Central Banks

The functions of a central bank are to maintain the stability of the country’s currency and to ensure growth. Unfortunately, these two objectives are mostly mutually exclusive because growth tends to cause rising inflation while controlling inflation means taking the wind out of the economy’s sails.

When the central bank becomes concerned about inflation, which is often caused by excessive demand, it raises interest rates to curb spending – but, of course, this tends to reduce spending because everyone has to pay more interest on their bonds overdrafts and credit cards. Conversely, when the central bank reduces rates to stimulate growth the increased spending inevitably results in higher inflation sooner or later.

So the Central bank’s monetary policy committee meets every two months (in normal circumstances) to either put their foot on the economy’s accelerator (by reducing rates) or the brakes (by increasing rates). They conduct a very delicate balancing act between economic stimulation and currency stability. In South Africa, that balancing act is considerably complicated by the strength or weakness of the rand against first world currencies.

Changing the level of interest rates is not the Central bank’s only weapon. They can also engage in “open market operations†– which basically means either buying or selling government bonds on the open market. When the central bank buys bonds they are injecting cash into the economy and vice versa.

Following the 2008 sub-prime crisis, the Federal Reserve Bank (“the Fedâ€), in their efforts to avoid an economic depression, engaged in excessive quantitative easing (printing money) and bought back an enormous number of US treasury bills from the public. Now that the depression has been averted, they are trying to reverse that position by once again selling bonds in large quantities.

This is removing excess liquidity from the economy at a slightly alarming rate. Apparently, commercial bank deposits with the Fed have dropped from around $2,9 trillion in 2014 to levels around $1,3 trillion at present. This is beginning to impact on the availability of cash. We believe that much of the cash that was printed and injected into the economy actually found its way overseas. After all, China is actually America’s largest creditor.

At the same time, the economic boom which is now taking place in America is increasing the demand for cash both from businesses and consumers.

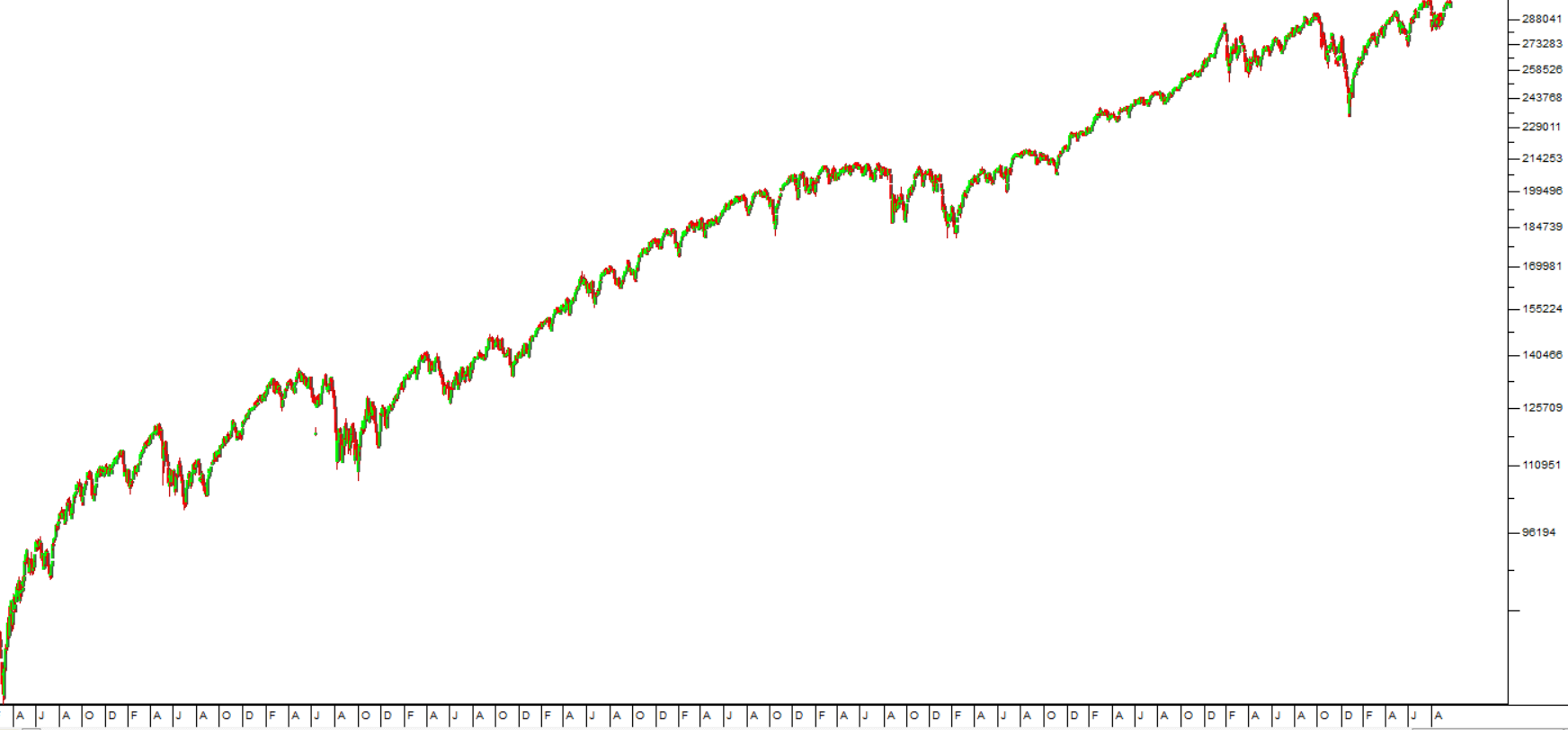

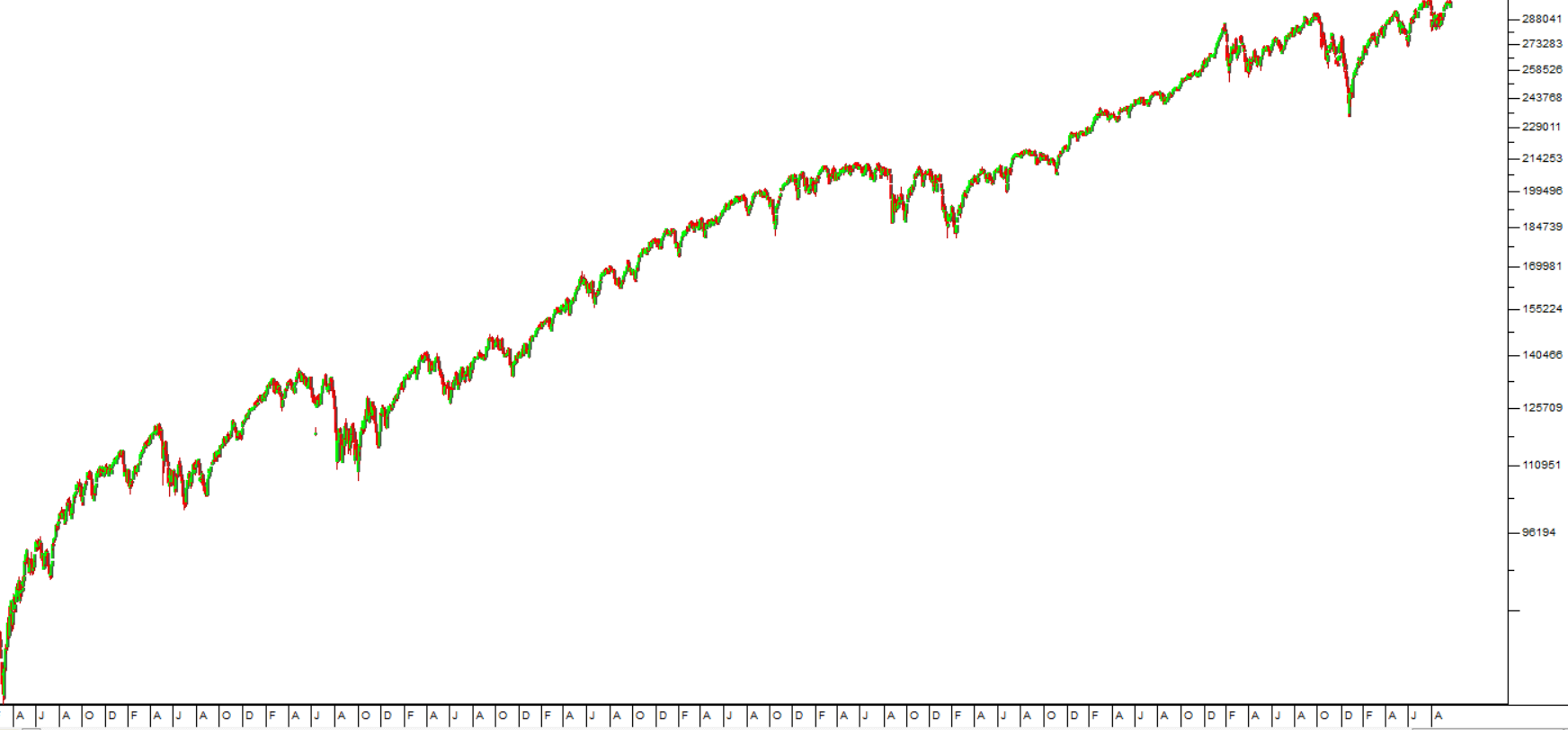

Clearly, the Fed cannot allow the money supply to become too tight because that would risk a deflationary crash (similar to what happened in 1929). So, they will almost certainly hold back on selling bonds and allow the money supply to continue to grow and that, in turn, means the continued rise in the stock market. Fortunately, the relatively low oil price (half of what it was in 2012) and the continued nervousness of consumers and businesses has meant that inflation remains subdued at less than 2%. Sooner or later the virtually full employment situation in the US must result in strong upward pressure on wages and hence inflation. To begin with inflation will be relatively benign, but it will gain momentum over time. The Fed is already raising rates, but those rates will become far more aggressive when the pandora’s box of inflation is opened fully. Rising interest rates are the force that will eventually result in the next stock market bear trend – but we still believe that that point is a considerable time away. The great bull market is set to continue and the charts confirm our opinion:

S&P500 Index Semi-Log Chart 2009 to 2019 - Chart by ShareFriend Pro

← Back to Articles