CORRECTION

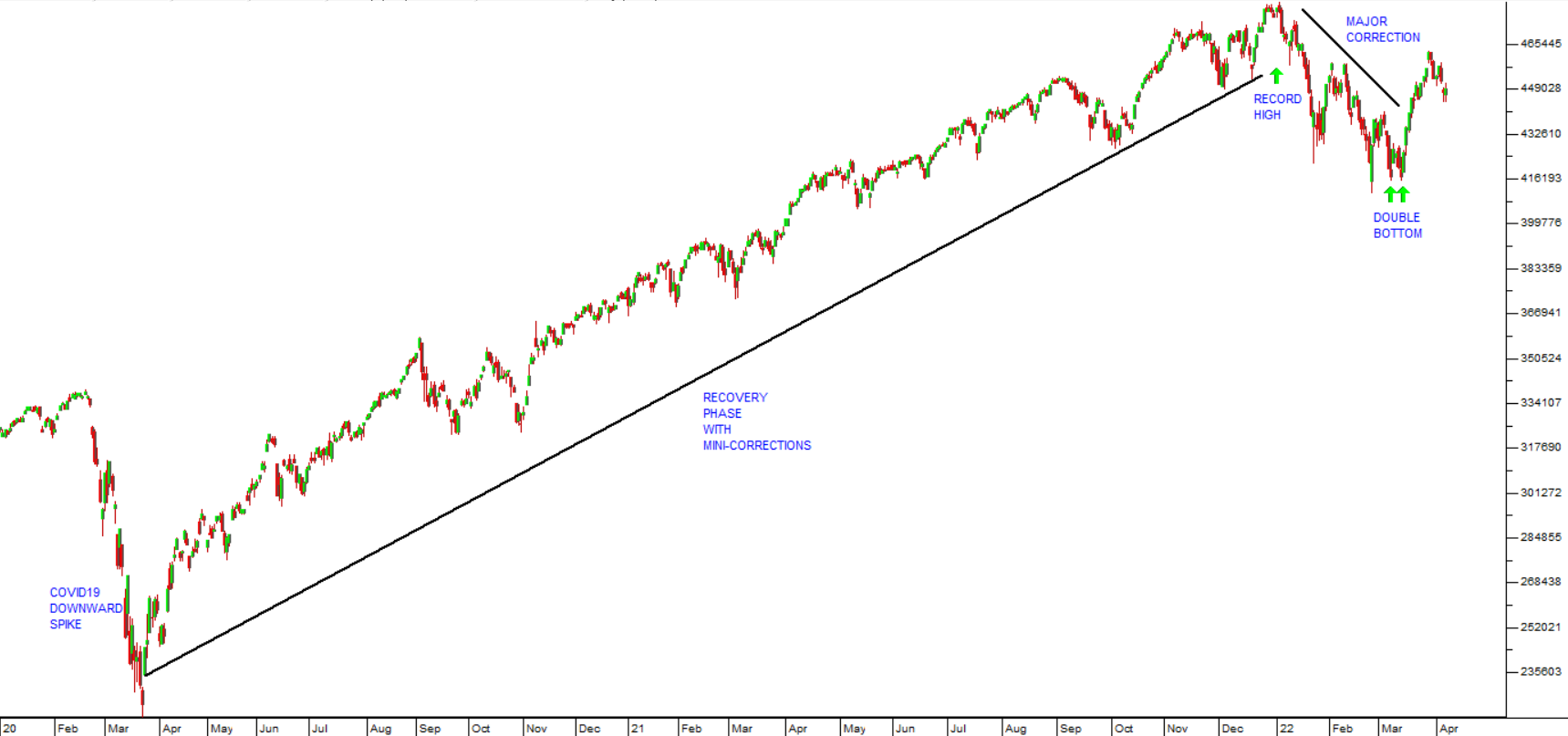

9 May 2016 By PDSNETThis term is used quite loosely to mean any short-term downward change in the direction in which a share or market is moving. More strictly, it refers to a temporary downward move in a bullish trend. A min-correction is less than 10% from the highest point and a major correction is between 10% and 20% down. For example, following the downward spike in the S&P500 index as a result of COVID-19 in March 2020, the index recovered steadily throughout the rest of 2020, and 2021 with series of small mini-corrections. At the start of 2022, in response to rising US inflation and then the Unkraine crisis, the index entered a major correction which took it down from its record high of 4796,56 made on 3rd January 2022 to a low of 4170,7 on 8th March 2022 where it made a "double bottom" and began to recover. That was a 13% correction and so is considered "major. Consider the chart:

Share this glossary term: