Many private investors shy away from IT shares because they can be difficult to understand. Their business models are often highly complex making it problematic to accurately assess their fundamental risk. Datatec is an international IT and telecommunications company with operations in more than 50 countries world-wide which makes it even more challenging as an investment. My response to this type of complexity is to look at the results and the people involved.

In its results for the six months to 31st August 2025 the company reported gross invoiced income up 9,4% and headline earnings per share (HEPS) up 109,5%. Clearly, this company is growing its turnover while at the same time hugely improving its operational efficiency.

Because of its international footprint, Datatec offers the investor a rand-hedge. It is also obviously benefiting from the world-wide move towards artificial intelligence (AI). It makes a gross margin of 26.3% and its operating costs are coming down. By bringing down its net debt the company has reduced its finance costs by 27.1%. From an investor’s perspective this makes buying the shares far less risky. Companies with plenty of “headroom” have the cash to avoid problems and take advantage of opportunities.

Its business is divided into three main divisions - technology distribution through Westcon International, integration and managed services through Logicalis, and consulting and financial services through Datatec Financial Services and Analysys Mason.

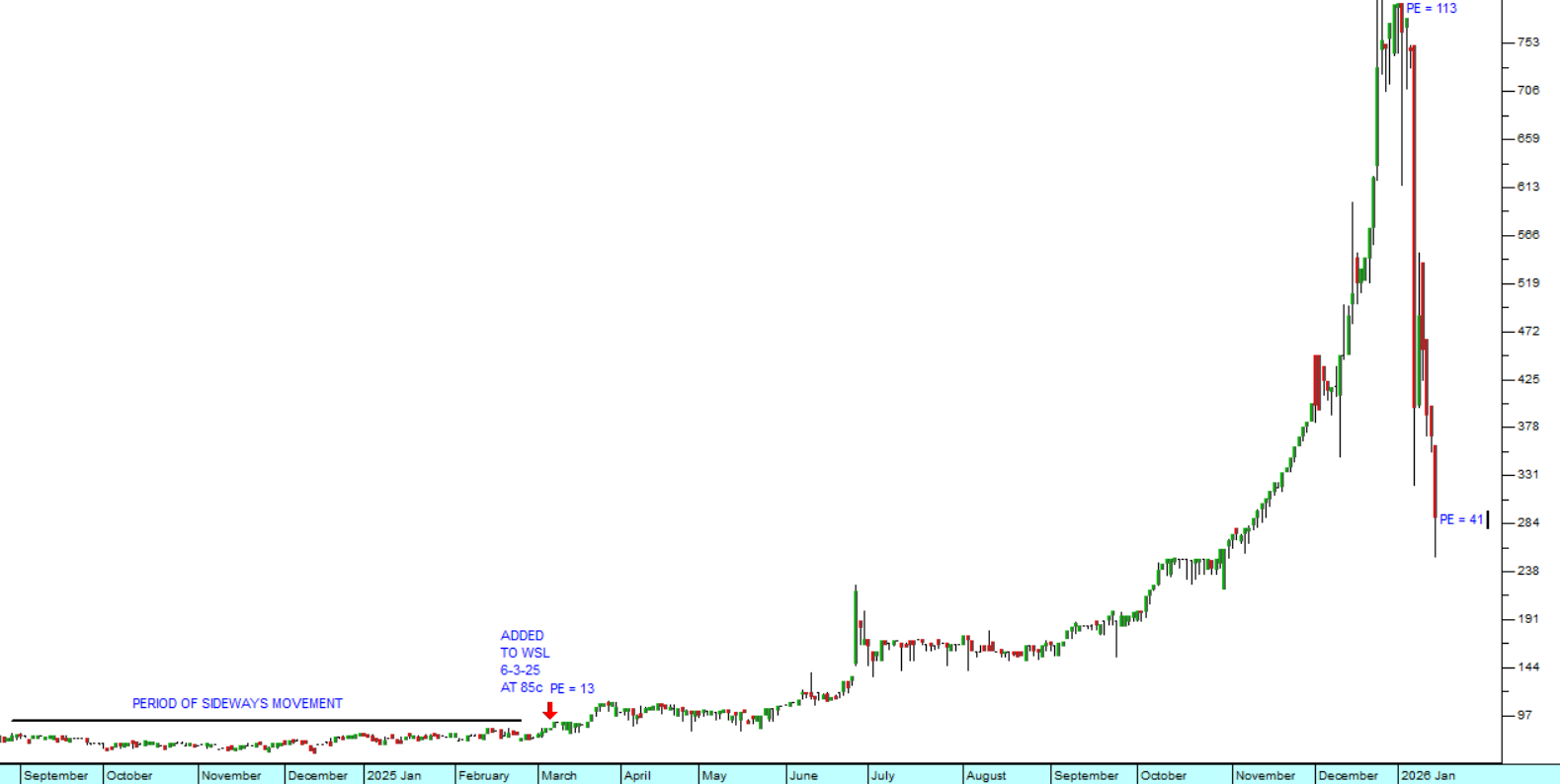

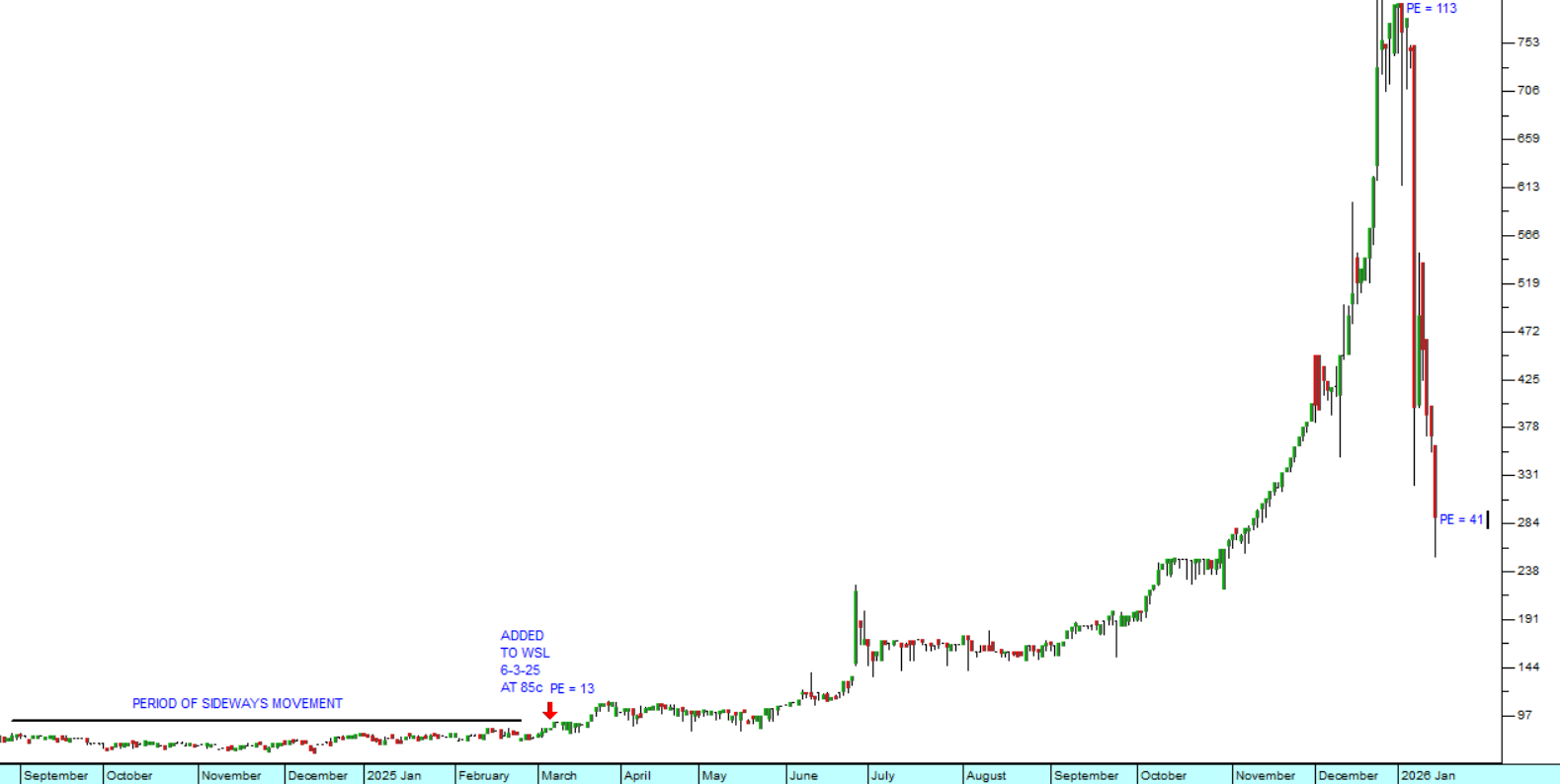

Consider the chart:

Datatec (DTC) : April 2023 - 6th of February 2026. Chart by ShareFriend Pro.

Datatec (DTC) : April 2023 - 6th of February 2026. Chart by ShareFriend Pro.

The chart shows that Datatec had an extended period of sideways movement between April 2023 and October 2024. Then it began to move up strongly. We added it to the Winning Shares List (WSL) 26th October 2024 at a price of 3950c, when it began showing signs of structural improvement and it has since gone up to 7781 – a gain of 97% in 15 months. We believe it will continue to perform well as AI becomes more ubiquitous.

Jens Montanana is the CEO of Datatec and has been in that position since the company listed on the JSE more than thirty years ago. His drive and energy are what taken the company up to a market capitalisation of R12bn. Montanana says that “...the growth of interconnected digital communities and increased IT complexity drove infrastructure demand in networking and cybersecurity”. Now I will be first to admit that I do not understand the implications of that statement – but I know growth and financial stability when I see it.

The rapid rise of artificial intelligence (AI) has forced businesses to implement the technology within their operations if they are to remain competitive. Datatec is riding that wave.

Obviously, this is a company which is dominated by Montanana and that does make it vulnerable to his inevitable retirement at some stage. However, we believe that Datatec has built a very solid international; presence which will continue to provide it with growth opportunities in the future whoever is in charge.

It is not one of the fastest growing shares on the JSE, but it has been a very steady performer since we added it to the WSL.