The Confidential Report - December 2023

6 December 2023 By PDSNETAmerica

As the year draws to a close, most analysts are saying that, despite the rapid increase in interest rates, the American economy will probably experience a “soft landing” – meaning that it will not enter into a recession, defined as two consecutive quarters of negative growth of gross domestic product (GDP).

Core inflation, excluding food and fuel costs, has proved to be stubborn, still hovering around 4%. The Federal Reserve Bank has a goal to get this down to 2%. So, the message is that the high interest rates will remain high for longer – possibly until the 4th quarter of 2024.

High interest rates mean that companies are vulnerable to the state of their balance sheets and their need to service whatever debt they have. Long-term debt was mostly re-financed at lower rates during the pandemic, but that long-term debt is now maturing, and new debt will have to be financed at today’s higher rates.

As many as half of the large companies in America are unprofitable at the moment and as their interest costs rise more bankruptcies will be recorded.

The market is being driven by high-tech companies, especially those involved in artificial intelligence (AI) like Nvidia, Amazon and Meta. The impact of AI is expected to improve the productivity of all companies across the board. So, the question is whether and for how long that increased efficiency will be sufficient to counter the inevitable longer-term impact of high interest rates.

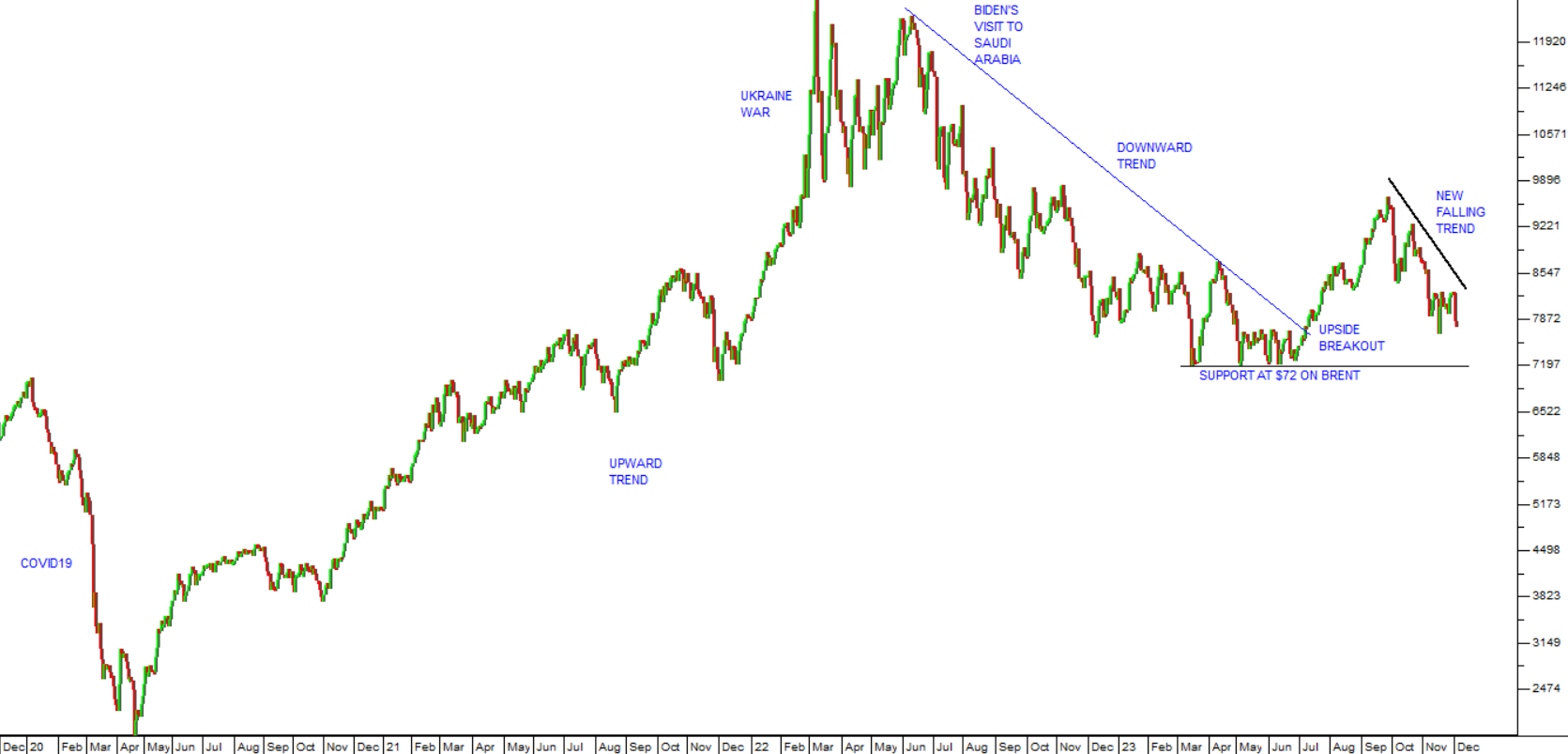

At the same time, the oil price is a major factor impacting on all businesses. Brent, now trading at around $80 and having peaked at around $96 per barrel at the end of September this year, has been trending down – which has had a positive effect on inflation rates and the profitability of businesses. If Brent can break below its previous cycle low and support level at around $72, then the “soft landing” scenario becomes far more likely. Consider the chart:

You can see here that Brent has been trending down again since September 2023 and is approaching the well-established support level at $72. Much now depends on whether this downward trend will continue or reverse. The oil-producing countries, and especially Saudi Arabia, appear unlikely to allow oil to fall below that level, but we can only guess at the pressure and incentives that the Biden administration has applied to them, especially in the run-up to the November 2024 US presidential election.

The US economy added 150 000 new jobs in October 2023 – considerably less than the 297 000 jobs created in September. The unemployment rate ticked up to 3,9% which is also an indication that the economy is beginning to slow down in response to higher interest rates. The United Auto-Workers strike had an impact on the figures.

Gross domestic product grew in America by an impressive 5,2% in the 3rd quarter of 2023. Since then, in the 4th quarter, growth has apparently slowed down somewhat leading to hopes that the Federal Reserve Bank (the “Fed”) will not need to raise interest rates further. It appears that after the substantial growth of the 3rd quarter the high level of interest rates has been having some impact.

The fact that interest rates are likely to remain high for longer, well into 2024, does not appear to be bothering investors.

98% of S&P 500 companies have now reported for the 3rd quarter. 82% of the companies’ profits were above analysts’ expectations and 62% had a higher revenue than was expected. Overall, S&P companies had earnings 4,8% above last year in the quarter. This shows that the largest companies in America are still growing rapidly, although growth is generally expected to be slower in the 4th quarter.

In our previous Confidential Reports, we have expressed the opinion that the fall in the S&P500 index from its all-time high of 4796 made on 3rd January 2022 to its low of 3577 on 12th October 2022, had turned out to be an exaggerated correction and not the start of a new bear trend. In our view, the great bull trend that began in March 2009 is still on-going and likely to continue. Consider the chart:

This position has now been substantially supported by the fact that the S&P broke up on Friday above its previous cycle high of 4589 to close at 4594. This shows that the 3-month correction from the end of July until the end of October is over and we can now look forward to further upside.

The S&P is now just 4,77% below its all-time record high made on 3rd January 2022 and we believe that will be superseded in the near future, possibly even during a Santa Clause rally at the end of December.

Ukraine

Ukraine has about 1 million people in its military services to oppose Russia. The country is constantly trying to get more soldiers to build up its reserves in what has clearly become a war of attrition. Western countries have been providing financial support and weaponry, but not soldiers. The strain is beginning to show among the people of Ukraine leading to demonstrations and petitions to reduce conscription. Russia too is struggling to find sources of new recruits having used prisoners and conducted a major conscription of 300 000 men. Clearly, the war is beginning to take its toll on both countries. Support for President Zelensky’s government has fallen substantially as the war has progressed. The lack-lustre results of the Spring offensive has been a major factor.

According to recent statistics, so far in the Ukraine war, Russia has lost 5520 tanks, 7878 artillery systems and 10282 armoured personnel carriers. Putin has said that in order to continue the Ukraine war, he is increasing the Russian defence spending to 30% of fiscal expenditure – which works out to about $630bn. That is a massive commitment for such a relatively small economy with a gross domestic product of around $2,1 trillion. Obviously, much of that money will have to be spent on replenishing the massive losses which Russia has suffered in the war so far. At the same time, he intends to increase the size of the army by a further 170 000 soldiers. This may all sound a little depressing for the Ukrainians, but you should remember that currently the NATO combined defence budget is over $1000 billion and completely dwarfs Russia’s increased defence spending. Germany recently announced that it will double its financial and military support for Ukraine next year.

The flight of capital from Russia is taking an enormous toll on the economy. In 2022, its trade surplus of $236bn was wiped out by net outflows of $239bn on the capital account. This year, the trade surplus has shrunk to just $23bn as exports to Europe of gas have collapsed.

A substantial proportion of the country’s reserves have been frozen and will probably be confiscated for the ultimate reconstruction of Ukraine and reparations. Military expenditure is estimated to absorb as much as 10% of GDP next year – more than double before the war. Sanctions are preventing the government from borrowing money abroad.

The average monthly wage in Russia has fallen from $1200 in 2013 to around $600 today and interest rates have ticked up to 15%. The Russian people are having to tolerate a much lower standard of living and a rising level of casualties from the war.

In our view, this war cannot continue for much longer and we expect it to be brought to a head, one way or another, next year. It is clear to us that the Russian economy is taking enormous strain as it shifts to a war footing and diverts resources away from more productive activities.

Statistics published by the British Ministry of Defence indicate that Russia suffered as many as 931 casualties per day and in the last week an average of about 1020 per day. Most of these losses have come from its efforts to take Avdiivka. The level of casualties is greater than those that occurred in the assault on Bakhmut earlier in the war. During the First World War, Russia lost 1,100 soldiers per day.

Our perception is that Putin may be forced to compromise very soon. Unfortunately for him, any settlement with Ukraine is likely to destroy his political future in Russia. All Ukraine and NATO need to do is to hold on and resist Russia’s increasing desperate attacks for a few more months, through the winter – but it is going to be an arduous task.

Political

We strongly recommend that, if you haven’t already, you watch this interview between Alec Hogg and the Democratic Alliance’s (DA) election campaign manager Greg Krumbock:

We regard what Krumbock says here to be factually and statistically sound. This means that the DA has increased its support to 32% of the electorate and the ANC has dropped back to 39%. It is also highly significant that the DA is gaining support in rural areas and among younger black voters. The importance of this information for people living in South Africa and for investors on the Johannesburg Stock Exchange (JSE) can hardly be over-emphasised.

It seems that the South African electorate has matured and is now less and less concerned with the ANC’s revolutionary history and far more concerned with the issue of service delivery. Two facts appear to have become abundantly clear even to the humblest voter:

- The Western Cape, under the control of the DA, is by far the best run province in South Africa with the best track record of service delivery.

- The DA, unlike the other two major parties in this country, does not have a reputation for blatant and uncontrolled corruption.

In any event, it seems that the DA’s recently formed alliance with other minor parties may be sufficient to obtain control over parliament in next year’s election. As Krumbock says, the trend is the important factor and between now and the election, it is probable that the DA’s support will only grow while the ANC’s will almost certainly shrink.

Clearly, the persistent problems with the electricity in this country leading to various levels of loadshedding since 2008 have cost the ANC its majority support and are about to cost it its position as the ruling party.

The task facing any new government in this country will be daunting. Corruption and mismanagement have invaded almost every government department at both a national and municipal level. Almost every state-owned enterprise (SOE) is bankrupt and riddled with corruption and incompetence. The police force has shown itself to be totally incapable of containing organised crime or even implementing such basic systems as the rules of the road.

It will take whatever new government comes into power next years at least a decade, in our view, to begin to rectify the situation. But there will be some immediate benefits. South Africa will increasingly be seen as a much better destination for international investment dollars – and that will impact directly on the JSE.

The ANC, cognisant of its impending doom is trying desperately to find ways to bolster its support before the election. Throwing whatever money they can find at vote-winning projects and baselessly denigrating their main opponents. For example, the suggestion of the Minister in the Presidency, Khumbudzo Ntshavheni, that the private sector in South Africa has no interest in developing the country and that it is “...engineering the collapse of the Ramaphosa administration...” is clearly an effort by the ANC to blame someone else for its own failures. The parlous state which the economy is in now, especially Transnet and Eskom, is almost entirely due to gross mismanagement by the ruling party. If anything the private sector has been the primary victim and has done whatever it could to mitigate the situation. Coming just before the 2024 elections this sounds like a desperate attempt by the ANC to find a scapegoat.

Then we have the Minister of Employment and Labour announcing a plan to grab R15bn to create 2 million jobs before March next year – even though similar plans have failed in the past. This too looks like an undisguised effort by the ANC to garner votes ahead of next year’s elections. The money is to be taken from the Unemployment Insurance Fund’s (UIF) surplus capital. We can expect more of these desperate ideas as the election draws closer. Clearly, the ANC is justifiably very worried about its prospects.

The ANC itself is struggling to hold onto its assets as it tries to avoid paying a R150m debt which it incurred during its 2019 election campaign. The money was spent on printing of pamphlets and posters in Natal. The Supreme Court of Appeals recently held that the debt must be paid and now its creditors are seeking to attach assets in settlement. The ANC is planning to appeal the decision to the Constitutional Court. This raises the question of whether a party which cannot run its own affairs should be running the country.

Argentina

You may think, with good reason, that the South African economy is being badly managed, but recent developments in another emerging market, Argentina, indicate that in many respects our economy is being very well managed. The Argentinian economy is in the process of collapsing. Inflation is running at 148% - which is 12,3% per month. Interest rates are at 133% or 11% per month. The newly elected president, Javier Milei, has come to office on the platform that he will make the US dollar Argentina’s official currency and scrap the peso and the Argentina central bank. Radical moves indeed for one of the world’s largest economies with a gross domestic product (GDP) substantially larger than that of South Africa. The example of Argentina also shows that raising interest rates does not contain inflation if the government continues to print money to pay its expenses. Essentially, like Zimbabwe, Argentina has printed its currency out of existence.

Economy

The consumer price index (CPI) was 5,9% in October 2023 – up from September’s 5,4% and above economists’ average predictions of 5,6%. As usual the higher figure was mainly a result of rising food and fuel prices. Core inflation which does not include these elements dropped to 4,4% in October from September’s figure of 4,5%. Inflation is being well-controlled in South Africa when compared to other emerging market economies – and even when compared to some first world countries. The CPI is expected to move back towards the mid-point of the target range next year, and interest rates are expected to begin falling.

Two of the three international ratings agencies, Standard and Poors (S&P) and Fitch, have South Africa at a sub-investment grade of BB minus. Moody’s has us one level higher at Ba2. S&P recently re-affirmed our rating at BB minus citing the probability that the national budget deficit could rise to 83% of gross domestic product (GDP) by 2027. The difficulties in South Africa’s road and rail system together with continued congestion at its ports are seen as major problem by the ratings agencies since they will inevitably impact on the economy’s growth rate. Growth is seen as being stuck at around 0,5% for the next 5 years. The inefficiencies and debt at state-owned enterprises (SOE) are a major negative for the economy and the budget deficit. Next year’s general election is seen as adding further uncertainty given that the ANC will almost certainly not be returned with a majority in parliament.

Transnet is collapsing due to theft, vandalism and rampant criminality. It has over 30 000 kilometres of railway to protect and is constantly targeted by organised crime. In its latest financial year, security incidents cost the company R3,7bn directly. Over the past five years the number of incidents has almost tripled. In the year to 31st March 2023 the company had 3877 incidents and over 1100km of cable were stolen. Transnet has become a major problem for the economy because of its inability to transport goods to port for export. It has recently been reported that it will take 4 months to clear the backlog at Durban port. President Ramaphosa has blamed the congestion at Richards Bay on staff incompetence and lethargy. The inability of Transnet to carry exports to port by rail has resulted in a massive increase in the use of trucks which are creating huge congestion in the towns near port facilities. For example, Transnet Port Terminals took the extraordinary step of suspending the receipt of all cargo brought into Richards Bay by road. The Road Freight Association (RFA) has called on the government to hand over the management of the ports and railways to the private sector. The CEO, Gavin Kelly, say that the current suspension of port facilities is “killing the country” and will inevitably lead to job losses in the economy.

The unemployment rate fell again in the third quarter of 2023 to 31,9% - down from the second quarter’s 32,6% and the 8th consecutive quarter of declines. The financial services sector added 235 000 jobs and community and social services added 120 000. These enormous gains more than compensated for 35 000 jobs lost in the mining sector and 50 000 jobs lost in manufacturing. Mining is expecting to lose more jobs with Sibanye and Implats both warning of further retrenchments. The coal industry is suffering with rapidly declining coal prices. However, the overall picture for the whole economy is one of rising employment which is obviously good. There has been a marked shift away from mining and manufacturing towards the service industries.

Private sector credit extension in September 2023 was up by 4,6%, compared with August’s gain of 4,4%. Both consumers and businesses are wary of taking on more debt in the current environment of higher interest rates. There was an increase in unsecured credit and credit card debt jumped 19% compared with 7% in August. Instalment sales and lease finance were up 13,7% compared with August’s 15,5% and overdrafts contracted slightly. Companies have been unwilling to take on more debt because of uncertainty in the economy and they are generally reducing debt. The high level of interest rates is constricting consumer spending.

The ABSA purchasing managers index (PMI) for October 2023 came in at 45,4 down from September’s 46,2. This is the sixth month that the index has remained below the critical level of 50 – which indicates that manufacturing is contracting. The business activity index which is a sub-component of the PMI was down 2,8 points at 40,3. New sales orders were also depressed for the month. Industrial demand was down due to the fall in commodity prices and the problems with ports and rail transport. Mining production was also down in September, falling 1,9% year-on-year as demand for commodities world-wide declined. Mineral sales were down 20,2% mainly as a result of lower precious metals demand. Transnet continues to be a problem with the rail network suffering from vandalism and theft.

America is South Africa’s largest trading partner accounting for about R21bn worth of trade in 2021. Of this about one fifth takes advantage of the African Growth and Opportunity Act (AGOA). It is particularly important for our motor industry exports. Recently, four African countries were taken out of the AGOA program for human rights abuses (Uganda, Niger, The Central African Republic and Gabon). While South Africa is unlikely to lose its position for that reason, it may lose its position because of its close ties to Russia given the invasion by that country of Ukraine. On the positive side, America may feel that excluding South Africa would drive the country even closer to Russia and China – and so reduce its influence in Africa. America reviews the eligibility of countries for AGOA every year.

The South African Revenue Service (SARS) reported a trade surplus of R13,1bn in September 2023 – up from August’s surplus of R12,6bn. Both imports and exports decreased during the month – an indication of lower commodity prices and lower imports due to a lack of consumer demand for overseas products.

There can be little doubt that South Africa’s immigration policies require an overhaul. Since 1994, our weak management of immigration and our porous borders have allowed people from all over Africa to the North, and especially Zimbabwe, to flood into the country. These foreigners have sought to escape the economic disasters in their own countries and to find employment in the relatively wealthy South Africa. Millions of them work here and remit part of their income back to their home country to support their families. This has resulted in South Africa carrying the burden of finding housing and employment for a significant number of foreigners, many of whom have been living here illegally. There have understandably been sporadic incidents of violence against these foreigners who have competed for jobs and business opportunities with the indigenous people. Now the department of Home Affairs is proposing that the relevant laws be consolidated and reviewed saying that South Africa can no longer afford its virtually unrestricted immigration policy. Of course, like many countries, many people, who are now South African citizens, were once immigrants. Immigration can also be seen as bringing in new skills and energy for growth.

The World Bank estimates that crime in South Africa is costing the economy about R700b a year and cutting the potential growth rate by as much as 1%. The World Bank predicts that South Africa’s gross domestic product (GDP) growth will come in at 0,7% this year and will average 1,5% per annum until 2026 with unemployment remaining at around 32%. Crime is a major part of the problem costing about 6,5% of GDP and causing a substantial misallocation of resources.

The Rand

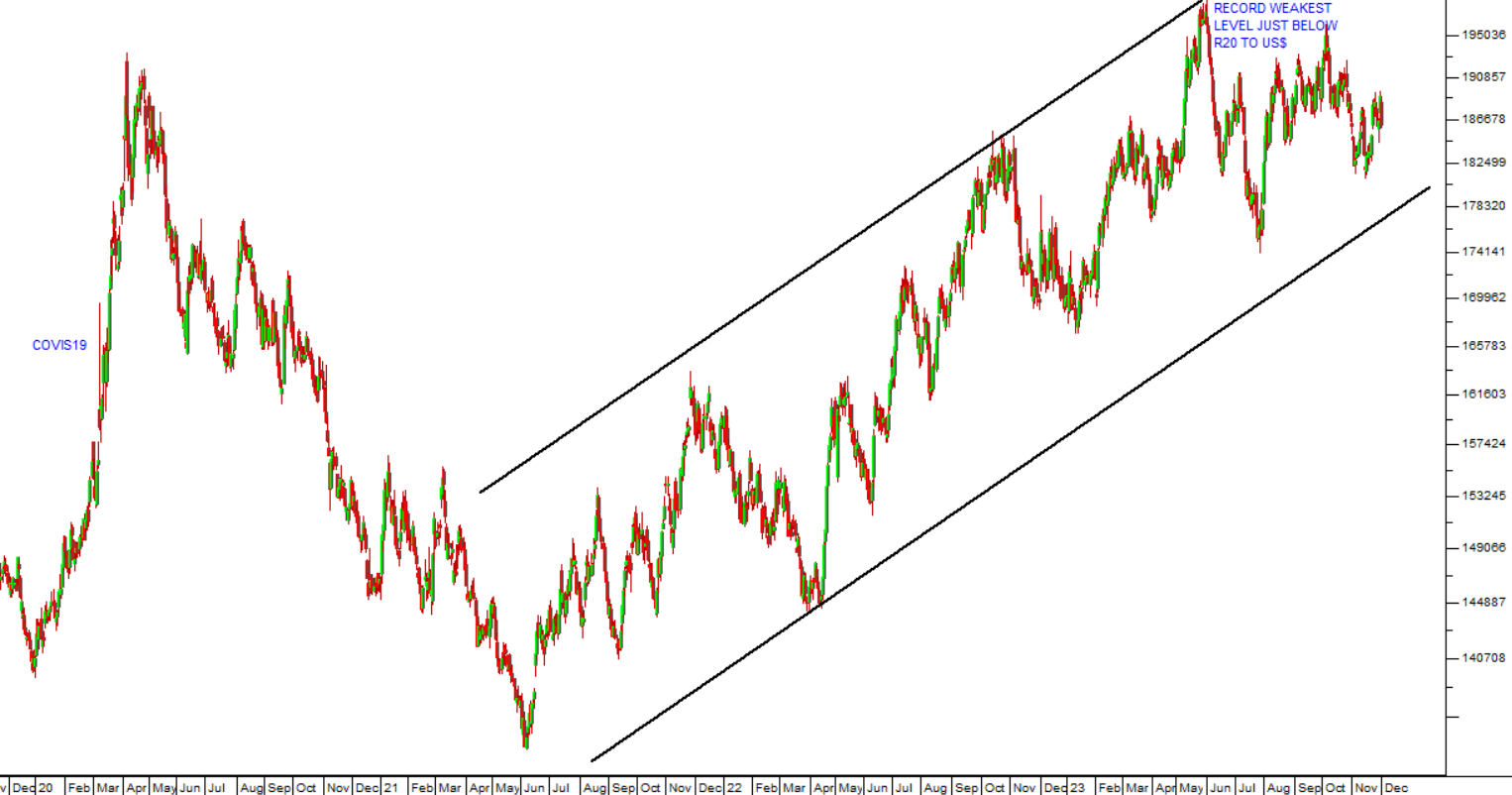

Over the past month, since the last Confidential Report, the rand has been slightly stronger or moving sideways against the US dollar. Since June 2021 it has however, been weakening in a downward channel that has seen it go from around R13.43 to current levels around R18.60. So, it has lost about 38,5% of its value against the dollar in just under two-and-a-half years. Consider the chart:

This loss of value can be attributed to the lack-lustre performance of our economy in the face of higher levels of loadshedding and more recently to concern about our ability to export raw materials through an increasingly dysfunctional rail and port system.

The strength of the rand is also a function of the international perceptions of emerging economies generally and the sentiment of overseas investors which alternates between “risk-on” and “risk-off”. Right now we are enjoying a period of risk-on which has helped the rand to remain relatively strong over the past month. We should not expect that benefit to be protracted however as international investors can change their position very quickly.

Eskom

The Electricity Regulation Amendment Bill is going through Parliament and it will change the electricity system in this country substantially by establishing a Transmission System Operator that will be responsible for providing a competitive platform for contracting and trading electricity. Effectively, this means that Eskom will no longer have a monopoly over the transmission grid. Eskom will just be an electricity provider competing with other electricity providers. The changes will be gradual and it is expected that the full impact will take about 5 years to be realised. Unfortunately, the bill is unlikely to be passed before next year and probably only after the election.

Eskom is facing huge costs to repair the Kusile coal-fired power station. The cost of the temporary fix which was originally estimated at about R250m has now turned out to be R700m and there may be further costs coming. The utility recorded a loss of R24bn in 2023, double its R12bn loss in 2022. It is predicting a loss of R23,2bn in 2024. It is blaming the cost of loadshedding and the failure of municipalities to pay what they owe which now amounts to R63bn. In 2024 Eskom will get a R78bn subsidy from the government as part of the R254bn debt relief agreed. Last year the utility paid R37bn in interest on its debt alone. The Acting CEO was confident that loadshedding would be reduced from stage 4 when Kusile’s units 2 and 5 come on stream soon. Eskom is still looking for a CEO to replace Andre de Ruyter. Its debt has now increased from R395bn last year to R423bn. The cost of running the open cycle gas turbines (OCGT), so far this year is R20bn due to higher levels of loadshedding. The cost of running these turbines increased by 50% mainly because the price of diesel increased by 30%. Eskom’s sales are expected to shrink by a further 2% in the year ahead as more and more households and businesses implement alternative power solutions.

The recent PwC report on energy usage in 2023 shows that Africa used about 6% less coal used due to the drop off in demand for Eskom’s electricity. At the same time, the use of diesel to generate power increased because of Eskom’s use of generators to avert loadshedding. The production of wind and solar power increased from 20% to 26% of total power used.

The global CEO of Volkswagen, Thomas Schaefer, has urged the government to solve the electricity and logistics problems caused by Eskom and Transnet. At stake is the continued investment by VW into the production of motor vehicles in South Africa. The motor manufacturing industry in this country accounts for 110 000 jobs directly and it contributes a total of about 6,5% to gross domestic product (GDP). The official policy on the production of electric vehicles has taken too long to come out and some motor manufacturers are questioning whether their investments would not be better placed in other countries. At the heart of this is the government’s refusal to provide a subsidy incentive for local consumers to buy electric vehicles (EV). About 63% of vehicles made in South Africa are exported which means that a failure to switch to EV production timeously will result in the loss of those markets.

Commodities

Coal production remains a major part of South African mining, both for local consumption and for export. But its future is in doubt as renewable energy becomes more ubiquitous and the price of gas comes down. The price of coal is falling and is expected to continue falling. It is estimated that it will be 26% lower in 2024 and then a further 15% down in 2025. Demand is seen as falling in America, the European union and even in China. So far, coal prices have fallen about 60% from their peak in 2022 at around $358 per ton. Exxaro and Thungela have both seen their profits falling and we should expect the downward trend to continue.

The gold price has risen in 2023 and is expected to continue rising next year as political turmoil and war take hold in various parts of the world. Escalation in the war in Ukraine or in Gaza could easily cause the metal to spike upwards. Gold is traditionally a hedge against the weakness of paper currencies in times of political uncertainty and especially war. Governments engaged in wars usually debase their currencies to pay for military materiel. This is what has been happening in Russia where the ruble has now fallen to 1c (US) and will probably fall further. Most South African gold mining shares are up strongly so far this year and the World Bank is bullish on the prospects for gold next year.

The National Union of Mineworkers (NUM) has raised concerns about the number of retrenchments which have been announced by various mining companies as commodity prices fall and inefficiencies at both Eskom and Transnet take their toll. They estimate that as many as 10 000 jobs could be lost by January 2024 in the mining industry, many of which will be lost due to the high cost and unreliability of Eskom’s electricity and the difficulties which Transnet is having with the railway network and the ports. Undoubtedly the ruling party will be blamed for these job losses which will add to their problems at next year’s general elections.

Companies

TRANSCAP (TCP)

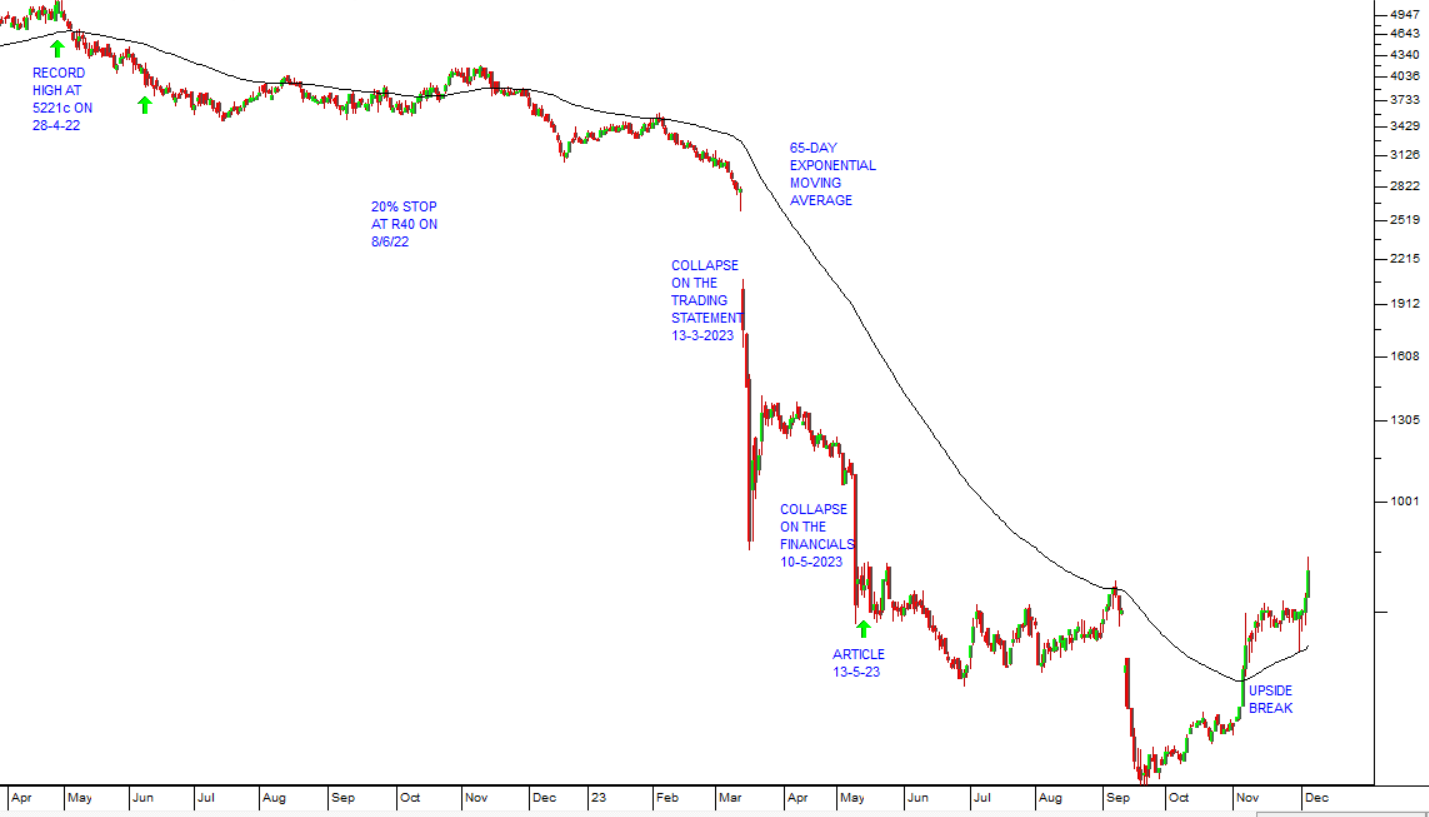

Transaction Capital has been a favourite of institutional investors (insurance companies, unit trusts and pension funds) until April 2022 when the share reached an all-time high of 5221c. After that the share began to fall as thousands of taxi operators found it increasingly difficult to meet the repayments on their vehicles resulting in repossessions. The taxi industry which had been seen as a strong growth industry was suddenly in doubt. Astute private investors sold out of the share on stop-loss over the next few weeks as it fell below 4000c. In our article of 15th May 2023, we advised clients to apply a 65-day exponentially-smoothed moving average and wait for an upside break. That break came on 6th November 2023 at a price of 577c. Since then the share has moved up to 799c. Consider the chart:

The share has rebounded and broken up through its 65-day exponentially smoothed moving average. Citi Bank has upgraded Transaction Capital to a “buy” with a price target of 1000c per share.

RHODES FOOD GROUP (RFG)

This company produces a variety of well known, high quality food brands which are consumed throughout Southern Africa and exported to first world countries. Like all manufacturing companies, RFG has a substantial amount of cash tied up in working capital. It is also directly impacted by the level of consumer spending, the strength or weakness of the rand against first world currencies, loadshedding and the availability of port facilities. During the year to 1st October 2023 the company reported volumes down 8,3% but revenue up 8,7% as the company continued to recover higher production costs through price increases. The company also made a 3,4% gain on foreign exchange as the rand fell 13,7% against a trade-weighted basket of international currencies. During the year the company acquired Today Pies which has contributed significantly to their results and shows the ability of RFG management to make bolt-on acquisitions. Overall, headline earnings per share (HEPS) were up 35,3% which put the company on a P:E of 6,99 with a dividend yield of 3,79%. This is an extremely well-managed company that has come through all the difficulties of the South African economy with flying colours. Consider the chart:

As you can see here, the share has been in a long-term downward trend since its peak 7 years ago at 3000c on 10th October 2016. That downward trend has now been convincingly broken and the share looks ready to begin improving. At its peak, the share was trading at a P:E of almost 30 and we believe it can regain much of its former glory.

MR PRICE (MRP)

Mr Price has become an extremely well-known South African clothing retailer. It is in the highly-competitive clothing industry where a miscalculation in fashion expectations can result in large quantities of obsolete stock which then has to be sold off at discounted prices. The company has been moving away from a cash-only store towards offering accounts and taking on credit. This obviously means that they are now carrying a debtors book which adds substantially to their working capital. Like all retailers they have been faced with the problems of low consumer spending, rising interest rates and loadshedding. In their results for the 26 weeks to 30th September 2023 the company reported revenue up 26,4% and headline earnings per share (HEPS) down 9,3%. Revenue was boosted by the recent acquisition of Studio 88. Loadshedding was 4 times higher in the first quarter than in 2022 and cost the company 60 000 trading hours equal to about R190m in revenue. Double digit food and fuel inflation as well as rising interest rates impacted on consumer demand. During the year the company added 121 new stores of which 58 came from the acquisition of Studio 88. Cash sales made up almost 88% of the group’s turnover and grew by 32% while credit sales grew by only 3,3% - indicating a very conservative approach to credit. The gross profit margin fell by 1,7% due to the more competitive environment which required higher mark-downs and the further weakness of the rand. Consider the chart:

Here you can see that the share has been in a long-term downward trend since its peak on 18th August 2021 at 24108c. It found solid support at around R125 per share and has now broken convincingly up through its downward trendline indicating a new upward trend. On a P:E of about 13, the share looks like good value to us. At its peak it was on a P:E of close to 30.

ZEDA (ZZD)

Zeda is an international car rental company which was unbundled from the Barlow World group and separately listed on 13th December 2022. It has the agencies for Avis and Budget in South Africa and ten other countries in sub-Saharan Africa. Its business is linked to tourism, especially in South Africa, but it offers rentals from one day up to one year. In its results for its maiden year to 30th September 2023 the company reported turnover up 12% to just over R9bn with a return on equity of 36,7%. Headline earnings per share increased 17,3% to 381c. Consider the chart:

After listing on 13th December last year, the share initially fell as institutional investors came to terms with its fundamentals. It reached a low point of 910c at the end of May 2023 and has been trending up since then. This is a new blue chip listing which is highly profitable and extremely well managed, but fund managers have been very slow to appreciate its value. It is currently trading on a P:E of just 3,41 which compares to the JSE Overall Index's P:E of 10.95. The company did not pay a dividend in the 2023 year, but plans to pay out between 20% and 30% of net after-tax profit from 2024. Based on this year’s HEPS that dividend would have been between 76,2c and 114,3c per share and put it on a dividend yield of between 5,8% and 8,7%. To us this looks like extremely good value – and a great opportunity to get into a really solid blue chip before it has been generally recognised.

LEWIS (LEW)

Lewis is a very well-known furniture retailer in South Africa with 868 stores of which 138 are located outside South Africa. Obviously, as a retailer of higher ticket products, the company is vulnerable to working capital management and also to the level of consumer spending. It makes money on the front end of every furniture sale, but also makes a good profit from offering insurance and finance for the deal as well. The management of its debtors’ book is exceptionally good. In the six months to 30th September 2023 the company reported merchandise sales up 4,8% and revenue up 8,3%. The debtors’ book grew by 10,8% and headline earnings per share (HEPS) were 6,6% higher. The company opened 29 new stores during the period. Credit sales increased by 19,5% while cash sales fell by 14,4% - indicating the pressure which consumers are under with rising interest rates and high unemployment. 64,4% of the company’s sales are made on credit. The company has very low debt levels with gearing of 13,4% and bought back 3,1m of its own shares during the period at a cost of R124,3m. Consider the chart:

The chart shows that Lewis shares have been trending lower for most of 2023 – until they reached a low point of 3663c on 23rd August. Since then, they have been in a new upward trend. What makes this share particularly exciting for private investors is the fact that it has a P:E of 4,98 and a dividend yield of 8,04%. This means it is exceptionally cheap.

We wish all our readers all the best for the Festive Season and the New Year.

The next Confidential Report and Webinar will be on the 7th of February 2024.

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: