The Rand

2025 has been a year of solid progress for South Africa. The government of national unity (GNU) has held together despite dire predictions and the country has implemented a number of notable economic reforms. At the same time, international investment sentiment has shifted firmly towards “risk-on” and the US dollar has lost significant ground against other first-world currencies.

The effect of these developments has been that in the last 8 months the rand has appreciated from an intra-day high of R19.93 on the 9th of April 2025 to the US$ to current levels around R16.75 – a gain of 16%. Consider the chart:

South African rand/US dollar : April 2025 - 19th of December 2025. Chart by ShareFriend Pro.

South African rand/US dollar : April 2025 - 19th of December 2025. Chart by ShareFriend Pro.

Combined with the falling oil price, this is having the effect of reducing the price of fuel in the country rapidly – and that has resulted in sharply lower inflation. The drop in inflation means that consumers are seeing an increase in the level of their real incomes and they have been paying off debt and spending more. In our view, the rand will continue to hold its value against other hard currencies and to appreciate against the US dollar.

Oil and Ukraine

The price of oil has continued to fall, with North Sea Brent dropping below $60 for the first time since February 2021. This decline reflects the steady movement of the world away from fossil fuels and the rapid implementation of alternative energy installations, especially solar power. We expect this trend to continue and even accelerate as the cost of solar power continues to become more efficient and more affordable.

The price of Urals crude has fallen even further than Brent and it now trades for less than $35 per barrel. This is a direct consequence of the Ukrainian attacks on Russia’s shadow fleet both in the Black Sea and even in the Mediterranean. Together with their on-going destruction of Russia’s oil infrastructure, these attacks are rapidly eroding Russia’s ability to finance the continuation of the war.

At the same time, Ukraine has recently secured a pledge for a further 90bn euro loan from the European Union to continue paying for the war for at least the next two years. To us it seems impossible for Russia to continue funding this war under these conditions and we anticipate some sort of resolution of the situation in the fairly near future – probably next year.

The S&P500 Index

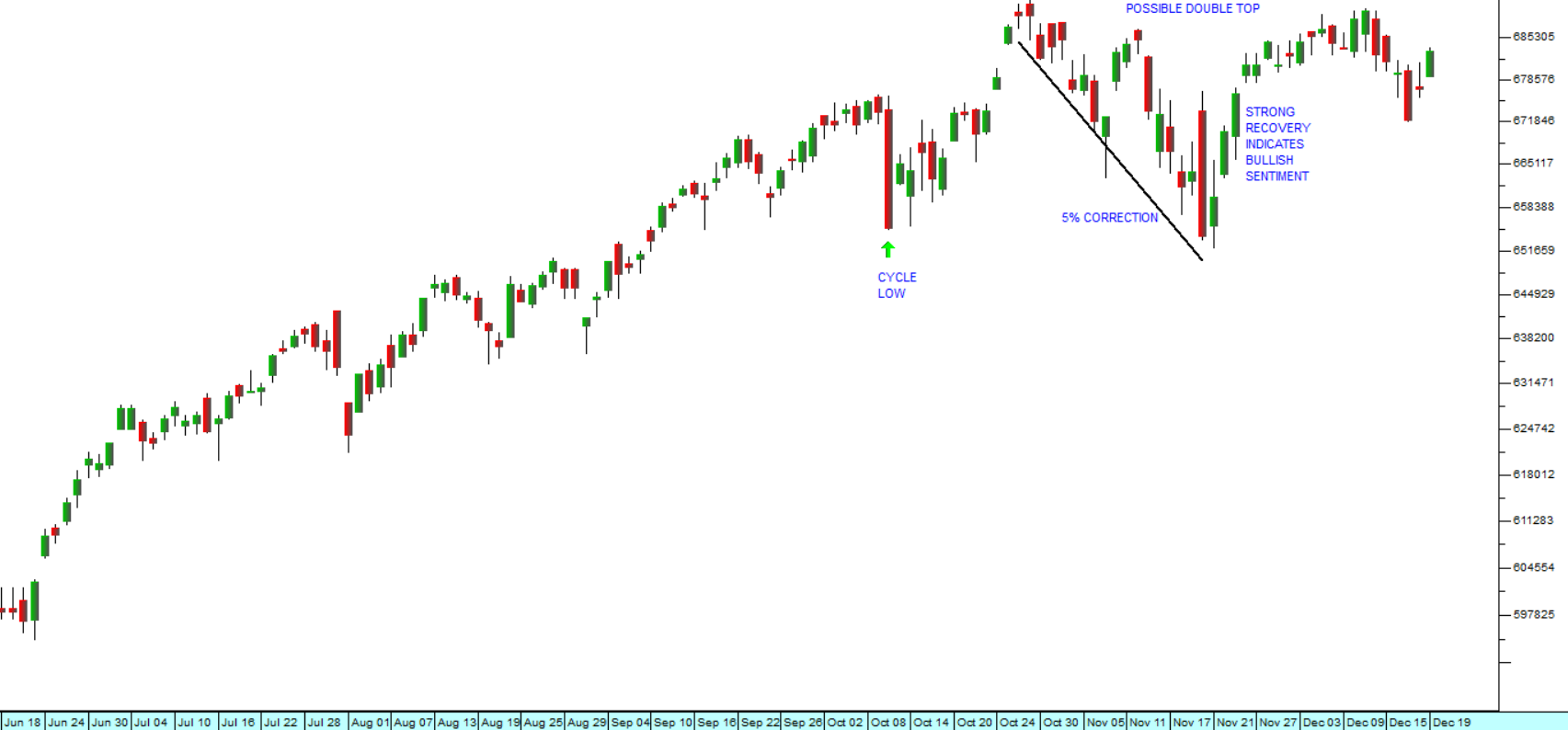

Wall Street remains firmly in a long-term bull trend, but has been moving more-or- less sideways since the beginning of October 2025. There has clearly been some rotation out of high-tech and especially AI shares into the broader market. Consider the chart.

S&P500 Index : 18th of June 2025 - 19th of December 2025. Chart by ShareFriend Pro.

S&P500 Index : 18th of June 2025 - 19th of December 2025. Chart by ShareFriend Pro.

The recent 5% correction in November took the S&P down to the cycle low of 10th October, where it found support. There was a very strong recovery from this level culminating in a new all-time record closing high at 6901 on 11th December 2025. Then the rotation and profit-taking began.

Technically, there is a possibility that what we are looking at is a double top formation with the highs on 29th October and then on 11th December. Our view is that this represents some resistance at the 6900 level and in time the market will recover and break convincingly above this level. The latest inflation and jobs figures coming out of America indicate that the economy is still performing well – albeit more slowly than it has been. There is still room for further interest rates cuts with inflation apparently well under control.

The staff and directors at PDSnet take this opportunity to wish you and your family all the best for the Festive Season and the New Year.

Please note: Our next article will be published on 12th January 2026.