ASK

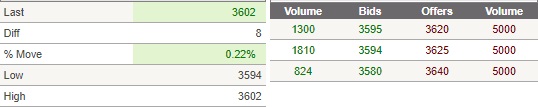

6 May 2016 By PDSNETThe price at which an investor who is holding a share (or other security) is willing to sell. Also referred to as the "offer price." The JSE's computer system will automatically execute a transaction when the best bid (i.e. the highest price at which someone is willing to buy) is the same as the best ask (i.e. the lowest price at which someone is willing to sell) for a particular share. The three best bid and offer prices should be given on your stockbroker's trading platform. Consider this example of the "depth of the market" taken from PSG Online:

Here you can see on the left-hand side of the above diagram that this share traded last at 3602c and that so far in the trading day it is up 8c - which is 0,22%. You can see it has traded as low as 3594c and as high as 3602c. On the right hand side of the diagram you can see the "depth of the market" - this is the best three bids and the best three offers. The best offer is at 3620c and there are 5000 shares available at that price. The second best offer is at 3625c (5c more) and there are 5000 shares available at that price - and then there is the third best offer. On the bids side the best bid is at 3595c and the second best bid is at 3594c. If the investor with the best offer was to bring his price down to where the best bid is, the JSE computer would automatically execute the transaction - and then that would become the "last" price on the left-hand side. The bids and offers are constantly changing throughout the trading day as investors adjust what they are willing to pay or accept for this share.

Share this glossary term: