Capitec Revisited

7 October 2024 By PDSNETOur first article on Capitec was published on Monday 19th February 2018. At the time the share was trading for R820.94 and we pointed out that it had established a support level at around R800. We suggested then that this was a share well worth accumulating on weakness as a long-term investment. On Friday last week the share closed at R3080.

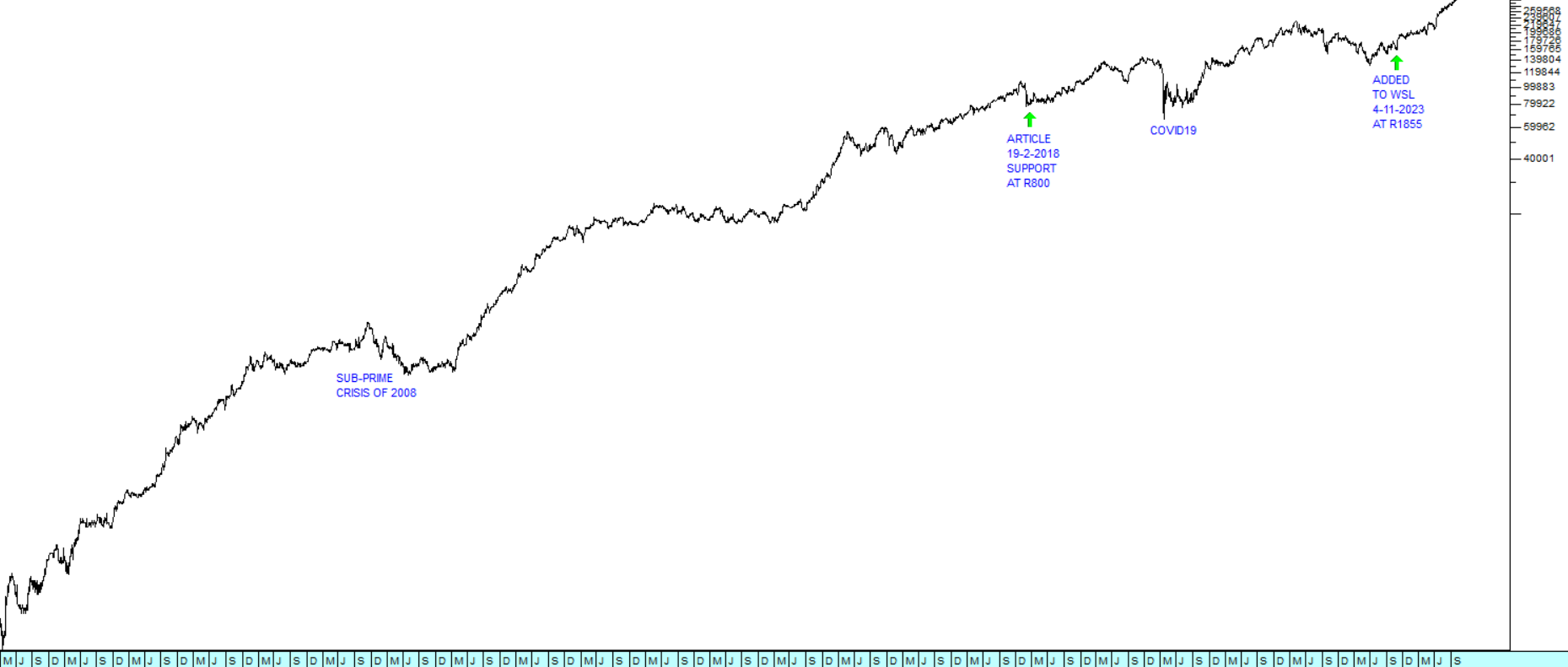

Since it listed on the JSE in February 2002 at about R1 this has been a remarkable investment – probably the best long-term investment that a private investor could have made over the past 22 years. Consider the chart:

As you can see, Capitec is the quintessential diagonal share, going from the bottom left-hand corner of your screen to the top right-hand corner. On the chart you can see the impact of the sub-prime crisis of 2008 and COVID-19 in 2020.

On Monday 18th March 2002, a month after it listed on the JSE, you could have bought Capitec shares for just 80c. In the 2024 year alone the company has declared dividends totalling R48.75 – what an incredible return on investment!

On Tuesday last week it published its results for the six months to 31st August 2024 showing headline earnings per share (HEPS) were up 36% from the previous year – a remarkable achievement off such a high base.

The company had an active client base of 23,2m – which means that it had almost doubled the size of its client base in the last 5 years. It is now by far the largest bank in South Africa by clients. By market capitalisation it dwarfs both ABSA and Nedbank and is just 22% smaller than Firstrand and 10% smaller than Standard Bank.

Capitec is expanding both its client base and the range of banking products it offers. In September 2022 the company launched Capitec Connect offering voice and data bundles to existing clients at competitive rates. The insurance business which began with funeral and credit life policies now has 38500 active policies. The Business Bank acquired in November 2019 is now opening 11 000 small and medium size company accounts every month. Altogether, value added services increased their contribution to after-tax earnings by R608m in the six months to 31st August 2024.

Capitec has a very well developed and sophisticated IT system which enables the company to refine its credit risk management through artificial intelligence (AI) and data mining. This has resulted in improved credit management and significantly reduced risk. The credit loss ratio has improved from 9,6% to 7,0%.

This share continues to offer excellent value. In our view it will soon be the largest bank in South Africa as it expands its offering into all areas of banking and related services and as its enormous client base continue to grow. It should benefit directly from the improved economic conditions that are likely to follow from the end of loadshedding, the appointment of the new government of national unity (GNU) and the downward trend of interest rates.

We added Capitec to the Winning Shares List (WSL) almost a year ago on 4th November 2023 at a price of R1855. It has since risen to R3080 – a gain of 72,3%. We believe that it will continue to perform and should be accumulated by private investors on any weakness.

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: