The Confidential Report - March 2023

1 March 2023 By PDSNETAmerica and Wall Street

We have previously made mention of the fact that one of the effects of the war in Ukraine was to push oil prices up sharply in the beginning - which had the effect of raising world inflation and forcing central banks to adopt a more hawkish policy stance. This, in turn, has had the effect of bringing the great 13-year bull market (which began on 9th March 2009 and ended on 3rd January 2022) to an abrupt end.

When the Ukraine war began, we had been expecting and predicting that the bull market would continue at least until the middle of 2024. The US Federal Reserve Bank did not seem particularly concerned about the rising inflation rate – they had been saying that the rise to around 5% was temporary and no radical moves were necessary.

The Ukraine war took the markets (and us) by surprise. The primary financial result was that a bear market began about 18 months earlier than it should have.

This premature commencement of the bear market has left a strong residual element of optimism among investors in the market. The tens of thousands of private individuals who had profited from the seemingly unending bull market were very reluctant to accept that things had changed. Most of them only had experience of a bull market – and to this day they still grab at any indication of hope to push the market up, despite the fact that, technically, there is absolutely no doubt that we are now in a bear trend and have been for over a year.

This excessive and persistent optimism has had a number of effects during this bear trend:

- It prevented a crash or initial shock one-day fall in markets such as characterised the 1987 crash.

- It has caused three very powerful and persistent rallies culminating in the latest and most powerful rally which began in October last year and now, finally, appears to be reversing.

- Unlike most bear trends, the slightest hint of positive news has often been sufficient to send the markets up sharply – in the face of clearly negative data.

- There has been an entrenched resistance to the idea that we are now in a bear trend and investors have clung stubbornly to the belief that the bear trend will end quickly.

- Notably a large percentage of investors have continued to “buy the dips” – the approach which had proved so profitable for them during the bull trend.

- In the face of growing evidence that the world economy is headed into a recession, investors have somehow maintained the much-vaunted myth that the US Federal Reserve Bank and other central banks will suddenly “pivot” from being hawkish to being dovish.

In the light of this, Jerome Powell’s remarks following the monetary policy committee’s (MPC) announcement of the latest 25-basis point hike in interest rates, were taken as being distinctly dovish. He said that the Fed was aware that the “direction of inflation had changed” but indicated that it would be some time before interest rates came down. Investors took heart from his remarks and saw them as dovish, especially when compared to the hawkish remarks which followed the previous November 2022 MPC meeting. The result was that the S&P climbed 2,5% to end the day strongly up. Our view is that inflation in America has not yet seen it worst levels despite the fact that it has been trending down these last few months.

We believe that the persistent and protracted monetary policy stimulation of the period from 2008 to 2021 cannot possibly have been extinguished by the paltry quantitative tightening and interest rate rises that have been implemented so far. This position is amply supported by the fact that the US economy created an extraordinary 517 000 new jobs in January 2023 which brought the unemployment level down to just 3,4%. Anyone who thinks that this is an economy which is “cooling down” must be dreaming.

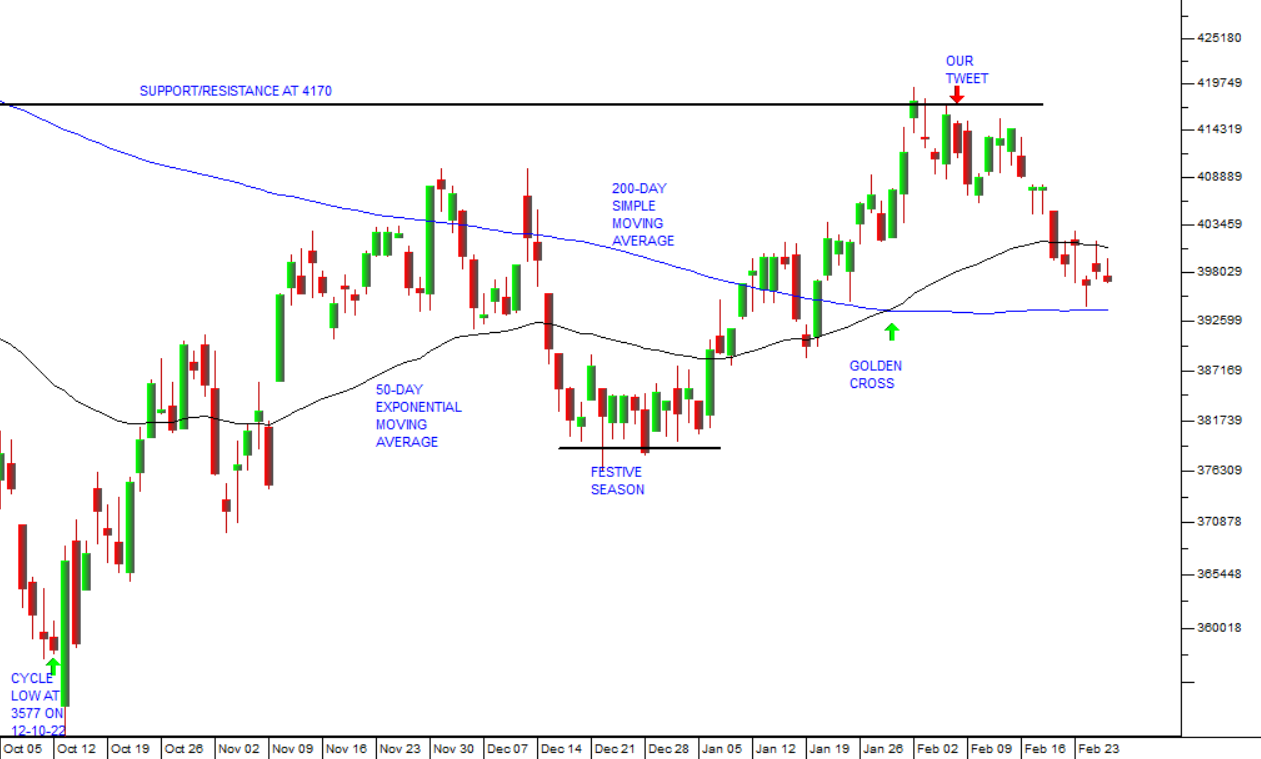

Consider the chart:

As you can see, the third bear market rally which has been in progress since the low at 3577 on 12th October 2022, now appears to have ended – having found significant resistance at the well-established level of 4170. Note that the rally was broken temporarily by a sell-off and sideways market during the festive season.

After the festive season, investors returned from their holidays full of optimism which was given steam by Jerome Powell’s inadvertently positive remarks following the monetary policy committee (MPC) meeting in early January.

At the time (on 9th February 2023) we tweeted: “Powell’s unfortunate remarks have caused a burst of investor optimism. However, the S&P500 has found a ceiling at 4170. We expect this level to hold and the S&P to fall back from this level”. You can follow our tweets at: https://twitter.com/PdsnetSA. Gross domestic product (GDP) grew at an annual rate of 2,7% in the last quarter of last year – a little less than the 2,9% of the third quarter, but when added to the amazing January jobs figure and the surge in retail sales, it shows that the monetary policy committee (MPC) still has some distance to go before inflation comes under control. It now seems clear that the MPC was caught completely unaware by the 517 000 jobs created in the US economy in January – and had they known they would probably have increased rates by 50 basis points rather than 25. Many commentators are now expecting the US economy to go into recession in the second half of 2023 – but most are expecting that recession to be “mild”. We, on the other hand expect that the recession when it comes may be fairly mild to begin with, but will end up being much deeper and last longer than expected. It will be more like the phenomenon that economists call “stagflation”. Some sectors, like high tech, the media industry and the housing sector are losing jobs and feeling the impact of higher interest rates, but most of the economy has yet to notice. Until the unemployment rate begins to increase, interest rates will have to continue rising.

Ukraine

The fears that Russia would make a massive push to gain some ground, coinciding with the anniversary of the start of the Ukraine war, appear to have been unfounded. There has certainly been increased pressure in the east around Bakhmut and the Russians seem to have made some small territorial gains at significant cost in men and materials. But, so far at least, the anniversary has come and gone without any notable Russian victories. There has also been speculation about a Russian “spring offensive” but again, at this stage it seems more likely that it will be Ukraine that will be mounting such an offensive when it is ready, especially with the new armour that it has been given by NATO.

The surprise visit by US President Joe Biden to Ukraine on the anniversary of Russia’s invasion sends an unassailable message both to Ukraine and to Russia. It is clear that the US and NATO will continue to provide almost unlimited support for the Ukrainian effort – which basically means that Russia cannot possibly prevail. Putin’s efforts to get Belarus involved in the war have so far been unsuccessful and the recent speech by the Polish president shows that the Belarussian people will probably not stand for such involvement – not to mention the fact that the now very heavily armed Poland would almost certainly then come in on the side of Ukraine.

The decision by Germany to send 14 Leopard tanks to Ukraine and to allow other European countries to do the same is significant change in the war. A spokesman for the Ukraine Ministry of Defence said that so far more than 321 main battle tanks (MBT) had been pledged including 31 Abrams tanks from the US and 14 challenger tanks from the UK. There has been some doubt as to whether these pledges will arrive in time to be effective against Russia’s suggested “spring offensive”, but information is that US has made available far more than 31 Abrams tanks which are already having an impact. From our perspective, there seems to be an escalation of the war, but one that will probably enable Ukraine to consider taking back some of the territory which it has lost, including Crimea.

It seems unlikely that the Putin regime could survive the loss of Crimea. In fact, the roles which the Wagner and Chechen groups are playing in the conflict suggest that Russia is breaking up into various groups, each prosecuting the war for their own goals. This loose grouping may not want Putin to continue as their master in the longer term. We believe that Russia is nearing the end of what it can achieve and its ability to withstand the effect of widespread and growing sanctions on its economy together with an increasingly negative military position. Both Prigozhin and Kadyrov appear to have their own agendas which do not necessarily include Putin.

Many commentators are saying that the war in Ukraine will devolve into a long drawn out conflict, a war of attrition that will go on for years. Our view is that the situation is rapidly coming to a head and will probably be resolved one way or another by the end of this year. We simply do not believe that Putin can survive politically as a dictator in the face of an inevitable Ukrainian counterattack based on its growing army of MBT's and the other systems arriving from European and American sources.

Budget

The South African budget deficit has more-or-less halved from roughly 10% of gross domestic product (GDP) at the height of the COVID-19 crisis to an estimated 5% of GDP this year. Much of this is due to the boom in commodities tax revenue, but some of it is due to fiscal disciplines such as the unilaterally imposed 3% wage hike which the civil service recently received. It is no secret that current polling is strongly suggesting that the ANC will win less than 40% of the vote in the general elections in 2024 – so it seems reasonable to expect that they will engage in various populist measures to boost their popularity ahead of that election. There are various avenues to them. For example, they could put through a much larger pay increase for the country’s massive civil service or sharply increase the social spending by increasing the various social grants. They can certainly be expected to throw money at the loadshedding problem as well. All of these approaches will obviously make the deficit worse, but may improve the ANC’s popularity in time to impact the election.

The Minister of Finance, Enoch Godongwana, revealed in the budget that, amazingly, South Africa managed to generate a primary budget surplus in the fiscal year through containing costs and revenue overruns. This surplus enables him to take R254bn of Eskom’s debt onto the government’s balance sheet over the next 3 years – which will take considerable pressure off the struggling state-owned enterprise (SOE). Furthermore, it has made it possible for the government to continue its “debt consolidation” process and to project bringing the national debt down to 4,2% this year (2023/24) and 3,2% by 2025/26 after taking on Eskom’s debt. The budget also offers R13bn in tax breaks. Altogether, this is a remarkable achievement by anybody’s standards and much of it is due to the strong tax collections, especially from the mining industry which accounts for about 30% of the tax collected from business. Godongwana himself says this windfall has been due to “elevated commodity prices”.

It is notable that SAA and the Post Office (arguably two of the most useless organisations in the country) both got further subsidies in this budget totalling R3,4bn. The Post Office is planning to close many of its branches and retrench as many as 6000 employees.

The budget allows for businesses to get a 125% deduction for the cost of their roof-top solar installation for two years. This will obviously encourage companies to move away from Eskom and find their own solutions. The incentive for consumers to put in roof-top solar has been controversial and much criticised.

Economy

Inflation slowed to 6,9% in January 2023, down from December 2022’s 7,2% bringing it closer to the Reserve Bank’s target range of between 3% and 6%. Core inflation which excludes food and fuel was 4,9% which is the lowest it has been for 3 months. The recent weakness in the rand does pose a serious threat to the inflation rate because it impacts directly on the cost of fuel. Food and non-alcoholic beverages rose by 13,4% with bread and cereals rising by 21,8%. The impending 18,65% rise in the cost of electricity will have a negative effect, but, despite this, the inflation rate is expected to come back within the target range this year.

Surprisingly, the ABSA production managers index (PMI) came in virtually unchanged in January from December at 53. Economists were expecting the PMI to be at least 1 point lower as a result of the intense loadshedding during the month. The number indicates that more and more manufacturers are taking steps to reduce their reliance on Eskom. President Ramaphosa is looking to push through the recommendations of the National Energy Crisis Committee (NECOM) to rapidly add as much as 8 gigawatts of power to the grid during 2023.

The SA Chamber of Commerce’s business confidence index fell in January 2023 to 112,9 – down from 117.3 in December 2022. The index did show the lagged effect of loadshedding which is expected to continue to be a drag going forward. There is evidence that South African businesses are rising to the challenge of finding alternative electricity supplies and moving away from Eskom.

On 13th February 2023, ABSA published a prediction that it expects the South African economy to fall into a technical recession during 2023 because of the increase in loadshedding. ABSA’s new forecast of 0,7% growth brings it closer to the Reserve Bank’s prediction that the economy will grow by only 0,3% during 2023 for the same reason. Standard Bank and Price Waterhouse Coppers (PWC) are more optimistic with predictions of between 1,3% and 1,6% respectively. These more optimistic predictions are based on a substantial shift by the private sector towards renewable energy production and away from reliance on Eskom. In 2022 South Africa imported about R5bn worth of solar panels capable of producing about 2 gigawatts of power.

In the 2023 financial year the mining industry contributed about R88bn to the fiscus through taxes and royalties. It also generated more than R900bn in export revenue – which was about 40% of the country’s total export revenue. At the same time, the fiscus lost over R50bn due to the inefficiency and breakdowns of Transnet’s port and rail service. Loadshedding remains a major problem for the mining industry, but most mining companies are busy installing alternative power sources to get away from Eskom’s expensive and unreliable offering. For example, Goldfields is installing a 50mw solar farm at South Deep. Notably mining production fell by a further 3,5% in December 2022 – and this was the 11th consecutive month of decline. Gwede Mantashe, minister of minerals and energy said that the backlog of applications for mining licences had been cut in half and that a new “cadastral” system would be in place by year end. South Africa has attracted less than 1% of global mining exploration spend. Mantashe says that he wants to increase that to 5% - and yet the inefficiencies in his own department are mostly to blame for South Africa’s poor exploration performance.

The head of the South African Revenue Service (SARS), Edward Kieswetter, said that the current level of loadshedding is likely to impact tax collections for this tax year negatively. Companies and consumers are diverting cash resources towards implementing alternative energy solutions to get away from Eskom’s unreliable and increasingly expensive supply. This leaves them with less cash to meet their tax obligations leading to more tax avoidance and the withholding of taxes due. However, it is apparent from the budget that tax collections have once again out-performed expectations.

Loadshedding has also been impacting on fixed investment in the economy which fell by one third in 2022 when compared with 2021. The 200+ days of loadshedding in 2022 combined with a slow-down in the world economy have made a dent in investment with some projects postponed and others cancelled as a result. Neal Froneman, CEO of Sibanye, has said that South Africa has become an unattractive option for mining companies because of loadshedding, Transnet’s inefficiencies and a high level of corruption. The value of new projects fell from the almost R400bn in 2021 to about R250bn in 2022.

South Africa’s population includes roughly 40 million people who are capable of working. Of those, only 16 million are registered for income tax and of those only about 330 000 earn more than R1 million per annum and pay about 41% of the total personal income tax collected. This relatively small number of wealthy people is also highly mobile and can move to another country without much difficulty. According to the head of the South African Revenue Service (SARS), Edward Kieswetter, about 6000 taxpayers left the country last year. On the other side of the equation roughly half of the South African population is dependent on some form of government social grant which means that the fiscus is constantly trying to fund growing expenditures out of a shrinking revenue stream.

The Public Servants Association (PSA) is demanding a 12,5% increase for 235 000 civil servants. This follows last year’s unilateral 3% increase. On that occasion, the government was doing all it could to control government spending and reduce the deficit – which they have done - with help from the commodities boom. Now it looks like the unions are trying to make up for their poor showing last year by demanding a much larger increase which is well above the inflation rate. The teachers, nurses, police, and prisons staff are threatening to go on strike – even though most of them are in what are defined as “essential services”. In our experience, civil service strikes are not very effective and we don’t expect this one to have much impact. Notably, the budget includes a 3,3% increase in the civil servant wage bill – up from R690,5bn in 2022/23 to R760,5bn in 2025/26.

The Reserve Bank’s leading business cycle indicator fell 4,5% for the year to December 2022 and was revised downwards to 2,8% for the year to end November. In the year to December, nine of ten components of the index were down. The indicator is supposed to show what will happen to the economy over the next 12 months. So, from this we can expect the economy to contract, perhaps by as much as 0,5% - mainly due to the higher levels of loadshedding since late last year. ABSA is expecting GDP to contract by 0,4% in the 4th quarter of last year compared to the previous quarter and most economists are now predicting that the economy will grow at a much slower pace in 2023. However, inflation is also expected to drop to around 5,6% during this year. The Treasury is expecting growth of 0,9% in 2023 which contrasts with the Reserve Banks prediction of 0,3%. From what we can see the economy has been doing much better than anyone expected given the high and persistent loadshedding that it has experienced. This may be because many businesses have now implemented some sort of alternative to Eskom to get away from their erratic and expensive offering.

Eskom

The 3-month state of disaster declared by President Ramaphosa at his state of the nation address (SONA) will hopefully focus the attention of all government agencies on the problem of fixing South Africa’s electricity supply. The declaration clears the way to eliminate the government red tape and bureaucracy which has been slowing down or impeding the granting of independent power producer licences and other efforts to move away from coal fired power stations. A minister of electricity will be appointed who will be in charge of the process and the national energy crisis committee. Hopefully, this action will lead to a speedy resolution of loadshedding, but in our opinion the problems at Eskom are deeply systemic and will not be easily or quickly resolved.

The explosive interview with Andre de Ruyter done by Annika Larsen of ENCA understandably coincided with his immediate resignation from Eskom. The interview can be seen at:

Basically, he has exposed for all South Africans to see the extraordinary corruption within Eskom that is preventing it from operating efficiently and which is costing electricity users and taxpayers an estimated R1bn a month. De Ruyter says that there are 4 major mafia-style organisations operating within Eskom and that the police and certain politicians are turning a blind eye. Perhaps the most striking line from the interview is the reason that de Ruyter was given by a senior person within the ANC for the lack of co-operation that he was receiving. He was told that the reason he was being stonewalled was that “...he was not giving the comrades a way to eat” – in other words, he was standing in the way of corruption and implementing systems and controls which reduced corruption.

A major issue raised by de Ruyter in his interview was the impact of Eskom’s on-going pollution of the environment. He said that about 29 000 people die every year in South Africa from air pollution. He also said that Eskom uses an extraordinary amount of water (about 40 billion litres per annum) which would ultimately contribute to a water shortage in Gauteng. He pointed out that South Africa is in danger of falling foul of the European Union’s Carbon Border Adjustment Mechanism (CBAM) which would result in South African exports being turned away – and that would directly impact our exports to the EU.

As you would expect, de Ruyter’s corruption expose has raised howls of anguish, especially from those who stood to benefit from it. Even Pravin Gordhan said that his comments were “unfortunate”. But some ANC senior members want him to be charged with treason for what he has revealed – and having now resigned with immediate effect, he says he intends to spend some time overseas until the situation calms down, which is probably wise after the recent attempt on his life. What is clear, however, is that the ANC will bear the brunt of de Ruyter’s comments in the coming 2024 elections.

The budget imposes strict conditions on Eskom in exchange for its 3-year R254bn bail-out. The main thrust of these is that Eskom must become a purely transmission/distribution company and get out of the energy generation business. It is prevented from taking on any more debt or investing in any new generation capacity. The various coal-fired power stations will be assessed by a “consortium of international experts” who will determine what needs to be done to bring them up to “original equipment manufacturers specifications” – and then some of them will be repaired and “concessioned” out to private enterprise. One of the conditions is that Eskom must become a transmission company and use the available funds to expand and improve its transmission capabilities so that it can take on power produced by independent power producers (IPP). What seems clear from this is that the Treasury at least is intent on Eskom’s generation activities being taken over by private enterprise.

Following the COP26 Climate Change summit in 2021, Europe, America, the UK, and Germany supported an $8,5bn “just transition” plan for South Africa to move away from coal-fired power stations towards renewable energy. And this funding was offered on exceptionally generous terms. It is now up to the South African government to come up with a concrete plan of action. The Komati power station will be the first of 4 power stations to be decommissioned as part of that plan. The plant will be converted to renewables in such a way that jobs are created and the community which depends on Komati will be looked after.

The PWC report on the economic outlook released on 30th January 2023 says that South Africa had 208 days of load-shedding in 2022 which cut about 5% off the growth of gross domestic product (GDP). In other words, without loadshedding, the economy would have grown by almost 7% - a level not seen for decades. So South Africa is coping with loadshedding but at a terrible cost. This year there has been loadshedding every day so far and the level has actually increased to stage 6 and even stage 7.

The Karpowership deal proposed by Gwede Mantashe (Minister of Minerals and Energy) will lock South Africa into a twenty-year contract at a very high price and with negative effect for the environment. Karpowership has a history of shady dealing in other countries according to Andre de Ruyter. The deal is being opposed in court by various environmental groups and OUTA, but Mantashe seems intent on getting it finalised by March this year. Clearly, this is a far worse solution than the encouragement of renewable energy projects.

Andre de Ruyter has drawn attention to the fact that corruption and theft in Eskom’s coal supply chain is a major cause of loadshedding. In his view this is accelerating the transition away from coal towards renewables in the economy. About 1 gigawatt of solar roof-top power is being installed every year in South Africa and that trend is accelerating. In January 2023 the energy availability factor (EAF) of Eskom’s power stations was below 50%. The government’s latest plan is to increase the EAF to 60% by end March 2023, 65% by March 2024 and 70% by March 2025. Eskom has shut down Komati with a capacity of 1000mw and plans to shut down a further 4700mw of power stations over the next five years. De Ruyter says the transition to renewables is inevitable.

Aspen Pharmacare, a JSE-listed company with a market capitalisation of R66,5bn is aiming to be completely independent of Eskom within 18 months. It joins a growing list of major companies such as Pick ‘n Pay, SA Breweries and Vodacom that are investing in their own power generation in order to escape Eskom’s increasingly expensive and unreliable service. Aspen has generators to cope with loadshedding but is now looking to replace these with renewable energy and battery back-up.

The Reserve Bank is expecting South Africa to have 250 days of loadshedding in 2023, 150 in 2024 and 100 in 2025. This is a much worse scenario than its original forecast and obviously is the cause of it adjusting its prediction of 2023 growth to just 0,3%. The ratings agencies Fitch and Standard & Poors have both warned that unless the energy situation is handled expeditiously, it will result in downgrades.

It is a little scary that the Reserve Bank and the financial services sector has recently been planning for a complete collapse of the electricity grid – which would make it impossible to conduct transactions in many areas of the economy and most notably on the JSE. There is actually a committee called the Financial Sector Contingency Forum (FSCF) which is tasked with seriously looking into preparations for this. Together with recent comments that Eskom is potentially moving to stage 8 loadshedding, this means that time is running out for business and consumers to install alternative electricity supplies.

The Rand

The rand is probably the most heavily traded of the emerging market currencies – and hence it tends to respond more to any shift towards risk-off on world markets. When international investors get scared they sell their high-yielding emerging market assets and move into safe low-return assets like US Treasury bills – and the opposite is also true. When they feel more positive, they go on the hunt for real returns and those can generally be found in emerging market investments.

When the S&P500 index is going up it is a sure sign that international investors are feeling positive and bullish – so some of them move into emerging market assets and the rand appreciates against hard currencies an especially the US dollar. When the S&P is falling then the opposite happens.

Of course, the rand is also impacted by local events like the budget, the loadshedding and major shocking an revealing news events like the interview which the erstwhile CEO of Eskom, Andre de Ruyter gave to ENCA.

Consider the chart of the rand/US dollar exchange rate over the past three years:

Here you can see that from April 2020 until June 2021 the rand was strengthening steadily. Then it began to weaken as international investors became more and more convinced that America was heading for a period of rising interest rates and economic recession. As the bear trend on the S&P gained credence, the rand has been weakening. At times the rand US dollar exchange rate has been a good indicator of where the S&P would go next – but the general trend was downwards. Now we are at the point where the negativity and bearishness on Wall Street has gained ascendancy. The third rally in this bear trend has run out of steam. Investors are running for cover and selling out of their rand-denominated assets as they go.

How far down will the rand go? That is a difficult question to answer, but in the cycle, we are expecting the S&P to keep falling at least until it breaks below its previous cycle low at 3577. And that could happen as soon as the end of April this year. Until then the rand is likely to remain under pressure against hard currencies.

Commodities

Sibanye is arguably the most effective mining conglomerate in South Africa and one of the most successful in the world. Much of that is due to its charismatic CEO, Neal Froneman, who has shown an uncanny knack of being able to buy up precious metals companies cheaply and then grow them into highly profitable entities. In the process he has created thousands of jobs in South Africa and contributed hugely to the fiscus. One of the companies Sibanye acquired was Lonmin which at the time (2019) was down on its luck following the Marikana massacre and Froneman managed to get it in a straight share deal to make Sibanye the world’s second largest producer of platinum group metals (PGM) behind Norilsk Nickel. Lonmin shareholders got one Sibanye share for every Lonmin share which they held. This deal was done against protests from the unions and some minority shareholders. Now Sibanye is trying to exploit a mineral right that it acquired as part of the Lonmin deal and it is being opposed by the Department of Minerals and Energy who say that Sibanye’s application to convert the exploration right into a mining right was rejected on the grounds that the time period allowed for this had expired. The application was made in 2021 but the process is so slow that it still has not been dealt with nearly 2 years later. As you would expect, our esteemed minister of Minerals and Energy, Gwede Mantashe, is championing the idea that the valuable mining right should be taken over by a third party and the Act says that it is his decision to make. Sibanye spent a considerable amount exploring the site and proving the existence of a viable ore body. So, they are contesting Mantashe’s decision in court. Of course, while all of this goes on the mine cannot be developed and become a productive part of the economy.

The combined impact of inefficiencies and corruption at Transnet and Eskom have curtailed South Africa’s mining production substantially. Anglo American’s CEO, Duncan Wanblad has said that South Africa is in a “delicate position” because these two “backbone infrastructure services” were failing. The Minerals Council of South Africa said that its members were reporting stockpiles of mined ore which they could not get to ports because of Transnet’s inefficiencies. It is becoming clear that some radical steps need to be taken to protect the mining industry which is vital to the South African economy.

Companies

CAPCO (CCO)

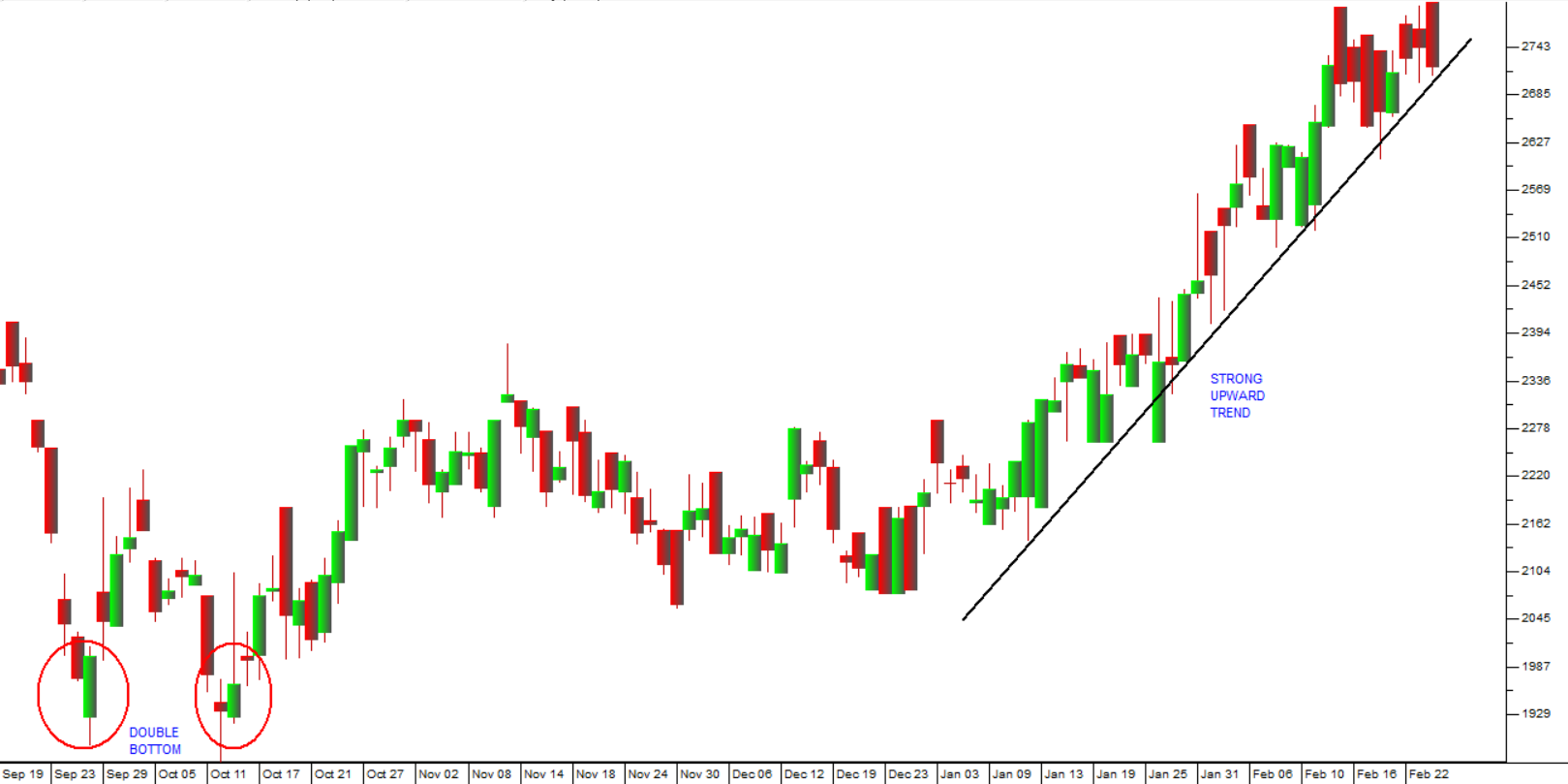

Capital Counties Properties (CCO), Capco, is a real estate investment trust (REIT) with a primary listing on the London Stock Exchange (LSE) and a secondary listing on the JSE. It is included in the FTSE250 index and is one of the largest property companies in London. It owns properties in greater London, including Covent Gardens (which now comprises about 94% of the portfolio). Covent Gardens is one of the most visited shopping destinations in London. The fallout from the Brexit decision has negatively impacted property valuations in the London area as did the advent of COVID-19 and its related lockdowns. The company's balance sheet remains strong with cash and significant headroom. The company intends to use that cash to make further acquisitions such as its recent purchase of 26,3% in Shaftsbury PLC. In a trading update for the year to 31st December 2022 the company reported that positive trading conditions through Christmas with 71 new leases and renewals signed up. At year-end the company had a loan-to-value (LTV) of just 21% and the share is trading well below its net asset value (NAV). Technically the share made a "double bottom" formation in late September and October 2022 and in 2023 it has been in a strong upward trend. In our view, this share will recover well as the UK economy normalises. Consider the chart:

HUDACO (HDC)

On 31st January 2023, Hudaco (HDC) published a trading statement which indicated that for the year to 30th November 2022 the company would increase its headline earnings per share (HEPS) by between 20% and 24%. This was then backed up 4 days later on 3rd February 2023 when they published their financials showing that HEPS had indeed risen by 22,3%. Hudaco has been a favourite share of ours for many years because of their excellent management and consistent track-record of growing profits. Just over a year ago we published an article in which we once again extolled the virtues of this share and pointed out that during the COVID-19 bear trend we had recommended that clients wait for a clear break up though the share’s downward trendline before buying. That break came on 27th January 2021 when Hudaco closed at a price of about R90. On Friday last week the share closed at R169.52 – a gain of just under 100% in 26 months. We still regard Hudaco as good value at the current price and at a P:E ratio of 8,45. Consider the chart:

WBHO (WBO)

WBHO (WBO) is now South Africa's largest construction company - after the relative demise of Aveng and Murray & Roberts. After the 2010 world cup, the ANC set about destroying the construction industry and that is reflected in the chart below as a long downward trend over the past 5 years. But WBHO has been busy rebuilding itself and getting rid of unprofitable operations. It now has a market capitalisation of about R6,4bn. In the early days, it diversified early into Africa to the North, Australia, and the UK but it has now extracted itself from Australia. In a trading statement for the six months to 31st December 2022 the company estimated that headline earnings per share (HEPS) from continuing operations would increase by between 35% and 40%. So, this is a company which is clearly on the mend. The share has recently broken up through its long-term downward trendline and looks like it may be entering a new upward trend. Consider the chart:

NASPERS and PROSUS

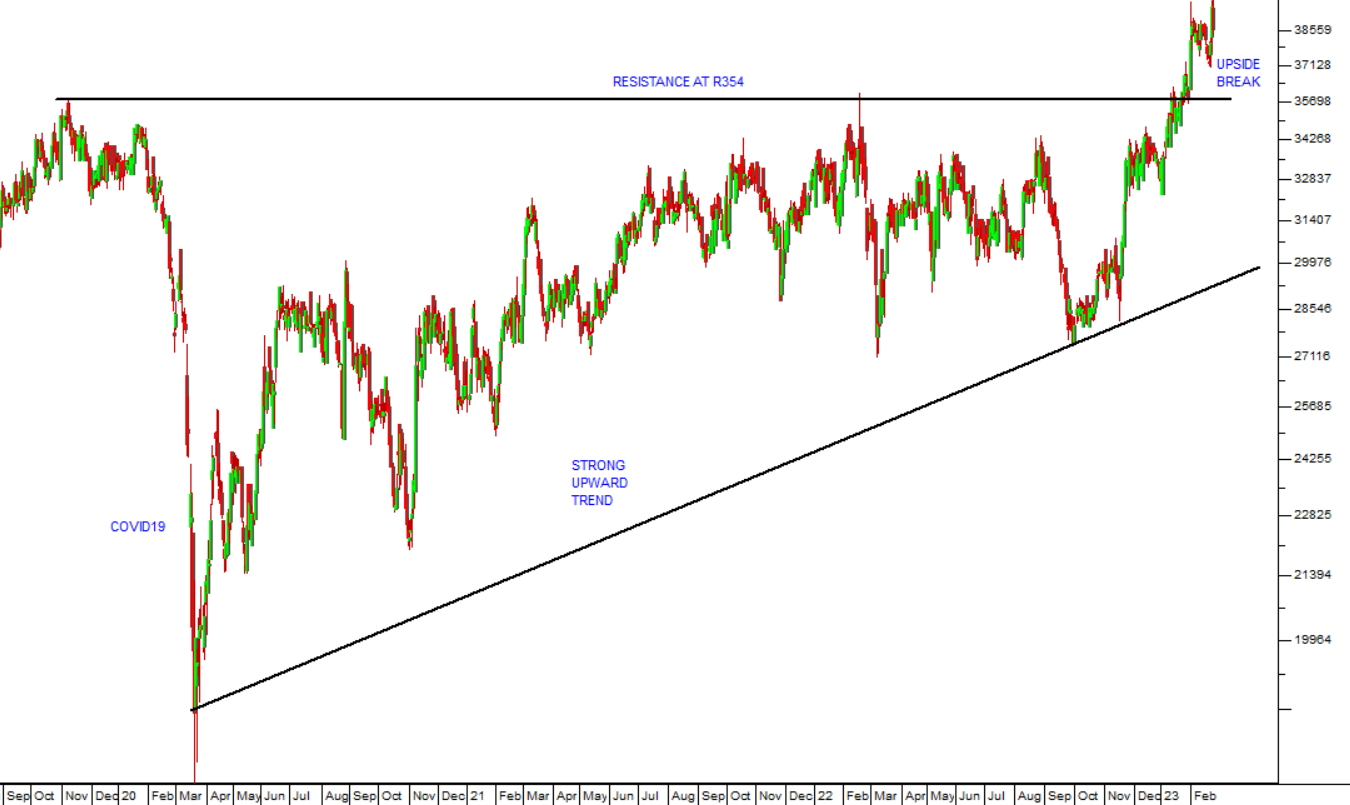

A recent report by Goldman Sachs says that they are anticipating that the Chinese stock market will rally by as much as 21% now that the COVID-19 restrictions are behind them. The chart of the Shanghai index below shows that the market may be breaking to the upside following its long downward trend. You will notice that following the upside break, the resistance has now become support.

If the Goldman prediction is correct, we would expect it to have a strong positive impact on Tencent – and hence on both Prosus and Naspers.

BIDCORP (BID)

Bidcorp (BID) is a diversified international food company which operates in 35 countries around the world. It was spun out of Bidvest in June 2016 to release shareholder value. We see this as a solid blue chip, rand hedge share which should perform well. About 95% of its income is generated outside South Africa. Bidcorp focuses on the wholesaling and delivery of what it describes as "fit-for-purpose" product ranges which it says will continue to grow strongly. In its results for the six months to 31st December 2022 the company reported revenue up 28,1% and headline earnings per share (HEPS) up 45,5%. The company said, "Currency volatility positively impacted the rand-translated results by 3,9%, with constant currency HEPS of 945,9 cents per share being recorded. Overall demand in the hospitality markets maintained the buoyancy seen in the latter part of F2022, assisted by inflationary impacts, but well surpassing pre-COVID-19 (COVID) levels". Technically, the share has recently broken above resistance at R354 above pre-pandemic levels and appears to be moving up strongly. It is on a P:E of 20,97 - which is an indication of its blue chip, rand-hedge status. We expect it to continue to perform well, benefiting directly from any recovery of the world economy. One of the great benefits of being in the food business is that people, wherever they are, have to eat – and that makes Bidcorp an excellent defensive share.

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: