Covid in Context

8 June 2020 By PDSNETIt is perhaps a good time to stand back from the hectic and extraordinary events that have accompanied the corona pandemic and try to put them into some sort of context from an investment perspective. It is steadily becoming more and more certain that the corona bear trend (if we can even call it that) has been short and sharp and completely unlike any previous bear trend in history. This is because it was not brought about by an accumulation of economic imbalances, but rather by an unexpected “black swan” event which is really unique in the history of markets.

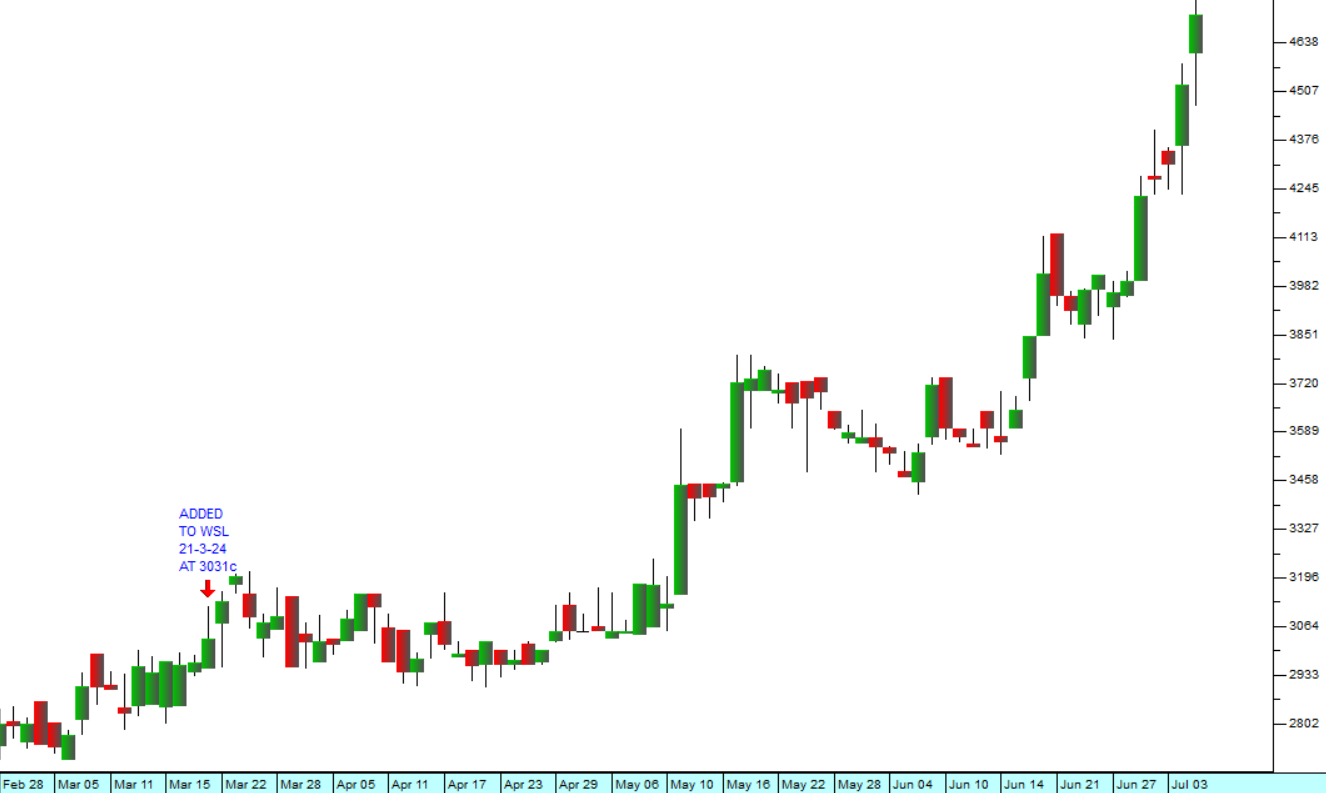

On 13th May 2020 when the corona downward trend was nearing its height, we suggested in an article that it would be a “V-Bottom” and that it would recover rapidly from its low point. This prediction is now proving to be accurate. Consider the chart of the S&P500 index:

Here you can see the previous record high on the index at 3386 which occurred on 19th February 2020 – less than four months ago. The market fell steeply to its low at 2237 about a month later, on 23rd March 2020. From that point the S&P has been recovering rapidly and has now regained 83,2% of the 1149 points that it dropped. It is now just 5,7% below its all-time record high, and we confidently anticipate that it will break that high within the next few months and go to new record levels. When we look back at this time in the future, it will appear to be exactly what it is – an aberration characterised by a sharp fall and an equally sharp recovery.

In terms of the long-term scenario which we sketch out in “Our Background Approach” (which you can find under the heading “About” on the PDSnet web site), the impact of the pandemic can be seen as an aberration which does not significantly change the predictions and ideas sketched out there.

So, we see the massive bull market which began in March of 2009 as essentially uninterrupted by this pandemic from a market perspective. We see the world economy moving rapidly back to the period of strong growth and economic boom conditions that we have been expecting and predicting for so long. If anything, the boom will be that much stronger because of the massive monetary and fiscal stimulation which has been affected world-wide to compensate for the pandemic.

For this reason, we suggest, as we have always suggested, that the pandemic offered and still offers a buying opportunity for private investors which is rapidly disappearing. Already, banking shares, which we suggested a few weeks ago were heavily under-priced are moving back up towards more reasonable levels. They are still good value, but not as good as they were when we made the observation. That point applies to many high-quality shares. With the advantage of hindsight we will all see that the corona bear trend was a huge buying opportunity for those who had the awareness to grasp it.

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article:

_art4mAy24.png)