Why is the Bitcoin price falling when the price of gold is rising?

Cryptocurrency doyens always claim that Cryptos are somehow a hedge against the impending weakness of paper assets – and especially the US dollar. But our observation is that Bitcoin is more of a risk-on asset than a risk-off asset. When risk-averse investors run for cover, they don’t switch to Bitcoin. Rather they switch out of Bitcoin and into gold.

Cryptocurrencies and gold are the same in that neither one of them offers the investor any kind of income or return. Your Krugerrands and your Bitcoin don’t pay you any interest, rent or dividends. So, neither of them can really be seen as an investment in any true sense. Both owe their value to investor belief and to their relative scarcity.

The difference is that almost everyone throughout the world believes in the value of gold, while only a very small, relatively esoteric, group of passionate protagonists (like Elon Musk) and their followers believe in the value of Bitcoin.

The simple truth is that your Krugerrands can be bought and sold in any country throughout the world. From the humblest coin dealer in the backstreets of Shanghai to the sophisticated halls of London’s Threadneedle Street, one ounce of gold is immediately recognised and highly valued. At the same time, the value of a Bitcoin is volatile and the subject of endless debate. Gold has been sought after and valued for more than five millennia, while Bitcoin has only been around for just over 15 years.

Elon Musk warns that the US government debt is eventually going to result in a collapse of the US dollar and hence a massive increase in the price of cryptos. While we agree that the US dollar is weakening and has been for most of this year, over the long term it has held its value. For example, in April 1990, the US dollar bought you 160 Japanese yen and today it buys you 155,8 yen. In May 2003, one US dollar was worth about 87 euro cents. Today it is trading for 85.40 euro cents.

In 1987 economists and investors were very concerned about the level of debt in America as the US government's borrowing reached $3 trillion and they warned of the imminent collapse of the economy. Today, 38 years later, the US national debt is $38,74 trillion and rising rapidly. The same experts and fear-mongers are again warning of the economy’s imminent demise.

Certainly, the US budget deficit is a concern, but we do not believe that it portends the collapse of the US economy any time soon. In our view, the US economy is being supported by the massive productivity benefits which are flowing from new technologies and particularly the spread of AI through the economy.

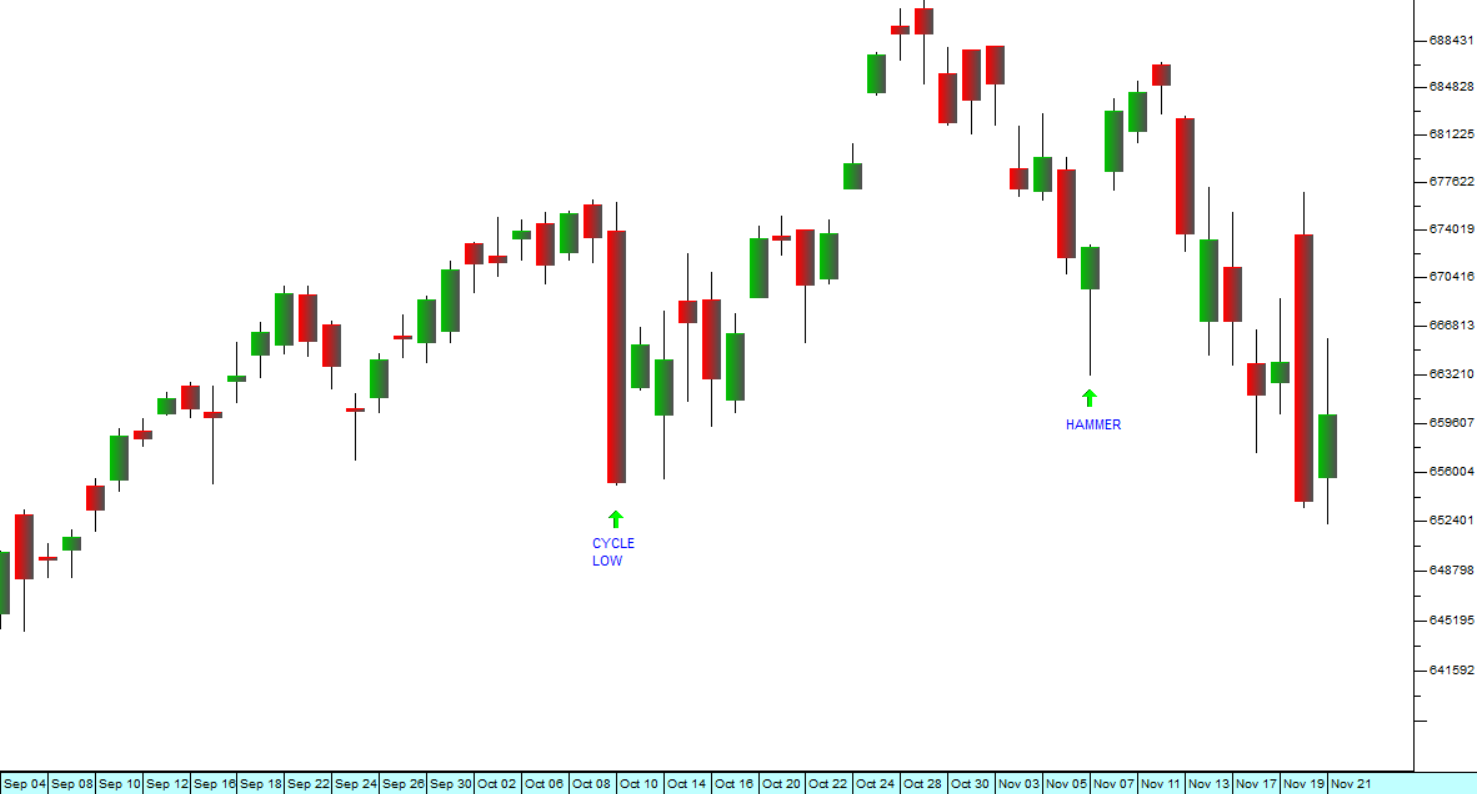

The Bitcoin price has itself collapsed over the last 10 weeks from its peak of $125265 to current levels of around $90 000 and it has been as low as $83268 (21-11-25). That’s a fall of 33,5%. Consider the chart:

Price of Bitcoin in US dollars : 3rd of July 2025 - 12th of December 2025. Chart by ShareFriend Pro.

Price of Bitcoin in US dollars : 3rd of July 2025 - 12th of December 2025. Chart by ShareFriend Pro.

The Nobel prize-winning economist, Professor Paul Krugman, suggests that the fall of crypto prices is directly linked to fall in Trump’s influence and power in America. He may well be right. There can be little doubt the Trump and MAGA movement have suffered some significant set-backs this year and that the excitement that his return to the White House created for cryptocurrencies has abated. There can also be little doubt that the big players are getting out of Bitcoin or as Krugman puts it, “...the Trump trade is unwinding”.

The rapid rise of the gold price since March 2024 definitely indicates that big international investors are worried about the future of paper assets. Why else would they give up the interest which they could earn on government Treasury bills and put their wealth into gold? But perhaps, instead of a collapsing US economy, they are seeing the inevitable inflation which will result from a world economy that is moving into a powerful boom phase, driven by rapidly increasing productivity levels.

Perhaps the only lesson we can learn from all of this is that cryptos are not in any sense a hedge. Rather, they are a rich man’s speculative plaything – to be abandoned whenever belief levels falter. And Musk’s economic opinions are about as reliable and consistent as his political opinions. He is undoubtedly an engineering genius – but that does not automatically make him an expert in social media, politics or economics.