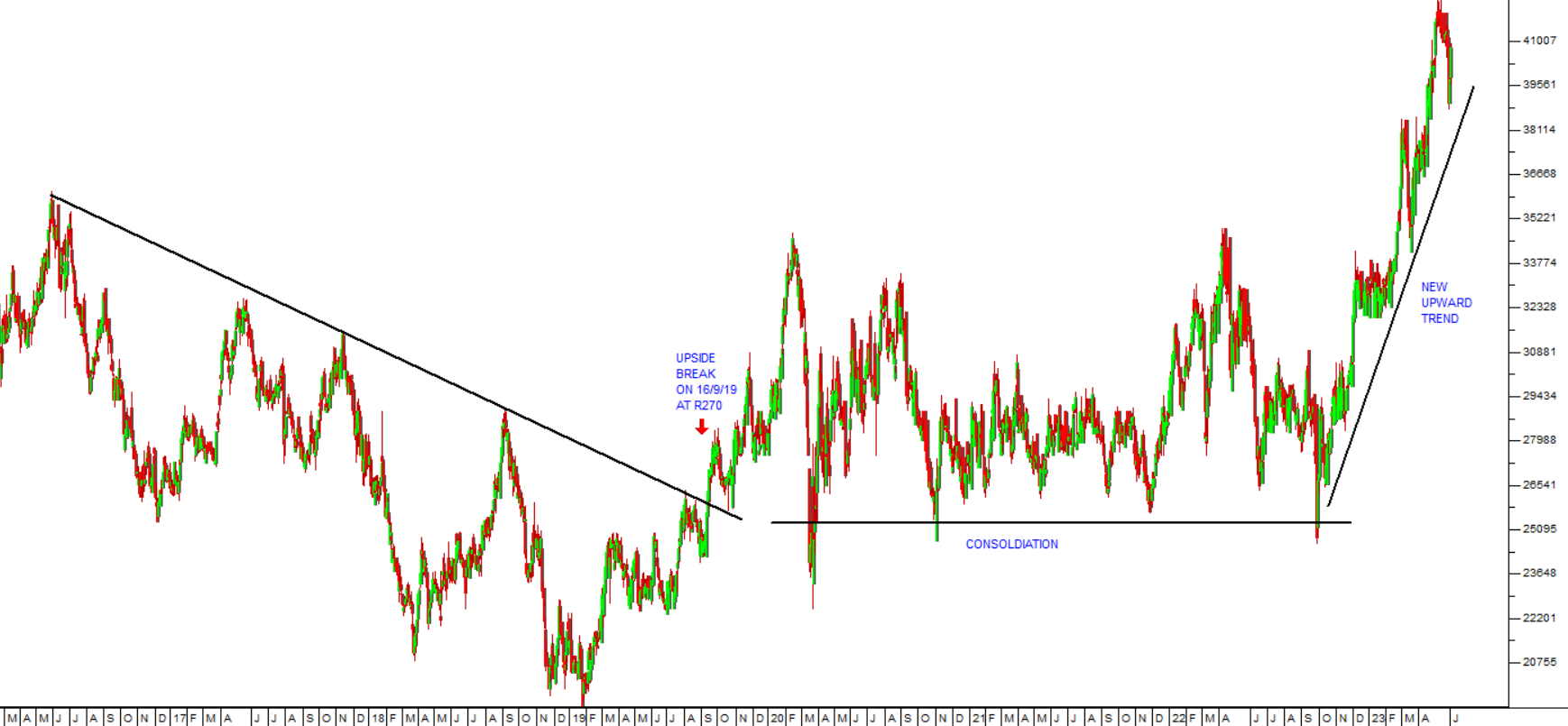

Reinet (RNI) is an investment holding company whose main asset is a holding of roughly 2,12% of British American Tobacco (BAT) worth about Euro 1,5million which now accounts for 27.3% of its net asset value (NAV). The decline from a year ago is because the price of BAT shares has fallen. Most of this reflects the more difficult legal environment for tobacco, especially in the US where the Food and Drug Administration is considering changing the laws on menthol cigarettes. In our view, Reinet shows no great urgency to divest itself of the BAT stake - which continues to contribute good dividends from growth in third world countries, while cigarette sales in first world countries fall. As the price of BAT has fallen, so the other assets in the Reinet portfolio have become more significant. The largest of these is its 46% stake in Pension Insurance Group Corporation (Penscorp) which now represents 48.7% of its portfolio. Aside from Penscorp, the company also owns a spread of private equity investments which account for around 20% of the portfolio. In its results for the six months to 30th September 2022 the company reported a net asset value (NAV) of 29,93 euros which gives it a compound growth rate of 8,8%, in euros, per annum since March 2009. The company has just completed a share buy-back program. The share is obviously a rand-hedge and fell from its high of R340 in February 2020 to lows around R287 on 22nd January 2021. We advised waiting for a breakup through its long-term downward trendline which happened on 16th September 2019 at a price of R270. It has been tracking sideways and upwards since then and has now reached R408. It is a solid long-term investment outside South Africa. Consider the chart:

TEXTAINER

Textainer (TXT) is one of the world's largest lessors of containers with 3,5m twenty-foot-equivalent units (TEU) in its fleet. It is listed on the New York Stock exchange and on the JSE. The company supplies dry freight, specialised and refrigerated containers to 200 customers all over the world and sells an average of 130 000 units each year. The company has 14 offices and 400 depots. Obviously, Textainer benefited from the extreme shortage of containers worldwide and the sharp rise in the price of renting containers. In an update on the 3 months to 31st March 2023 the company reported "Adjusted EBITDA was $167 million, and adjusted net income was $54 million, or $1.22 per diluted share, resulting in an annualized ROE of 13%". The share is very liquid with more than R20m worth of shares changing hands daily and it is in a rising trend since August 2020. It trades on a P:E of 6,99 - which looks cheap to us. It is clearly a rand hedge share which is impacted by the level of world trade. Consider the chart:

AVENG

The once-massive construction company, Aveng (AEG), which traded at R69 a share in 2008, was reduced to a penny stock, brought about by a number of factors. Among these, the reduction in construction spending following the sub-prime crisis has been critical. The government ceased infrastructure development after the 2010 World Cup which had a further detrimental impact. This was then followed up by the competition commission's R1,4bn fines in the construction industry. The difficult operating environment was made worse by losses on various construction contracts which have required extensive write downs and impairments. Its objective has been to focus on McConnell Dowell in Australia and the mining contractor Moolmans, both of which are now profitable. In its financials for the six months to 31st December 2022 the company reported revenue of R15bn (up from R13bn) and headline earnings per share (HEPS) of 61c compared with 14c in the previous period. The company announced the sale of Trident Steel on 3rd May 2023 for R1,2bn - which effectively leaves the company debt-free. On a P:E of 3,16 the share is risky, but now looks very cheap. Consider the chart:

CMH

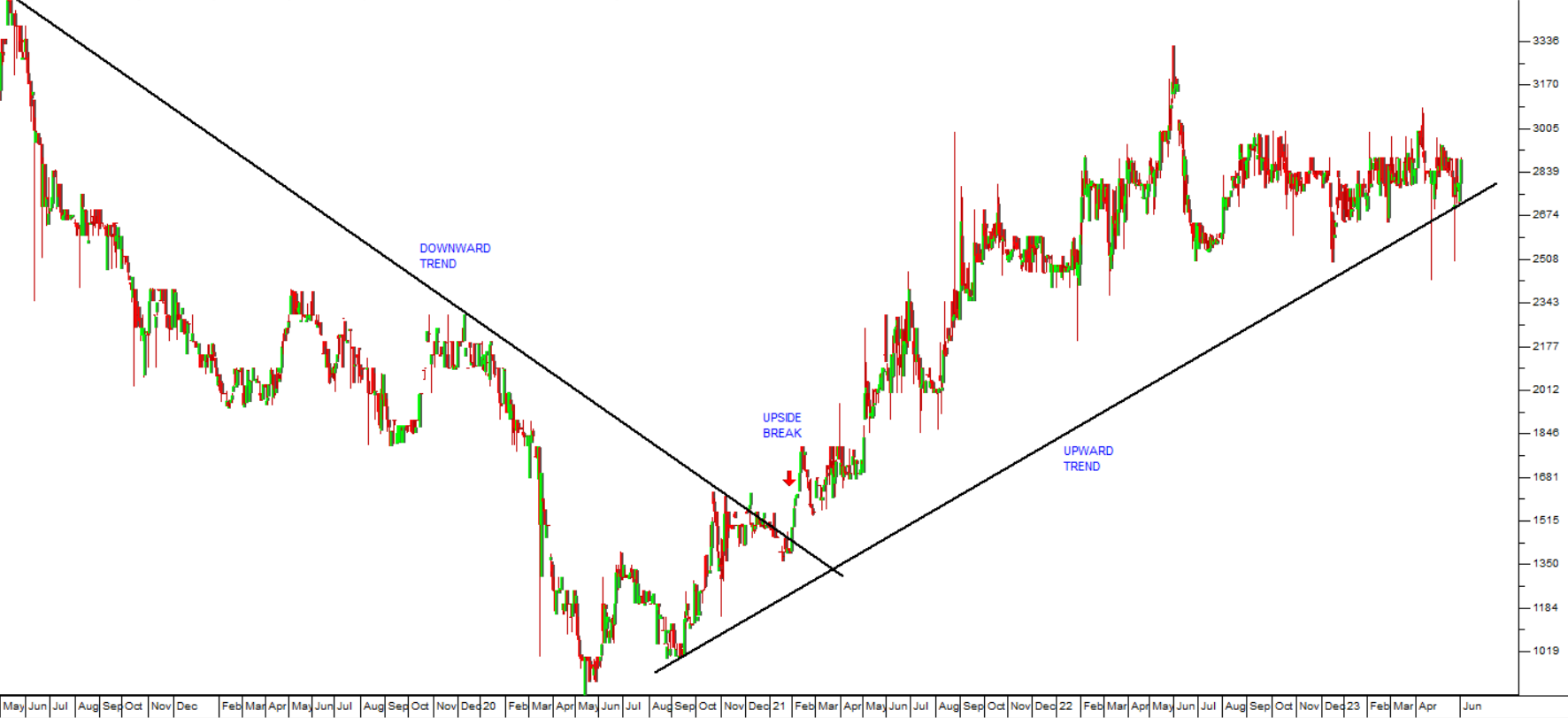

Combined Motor Holdings (CMH) runs car dealerships in Nissan, Volvo, Toyota, Opel, Subaru, Lexus, Mazda, Isuzu and Ford - selling both new and used vehicles. The motor industry is especially affected by the state of the economy because consumers can usually keep their vehicles on the road for longer in recessionary times. The car hire business has been recovering steadily from the effects of COVID-19. In its results for the year to 28th February 2023 the company reported revenue up 11,3% and headline earnings per share (HEPS) up 23,2%. Technically, this share made a "V-top" at 3350c on 10th May 2018 and then fell heavily to around 950c in May 2020 as a result of COVID-19. We recommended waiting for a break up through its long-term downward trendline - which came at 1489c on 2nd February 2021. Since then the share has risen steadily to around 2900c where it is on an undemanding P:E of 4,77. In our view, it represents good value at these levels. Consider the chart:

ISA HOLDINGS

ISA Holdings (ISA) is a small Alt-X listed IT company offering network, internet, and information security in sub-Saharan Africa. The company claims to employ some of the leading IT security specialists and to have the tools and experience to offer effective information security solutions. In its results for the year to 28th February 2023 the company reported revenue up 1% and headline earnings per share (HEPS) up 34%. More than 90% of the company's revenue is recurring. This looks like a good quality IT company that is profitable and has survived difficult times in South Africa. The problem is that the share is thinly traded with only about R46 000 worth of shares changing hands on average each day. This makes it riskier for private investors, however, on a P:E of 9 and a dividend yield of 8,89% the shares look like good value.

SIRIUS

Sirius (SRE) is a real estate investment trust (REIT), listed on the JSE and the London Stock Exchange (LSE), which specialises in office, manufacturing, and warehousing properties in Germany. The company owns 140 assets with a book value of over 2bn euros. Obviously, this is a well-managed and growing rand-hedge. In its results for the six months to 30th September 2022 the company reported revenue up by 47,7% and headline earnings per share (HEPS) up by 42%. In a trading update for the year to 31st March 2023 the company reported the group rental roll had increased by 8,1%. The company said, "For the ninth consecutive year, the Group has achieved like for like rent roll growth in excess of 5%. Cash collection has remained robust at above 98.5% on a rolling 12-month basis". In a trading statement for the year to 31st March 2023 the company estimates that its dividend will increase by as much as 31,4%. Technically, the share has been falling and we recommended applying a trendline and waiting for a convincing upward break. That break came on 17th November 2022 at a price of 1632c and the share has so far moved up to 2113c. We expect it to continue to perform well. At current levels, it is on an earnings multiple of 15,67 - which makes it one of the most highly rated REIT's on the JSE. It is also, obviously, a great rand hedge. We expect that it will prove to be a solid long-term investment in the years to come, but right now we think it may still fall further.

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: