Astoria

7 August 2023 By PDSNETAstoria (ARA) is an investment holding company listed on the Alt-X of the JSE and also on the Stock Exchange of Mauritius (SEM). It has a market capitalization of R614m and trades on a P:E ratio of 15,14 – which compares to the JSE’s average P:E of 10,48.

The share is currently trading at a 22% discount to its net asset value (NAV) of 1408c. It is quite normal for the shares of investment holding companies to trade on the JSE at a discount to their NAV. Sometimes they decide to “unbundle” their holdings into the hands of their shareholders to release that unrealized value, but sometimes the discount makes them an attractive take-over prospect.

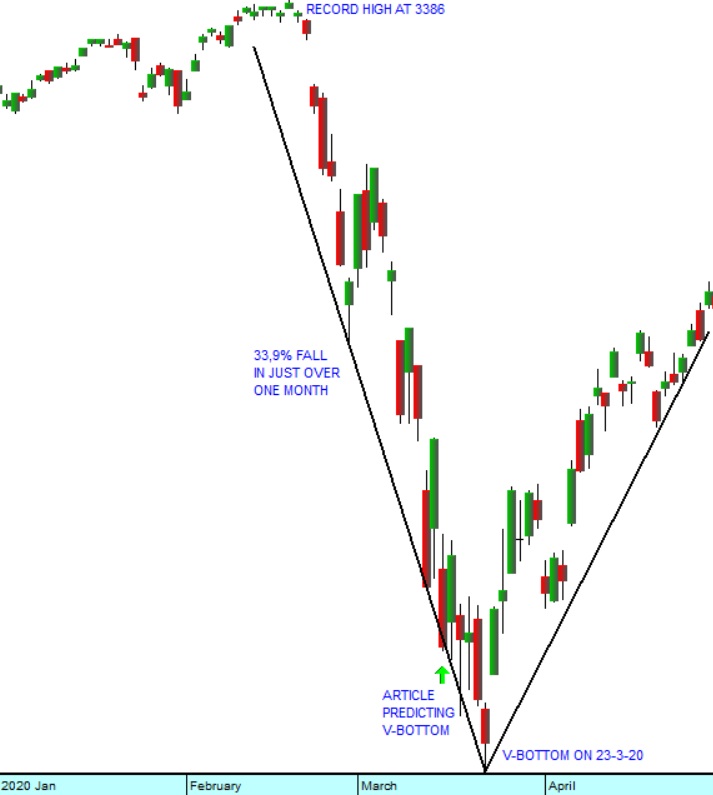

We added Astoria to the Winning Shares List (WSL) on 18th July 2023 when the shares closed at 1000c. Our primary reason for adding it was that it had published a “cautionary” in which it said that it was involved in “negotiations” which might result in the company being acquired. We felt that, since it was trading at a discount to its NAV, it probably represented good value for a prospective buyer. We were also motivated by the fact that, although thinly traded, the share had been trending upwards for some time. Consider the chart:

On 2nd August 2023 Astoria published its results for the six months to the end of June 2023. These results showed that its NAV had fallen in US dollars by 9,6% but had remained virtually the same in rands – because the rand had fallen by 10,8% against the US dollar over the period.

In those results, Astoria gave a detailed list of the various investments that it held on 30th June 2023. Where the investments were unlisted, the company provided a directors’ valuation.

Almost half of the company’s NAV (47,5%) is invested in a 40% stake in Outdoor Investment Holdings (OIH). This business is focused on catering to the safari and outdoor hunting market. This is a niche market aimed at wealthy, mostly American and local gun-lovers and hunters. With the strong economy currently being experienced in America, many people are deciding to indulge their life-long ambition to “bag” one or more of the Big Five game animals only available in Africa. At the same time South Africans have been buying weapons for self-protection.

The directors of Astoria value their unlisted investments like OIH at 6 times their earnings before interest and taxation (EBIT) minus their net debt. OH has seen an increase in profits and a reduction in its debt leading to a high valuation. Astoria received a dividend of R6,9m from Outdoor Investment Holdings after the end of the half year.

22,6% of Astoria’s NAV is a 25,1% investment in Transhex diamond mining company which has seen lower production and diamond prices. This is a sound operation, but clearly dependent on the international demand for and the prices of diamonds – which makes its profitability volatile. Nonetheless, Astoria received a R7,5m dividend from Transhex during the period.

The company has a policy of re-investing the dividends it receives back into its portfolio of investments.

The company is almost completely debt-free – which reduces the investment risk for private investors substantially.

So, in our view, Astoria would be a good investment – even if it were not a take-over prospect.

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: