Reverse Takeover

18 March 2024 By PDSNETAt the end of October 2023, Mix Telematics (MIX) was a relatively small fleet management company with a market capitalisation of just R2,3bn listed on both the JSE and the American NASDAQ. Its shares on the JSE were wallowing at a low of 380c. This compares with its competitor, Karoo (KRO), also listed on the JSE, but which was at the time, more than six times larger. The problem was that Mix was just too small to attract institutional interest because it lacked sufficient scale.

At the same time, another fleet management company was also listed on the NASDAQ in America called Powerfleet (PWFL) and it had a market capitalisation of R1,19bn ($63,48m X R18.75). Powerfleet specialises in the “internet of things” (IOT) and is described by Wikipedia as, “...a global provider of wireless IoT and M2M solutions for securing, controlling, tracking, and managing high-value enterprise assets such as industrial trucks, tractor trailers, intermodal shipping containers, cargo, and vehicle and truck fleets.”

The two companies were in almost identical businesses with considerable potential synergies. Both were also suffering from their small size which made it very difficult to attract large investors and clients.

To overcome this problem the two companies agreed that Mix would execute a reverse takeover of Powerfleet. We say that Mix would “reverse into Powerfleet”. To achieve this, Powerfleet increased its authorised share capital from 75m shares to 175m shares and “bought” all the issued ordinary shares of Mix at the rate of 0.12762 Powerfleet shares for every Mix share. This deal was announced on 10th October 2023.

The effect of this was that Mix shareholders ended up with 65,5% of the merged company – which is approximately the ratio of their respective market capitalisations at the end of October 2023 (R2,3bn to R1,19bn), prior to the deal.

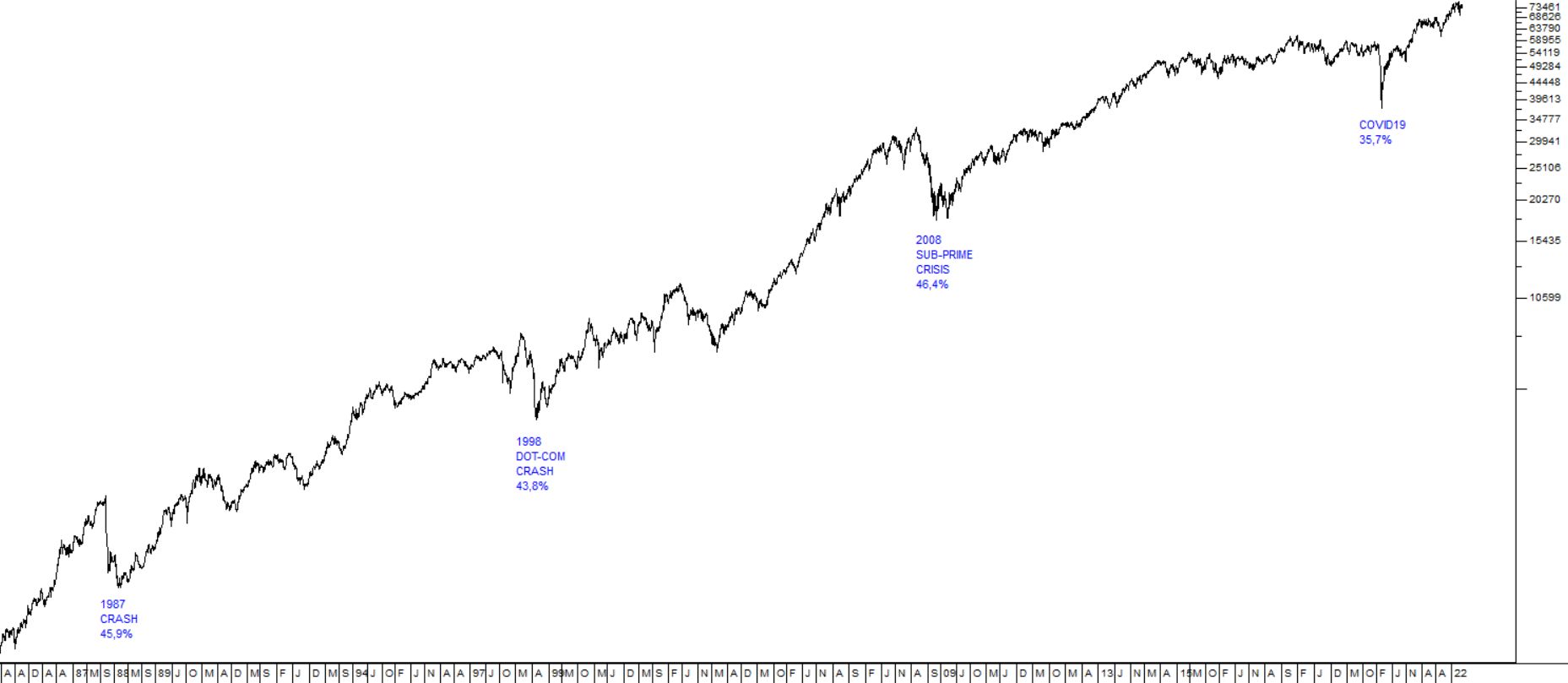

The benefit would be to “...create an enlarged MergeCo platform that the Parties believe will be well positioned to capitalise on consolidation opportunities in the global IoT industry. As a result, MergeCo should be able to benefit from enhanced market presence and influence.” But in effect Mix bought Powerfleet for 34,5% of its shares and took over its name and listing on the NASDAQ. In other words, it was a large acquisition which has had the effect of more than doubling the market capitalisation of Mix to R5,15bn in just six months. Consider the chart:

As you can see here the share reached its lowest point on 31st October 2023 at 380c. Since then, the market has been pricing in the effect of the reverse takeover of Powerfleet and a strong new upward trend has emerged. We added Mix to the Winning Shares List on 28th December 2023 at a price of 590c and since then it has risen to 850c – a gain of 44% in about two-and-half months. This example shows how important it can be to watch and understand the announcements which are published by listed companies on the Stock Exchange News Service (SENS). You should note that the merged company will be listed on the JSE to trade as Powerfleet (PWR) with effect from 26th March 2024.

DISCLAIMER

All information and data contained within the PDSnet Articles is for informational purposes only. PDSnet makes no representations as to the accuracy, completeness, suitability, or validity, of any information, and shall not be liable for any errors, omissions, or any losses, injuries, or damages arising from its display or use. Information in the PDSnet Articles are based on the author’s opinion and experience and should not be considered professional financial investment advice. The ideas and strategies should never be used without first assessing your own personal and financial situation, or without consulting a financial professional. Thoughts and opinions will also change from time to time as more information is accumulated. PDSnet reserves the right to delete any comment or opinion for any reason.

Share this article: